A 401(k) statement is a comprehensive document provided by your plan provider, offering a detailed snapshot of the current status of your 401(k) retirement account. The information in this statement is critical for anyone interested in taking charge of their retirement future. The statement, typically issued on a quarterly basis, gives you an in-depth look into your retirement savings and investments. It shows all the transactions, contributions, distributions, fees, and investment returns for a specific period. This document is your roadmap, guiding you through your journey to financial security in your golden years. The primary objective of a 401(k) statement is to provide you with information about your retirement account. Not only does it serve as a comprehensive financial report, but it also helps you make informed decisions about investment strategy, contribution amounts, and retirement goals. To extract meaningful insights from your 401(k) statement, you must first understand its structure. Most 401(k) statements have a similar structure, beginning with an account summary. This summary offers a high-level overview of your account status, including balances, contributions, and returns. The subsequent sections will break down your investments, their performance, and associated fees, followed by a complete transaction history. The format aims to provide you with a comprehensive view of your retirement account's health. The principal components of a 401(k) statement are your total contributions, your employer's contributions, investment earnings, and fees. Understanding these elements is crucial for effectively managing your account. Knowledge of these components can help you identify trends, project future growth, and make proactive decisions to secure your retirement future. Being able to decode your 401(k) statement empowers you to take charge of your retirement savings. This section provides a summary of all contributions you've made to your 401(k) account within a specific reporting period. Monitoring your contributions is an essential aspect of retirement planning, as it helps you ensure you are consistently working towards your retirement savings goals. If your employer offers matching contributions, this section shows the additional money added to your account. Employer contributions can significantly boost your retirement savings, and understanding this component of your statement ensures you're leveraging all available resources. This component represents the gains your investments within the 401(k) have generated over the reporting period. It can include dividends, interest, and capital gains. A keen eye on this section helps you understand if your investments are performing as expected and contributing effectively towards your retirement corpus. Every 401(k) plan comes with associated fees. Understanding these costs is crucial as they can impact your overall returns and the growth of your retirement savings over time. Consistently reviewing your 401(k) statement can guide your retirement savings strategy and help you make informed financial decisions. Frequently reviewing your 401(k) statement helps you track the progress of your retirement savings. It enables you to recognize trends, anticipate future challenges, and reassess your retirement goals, ensuring you're always on the right path. Even in automated systems, errors can occur. Regularly reviewing your statement allows you to spot any potential discrepancies or errors promptly. Catching mistakes early can save you time and prevent future complications. Your 401(k) statement provides key data about your investments' performance. Regularly evaluating this information can help you assess the effectiveness of your current investment strategy and make adjustments as necessary. Once you have reviewed your statement, it is crucial to take appropriate actions to ensure that your retirement savings continue to grow effectively. Over time, the market's ebbs and flows can shift your asset allocation. If unchecked, this drift can alter your risk exposure and potential returns. Portfolio rebalancing is a vital strategy to keep your investments aligned with your original asset allocation and risk tolerance. If your statement shows you're not on track to meet your retirement goals, you may need to increase your contributions. On the other hand, if you're ahead of schedule, you may have the flexibility to contribute less. Regular assessment of your contributions allows for timely adjustments to align with your evolving financial goals. Your 401(k) statement provides a snapshot of your investment performance. This can help you determine if your current investments align with your risk tolerance and retirement goals. If they do not, adjustments may be necessary to ensure your portfolio remains optimized for your personal financial circumstances. Understanding common pitfalls can help you avoid mistakes when interpreting your 401(k) statement. Investment performance can fluctuate, and it's crucial to understand these changes within the context of your long-term retirement goals. Avoid reactive decisions based on short-term performance. Instead, maintain a balanced perspective, understanding that investments are a long-term endeavor. Though they may seem small, fees can substantially erode your retirement savings over time. Understanding how fees impact your returns is an essential aspect of managing your 401(k). A lower-fee alternative can often lead to significant savings over the long term. Estimating the amount you'll need in retirement is challenging. Various factors come into play, including life expectancy, healthcare costs, and lifestyle choices. Misjudging any of these factors can lead to a shortfall in your retirement savings. Seeking professional guidance can be beneficial in understanding your 401(k) statement and making informed retirement planning decisions. If you find yourself overwhelmed by the complexities of your 401(k) statement or unsure about your retirement strategy, it may be time to seek professional help. Financial advisors can offer personalized advice tailored to your specific circumstances. A skilled financial advisor can help demystify your 401(k) statement and assist you in formulating a robust retirement savings strategy. Consider the advisor's credentials, experience, and understanding of your financial situation when selecting a professional. The right advisor can make a significant difference in your journey toward financial independence in retirement. A 401(k) statement is a critical tool in retirement planning, providing a comprehensive snapshot of your retirement account's current status. Regularly reviewing this document can guide your retirement savings strategy, helping you track progress, identify potential errors, assess investment performance, and decide on key actions like portfolio rebalancing and adjusting contributions. Moreover, understanding the common pitfalls, such as misunderstanding investment performance, overlooking the impact of fees, and miscalculating required retirement savings, can significantly enhance your retirement planning process. Lastly, should you find the task daunting or complex, seeking professional help from a skilled financial advisor can help demystify your 401(k) statement and assist you in formulating a robust retirement savings strategy.What Is a 401(k) Statement?

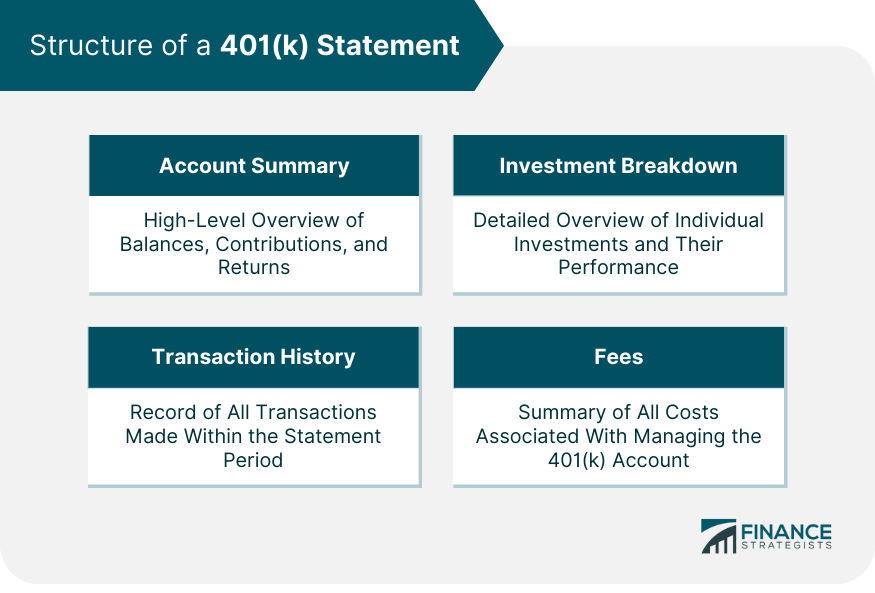

Structure of a 401(k) Statement

Overview of 401(k) Statement Format

Breakdown of Individual Components

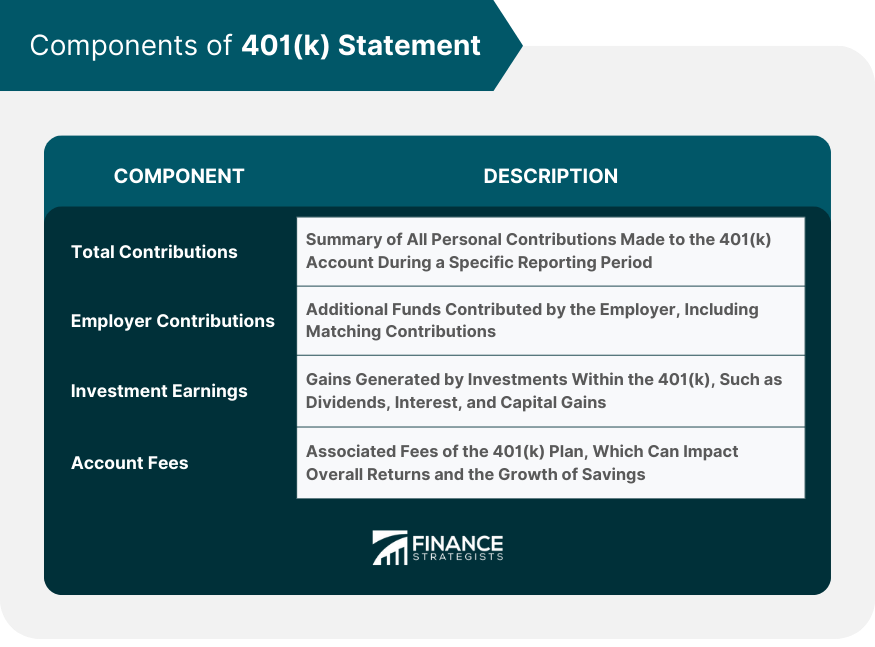

Components of 401(k) Statement

Total Contributions

Employer Contributions

Investment Earnings

Account Fees

Significance of Regularly Reviewing 401(k) Statement

Tracking Retirement Savings Progress

Identifying Potential Errors

Assessing Investment Performance

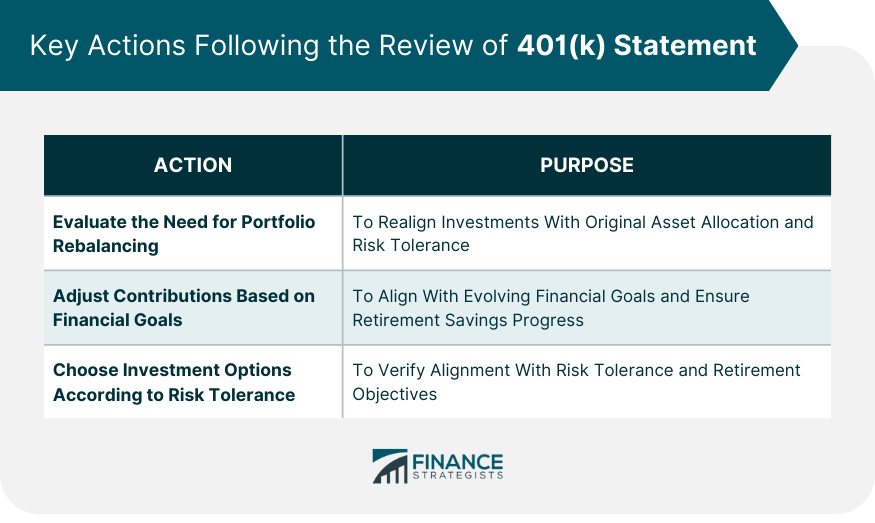

Key Actions Following the Review of 401(k) Statement

Evaluate the Need for Portfolio Rebalancing

Adjust Contributions Based on Financial Goals

Choose Investment Options According to Risk Tolerance

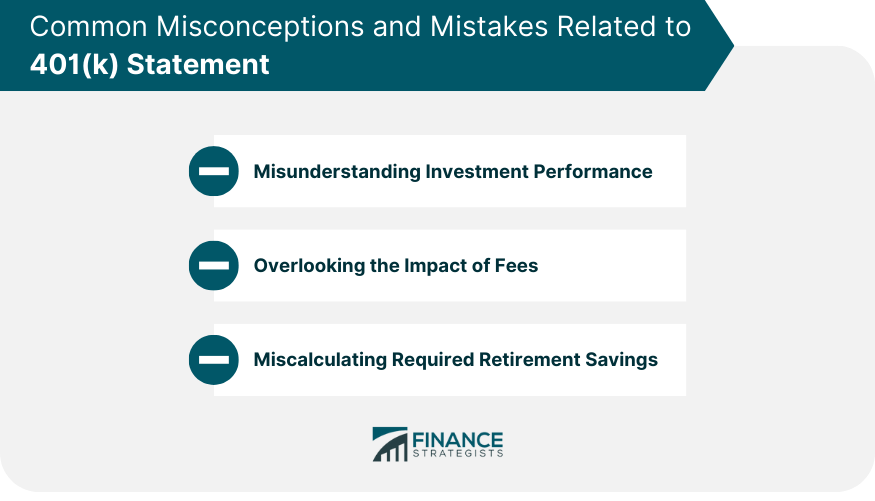

Common Misconceptions and Mistakes Related to Your 401(k) Statement

Misunderstanding Investment Performance

Overlooking the Impact of Fees

Miscalculating Required Retirement Savings

Role of Professional Guidance in Understanding 401(k) Statement

When to Seek Help

Finding the Right Financial Advisor

Final Thoughts

401(k) Statement FAQs

A 401(k) statement is a detailed document issued by your retirement plan provider outlining the status of your retirement savings, investments, and transactions.

The key components include your total contributions, your employer's contributions, investment earnings, and account fees.

Regular reviews help track your retirement savings progress, identify potential errors, and assess your investment performance to ensure alignment with your financial goals.

You should evaluate the need for portfolio rebalancing, adjust contributions based on financial goals, and ensure your investments align with your risk tolerance.

Common misconceptions include misunderstanding investment performance, overlooking the impact of fees, and miscalculating the amount needed for retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.