A 401(k) plan is a retirement savings account that allows employees to save and invest for their own retirement on a tax-deferred basis. For small businesses, a 401(k) plan can be a powerful tool that can help attract and retain top talent while providing the business with valuable tax benefits. The purpose of a 401(k) plan for small businesses is two-fold. Firstly, it is designed to provide employees with a means to save for their retirement, often complemented by employer-matching contributions. Secondly, it serves as a key employee benefit that can help small businesses compete with larger corporations in terms of employee compensation and benefits. Setting up a 401(k) plan involves deciding on the plan's design, selecting a plan provider, and setting up the plan's administrative procedures. It's a step-by-step process that typically involves consulting with a financial advisor or plan provider. Once the plan is established, employees can choose to participate by deferring a portion of their salary to the plan. This money is invested in the various investment options the plan provides, ranging from mutual funds to exchange-traded funds (ETFs) and more. In addition to employee contributions, many small businesses choose to match a portion of their employees' contributions as an added benefit. The matching amount varies but is usually a percentage of the employee's contribution up to a certain limit. 401(k) plans provide a variety of investment options that employees can choose from. These usually include a mix of equity funds, bond funds, and money market funds, providing employees with the ability to customize their investment strategy based on their risk tolerance and retirement goals. A 401(k) plan can serve as a powerful tool for attracting and retaining talented employees. Offering a competitive retirement plan shows potential employees that the business is invested in their long-term future and financial stability. Current employees are more likely to stay with a company that helps them plan and save for retirement. From a financial perspective, offering a 401(k) provides significant tax advantages to businesses. Employer contributions to the plan are tax-deductible, and the business may be eligible for a tax credit to offset the costs of starting the plan. Moreover, any assets in the plan grow tax-free, providing further financial benefits. A 401(k) plan allows for flexibility in terms of both the amount and frequency of contributions. Employees can adjust their contribution levels as their financial situation changes, allowing for more personalization and control over their retirement savings strategy. Beyond the immediate financial benefits, offering a 401(k) plan also contributes to the overall financial wellness of employees. By encouraging employees to save for retirement, businesses can foster a more financially secure and, therefore, more productive and engaged workforce. Setting up and managing a 401(k) plan can be time-consuming and complex. It involves regulatory paperwork, plan administration, and regular monitoring to ensure compliance with federal regulations. This administrative burden can be significant, particularly for small businesses with limited resources. 401(k) plans are subject to a range of federal laws and regulations. Ensuring compliance with these rules is crucial to avoid penalties and maintain the tax-advantaged status of the plan. This can add an additional layer of complexity to the administration of the plan. If the plan is not administered correctly, businesses can potentially face legal liabilities. For example, failure to meet fiduciary duties or to comply with non-discrimination testing requirements could result in legal action. Finally, simply offering a 401(k) plan does not guarantee employee participation. Businesses must also actively engage employees through education and communication to ensure they understand and take advantage of the benefits the plan offers. Traditional 401(k) plans provide the most flexibility for employers and employees in terms of contributions and vesting schedules. Employers can choose whether to match employee contributions and to what extent, while employees can contribute up to the IRS limit each year. However, these plans require annual nondiscrimination testing to ensure the plan doesn't overly favor highly compensated employees. Safe Harbor 401(k) plans are an attractive option for many small businesses because they bypass some of the complex nondiscrimination testing associated with traditional plans. They do, however, require employers to make mandatory contributions to employees' accounts. These contributions are immediately fully vested, meaning the employee has the right to take all the money with them, even if they leave the company. SIMPLE (Savings Incentive Match Plan for Employees) 401(k) plans are designed specifically for small businesses with 100 or fewer employees. They're easier to administer and require less paperwork than traditional or safe harbor plans. However, they also have lower contribution limits and mandatory employer contributions. Choosing the right 401(k) plan for your small business depends on several factors, including the size of your business, the resources you can dedicate to administering the plan, and the benefits you want to offer your employees. Consulting with a financial advisor or plan provider can help you navigate these considerations and choose the plan that best meets your needs. When choosing a 401(k) plan provider, it's important to consider their reputation, the services they offer, the investment options they provide, and the fees they charge. It's also essential to evaluate their customer service and the educational resources they provide to help your employees make informed investment decisions. A 401(k) plan provider plays several key roles, including plan administration, recordkeeping, and compliance services. They also provide a platform through which employees can manage their accounts, make investment decisions, and access educational resources. Having a strategic plan for your business's 401(k) is essential. The plan should be designed to meet the needs of your employees and your business. It should be flexible enough to adjust as those needs change over time. Regular review and adjustment of the plan are key to its long-term success. A sustainable 401(k) plan is one that is manageable for the business while providing substantial benefits to employees. This balance can be challenging to achieve. It involves managing administrative responsibilities, regulatory compliance, and financial obligations. It's vital to consider the resources required to sustain the plan over the long term when choosing a 401(k) plan for your business. Providing education and ongoing communication about the 401(k) plan can significantly impact employee participation rates and the effectiveness of the plan. Employees need to understand how the plan works, the benefits of participating, and how to make investment choices. Regular communication can keep the plan top of mind for employees and encourage them to take full advantage of the benefit. A 401(k) plan can be a valuable asset for small businesses seeking to enhance employee benefits and financial security while reaping tax advantages. Despite the challenges involved in setup and management, strategic planning, employee education, and sustainable practices are key to its success. By choosing the right plan type and partnering with a reliable plan provider, businesses can streamline the process and ensure regulatory compliance. Regular review and adjustments will keep the plan aligned with changing needs, creating a win-win situation for both employers and employees. Ultimately, a well-executed 401(k) plan serves as a powerful tool, fostering a loyal and motivated workforce while paving the way for a prosperous retirement for employees, making it an investment worth considering for small businesses.What Is a 401(k) Plan for Small Businesses?

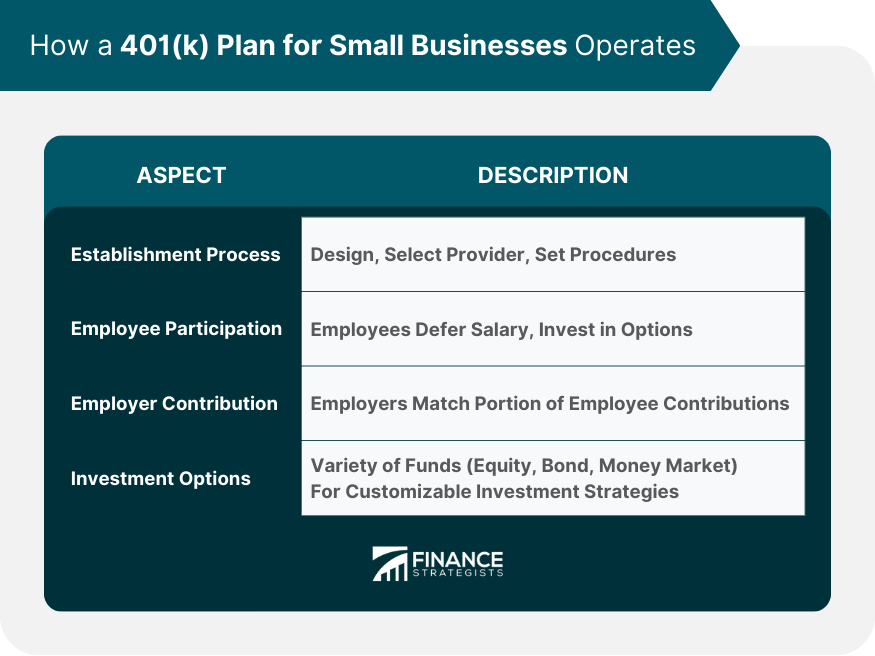

How a 401(k) Plan for Small Businesses Operates

Establishment Process

Employee Participation and Contributions

Employer Contribution Match

Investment Options

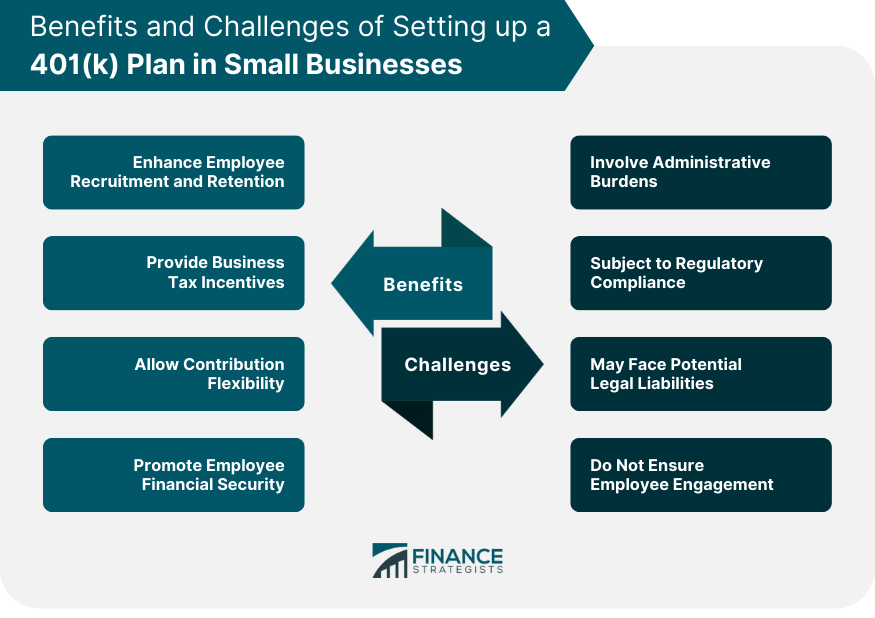

Benefits of Implementing a 401(k) Plan in Small Businesses

Enhance Employee Recruitment and Retention

Provide Business Tax Incentives

Allow Contribution Flexibility

Promote Employee Financial Security

Challenges of Setting Up a 401(k) Plan in Small Businesses

Involve Administrative Burdens

Subject to Regulatory Compliance

May Face Potential Legal Liabilities

Do Not Ensure Employee Engagement

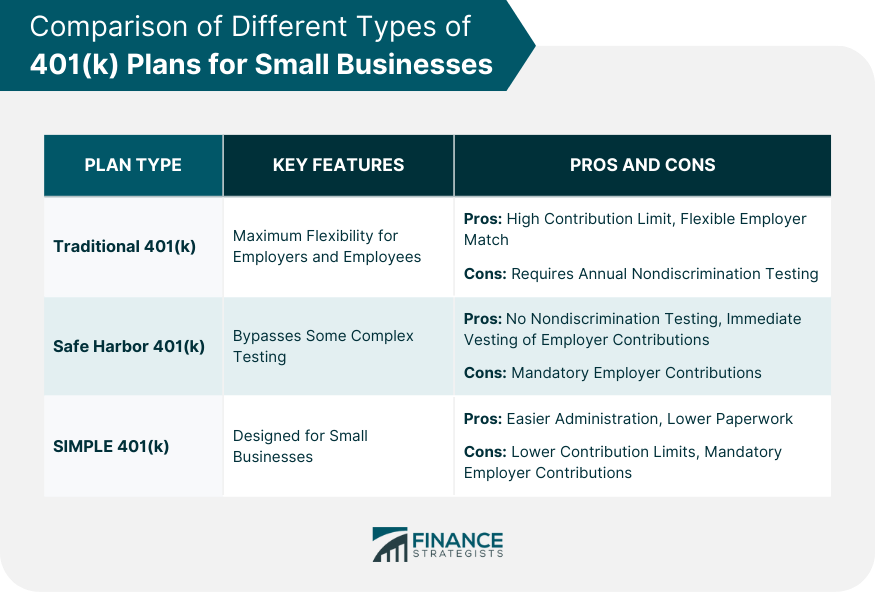

Comparing Different Types of 401(k) Plans for Small Businesses

Traditional 401(k) Plans

Safe Harbor 401(k) Plans

SIMPLE 401(k) Plans

Factors to Consider When Choosing a Plan

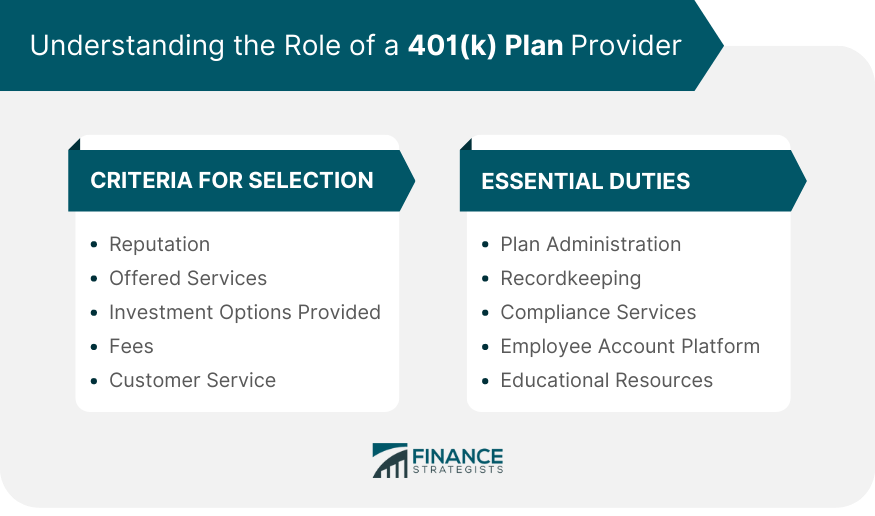

Understanding the Role of a 401(k) Plan Provider

Criteria for Selecting a Provider

Essential Duties of a Plan Provider

Creating a Successful 401(k) Plan

Strategies for Effective Future Planning

Sustainability Considerations for a 401(k) Plan

Employee Education and Communication

Final Thoughts

401(k) Plans for Small Businesses FAQs

A 401(k) plan is a retirement savings account provided by small businesses that let employees save and invest for their retirement on a tax-deferred basis.

Key benefits include attracting and retaining talent, tax incentives for the business, contribution flexibility, and promoting employee financial security.

Businesses might face administrative burdens, the need for regulatory compliance, potential legal liabilities, and the challenge of ensuring employee engagement.

Small businesses can choose from traditional 401(k) plans, safe harbor 401(k) plans, and SIMPLE (Savings Incentive Match Plan for Employees) 401(k) plans.

A 401(k) plan provider is responsible for plan administration, record-keeping, compliance services, and providing a platform for employees to manage their accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.