A discretionary contribution in a 401(k) plan is a type of contribution that's at the sole discretion of the employer. While contributions are typically defined, and regular in most plans, discretionary contributions offer a degree of flexibility for employers. These funds can be an unexpected windfall for employees, providing an added boost to their retirement savings above and beyond what they personally contribute. Mandatory contributions, on the other hand, form the backbone of many retirement plans. These are set, regular amounts that employers contribute to the employee's 401(k), irrespective of other factors. In contrast, discretionary contributions offer more adaptability. They fluctuate based on the employer's will and financial condition, providing employers a way to share business success directly with employees while also allowing them to conserve resources during lean times. Profit-sharing contributions are a unique and appealing aspect of 401(k) plans. When an employer chooses to distribute a portion of the company's pre-tax profits among employees' 401(k) accounts, they're making a profit-sharing contribution. This not only incentivizes employees to contribute to the company's profitability, but it also creates a direct correlation between the company's success and the employees' financial futures. Non-elective contributions are yet another form of discretionary contributions that employers can decide to make. These are not based on the profitability of the company, giving the employer more autonomy in deciding when and how much to contribute. These types of contributions can provide a steady influx of employer funds into an employee's 401(k), regardless of the company's profits. Matching contributions are a common feature of many 401(k) plans. They involve the employer matching the amount an employee contributes to their 401(k) up to a certain limit. This type of contribution is an excellent incentive for employees to actively contribute to their 401(k) accounts, as it directly multiplies the effectiveness of their saving efforts. Company profitability is one of the key drivers of discretionary contributions. If the company has a robust bottom line, it may choose to reward employees by making generous discretionary contributions. However, if profits are thin, the company might choose to reduce or even withhold these contributions. Therefore, discretionary contributions can serve as a reflection of the financial health of the company. The economic climate and the business cycle significantly impact discretionary contributions. During economic booms, when profits are high, companies might make larger contributions. In contrast, during downturns, when companies may face financial strain, these contributions might be decreased or stopped. Discretionary contributions, as the name suggests, are ultimately at the employer's discretion. This gives the employer significant leeway in using these contributions as a strategic tool. They can be used to motivate employees, reward high performers, or as a retention tool. However, it's essential for employers to manage these contributions judiciously to avoid fostering a sense of unfairness or unpredictability. Discretionary contributions provide a way for employees to boost their retirement savings without needing to increase their personal contributions. Since these contributions are in addition to the employee's own contribution, they can greatly enhance the total savings, bringing the employee closer to their retirement goals. Discretionary contributions can also have a positive impact on employee morale and retention. When employees know that their hard work can result in larger contributions to their retirement savings, they're likely to feel more motivated and appreciated. Moreover, the potential for these additional contributions can also incentivize employees to stay with the company longer. Discretionary contributions, like other 401(k) contributions, are typically made pre-tax. This can reduce the employee's taxable income, potentially leading to substantial tax savings. This benefit enhances the attractiveness of 401(k) plans and can make a significant difference in the long-term growth of retirement savings. Despite their advantages, discretionary contributions come with certain drawbacks, the most significant of which is their unpredictability. Unlike regular contributions, employees cannot depend on them, which may make retirement planning more challenging. Employees should be mindful of this aspect when considering their retirement strategies. Discretionary contributions can also lead to potential inequality among employees. Some companies may choose to contribute more for certain employees based on their compensation, position, or performance. While this can serve as a motivation for some, it could foster a sense of unfairness among others. There are limits on how much an employer can contribute to a 401(k) plan, which includes both mandatory and discretionary contributions. Employers must also ensure compliance with non-discrimination rules, which are in place to ensure that 401(k) contributions do not disproportionately benefit highly compensated employees. The key to making the most of your 401(k) with discretionary contributions lies in the amount you are able to contribute. As an employee, you should strive to maximize your individual contributions to take full advantage of your employer's discretionary contributions. Remember, the more you contribute, the more your employer can contribute, leading to faster growth of your retirement savings. Employers often communicate changes in their discretionary contribution practices, which may be influenced by their financial situation and business objectives. As an employee, it's crucial to keep an eye on these communications to stay updated about your potential earnings. Understanding the trends and patterns of your employer's discretionary contributions can help you plan your own contributions and retirement savings strategy more effectively. Periodic review of your 401(k) statements is another important strategy to ensure you're maximizing the benefits of discretionary contributions. These statements give you an overview of your account balance, your own contributions, your employer's matching and discretionary contributions, as well as the investment returns. Regularly reviewing these statements will not only help you keep track of your savings progress but also allow you to spot any discrepancies or issues that might arise. Every employer has a different pattern of making discretionary contributions. Some may contribute more when the company has a profitable year, while others may keep a consistent contribution irrespective of the profits. By understanding this pattern, you can plan your contributions and investment strategy more efficiently, ensuring that you're making the most of every dollar contributed to your 401(k) account. As an employer, your role in managing and implementing discretionary contributions is crucial. The first step is to be transparent about the possibility of these contributions. Clearly communicating their potential and the conditions that would lead to their implementation is an essential aspect of this. By doing so, you can manage employee expectations and foster a better understanding of the retirement savings process. Clear and open communication with employees about discretionary contributions is necessary to avoid any misconceptions or confusion. This communication should cover the potential for these contributions, how they're calculated, and when they might be made. Providing regular updates and being open to queries or discussions about these contributions can help build a culture of trust and awareness within your organization. Discretionary contributions are governed by specific regulations outlined by the Internal Revenue Service (IRS) and the Department of Labor. As an employer, it's crucial to be familiar with these rules to avoid potential legal complications. These rules can include maximum contribution limits, nondiscrimination requirements, and top-heavy rules. Failure to comply with these regulations could lead to hefty penalties or the disqualification of the entire plan. Once familiar with the regulations; employers should ensure they strictly adhere to them. This can involve setting up processes to track contributions, conducting regular audits to ensure compliance, and seeking advice from retirement plan professionals or legal counsel. Ensuring adherence not only prevents potential legal issues but also reinforces your organization's commitment to providing a fair and beneficial retirement plan to employees. Establishing an employee education program about discretionary contributions can also be beneficial. This can help employees better understand the nature of these contributions, how they can maximize their benefits, and the role these contributions play in their overall retirement savings strategy. An informed workforce is more likely to feel satisfied and engaged, contributing to a positive work environment. Discretionary contributions to a 401(k) provide a dynamic and valuable avenue for employers to incentivize employee engagement, align business success with workforce prosperity, and potentially enhance retirement savings for employees. They are a powerful tool, flexible to business cycles and profitability, that can motivate employees and foster long-term loyalty. However, they also come with challenges, such as unpredictability, potential inequality, and compliance with regulations. Thus, proactive strategies from both employees and employers are crucial. Employees should strive to maximize their contributions, stay informed about company updates, and review their 401(k) statements regularly. Employers, on the other hand, should uphold transparency, clear communication, and adherence to regulations and foster an educational culture around these contributions. If you are contemplating your retirement planning strategy, seek professional guidance from retirement planning services, where you can better understand and leverage these unique contributions.Overview of 401(k) Discretionary Contribution

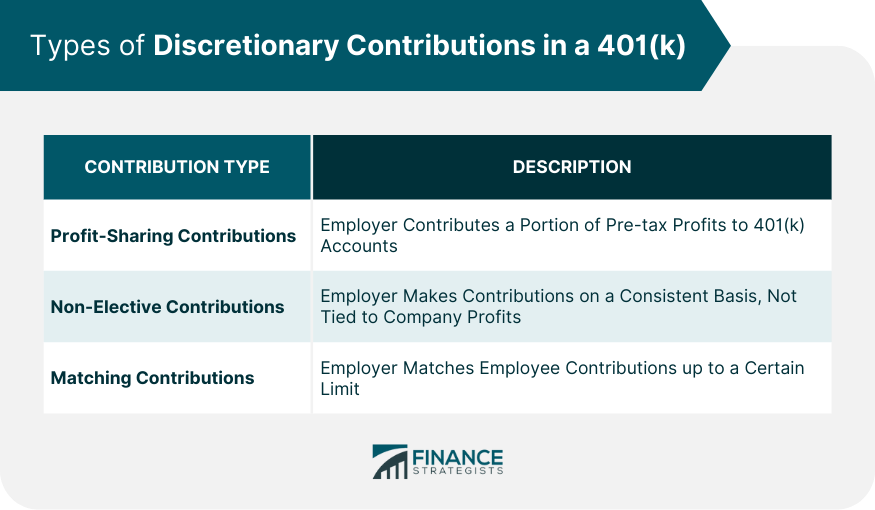

Types of Discretionary Contributions in a 401(k)

Profit-Sharing Contributions

Non-Elective Contributions

Matching Contributions

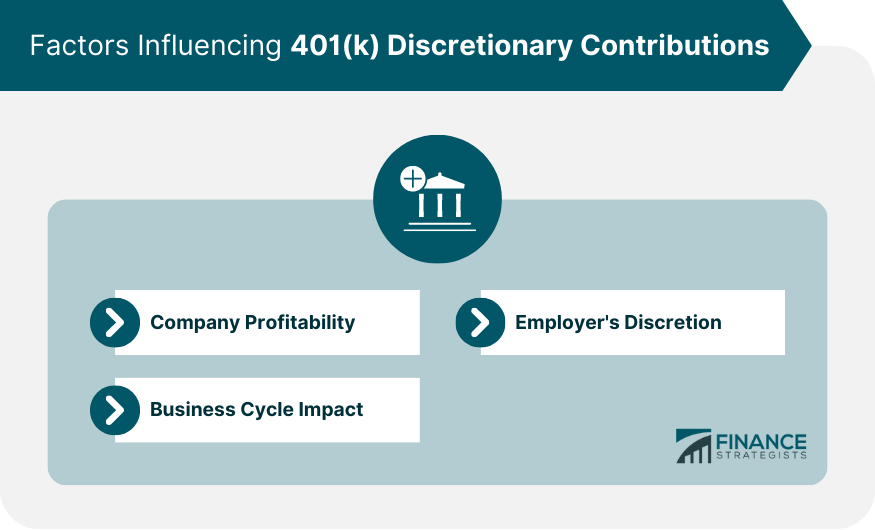

Factors Influencing 401(k) Discretionary Contributions

Company Profitability

Business Cycle Impact

Employer's Discretion

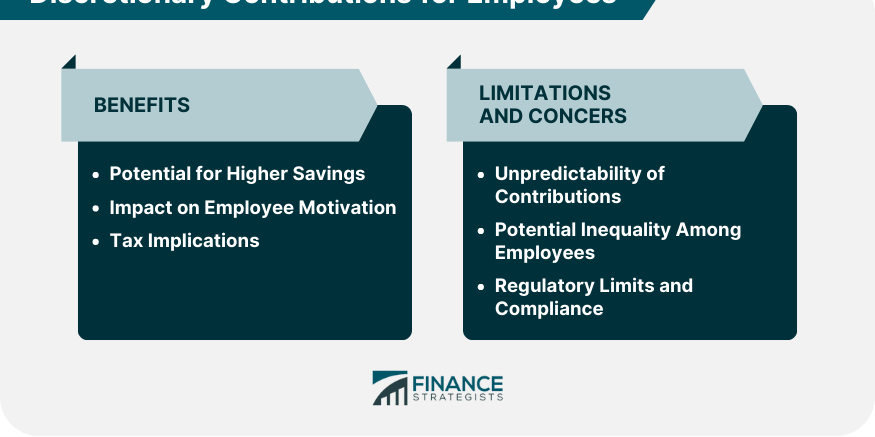

Benefits of 401(k) Discretionary Contributions for Employees

Potential for Higher Savings

Positive Impact on Employee Motivation and Retention

Tax Benefits

Limitations and Concerns About 401(k) Discretionary Contributions

Unpredictability of Contributions

Potential Inequality Among Employees

Regulatory Limits and Compliance

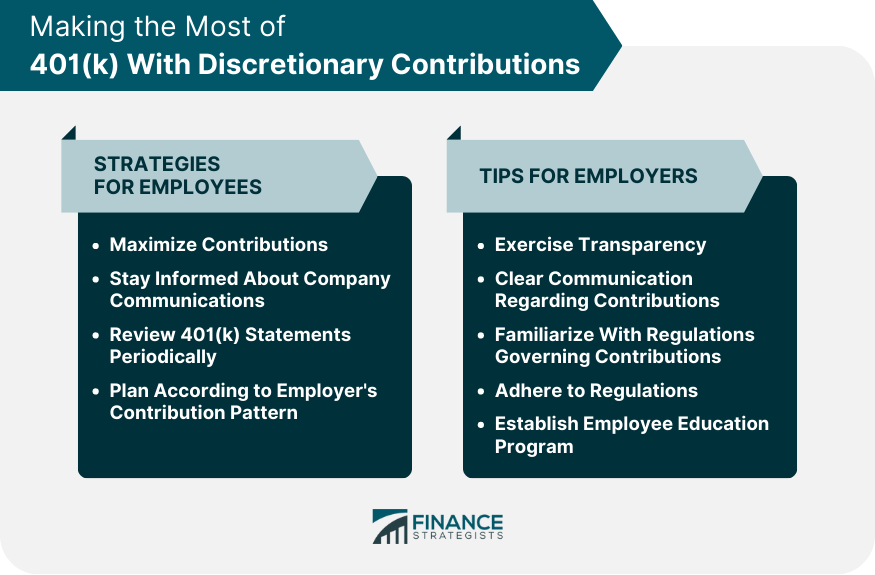

Making the Most of Your 401(k) With Discretionary Contributions

Strategies for Employees to Maximize Benefits

Maximize Your Contributions

Stay Informed About Company Communications

Perform Periodic Review of Your 401(k) Statements

Plan According to Employer's Contribution Pattern

Tips for Employers Implementing Discretionary Contributions

Exercise Transparency

Provide Clear Communication Regarding Contributions

Familiarize With Regulations Governing Discretionary Contributions

Adhere to Regulations

Establish an Employee Education Program

Bottom Line

401(k) Discretionary Contributions FAQs

401(k) discretionary contributions are employer-contributed funds that are not mandatory and offer flexibility in boosting employees' retirement savings.

Profit-sharing contributions involve employers sharing a portion of pre-tax profits with employees' 401(k) accounts, providing a direct link between company success and retirement savings.

Yes, discretionary contributions can enhance employee motivation as they perceive their efforts being rewarded and can contribute to their long-term financial security.

Discretionary contributions, like regular 401(k) contributions, are typically made on a pre-tax basis, resulting in potential tax savings for employees.

Yes, discretionary contributions can be unpredictable, potentially leading to challenges in retirement planning. Inequality among employees and regulatory compliance are also considerations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.