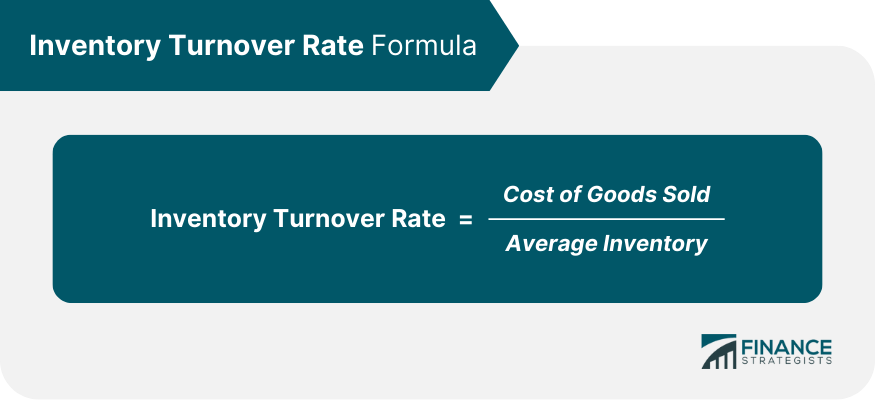

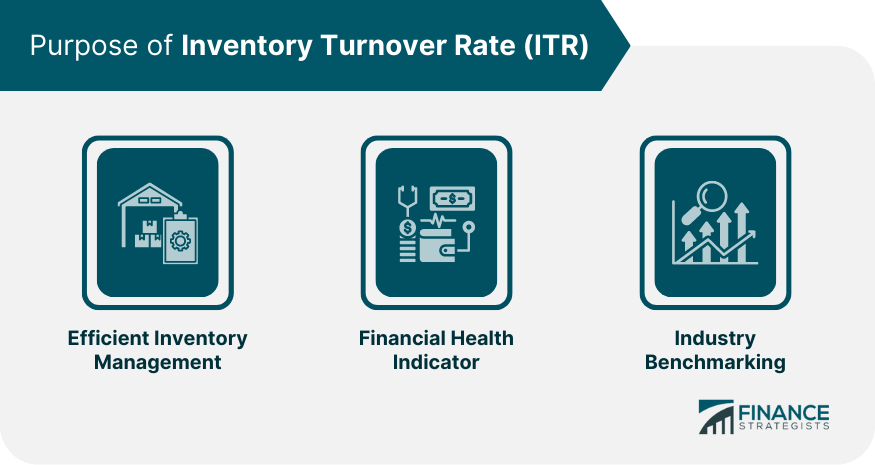

The inventory turnover rate (ITR) is a key metric that measures how efficiently a company sells and replenishes its inventory over a specific period, typically a year. This ratio helps businesses understand how quickly their products move from the warehouse to the customer. The inventory turnover rate is essentially how fast a company sells its stock. It's an important gauge of business health. The formula for calculating the inventory turnover rate is as follows: This formula gives a clear picture of how effectively a company's inventory is being utilized in relation to its sales. Average Inventory is the mean value of the inventory during a specific period, typically calculated by adding the beginning and ending inventory for a period and dividing by two. On the other hand, COGS, or Cost of Goods Sold, pertains to the total cost associated with producing the goods sold by a company during a specific timeframe. Together, these components provide a comprehensive perspective on the company's sales in relation to its inventory. For example, a company with $20,000 in average inventory with a COGS of $200,000 will have an ITR of 10. The purpose of calculating the inventory turnover rate is to help companies make informed decisions about pricing, manufacturing, marketing, and purchasing new inventory. A low ratio can imply weak sales and/or possible excess inventory, also called overstocking. This could be due to a problem with the goods being sold, insufficient marketing, or overproduction. A high ratio can imply strong sales, but also insufficient inventory. While strong sales are good for business, insufficient inventory is not. Investors may also like to know the inventory turnover rate to determine how efficiently one company is performing against the industry average. A healthy inventory turnover ratio (ITR) shows you manage your inventory effectively. When products sell quickly, you free up cash to reinvest in your business growth. Smart inventory management also helps prevent losses on outdated or perishable items – a crucial advantage for tech companies or businesses with perishable goods. The ITR also acts as a mirror reflecting a company's financial health. Businesses with an optimal turnover rate often have a better cash flow and reduced storage costs, indicative of effective operations. Conversely, a low turnover might signify overstocking, while a high turnover might point to lost sales and understocking. Comparing your ITR to industry averages is a powerful way for businesses to gauge their competitive position. Consumer demand can be unpredictable and can significantly impact ITR. A sudden spike in demand might lead to rapid stock depletion, while a drop in interest might leave companies with excess inventory, both affecting turnover rates. Certain products experience higher demand during particular seasons. For instance, winter wear sees a surge in sales during colder months. Companies must account for these seasonal variations in demand to maintain an appropriate ITR. Long lead times can hinder the replenishment of inventory, affecting the turnover rate. Additionally, disruptions in supplier relationships or supply chain issues can result in stockouts or overstock situations, directly impacting the ITR. A high ITR means that inventory is selling and being replenished quickly, which often points to robust sales. However, it’s important to watch out for the flip side: it might also mean you’re at risk of running out of stock, potentially missing out on sales if you can't keep up with demand. Companies need to make sure their high turnover is due to strong customer demand, rather than simply keeping too little stock on hand. On the other hand, a low ITR indicates that products are lingering in stock longer than they should. This could be due to overstocking, a dip in demand, or a combination of both factors. Getting demand forecasting right is crucial for businesses looking to balance their inventory with actual customer demand. This precision helps reduce excess stock and optimize turnover rates. Moreover, thoughtful planning prevents both overstocking and shortages, enhancing operational efficiency across the board. JIT systems streamline inventory management by ensuring that materials and products are received only as needed, either for immediate production or for fulfilling customer orders. A deep dive into how different products perform, focusing on their turnover rates and profitability, can significantly influence resource allocation decisions. By identifying products that are both in high demand and highly profitable, businesses can fine-tune their inventory strategies. This targeted approach helps in boosting turnover rates and enhancing overall financial health. While the inventory turnover rate provides insights into sales efficiency, it overlooks the costs associated with maintaining excess inventory, such as storage, insurance, and depreciation. Ignoring these costs can lead to less-than-ideal decision-making and impact overall profitability. This metric often fails to reflect seasonal variations in demand, which can skew the understanding of how effectively inventory is managed. Companies need to factor in these seasonal shifts to more accurately interpret their turnover rates. Not all products contribute equally to a company’s bottom line. The inventory turnover rate treats all items the same, which can result in misguided decisions about stocking levels, especially when comparing high-margin items to low-margin ones. Considering both profitability and turnover rates is essential for making informed inventory decisions. The Inventory Turnover Rate (ITR) is an essential metric that shows how quickly a company sells and restocks its inventory. It provides valuable insights into the frequency of inventory turnover, helping shape strategies around purchasing, production, and sales. Regular monitoring of the ITR is crucial for maintaining the right balance of stock, ensuring businesses avoid both understocking, which can lead to missed sales opportunities, and overstocking, which ties up valuable resources. Maintaining an optimal ITR helps in reducing storage costs, decreasing the risk of product obsolescence, and boosting cash flow. However, it’s important to recognize the limitations of ITR. It does not account for inventory holding costs, overlooks seasonal demand fluctuations, and ignores variations in product profitability. These gaps highlight the necessity for a more comprehensive approach to inventory management, one that considers additional factors to better support business decisions.Inventory Turnover Rate Definition

By tracking how fast items are sold, companies can make smarter choices about buying more materials, adjusting production levels, and fine-tuning their sales approaches.

Keeping an eye on the ITR is crucial for businesses to balance their inventory levels perfectly—avoiding both excess stock, which ties up capital, and shortages, which can lead to missed sales opportunities.

Maintaining an optimal ITR not only helps in cutting down storage costs but also reduces the risk of products becoming outdated. Plus, it improves cash flow, allowing businesses to reinvest in new opportunities swiftly. Define Inventory Turnover Rate in Simple Terms

Think of it this way: the longer a product sits on the shelf, the more it costs the company to hold onto it. That's why businesses that can quickly turn their inventory into sales often stand out as top performers in their industry. They keep their holding costs low and keep things moving smoothly.Calculating Inventory Turnover Rate

The Purpose of Inventory Turnover Rate

Efficient Inventory Management

While the ITR is an important indicator, achieving a good ratio takes more than just tracking the number. Explore strategies and solutions for optimizing your warehouse inventory management.Financial Health Indicator

Industry Benchmarking

This comparison helps companies see how they stack up against their peers, pinpointing strengths and identifying areas where they can improve their inventory management. This kind of insight is invaluable for staying competitive and fine-tuning operations.

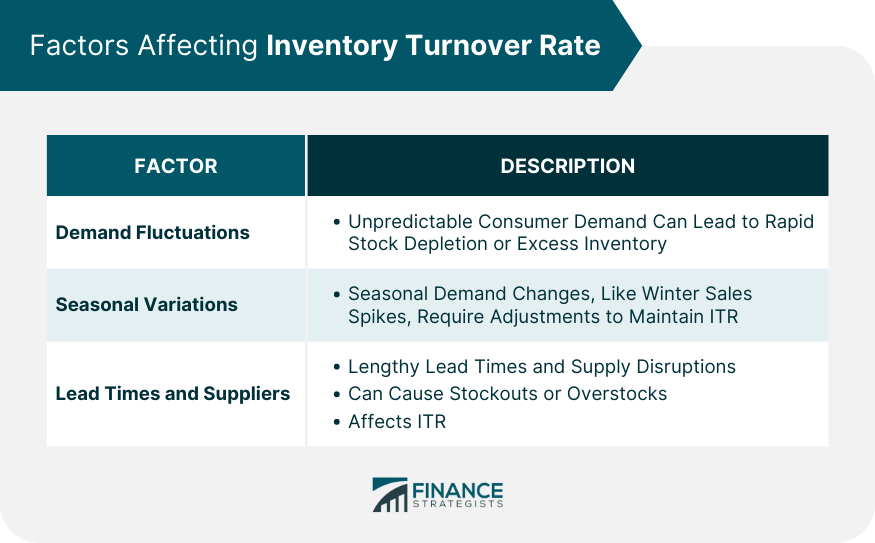

Factors Affecting Inventory Turnover Rate

Demand Fluctuations

Seasonal Variations

Lead Times and Supplier Relationships

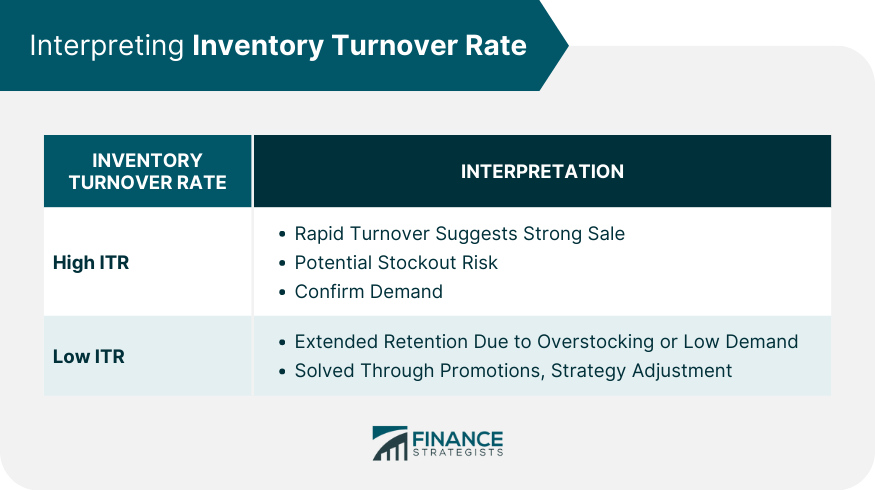

Interpreting Inventory Turnover Rate

High ITR

Low ITR

To tackle a low ITR, strategies might include launching promotions to boost sales, revising purchasing plans, or expanding the range of products offered to attract more customers.

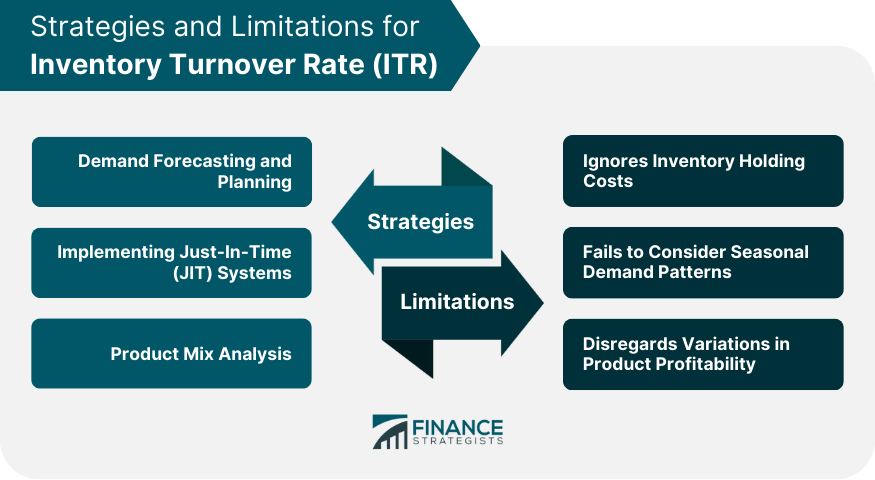

Strategies to Improve Inventory Turnover Rate

Demand Forecasting and Planning

Implementing Just-In-Time (JIT) Systems

This approach not only cuts down on carrying costs but also minimizes the risk of items becoming obsolete, thereby improving your inventory turnover and keeping your supply chain lean and efficient.Product Mix Analysis

Limitations of Inventory Turnover Rate

Ignores Inventory Holding Costs

Fails to Consider Seasonal Demand Patterns

Disregards Variations in Product Profitability

Conclusion

Inventory Turnover Rate (ITR) FAQs

ITR is an acronym for Inventory Turnover Rate.

Inventory turnover rate (ITR) is a ratio measuring how quickly a company sells and replaces inventory during a given period.

ITR is calculated by dividing a company's Cost of Goods Sold by its Average Inventory.

The purpose of calculating the inventory turnover rate is to help companies make informed decisions about pricing, manufacturing, marketing, and purchasing new inventory.

Companies that move inventory relatively quickly tend to be the best performers in an industry.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.