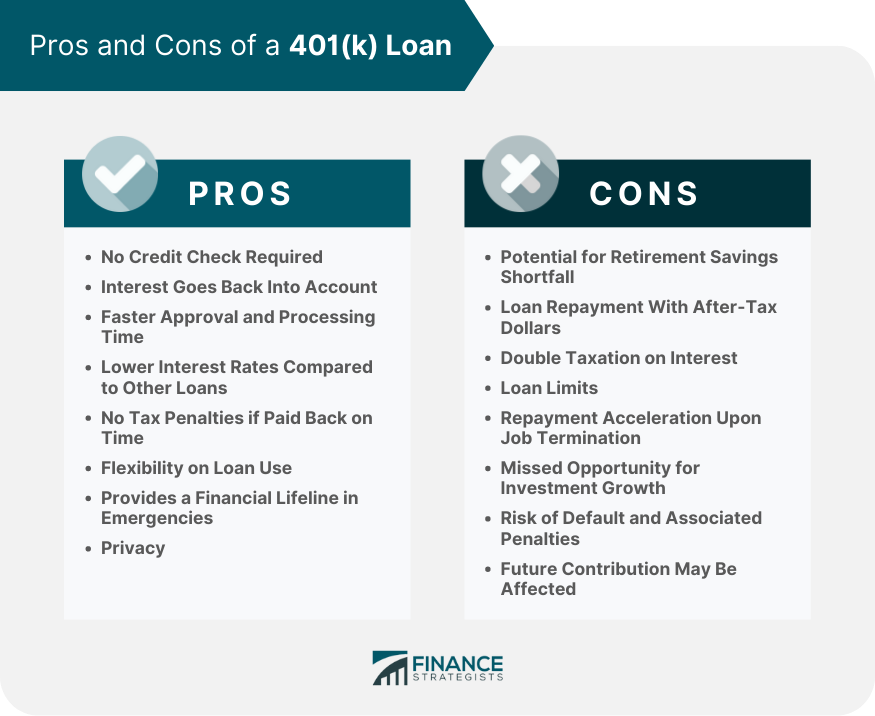

A 401(k) loan can be a tempting option for individuals in need of quick access to funds without the hassle of a credit check. While it offers advantages like lower interest rates and flexibility in loan use, there are significant trade-offs to consider. Taking a loan from your 401(k) can potentially impact your retirement savings, hinder investment growth, and expose you to tax implications. The pros and cons of a 401(k) loan provides valuable insights to help you make an informed decision about whether this financial tool aligns with your long-term goals and financial needs. Understanding the potential benefits and drawbacks is crucial before tapping into your retirement savings, ensuring you safeguard your financial future. One advantage of a 401(k) loan is that there are no credit checks involved. Since you are borrowing from your savings, your credit score does not matter, which can be beneficial for those with low credit scores. Another advantage is that the interest paid on the loan goes back into your 401(k) account. This can help offset some of the impact on your retirement savings. As compared to traditional loans, 401(k) loans can be processed more quickly. Since you're borrowing from your savings, there's less red tape involved, allowing for a quicker turnover time. The interest rates on 401(k) loans are generally lower than those of personal loans or credit cards. This can save you money if you're in need of a loan. If a 401(k) loan is paid back within the specified time frame, typically five years, there are no tax penalties. This is different from a 401(k) withdrawal, which would incur a penalty and be subject to taxes. There are no restrictions on how you can use a 401(k) loan. Whether it's for paying off debt, home renovations, or medical expenses, the choice is yours. During financial emergencies, a 401(k) loan can serve as a lifeline. It can provide quick access to funds when you need them the most. When taking a 401(k) loan, there's no need to provide the reason for needing the loan. This provides a level of privacy that you may not get with other loan types. The most significant risk of a 401(k) loan is that it can lead to a shortfall in your retirement savings. When you take out a loan, you reduce the balance of your retirement funds, which can hinder the growth of your savings. Unlike 401(k) contributions, which are made with pre-tax dollars, repayments on a 401(k) loan are made with after-tax dollars. This means you are effectively taxed twice on the loan amount. The interest paid on a 401(k) loan is also subject to double taxation. You pay the interest with after-tax dollars, and it's taxed again when you withdraw it in retirement. The IRS sets limits on how much you can borrow from your 401(k). The maximum loan amount is the lesser of 50% of your vested account balance or $50,000. This can limit the usefulness of a 401(k) loan for large financial needs. If you leave or lose your job, you're usually required to repay the 401(k) loan in full within 60 days. If you can't, the outstanding balance is treated as a taxable distribution. When you take a loan from your 401(k), the borrowed money is no longer invested. This means you're missing out on potential investment growth, which can have a significant impact on your retirement savings. If you're unable to repay your 401(k) loan, it can result in a loan default. A default is treated as a distribution, making it subject to taxes and possibly an early withdrawal penalty. Some 401(k) plans may not allow you to make contributions while you have a loan. This can affect your future retirement savings and potential employer matching contributions. Personal loans are a potential alternative to 401(k) loans. They can be obtained from banks, credit unions, or online lenders. Interest rates and terms vary based on creditworthiness. If you're a homeowner with some equity in your home, a home equity loan might be an option. These loans use your home as collateral and typically have lower interest rates than personal loans. Credit cards can be used for small, short-term financial needs. However, interest rates are typically higher than other forms of loans. Borrowing money from friends or family can be an alternative, especially for small amounts. However, this can lead to strained relationships if the loan is not repaid in a timely manner. Taking a 401(k) loan presents a blend of pros and cons. On the positive side, it provides quick funding with lower interest rates, does not require a credit check, and offers payment flexibility. Notably, the interest goes back into your account, and it can serve as a financial lifeline during emergencies without the need to disclose why you need the funds. However, the downsides, like potential retirement savings shortfall, loan repayment with after-tax dollars leading to double taxation, and repayment acceleration upon job termination, could be significant. Borrowers may also miss out on potential investment growth and risk loan default. Moreover, future contributions to the 401(k) plan might be impacted. Therefore, while a 401(k) loan might appear as a convenient option, it should be carefully considered in light of its potential impact on long-term retirement savings. Alternatives, such as personal loans, home equity loans, credit cards, or borrowing from friends and family, may also be explored.401(k) Loan Overview

Pros of a 401(k) Loan

No Credit Check Required

Interest Goes Back Into Account

Faster Approval and Processing Time

Lower Interest Rates Compared to Other Loans

No Tax Penalties if Paid Back on Time

Flexibility on Loan Use

Provide a Financial Lifeline in Emergencies

Privacy

Cons of a 401(k) Loan

Potential for Retirement Savings Shortfall

Loan Repayment With After-Tax Dollars

Double Taxation on Interest

Loan Limits

Repayment Acceleration Upon Job Termination

Missed Opportunity for Investment Growth

Risk of Default and Associated Penalties

Future Contribution May Be Affected

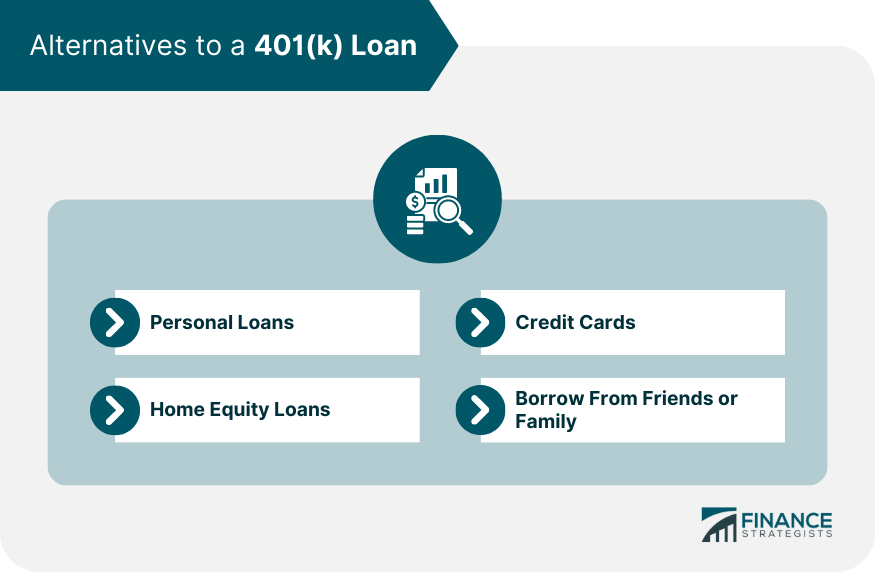

Alternatives to a 401(k) Loan

Personal Loans

Home Equity Loans

Credit Cards

Borrow From Friends or Family

Final Thoughts

Pros and Cons of 401(k) Loan FAQs

The pros of a 401(k) loan in an emergency include quick approval, lower interest rates, and no credit checks. However, the cons include the potential for retirement savings shortfall, the risk of loan default, and repayment acceleration if you lose your job.

Pros of a 401(k) loan, like interest repayment to your account, can potentially help offset some impact on your retirement savings. However, the cons, such as missed opportunities for investment growth and potential future contribution restrictions, can significantly affect your retirement savings.

While the low-interest rate and the flexibility of loan use are pros that make a 401(k) loan seem attractive for debt consolidation, the cons, such as potential double taxation, loan limits, and the risk of default, could make it a less favorable choice.

The pros of a 401(k) loan include no credit checks, lower interest rates, and faster processing time. However, the cons include double taxation, missed investment growth opportunities, and the potential for retirement savings shortfall, which aren't typically concerns with other loan types.

A 401(k) loan should be considered as a last resort. Although it has pros like lower interest rates and no credit checks, the cons, including potential retirement savings shortfall, loan limits, and risk of default, can greatly impact your financial future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.