An early withdrawal penalty is a financial penalty imposed on individuals who withdraw funds from certain types of accounts, such as retirement accounts or certificates of deposit (CDs), before a specified age or time period. The penalty is designed to discourage early withdrawals and encourage individuals to keep their funds invested for the long term. Early withdrawal penalties are most commonly associated with tax-advantaged retirement accounts, such as traditional IRAs, Roth IRAs, and 401(k) plans. Still, they can also apply to other types of time-based savings accounts. It is important to note that certain exceptions to early withdrawal penalties, such as specific hardship situations or qualified first-time home purchases, may allow individuals to access their funds without incurring a penalty. Traditional IRA: Individual Retirement Accounts (IRAs) are tax-advantaged savings accounts designed for retirement savings. Withdrawing funds before age 59½ incurs a penalty. Roth IRA: Similar to Traditional IRAs, Roth IRAs are retirement accounts with different tax structures. Early withdrawals are subject to penalties unless specific conditions are met. 401(k): Employer-sponsored retirement plans that allow employees to contribute pre-tax income. Early withdrawals typically result in penalties. 403(b): Retirement plans for employees of certain tax-exempt organizations. Similar to 401(k) plans, early withdrawals are penalized. 457 plans: Retirement plans for state and local government employees and some non-governmental organizations. Early withdrawal penalties apply in most cases. Certificates of Deposit: Financial products offered by banks and credit unions which require the account holder to leave their funds untouched for a specified period. Early withdrawals attract penalties. Withdrawal Before Age 59½: Withdrawing funds from retirement accounts such as IRAs and 401(k)s before age 59½ typically results in penalties. Exceptions for Specific Life Events: Some life events, such as purchasing a first home or paying for higher education, may qualify for penalty-free withdrawals. Withdrawal Before the Maturity Date: Withdrawing funds from a CD before its maturity date incurs penalties. Penalties Based on the Term of the CD: The penalty amount often depends on the term length of the CD. First-Time Home Purchase: Some retirement accounts permit penalty-free withdrawals for first-time homebuyers up to specified limits. Qualified Higher Education Expenses: Penalty-free withdrawals may be allowed for qualified higher education expenses. Medical Expenses: Certain unreimbursed medical expenses may qualify for penalty-free withdrawals. Disability: In case of total and permanent disability, early withdrawal penalties may be waived. Inherited Retirement Accounts: Inheriting a retirement account may allow the beneficiary to withdraw funds without incurring penalties. No-Penalty CDs: Some financial institutions offer CDs that do not impose penalties for early withdrawals. Promotional Terms and Conditions: Promotions or specific account terms may waive early withdrawal penalties under certain conditions. Penalties for early withdrawals from retirement accounts typically amount to 10% of the withdrawn funds and regular income taxes. For example, an individual withdrawing $10,000 before age 59½ from a Traditional IRA would pay a $1,000 penalty, plus applicable income taxes. Penalties for early withdrawals from CDs are often calculated based on the interest earned or a fixed number of months' interest. An example is a 12-month CD with an early withdrawal penalty of three months' interest would result in the loss of a quarter of the total interest earned. Emergency Funds: Establishing an emergency fund separate from your retirement accounts can help avoid early withdrawals and related penalties. Roth IRA Contributions: Roth IRA contributions can be withdrawn tax-free and penalty-free under certain conditions, making them a more flexible option. Utilizing Exceptions and Exemptions: Familiarize yourself with the available exceptions and exemptions to minimize early withdrawal penalties. Laddering CDs: Implementing a CD ladder strategy can provide more frequent access to funds while still earning interest, reducing the need for early withdrawals. Selecting Appropriate Terms: Choose CD terms that align with your financial goals and anticipated liquidity needs to avoid early withdrawal penalties. Researching No-Penalty Options: Consider no-penalty CDs or other flexible savings options to ensure easy access to funds without incurring penalties. Federal Tax Consequences: Early withdrawals from retirement accounts are generally subject to federal income taxes in addition to penalties. State Tax Consequences: Depending on your state of residence, early withdrawals may also be subject to state income taxes. Federal Tax Consequences: Although CD early withdrawal penalties may not incur additional federal taxes, the interest earned is generally subject to federal income tax. State Tax Consequences: Interest earned on CDs may also be subject to state income taxes, depending on your state of residence. Early withdrawal penalties are financial penalties imposed on individuals who withdraw funds from certain types of accounts before a specified age or time period. Retirement accounts, such as Traditional IRAs, Roth IRAs, and 401(k) plans, are most commonly associated with early withdrawal penalties, but they can also apply to other types of time-based savings accounts, such as Certificates of Deposit (CDs). Exceptions to early withdrawal penalties exist, such as for specific life events like a first-time home purchase or qualified higher education expenses. Early withdrawal penalties are calculated differently for retirement accounts and time-based savings accounts, and individuals can minimize these penalties through strategies like establishing emergency funds or choosing appropriate terms. It is important to keep in mind that early withdrawal penalties may also have tax implications, including federal and state income taxes. Understanding early withdrawal penalties and how to minimize them can help individuals make informed decisions about their finances and avoid unnecessary penalties and taxes.What Is an Early Withdrawal Penalty?

Types of Accounts With Early Withdrawal Penalties

Retirement Accounts

Time-Based Savings Accounts

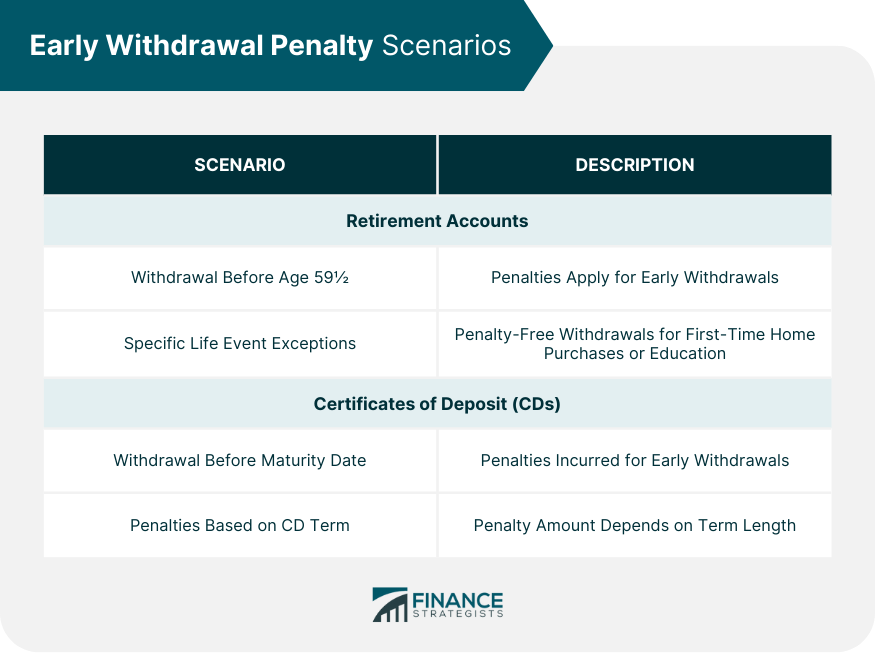

Early Withdrawal Penalty Scenarios

Retirement Accounts

Certificates of Deposit (CDs)

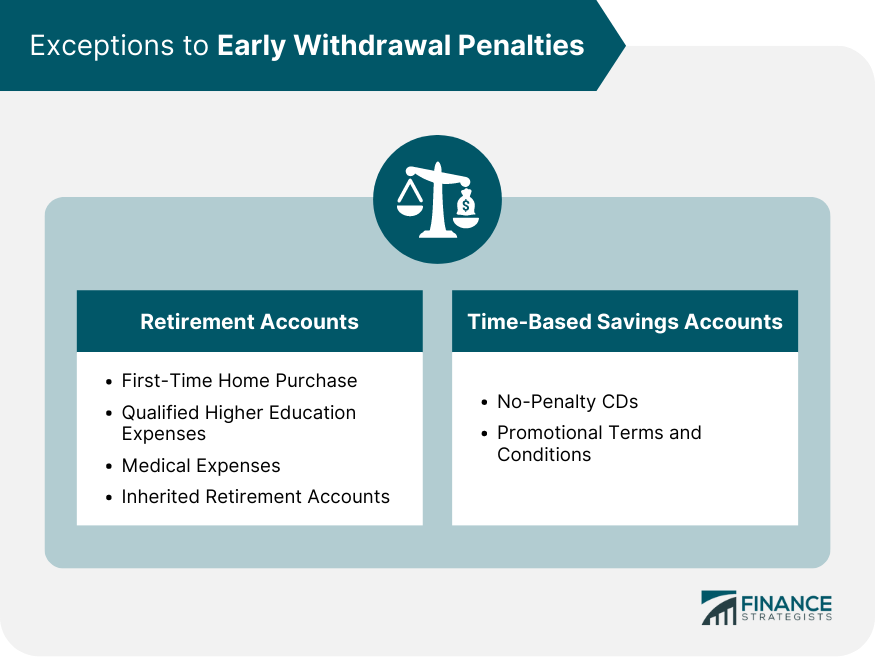

Exceptions to Early Withdrawal Penalties

Retirement Accounts

Time-Based Savings Accounts

Calculating Early Withdrawal Penalties

Retirement Accounts

Time-Based Savings Accounts

Strategies to Minimize Early Withdrawal Penalties

Retirement Accounts

Time-Based Savings Accounts

Tax Implications of Early Withdrawal Penalties

Retirement Accounts

Time-Based Savings Accounts

Conclusion

Early Withdrawal Penalty FAQs

Early withdrawal penalties are fees imposed on individuals who withdraw funds from specific types of accounts, such as retirement accounts or CDs, before a predetermined time or age. These penalties exist to encourage long-term savings and deter individuals from accessing funds prematurely.

Early withdrawal penalties are generally associated with retirement accounts (such as Traditional IRAs, Roth IRAs, 401(k)s, 403(b)s, and 457 plans) and time-based savings accounts like Certificates of Deposit (CDs).

Yes, there are exceptions to early withdrawal penalties for specific circumstances, such as first-time home purchases, qualified higher education expenses, medical expenses, disability, and inherited retirement accounts. Some financial institutions also offer no-penalty CDs that allow for penalty-free withdrawals.

For retirement accounts, early withdrawal penalties are typically 10% of the withdrawn amount, plus regular income taxes. For CDs, penalties are often calculated based on the interest earned or a fixed number of months' interest, depending on the terms of the CD.

To minimize early withdrawal penalties, consider establishing an emergency fund, utilizing Roth IRA contributions, taking advantage of available exceptions and exemptions, implementing a CD laddering strategy, selecting appropriate CD terms, and researching no-penalty options.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.