Filing for bankruptcy may raise concerns about the safety of retirement savings, particularly the 401(k). Federal law and the Employee Retirement Income Security Act (ERISA) generally protect the 401(k) when declaring bankruptcy. It is treated as a separate trust, exempt from the bankruptcy estate and safeguarded from creditors. However, caution must be exercised to avoid jeopardizing its protected status by taking loans or withdrawals before filing. Chapter 7 and Chapter 13 bankruptcies may have nuanced differences in treatment, especially concerning ongoing contributions. Seeking guidance from a financial advisor or bankruptcy attorney is advisable to navigate the complexities and ensure the 401(k) remains secure. Bankruptcy, understandably, raises concerns about the security of a 401(k). Given that the purpose of bankruptcy is to liquidate assets to repay creditors, one might assume that this would include retirement accounts. However, most retirement accounts, including 401(k)s, are protected in bankruptcy due to federal law. The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 provides extensive protection for retirement accounts in bankruptcy. Specifically, 401(k) plans are entirely exempt from the bankruptcy estate, meaning they cannot be used to pay off creditors. The Employee Retirement Income Security Act of 1974 also plays a significant role in protecting 401(k)s during bankruptcy. It sets minimum standards for retirement plans in private industries to provide protection for individuals enrolled in these plans. A 401(k) plan under ERISA is considered a trust, separate from the debtor's estate, thereby shielding it from creditors. As previously mentioned, a 401(k) is generally safe in a Chapter 7 bankruptcy. Thanks to federal bankruptcy laws and ERISA, the 401(k) is excluded from the bankruptcy estate, and the individual filing bankruptcy retains full rights to their retirement savings. In Chapter 13 bankruptcy, a repayment plan is established, and the debtor's income is considered in determining how much they can pay. While 401(k) assets are still protected, ongoing contributions to a 401(k) during a Chapter 13 bankruptcy may be considered disposable income and could affect the amount required to repay creditors. In both types of bankruptcy, the 401(k) assets are protected. However, how they are treated can vary slightly. The crucial difference is that ongoing contributions to a 401(k) during a Chapter 13 bankruptcy could be counted as part of the debtor's income when calculating repayment to creditors. One major exception to the general rule of 401(k) protection is for non-qualified 401(k) plans. While ERISA safeguards apply to most 401(k) plans, if your 401(k) is not a qualified plan under ERISA, its protections may not be applicable. As such, it is crucial to ascertain whether your 401(k) plan is ERISA-qualified to ensure its safety in bankruptcy proceedings. Inherited 401(k)s or Individual Retirement Accounts (IRAs) do not enjoy the same level of protection as personal 401(k) accounts. They are considered part of the bankruptcy estate and hence may be vulnerable to claims from creditors. If you have inherited a 401(k) or an IRA, it is essential to be aware that these assets may not be fully protected in bankruptcy. If you have an outstanding loan against your 401(k), the situation can become complicated during bankruptcy. While the 401(k) itself is protected, an outstanding loan against it is considered an asset of the bankruptcy estate. If not repaid before filing for bankruptcy, the remaining loan balance could become taxable income and might potentially be accessible to creditors. One common mistake individuals often make when facing financial hardship is making early withdrawals from their 401(k). While it might seem like a quick solution to address immediate financial needs, early withdrawals can have long-term implications. Apart from the potential tax consequences, early withdrawals may jeopardize the protection of your 401(k) during bankruptcy. Therefore, it's crucial to leave your 401(k) untouched until your bankruptcy proceedings have been concluded. Just as with early withdrawals, taking out loans against your 401(k) before filing for bankruptcy is not advisable. Although your 401(k) itself is protected in bankruptcy, a loan against it can complicate matters. If the loan is not repaid before filing, the remaining balance may become taxable income and could potentially be considered an asset during bankruptcy. Financial advisors can be a significant asset during this challenging time. They can provide valuable advice, guiding you through financial decisions that won't jeopardize your 401(k) or your future financial stability. They can help ensure the safety of your retirement savings and guide you toward a better financial future post-bankruptcy. A bankruptcy attorney is a crucial partner in ensuring your 401(k) is protected during the bankruptcy process. They can offer advice on which type of bankruptcy to file, explain the intricacies of the bankruptcy process, and make sure all paperwork is correctly filed to protect your assets as much as possible. They can also work in tandem with your financial advisor to provide comprehensive support during this challenging period. Bankruptcy, a solution for overwhelming debt, does not generally jeopardize your 401(k) due to the robust protections in place. The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 and the Employee Retirement Income Security Act (ERISA) collectively guard these retirement savings from creditors. Both Chapter 7 and Chapter 13 bankruptcy preserve 401(k) assets, but Chapter 13 can consider ongoing contributions as disposable income. Exceptions to this safeguard exist, such as for inherited 401(k)s or when there's an outstanding 401(k) loan. Essential preemptive measures include refraining from early withdrawals or loans against your 401(k). Leveraging the expertise of financial advisors and bankruptcy attorneys can help navigate this complex process, ensuring your retirement savings remain intact and facilitating a smoother financial recovery post-bankruptcy.Does Filing for Bankruptcy Affect My 401(k)?

Bankruptcy and Its Impact on 401(k)

How Bankruptcy Affects 401(k)

Protection of 401(k) Under Federal Law During Bankruptcy

Role of Employee Retirement Income Security Act (ERISA) in Protecting 401(k)

Effects of Chapter 7 and Chapter 13 Bankruptcy on 401(k)

Impact of Chapter 7 Bankruptcy on 401(k)

Impact of Chapter 13 Bankruptcy on 401(k)

Comparing the Impact of Chapter 7 and Chapter 13 Bankruptcy on 401(k)

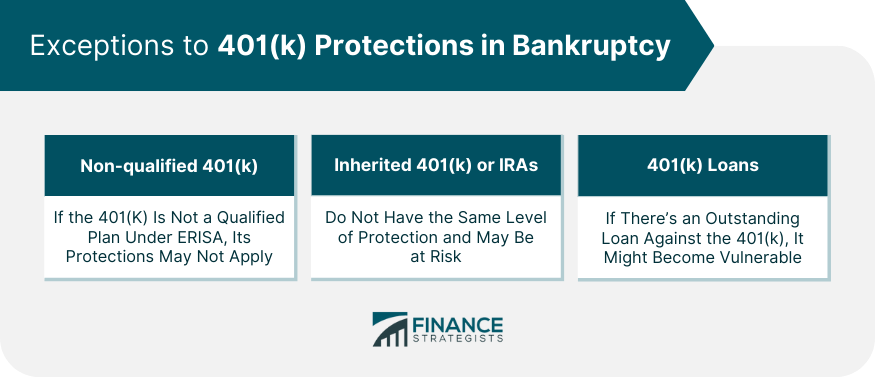

Exceptions to 401(k) Protections in Bankruptcy

Non-qualified 401(k) Plans

Inherited 401(k) or Individual Retirement Accounts (IRAs)

401(k) Loans

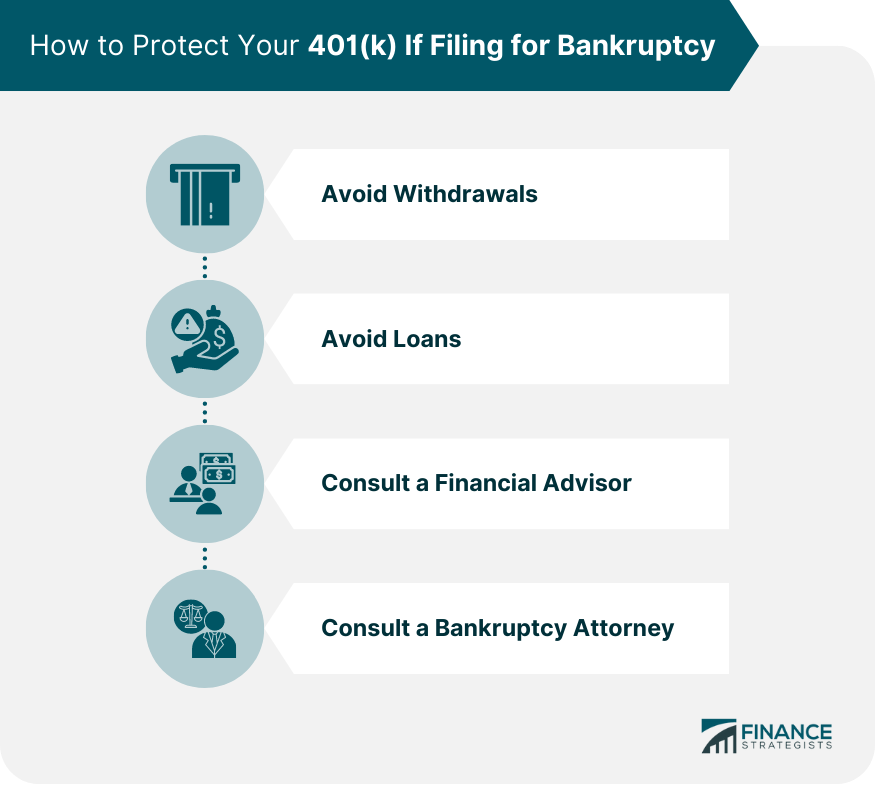

How to Protect Your 401(k) if Filing for Bankruptcy

Avoid Early Withdrawals

Steer Clear of 401(k) Loans

Consult With a Financial Advisor

Seek Legal Consultation

Conclusion

Does Filing for Bankruptcy Affect My 401(k)? FAQs

Generally, 401(k) assets are protected from bankruptcy under federal law and the Employee Retirement Income Security Act (ERISA). They are exempt from the bankruptcy estate and cannot be used to pay off creditors.

Chapter 7 bankruptcy typically doesn't affect your 401(k) contributions. The assets in your 401(k) are excluded from the bankruptcy estate, protecting them from creditors.

In a Chapter 13 bankruptcy, while the 401(k) assets are still protected, ongoing contributions to a 401(k) during the bankruptcy proceedings may be considered disposable income. This could affect the amount you're required to repay creditors.

While 401(k)s are generally protected during bankruptcy, there are exceptions. If the 401(k) plan is not qualified under ERISA or if you have an outstanding loan against your 401(k), it may be vulnerable.

To protect your 401(k), avoid making any withdrawals or taking loans against it before filing bankruptcy. Also, consulting with financial advisors and legal professionals can help navigate the intricacies of bankruptcy laws and ensure the safety of your retirement savings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.