A "401(k) without an employer match" refers to a retirement savings plan in the U.S. where employers don't contribute to the employee's account. In contrast to a typical 401(k), where employers match a portion of their employee's contributions, the employee wholly funds this type of plan. However, they continue to benefit from the tax advantages associated with a conventional 401(k). Although it might seem less appealing without an employer match, such a 401(k) can still play a vital role in retirement planning. It encourages early savings, capitalizing on compound interest, and offers significant tax benefits. This plan is particularly beneficial for those without access to a traditional pension plan or those desiring a more active role in managing their retirement investments. Despite no matching contributions, these plans provide a structured and disciplined approach to long-term savings. Without an employer match, all contributions to the 401(k) are made by the employee. The IRS sets limits on how much an individual can contribute each year. In 2024, the contribution limit for individuals under 50 is $23,000. For those 50 and over, there is an additional "catch-up" contribution allowed, currently set at $7,500. These limits are periodically adjusted for inflation, allowing individuals to save more over time. 401(k) plans typically offer a selection of investment options. These often include stock mutual funds, bond mutual funds, and money market funds. Some plans may also offer target-date funds that automatically adjust the investment mix as you near retirement. The variety of options allows individuals to tailor their investment strategy according to their risk tolerance and retirement goals. While 401(k) accounts are meant for retirement, withdrawals can be made before the age of 59 ½ under certain circumstances. However, these early withdrawals usually come with a 10% penalty plus the income tax due. This discourages early withdrawals and helps to ensure that the funds are used for their intended purpose – to provide income in retirement. Contributions to a traditional 401(k) are tax-deductible in the year they're made. This can help lower your overall tax bill. However, distributions during retirement are taxed as regular income. This tax deferral can result in substantial savings over the life of the account, especially for individuals who expect to be in a lower tax bracket in retirement. With a 401(k) without an employer match, you have the autonomy to contribute as much as you want (within IRS limits) without depending on an employer contribution. You also have the freedom to decide on your investment options. This level of control can be empowering and allows you to tailor your retirement savings plan to your unique needs and goals. Another benefit is the tax-deferred growth of your investments. You don't pay taxes on the returns of your investments until you start making withdrawals in retirement. This allows your investments to compound more rapidly than they would in a taxable account, potentially leading to a larger retirement nest egg. Compared to IRAs, 401(k)s offer higher contribution limits. Even without an employer match, you can contribute significantly more to a 401(k) than you could to an IRA. This makes a 401(k) without an employer match a particularly valuable tool for high earners or those who get a late start on retirement savings. A 401(k) without an employer match could be rolled over into a new employer's plan or an IRA when changing jobs, which can make it easier to manage retirement savings. This flexibility is a significant advantage and helps to ensure that you maintain control over your retirement funds throughout your career. The most obvious drawback is the lack of employer contributions. Without a match, you're missing out on "free money" that can grow over time and boost your retirement savings. This makes it even more critical to contribute regularly and take full advantage of the tax benefits and compounding growth of a 401(k). As with any investment, there's a risk that the value of your 401(k) could decrease. It's important to carefully consider your risk tolerance and investment strategy. Diversifying your investments and regularly reviewing and adjusting your portfolio can help manage this risk. 401(k) plans often have higher fees than other investment vehicles. Without an employer match to offset these costs, these fees can eat into your returns over time. It's important to understand the fee structure of your 401(k) plan and consider this in your retirement planning. While you can technically access your 401(k) funds before retirement, early withdrawal penalties make this an expensive option. Unless there's a significant financial emergency, it's generally best to leave your 401(k) funds untouched until retirement. Investing in a mix of asset types can help manage risk. Diversify your 401(k) portfolio by allocating funds across a range of investment options. This spreads out your risk and can help to smooth out the ups and downs of the market. The key to a sizable retirement nest egg is regular and consistent contributions. Make it a point to contribute to your 401(k) every pay period, even if there's no employer match. Regular contributions can take advantage of dollar-cost averaging and help mitigate the impact of short-term market fluctuations. Regularly rebalance your 401(k) to ensure it aligns with your risk tolerance and investment goals. Over time, some investments may perform better than others, shifting your portfolio's balance. Rebalancing helps to maintain your desired level of risk and return. If you're 50 or older, take advantage of catch-up contributions. This allows you to contribute an extra $7,500 per year to your 401(k), accelerating your retirement savings. It's a valuable tool for those who may have gotten a late start on saving for retirement. Even without an employer match, it's essential to contribute regularly to your 401(k). Failing to contribute enough can significantly impact the size of your retirement savings. Aim to contribute at least enough to take full advantage of the tax benefits. High fees can eat into your retirement savings. Make sure to understand all the fees associated with your 401(k) plan. When comparing investment options, look at the expense ratios and other associated costs, not just the potential returns. Putting all your eggs in one basket is risky. Diversify your investments across different asset classes to mitigate potential losses. This can help to protect your retirement savings in the event of a downturn in any one asset class. It's crucial to keep your beneficiary information up to date. Failing to do so can lead to complications in the event of your death. This is particularly important in the case of major life changes, such as marriage, divorce, or the birth of a child. The first step in retirement planning is to understand your financial goals. This includes how much income you'll need in retirement, your desired retirement age, and your lifestyle expectations. It's important to revisit these goals regularly and adjust your savings strategy as necessary. Once you know your retirement goals, you can calculate how much you'll need to save. There are many online calculators available to help you determine this amount. It's also advisable to consult with a financial advisor or retirement planning specialist to ensure that your calculations are accurate and realistic. If early retirement is part of your plan, you'll need to save more and potentially invest more aggressively. Keep in mind the rules for early withdrawal from your 401(k). Early retirement requires careful planning to ensure that you have enough to live on without depleting your retirement savings prematurely. Finally, consider other sources of income in retirement, like Social Security, pensions, or part-time work. These can supplement your 401(k) savings and help you achieve your retirement goals. Diversifying your income sources in retirement can provide a measure of security and financial stability. A 401(k) without an employer match presents a unique set of benefits and drawbacks. While the lack of matching contributions can feel limiting, the independence and tax-deferred growth, as well as the potential for higher contribution limits and rollovers, make it a compelling tool for retirement planning. However, proper use of this plan necessitates strategic investment diversification, regular contributions, periodic rebalancing, and diligent fee management. The challenges of early access, potential high fees, and investment risks require careful attention. Whether you're pursuing early retirement or figuring out how to best utilize the catch-up contributions provision, understanding and regularly revisiting your retirement goals is crucial. As you navigate this journey, remember that a 401(k) is just one part of a broader retirement plan that may include Social Security, pensions, or other income sources. Reach out to a retirement planning specialist today and start crafting your tailored retirement savings plan.Understanding a 401(k) Without an Employer Match

How a 401(k) Without an Employer Match Works

Contributions

Investment Options

Withdrawals and Penalties

Taxes

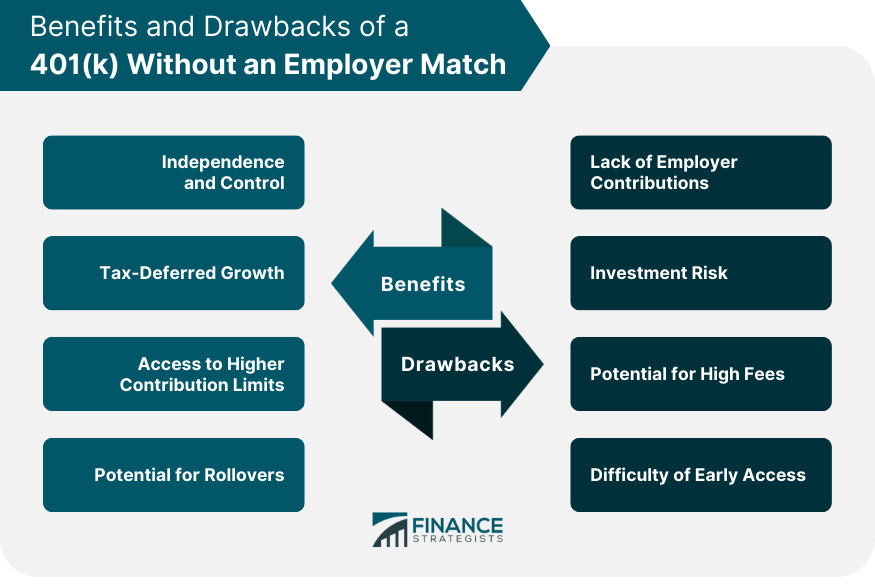

Benefits of a 401(k) Without an Employer Match

Independence and Control

Tax-Deferred Growth

Access to Higher Contribution Limits

Potential for Rollovers

Drawbacks of a 401(k) Without an Employer Match

Lack of Employer Contributions

Investment Risk

Potential for High Fees

Difficulty of Early Access

Strategies for Maximizing a 401(k) Without an Employer Match

Diversification

Regular Contributions

Rebalancing

Catch-up Contributions for Older Employees

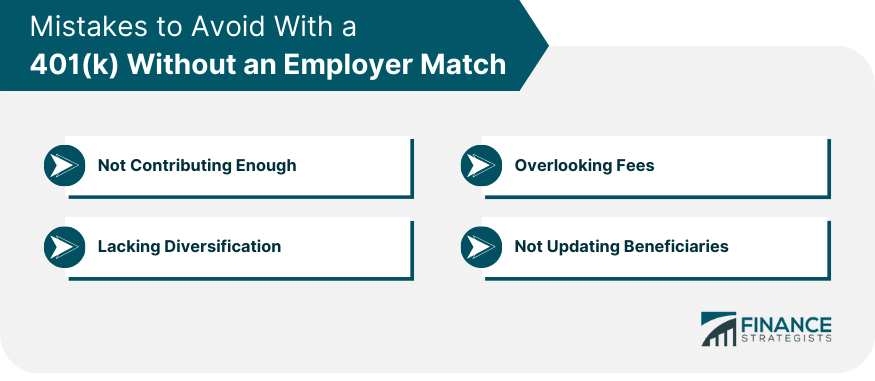

Mistakes to Avoid With a 401(k) Without an Employer Match

Not Contributing Enough

Overlooking Fees

Lacking Diversification

Not Updating Beneficiaries

Planning for Retirement Without an Employer Match

Understanding Retirement Goals

Calculating Required Savings

Considerations for Early Retirement

Role of Social Security and Other Income Sources

Bottom Line

401(k) Without an Employer Match FAQs

A 401(k) without an employer match is a retirement savings plan where the employee makes all the contributions without any matching contributions from the employer.

Despite the lack of an employer match, benefits include tax-deferred growth, higher contribution limits compared to IRAs, potential for rollovers, and more control over investments.

Drawbacks include lack of employer contributions, potential for high fees, investment risk, and penalties for early withdrawal.

Strategies include diversifying investments, making regular contributions, rebalancing the portfolio regularly, and taking advantage of catch-up contributions if over 50.

Common mistakes include not contributing enough, overlooking high fees, not diversifying investments, and failing to update beneficiary information.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.