Cryptocurrencies, digital or virtual currencies that use cryptography for security, have taken the financial world by storm. With this rise in prominence, the need for tools to manage and monitor these assets has become paramount. Cryptocurrency alerting is one such vital tool. At its core, it provides real-time notifications about changes and trends in the crypto space, thus aiding investors in making informed decisions. These alert systems have grown in complexity and utility, serving not just as a price tracker but as a multifunctional tool for market analysis. In an era where milliseconds can mean the difference in substantial gains or losses, the significance of these alerts cannot be overstated. The early days of cryptocurrency were characterized by basic monitoring tools that only offered simple alerts. As the crypto ecosystem matured, so did the tools, evolving into sophisticated systems capable of monitoring intricate details of multiple cryptocurrencies across various exchanges. The volatile nature of cryptocurrency prices requires constant monitoring. But instead of being glued to your screen, price change alerts notify users when certain price points are hit. There are two primary types of price change alerts. As cryptocurrencies see daily swings, being alerted in real-time can be a game-changer, allowing investors to maximize profits and mitigate potential downturns. A threshold-based alert is a straightforward notification triggered when a cryptocurrency surpasses or drops below a predetermined value. For instance, you might set an alert to notify you when Bitcoin reaches $50,000 or drops below $30,000. Setting these thresholds ensures that traders and investors do not miss potential buy or sell opportunities, especially in a market known for its unpredictable behavior. While threshold-based alerts focus on specific values, percentage change alerts notify users when a cryptocurrency increases or decreases by a specific percentage. This type is particularly useful for spotting trends, especially in newer or less stable currencies. It offers a macro perspective, highlighting the overall market sentiment and indicating the strength or weakness of particular crypto assets. For many investors, tracking the movement of significant volumes of cryptocurrency is crucial. Transaction alerts serve this purpose, providing information about substantial cryptocurrency transactions. These alerts give insights into major shifts and can hint at market sentiments, paving the way for strategic investment decisions. Some investors track "whales" - entities holding a large number of cryptocurrencies. Alert systems can notify users when these whales make significant moves, providing insight into potential market shifts. Such movements often precede significant price changes, making it crucial for both long-term investors and day traders to monitor these transactions actively. On a more personal note, users can set alerts for specific wallets, particularly if they want to monitor a competitor or even keep tabs on their transactions. By tracking wallet activities, investors can gain a strategic edge. It provides transparency into transaction patterns and can hint at an individual or entity's investment strategy. The listing of a cryptocurrency on a new exchange can significantly influence its price. Exchange listing alerts notify users when a particular cryptocurrency is added to or removed from an exchange. These alerts are valuable, especially for those holding or considering investment in the said cryptocurrency. A new listing can lead to increased demand and liquidity, potentially boosting the cryptocurrency's price, making these alerts crucial for proactive trading. In the ever-evolving crypto landscape, staying updated with regulatory changes and significant news is vital. Regulatory and news alerts keep investors in the loop, ensuring they aren't caught off guard by market-moving news or shifts in the regulatory environment. The crypto space is sensitive to news, be it regulatory clampdowns, technological advancements, or significant partnerships. Being timely informed helps in navigating the complex and often volatile crypto waters. Having real-time information at your fingertips empowers you to make well-informed decisions. When you're aware of market trends and movements, you're better equipped to predict the future trajectory, enabling more profitable investment choices. This proactive approach, backed by timely data, allows for agility in investment strategies, optimizing returns on investments. Crypto markets move rapidly, often swinging dramatically within short time frames. With real-time alerts, investors can react promptly to these changes, capitalizing on opportunities or mitigating potential losses. In a space where a few hours can see double-digit percentage changes, the speed of response can be the linchpin of successful crypto trading. Cryptocurrency, like any investment, involves risk. Alerting tools not only provide insights into market trends but can also notify users of potential security breaches. By promptly reacting to these alerts, investors can take measures to secure their investments. Beyond market movements, these tools safeguard investments against potential hacks, unauthorized access, or other security threats. Knowledge breeds confidence. When you're continually informed about the crypto space's happenings, it leads to a more confident approach to trading and investment, eliminating second-guessing and promoting decisive actions. This assurance, stemming from real-time data, paves the way for more assertive and strategic investment maneuvers. By staying updated on various cryptocurrencies, their trends, and significant news, investors can optimize their portfolios, ensuring diversification and effective strategy implementation. This holistic view enables a balanced approach to crypto investments. An informed portfolio strategy not only maximizes profits but also spreads risk across various assets, mitigating potential downturns. Automated alerts are undoubtedly beneficial, but over-reliance can be detrimental. It's essential to complement these tools with personal research and insights to ensure a holistic understanding of the crypto market. Relying solely on alerts could leave blind spots in your market understanding, making a combination of personal research and automated insights ideal. With a multitude of alerts flooding in, there's a risk of becoming desensitized. Alert fatigue can lead to critical notifications being overlooked, negating the purpose of setting them up in the first place. Regularly evaluating and tweaking alert frequencies can mitigate this, ensuring each notification retains its significance. No tool is flawless. There's always a potential for inaccuracies or delays in notifications. It's crucial to use alerting tools as a guide, not an absolute truth, and verify information from multiple sources when making decisions. This multipronged approach ensures the authenticity of the data and guards against potential misinformation. For those new to the crypto space, the sheer volume of alerts can be overwhelming. It's essential to start with basic notifications and gradually scale up as understanding and confidence grow. Simplifying the initial alerting setup ensures a smoother onboarding process, progressively increasing in complexity as familiarity with the market increases. Misinterpreting an alert can lead to misguided actions. Always ensure clarity in understanding alerts and, if in doubt, seek expert advice before making investment moves. Investing in the crypto market requires both data and wisdom, ensuring that actions taken align with the larger investment goals and strategies. A key factor in selecting the right tool is its ability to be tailored to specific needs. With the varied interests and investment strategies of individuals in the crypto space, it's vital for an alerting tool to provide customization options. This ensures that you receive alerts relevant to your specific criteria, helping you streamline decision-making. The crypto universe is expansive, with numerous exchanges and thousands of cryptocurrencies. Thus, it's imperative for the alerting tool to provide broad coverage. This ensures you are kept informed about trends, price movements, and other crucial developments across a wide spectrum of exchanges and cryptocurrencies. Ideally, your chosen tool should provide insights into major exchanges and a vast array of currencies to ensure a comprehensive understanding of the market. Reliability is paramount. The crypto market is known for its volatility, where prices can swing dramatically in a matter of minutes. Therefore, it's crucial for your alerting tool to have consistent uptime and promptly relay accurate information. A tool with a strong track record of minimal downtimes ensures that you're always in the loop, reducing the risk of missed opportunities. Equally important is the tool's reputation for providing accurate and timely alerts, reinforcing its dependability. An effective alerting system should seamlessly integrate with other financial tools and platforms. Such integration ensures a holistic approach to wealth management, combining the strengths of various tools for optimal financial strategy formulation and execution. Whether it's integrating with tax software, portfolio managers, or trading platforms, a well-connected alerting system enriches the overall crypto management experience. Just as diversifying investments is crucial, so is diversifying the types of alerts you set up. By having a mix of price, transaction, regulatory, and other alerts, you ensure comprehensive monitoring of the crypto space. An eclectic mix ensures you're not blindsided by any unexpected market developments, offering a 360-degree view of the market. The frequency of alerts should strike a balance. Too many can overwhelm, while too few might mean missing out on crucial information. Furthermore, consider the timing – do you want alerts throughout the day, or just at specific times? Setting alerts in line with your trading habits and market involvement ensures you get the most out of these notifications. The crypto landscape changes rapidly. Thus, it's essential to periodically evaluate and adjust your alert settings to ensure they remain relevant and beneficial. Regularly revisiting your alerts ensures you're always in tune with your investment goals and the evolving market. Relying on a single alerting platform can be risky. By leveraging multiple platforms, you ensure redundancy and more comprehensive coverage, ensuring no critical information slips through. It's akin to having multiple safety nets, safeguarding against potential platform downtimes or other unforeseen issues. Setting alerts is one thing, understanding their significance is another. Always ensure you comprehend what each alert type means and its potential implications for your investment strategy. Taking the time to understand each alert's nuance aids in swift and informed decision-making, avoiding potential pitfalls. In the digital age, where cryptocurrencies have taken center stage, managing and monitoring these assets becomes paramount. Cryptocurrency alerting has emerged as a pivotal tool, transcending from simple price trackers to multifaceted systems for comprehensive market analysis. These tools aid investors in capitalizing on market opportunities, reacting swiftly to rapid market changes, and securing their investments against potential threats. However, while their importance is undeniable, it's crucial to adopt them judiciously. Over-reliance, potential inaccuracies, and the overwhelming volume of information necessitate a balanced approach, intertwining automated alerts with personal research. In a dynamic crypto landscape, staying updated, diversifying alerts, and understanding their significance can be the difference between success and missed opportunities. As the crypto ecosystem continues to evolve, so should our strategies, leveraging these tools for optimal benefit.What Is Cryptocurrency Alerting?

Types of Cryptocurrency Alerts

Price Change Alerts

Threshold-Based Alerts

Percentage Change Alerts

Transaction Alerts

Large Movements and Whale Watching

Specific Wallet Transactions

Exchange Listing Alerts

Regulatory and News Alerts

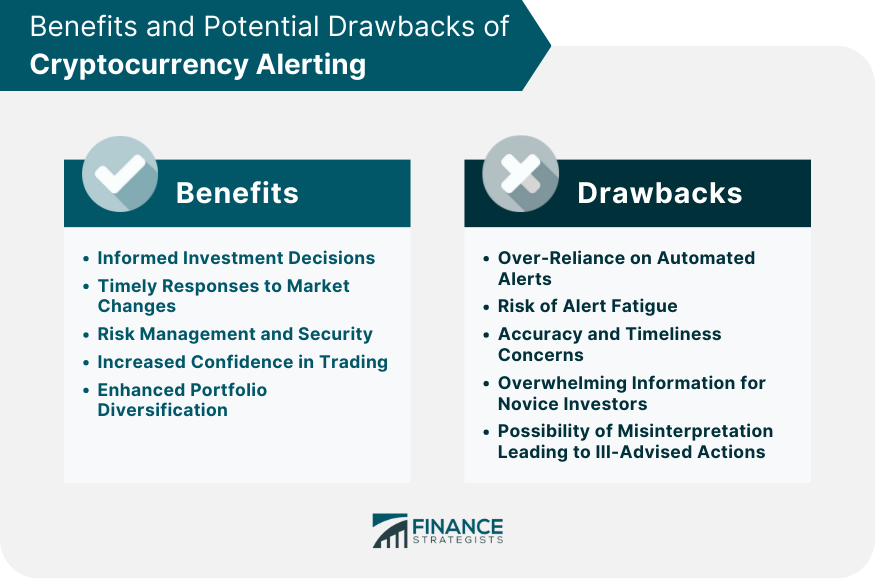

Benefits of Cryptocurrency Alerting

Informed Investment Decisions

Timely Responses to Market Changes

Risk Management and Security

Increased Confidence in Trading and Investment Actions

Enhanced Portfolio Diversification and Strategy Implementation

Potential Drawbacks and Limitations of Cryptocurrency Alerting

Over-Reliance on Automated Alerts

Risk of Alert Fatigue

Accuracy and Timeliness Concerns

Potential Overwhelming of Information for Novice Investors

Possibility of Misinterpretation Leading to Ill-Advised Actions

Choosing the Right Cryptocurrency Alerting Tool

Factors to Consider

Customization Features

Coverage of Exchanges and Currencies

Reliability and Uptime

Integration With Other Financial Tools

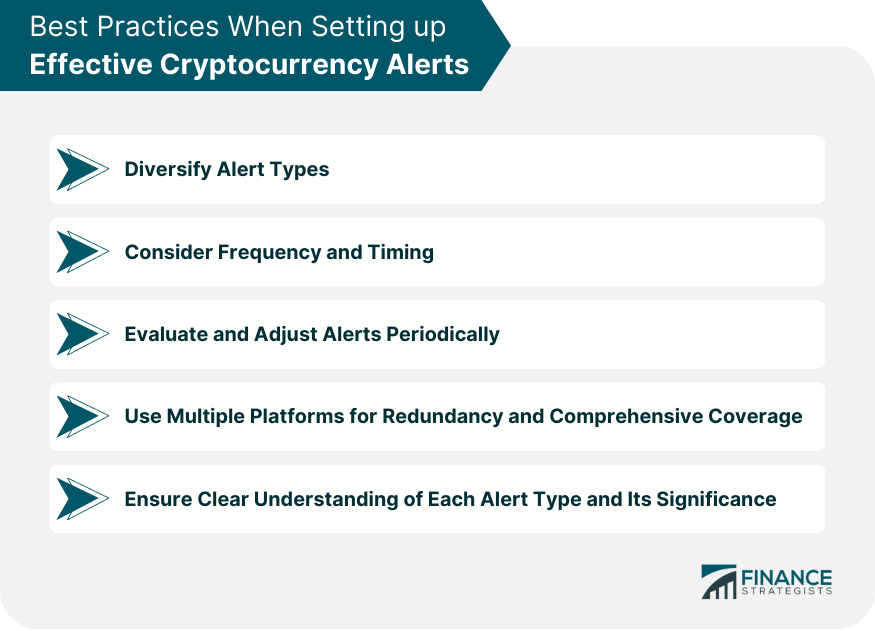

Best Practices When Setting up Effective Cryptocurrency Alerts

Diversify Alert Types

Consider Frequency and Timing

Evaluate and Adjust Alerts Periodically

Use Multiple Platforms for Redundancy and Comprehensive Coverage

Ensure Clear Understanding of Each Alert Type and Its Significance

Final Thoughts

Cryptocurrency Alerting FAQs

Cryptocurrency alerting provides real-time notifications about changes and trends in the crypto space, aiding investors in decision-making.

Different types of alerts, such as price change, transaction, and regulatory alerts, offer varied insights, helping investors navigate the volatile crypto market.

Alerting equips investors with real-time information, facilitating informed decisions, timely market responses, risk management, and a confident trading approach.

Consider customization features, coverage of exchanges/currencies, reliability, and integration with other financial platforms for optimal alerting experiences.

Yes, potential issues include over-reliance on alerts, alert fatigue, accuracy concerns, information overwhelming for novices, and possible misinterpretations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.