An instrument refers to a financial or non-financial asset that can be utilized as a vehicle for investment. The purpose of financial instruments is to provide individuals and wealth managers with various options to preserve wealth, generate income, and achieve long-term financial goals. They allow individuals to allocate their resources effectively, optimize risk and return, and diversify their investment portfolios. Instruments provide opportunities for wealth preservation by offering avenues for investing in assets that have the potential to appreciate in value over time. In addition, they also enable individuals to generate income through dividends, interest payments, rental income, or other forms of returns. Instruments provide individuals with access to different markets and asset classes, such as stocks, bonds, commodities, real estate, and more. Instruments play a crucial role in wealth management strategies as they provide individuals and wealth managers with various options to preserve wealth, generate income, and achieve long-term financial goals. Stocks, also known as equities, represent ownership in a company. When an individual purchases shares of a company's stock, they become a shareholder and have a proportional ownership stake in the company. Stocks offer the potential for capital appreciation and dividend income. They are commonly traded on stock exchanges and are subject to market volatility and company-specific risks. Common stocks are the most common type of stocks available in the financial markets. Shareholders of common stocks have voting rights and are entitled to receive dividends when declared by the company. Common stocks offer potential capital appreciation, but they also carry higher risks compared to other types of instruments. Preferred stocks are a type of stock that combines characteristics of both stocks and bonds. Preferred stockholders have a higher claim on a company's assets and earnings compared to common stockholders. They receive dividends before common stockholders and have a fixed dividend rate. However, preferred stockholders do not typically have voting rights. Government bonds, also known as sovereign bonds, are debt instruments issued by governments to borrow money from investors. They are considered to be relatively low-risk investments because they are backed by the issuing government's ability to tax and print currency. Government bonds provide fixed interest payments, known as coupon payments, to investors over a specified period until the bond matures. Corporate bonds are debt instruments issued by corporations to raise capital. When investors purchase corporate bonds, they are essentially lending money to the issuing company. Corporate bonds offer fixed interest payments to investors, known as coupon payments, and return the principal amount at maturity. They carry varying levels of credit risk depending on the financial strength of the issuing company. Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges like individual stocks. ETFs are designed to track the performance of a specific index, sector, or asset class. They provide investors with diversification across a basket of securities within a single investment, offering convenience and flexibility in portfolio construction. Options are derivative contracts that give investors the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predetermined period. Options can be used for hedging, speculation, or income generation strategies. They provide flexibility and the potential for leveraging investment returns. Futures are standardized contracts that obligate the parties involved to buy or sell an underlying asset at a predetermined price and date in the future. Futures contracts are commonly used for hedging purposes or for speculating on price movements in commodities, currencies, or financial instruments. Derivatives are financial instruments whose value is derived from an underlying asset. They include options, futures, swaps, and other complex instruments. Derivatives can be used for hedging, speculation, or arbitrage strategies. They offer opportunities for managing risk and enhancing investment returns. Real estate investments refer to properties, such as residential homes, commercial buildings, or land, that are purchased with the expectation of generating income or achieving capital appreciation. Real estate investments offer potential rental income and the opportunity to benefit from property value appreciation. Commodities are raw materials or primary agricultural products that can be bought and sold in the financial markets. Examples of commodities include oil, gold, natural gas, wheat, and coffee. Commodities provide investors with exposure to the price movements of these physical goods. They can be traded through futures contracts, exchange-traded funds (ETFs), or commodity-specific investment vehicles. Precious metals, such as gold, silver, platinum, and palladium, are non-financial instruments that are widely recognized for their intrinsic value and use in various industries. Precious metals can be purchased in the form of bullion, coins, or through exchange-traded products (ETPs). They are often considered as a store of value and a hedge against inflation or economic uncertainties. Collectibles are unique items that possess rarity, historical significance, or artistic value. Examples of collectibles include art, rare coins, vintage cars, stamps, or antiques. Collectibles can be purchased for personal enjoyment or as an investment. The value of collectibles is influenced by factors such as market demand, rarity, condition, and provenance. The liquidity of an instrument refers to how quickly and easily it can be converted into cash without significantly impacting its market value. Instruments such as stocks and government bonds are generally considered liquid as they can be readily bought or sold in the financial markets. On the other hand, non-financial instruments like real estate or collectibles may have lower liquidity and require more time and effort to convert into cash. Different instruments carry varying levels of risk and return potential. Stocks and other equity investments tend to offer higher potential returns but also come with higher volatility and market risk. Bonds and other fixed-income instruments provide more stable returns but with lower potential for capital appreciation. Non-financial instruments like real estate or commodities may offer unique risk and return profiles influenced by factors such as market conditions, supply and demand dynamics, or industry-specific factors. The time horizon refers to the length of time an investor intends to hold an instrument. Some instruments, such as stocks or ETFs, are suitable for long-term investments where the investor can benefit from compounding returns and potential capital appreciation over time. Other instruments, such as options or futures, are often used for shorter-term strategies, taking advantage of market fluctuations or specific events. Different instruments have varying tax implications. For example, dividends from stocks may be subject to different tax rates than interest income from bonds. Capital gains taxes may apply when selling certain investments, such as stocks or real estate. It is important for wealth managers to consider the tax implications of different instruments and incorporate tax-efficient strategies into wealth management plans. Instruments offer diversification potential, allowing investors to spread their risks across different asset classes, sectors, or geographic regions. By investing in a mix of instruments with low correlations, wealth managers can reduce the overall risk of the portfolio and potentially enhance returns. Diversification helps to mitigate the impact of individual investment performance and provides a more balanced and robust wealth management strategy. Instruments play a vital role in wealth preservation strategies. By investing in instruments with low risk and stable returns, wealth managers can help their clients protect their wealth and preserve its purchasing power over time. Instruments such as government bonds or high-quality corporate bonds are often considered as safer investments that can provide income and capital preservation. Instruments also serve as a means for wealth growth. Higher-risk instruments, such as stocks or equity-based investments, offer the potential for capital appreciation and higher returns over the long term. These instruments can help clients achieve their financial goals, accumulate wealth, and outpace inflation. Many instruments are designed to generate income for investors. Bonds, for example, are well-known for their income generation potential through periodic interest payments. Dividend-paying stocks and real estate investments can also provide a steady stream of income. By incorporating income-generating instruments into wealth management strategies, wealth managers can help clients generate cash flow to support their lifestyle or reinvest for further growth. Understanding a client's risk tolerance is essential when selecting instruments for their investment portfolio. Some clients may be comfortable with higher levels of risk and volatility, while others may prefer more conservative options. Wealth managers need to assess the client's risk appetite and align it with suitable instruments that match their risk tolerance and investment objectives. Each client has unique investment objectives, whether it is capital appreciation, income generation, or wealth preservation. Wealth managers should consider these objectives when selecting instruments to ensure they align with the client's financial goals and time horizon. Instruments that match the client's investment objectives can help increase the probability of achieving their desired outcomes. The client's time horizon is an important factor in selecting suitable instruments. Short-term investment goals may require instruments with liquidity and stability, whereas long-term investment goals can benefit from growth-oriented instruments that can ride out market fluctuations. Aligning the time horizon with appropriate instruments helps optimize investment performance and minimize potential risks. Market conditions play a crucial role in instrument selection. Different instruments perform differently under various market scenarios. Some instruments may thrive in bullish markets, while others may be more resilient during economic downturns. Wealth managers need to consider the current market conditions and economic outlook when selecting instruments to ensure they are well-suited to the prevailing market environment. Regulatory and legal factors should also be considered when selecting instruments. Different instruments may be subject to specific regulations or legal requirements. For example, certain types of investments may require compliance with securities laws or registration with regulatory bodies. Wealth managers need to ensure that the selected instruments comply with applicable regulations and align with the client's legal requirements. Asset allocation involves spreading investments across different asset classes, such as stocks, bonds, and alternative investments, to achieve a desired balance of risk and return. By diversifying across asset classes, wealth managers can manage risk and capture opportunities across various market conditions. The allocation percentages can be adjusted based on the client's risk tolerance, investment objectives, and market outlook. Portfolio diversification aims to reduce risk by investing in a variety of instruments within each asset class. By spreading investments across different stocks, bonds, sectors, and geographies, wealth managers can reduce the impact of individual investment performance on the overall portfolio. Diversification helps to capture different sources of return and enhance the risk-adjusted performance of the portfolio. Regular portfolio rebalancing is crucial to maintaining the desired asset allocation and risk profile. Over time, the performance of different instruments can cause the portfolio to deviate from the intended allocation. Wealth managers need to periodically review the portfolio and rebalance it by buying or selling instruments to bring it back to the target allocation. Rebalancing ensures that the portfolio remains aligned with the client's investment objectives and risk tolerance. Risk management techniques are employed to mitigate potential risks associated with instruments. Techniques such as hedging, diversification, and stop-loss orders can help protect against downside risk. Wealth managers use risk management strategies to safeguard the client's portfolio and ensure that risk exposure is appropriately managed. By considering these strategies, wealth managers can effectively allocate instruments within client portfolios to optimize risk-adjusted returns and align with the client's financial goals and risk tolerance. Instruments refer to various financial assets or contracts that hold value and can be traded. These instruments serve as vehicles for investment and can be used to allocate capital, generate returns, and manage risk. They represent a wide range of financial products, including stocks, bonds, options, futures, currencies, commodities, and more. They are diverse in their characteristics, and functions, catering to the unique needs and preferences of investors. Financial instruments can be categorized into various types, including stocks, bonds, derivatives, commodities, currencies, and real estate. Each type has its own set of characteristics, such as risk and return profiles, liquidity, and market dynamics. When considering financial instruments, it is crucial to assess factors such as risk tolerance, investment horizon, liquidity needs, and overall portfolio diversification. It is essential to conduct thorough research, seek professional advice if necessary, and regularly review.What Is an Instrument?

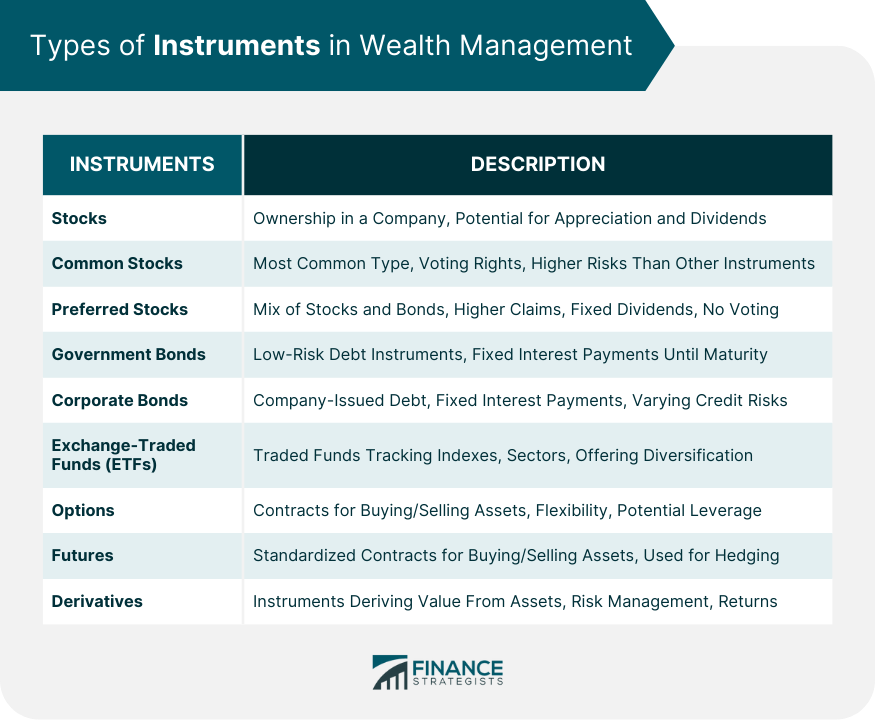

Types of Instruments in Wealth Management

Stocks

Common Stocks

Preferred Stocks

Government Bonds

Corporate Bonds

Exchange-Traded Funds (ETFs)

Options

Futures

Derivatives

Types of Non-financial Instruments

Real Estate Investments

Commodities

Precious Metals

Collectibles

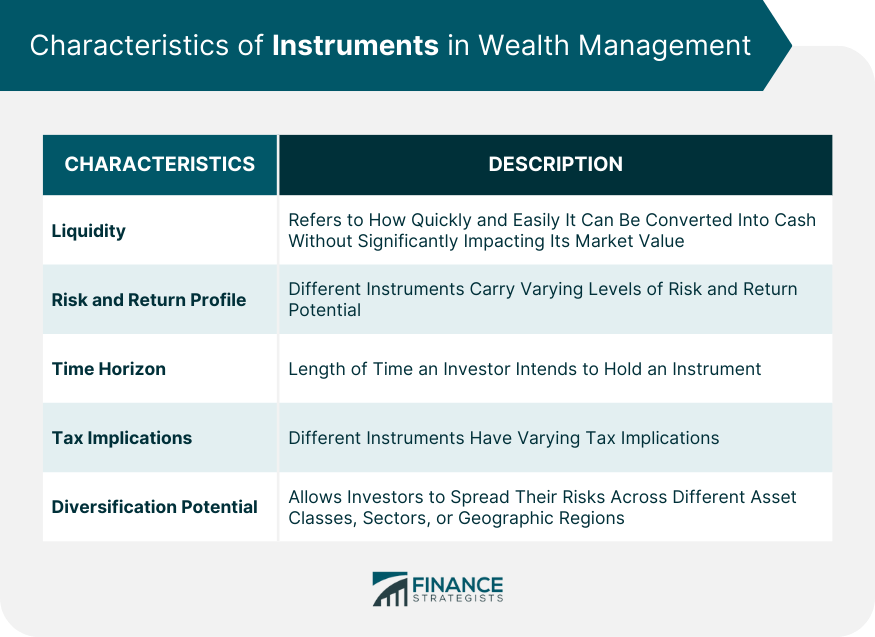

Characteristics of Instruments in Wealth Management

Liquidity

Risk and Return Profile

Time Horizon

Tax Implications

Diversification Potential

Role of Instruments in Wealth Management

Wealth Preservation

Wealth Growth

Income Generation

Considerations for Selecting Instruments

Risk Tolerance

Investment Objectives

Time Horizon

Market Conditions

Regulatory and Legal Factors

Strategies for Effective Instrument Allocation

Asset Allocation

Portfolio Diversification

Rebalancing

Risk Management Techniques

The Bottom Line

Instrument FAQs

In wealth management, an instrument refers to a financial or non-financial asset that is utilized for investment purposes.

Common types of instruments include stocks, bonds, mutual funds, real estate investments, commodities, and precious metals.

Instruments vary in liquidity, risk and return profile, time horizon, tax implications, and diversification potential.

Consider factors such as your risk tolerance, investment objectives, time horizon, market conditions, and regulatory/legal factors.

Instruments play a crucial role in wealth preservation, growth, and income generation. They are allocated and managed strategically for optimal results.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.