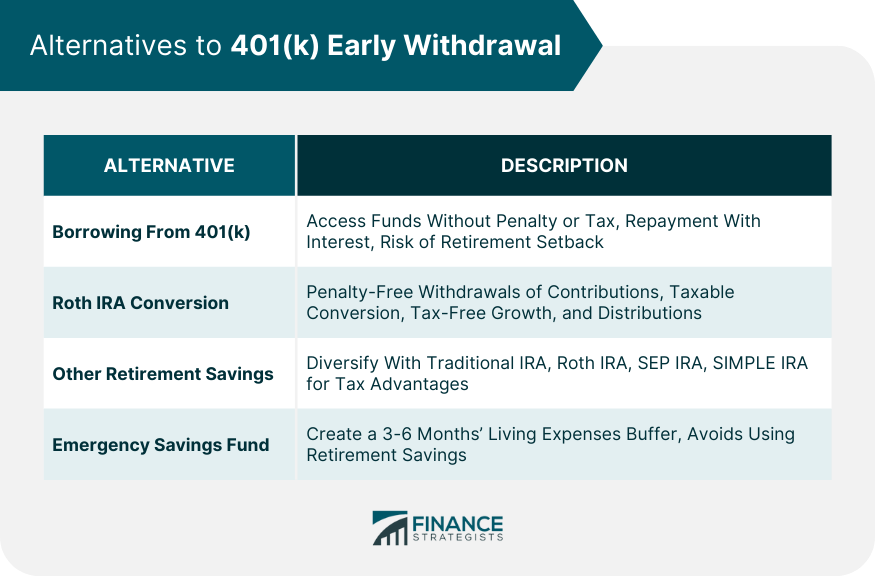

When faced with the need for funds before retirement age, exploring alternatives to early 401(k) withdrawals becomes essential. Early withdrawals can incur taxes, penalties and reduce retirement savings, making it crucial to consider other options such as loans, hardship withdrawals, or alternative savings strategies to meet immediate financial needs while preserving long-term retirement goals. One viable option is borrowing from your 401(k). This allows you to access funds without being subject to the 10% penalty or paying income tax. However, these loans must be repaid within a certain period, typically five years, with interest. If not repaid within the stipulated period, it could convert into an early withdrawal, attracting penalties. The major downside of this alternative is that it can set back your retirement savings if the loan is not repaid promptly. Another alternative is converting your 401(k) into a Roth IRA. This action allows withdrawals of contributions (not earnings) at any time without penalty. The catch is that the conversion is a taxable event, so you'll need to pay taxes on the amount converted. However, once the money is in a Roth IRA, it can grow tax-free, and qualified distributions are also tax-free. Diversifying your retirement savings across multiple types of accounts is another strategy. For instance, a Traditional IRA allows for tax-deductible contributions, whereas a Roth IRA provides for tax-free withdrawals during retirement. SEP IRAs and SIMPLE IRAs are designed for self-employed individuals and small businesses, respectively, offering higher contribution limits. While these alternatives do not necessarily provide immediate access to funds without penalty, they can offer more flexibility in specific circumstances. Creating an emergency savings fund is a financial strategy that helps manage unexpected expenses without dipping into retirement savings. This fund should ideally hold three to six months' worth of living expenses. Having this financial buffer not only reduces financial stress but also keeps your retirement savings intact for your future. In addition to retirement accounts, it's beneficial to have other types of savings or investments. High-yield savings accounts offer higher interest rates compared to traditional savings accounts, making them a good place to store and grow emergency funds. These accounts are relatively low risk and provide quick access to your money. Money market accounts are another low-risk investment option. They usually offer higher interest rates than savings accounts and come with check-writing and debit card privileges, providing both growth and flexibility. Certificates of Deposit (CDs) offer guaranteed returns over a specific period, though they lack the flexibility of withdrawal without penalty. However, they can be a suitable option for funds you know you won't need until a specific future date. For a more significant return on investment, consider investing in bonds and mutual funds. Bonds are relatively low risk, while mutual funds offer an opportunity to diversify your portfolio. However, these involve some level of risk and require careful management. Real estate can also be a profitable investment, providing both rental income and capital appreciation. However, like all investments, real estate has its own set of risks and requires due diligence before diving in. Substantially Equal Periodic Payments, commonly known as SEPP, are a series of payments that allow you to withdraw funds from your retirement account before reaching 59 ½ years old without incurring a 10% early withdrawal penalty. The SEPP option is designed to provide retirement income for those who retire early or need access to their retirement funds before the standard retirement age. However, the plan requires careful consideration, as the payments must follow certain rules established by the IRS to avoid penalties. There are three IRS-approved methods for calculating SEPP distributions: the Required Minimum Distribution (RMD) method, the Fixed Amortization method, and the Fixed Annuitization method. The RMD method is the simplest, and it recalculates the amount annually based on your life expectancy and account balance. The Fixed Amortization and Fixed Annuitization methods are more complex, but they offer fixed payments throughout the SEPP program. It's crucial to note that once started, SEPP programs must continue for five years or until the account holder turns 59 ½, whichever is longer. Making changes to the payment plan or stopping it prematurely may result in penalties and back taxes. Before committing to a SEPP, one must consider their future financial situation, retirement plans, and other financial needs. Section 72(t) of the IRS code provides a means for individuals to take early withdrawals from their retirement accounts without incurring the usual 10% penalty. The section stipulates that individuals may take Substantially Equal Periodic Payments based on their life expectancy or a joint life expectancy with a beneficiary. The methods for taking SEPPs under section 72(t) are the same as those described above for the SEPP program. You can use the RMD, Fixed Amortization, or Fixed Annuitization methods. Each method has its benefits and drawbacks, and the best choice depends on your individual circumstances and financial goals. While 72(t) distributions can provide penalty-free access to retirement funds, they come with several potential risks. On the positive side, they allow for earlier access to retirement funds and the ability to retire early. However, they also lock the individual into a schedule of withdrawals that may not suit future changes in financial circumstances or market conditions. This can potentially deplete retirement savings faster than desired. The Rule of 55 allows individuals who are 55 years old or older and have left their job to make withdrawals from their 401(k) or 403(b) plan without a 10% penalty. This is a specific exemption that only applies to these types of retirement accounts and not to others, like IRAs. To qualify for Rule 55, an individual must have left their job during or after the year they turn 55. This rule does not apply to individuals who rolled over their 401(k) or 403(b) into an IRA. The withdrawals must also be made from the plan tied to your most recent job, and you cannot make withdrawals from plans held with previous employers. The Rule of 55 can be combined with other withdrawal options, such as SEPP or 72(t) distributions, to maximize retirement income. However, combining withdrawal methods requires careful planning and understanding of the different rules and potential implications for your overall financial plan. Before deciding on early withdrawals, it's essential to evaluate your financial needs and explore alternative funding sources. This may include part-time work, rental income, savings, or investment income. Early withdrawals should be a last resort, as they can significantly impact your retirement savings. Early withdrawals can significantly deplete your retirement savings, leading to potential financial insecurity later in life. They may also impact your ability to take advantage of compounding returns and tax-deferred growth in your retirement accounts. Carefully consider the long-term impacts before deciding on early withdrawals. Before making any decisions about early withdrawals, consult with a financial advisor who can provide personalized guidance based on your unique circumstances and financial goals. They can help you navigate the complexities of the various withdrawal rules and provide strategies to minimize the impact on your retirement savings. The financial implications of early retirement account withdrawals can be significant, encompassing penalties, taxes, and potential compromise of your long-term financial security. Alternatives like borrowing from a 401(k), Roth IRA conversion, diversifying retirement savings, or investing in non-retirement options such as high-yield savings, money market accounts, real estate, or bonds can mitigate these risks. Understanding withdrawal strategies, like SEPPs, 72(t) distributions, and the Rule of 55, can provide a penalty-free means to access retirement savings early. However, these options necessitate thorough understanding and careful management to prevent the depletion of retirement funds. Whether considering early withdrawal or exploring alternative options, consulting with a financial advisor for personalized guidance can be invaluable. They can help ensure decisions align with your individual financial goals, promote long-term security, and navigate the complexity of early withdrawal rules.Alternatives to 401(k) Early Withdrawal

Borrowing From 401(k)

Roth IRA Conversion

Other Retirement Savings Accounts

Emergency Savings Fund

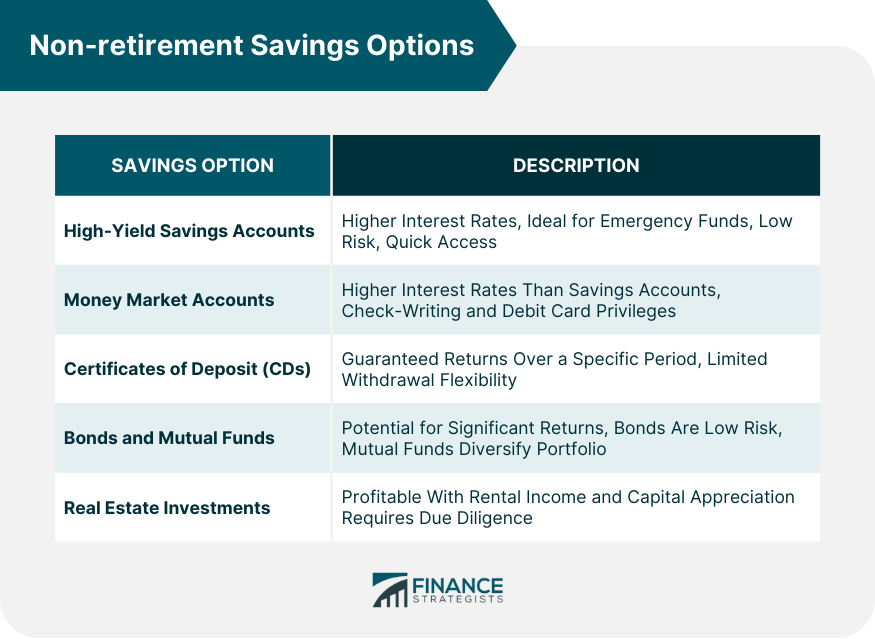

Non-retirement Savings Options

High-Yield Savings Accounts

Money Market Accounts

Certificates of Deposit (CDs)

Bonds and Mutual Funds

Real Estate Investments

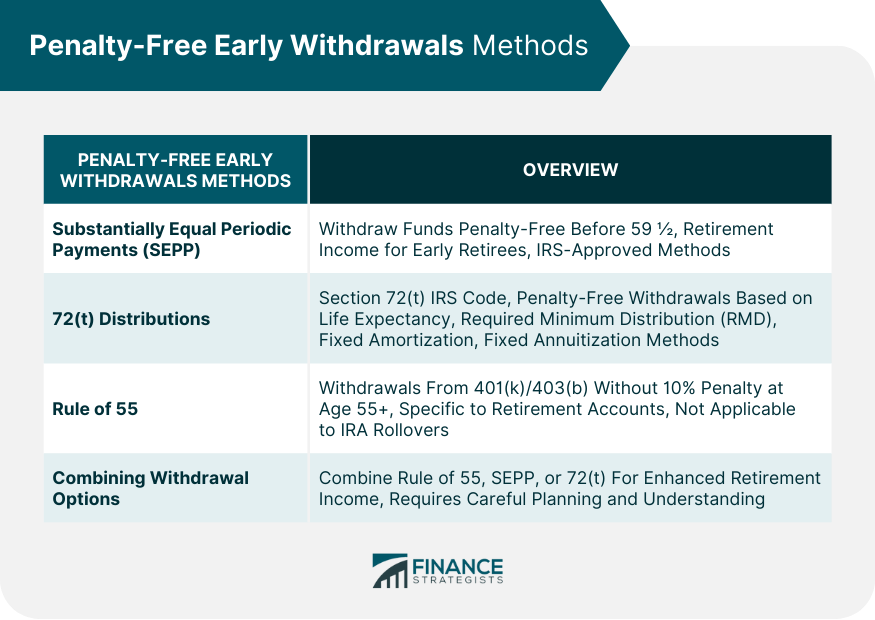

Penalty-Free Early Withdrawals Methods

Substantially Equal Periodic Payments (SEPP)

Overview of SEPP as a Method for Penalty-Free Early Withdrawals

IRS-Approved Methods for Calculating SEPP Distributions

Long-Term Commitment and Considerations for SEPP Withdrawals

72(t) Distributions

Explanation of Section 72(t) of the IRS Code

Methods for Taking Substantially Equal Periodic Payments Under 72(t)

Advantages and Risks Associated With 72(t) Distributions

Rule of 55

Understanding the Rule of 55 for Penalty-Free Withdrawals

Qualifications and Limitations of Rule 55

Combining Rule of 55 With Other Withdrawal Options

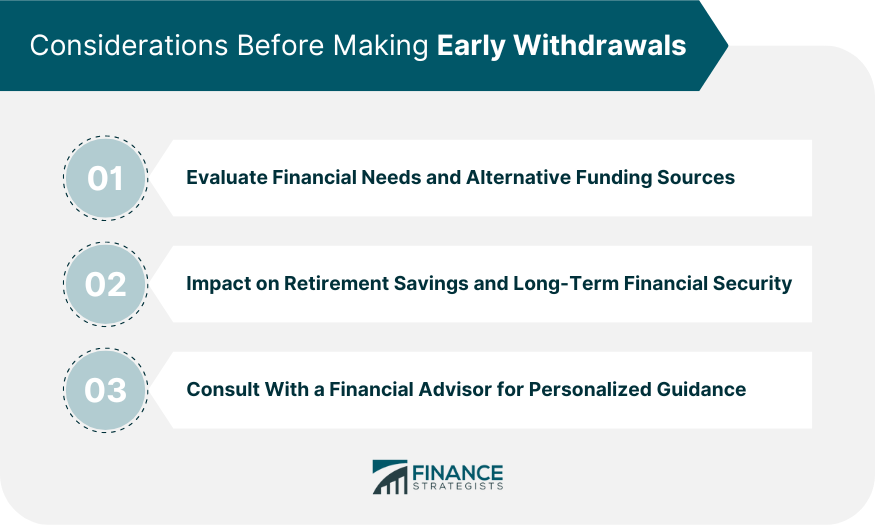

Considerations Before Making Early Withdrawals

Evaluating Financial Needs and Alternative Funding Sources

Impact on Retirement Savings and Long-Term Financial Security

Consulting With a Financial Advisor for Personalized Guidance

Conclusion

401(k) Early Withdrawal Alternatives FAQs

Alternatives include borrowing from your 401(k), converting your 401(k) into a Roth IRA, diversifying your retirement savings across different types of accounts, creating an emergency savings fund, and investing in non-retirement savings options such as high-yield savings accounts, money market accounts, real estate, or bonds.

Substantially Equal Periodic Payments (SEPP) is a method that allows you to withdraw funds from your retirement account before you reach 59 ½ years old without incurring a 10% early withdrawal penalty. There are three IRS-approved methods for calculating SEPP distributions, including the Required Minimum Distribution (RMD) method, the Fixed Amortization method, and the Fixed Annuitization method. However, once a SEPP program starts, it must continue for five years or until the account holder turns 59 ½, whichever is longer.

Section 72(t) of the IRS code provides a means for individuals to take early withdrawals from their retirement accounts without the usual 10% penalty by taking Substantially Equal Periodic Payments based on their life expectancy or a joint life expectancy with a beneficiary. The same calculation methods for SEPP apply under section 72(t). While this method allows for earlier access to retirement funds, it locks individuals into a withdrawal schedule, potentially depleting retirement savings faster than desired.

The Rule of 55 allows individuals who are 55 years old or older and have left their job to make withdrawals from their 401(k) or 403(b) plan without a 10% penalty. To qualify, an individual must have left their job during or after the year they turn 55, and the withdrawals must be made from the plan tied to their most recent job.

Early withdrawals can significantly deplete retirement savings, potentially leading to financial insecurity later in life. They may also impact the ability to take advantage of compounding returns and tax-deferred growth in retirement accounts. Therefore, it's crucial to consult with a financial advisor to understand these impacts before deciding on early withdrawals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.