Global macro hedge funds are specialized investment vehicles that aim to generate returns by identifying and capitalizing on global economic trends and shifts in geopolitics. You need both strategy and adaptability to win, because the economic landscape can shift as quickly as the wind. These funds use a top-down approach to investing, which involves analyzing macroeconomic indicators and political events to make informed decisions about the direction of various asset classes and markets. These investment strategies are highly adaptive and opportunistic, allowing fund managers to take advantage of market dislocations, currency fluctuations, and shifts in interest rates. By making bets on the direction of economies, markets, and asset classes, global macro hedge funds can profit from both rising and falling markets. They offer diversification by providing exposure to a wide range of asset classes and geographical regions, which can help mitigate risks associated with traditional asset classes such as stocks and bonds. This diversification can lead to improved risk-adjusted returns for investors. Second, global macro hedge funds have the potential to deliver absolute returns, regardless of the broader market environment. This characteristic can be particularly attractive during periods of economic uncertainty or market volatility when traditional investments may struggle to generate positive returns. In addition, global macro hedge funds often employ sophisticated risk management techniques, which can help protect investor capital during turbulent market conditions. Global macro hedge funds employ a top-down investment approach, focusing on macroeconomic factors and political events to make investment decisions. This approach involves analyzing economic indicators, such as GDP growth, inflation, interest rates, and unemployment, as well as assessing the impact of geopolitical developments on financial markets. Fund managers typically have a high degree of flexibility in their investment approach, allowing them to adapt to changing market conditions and capitalize on emerging opportunities. This flexibility can involve varying the degree of leverage used, investing across different asset classes, and pursuing both long and short positions. One of the key differentiators of global macro hedge funds is their focus on global economic and political factors. By assessing the interplay between macroeconomic trends and geopolitical events, fund managers can identify potential investment opportunities that may not be apparent through traditional bottom-up analysis. This focus on global factors allows these funds to take advantage of market inefficiencies and dislocations, which can arise due to shifting economic and political landscapes. As a result, global macro hedge funds can profit from both rising and falling markets, providing investors with the potential for positive returns even during periods of economic uncertainty. Global macro hedge funds are known for their diversification across asset classes and geographies. By investing in a wide range of assets, including stocks, bonds, currencies, commodities, and derivatives, these funds can reduce the impact of market volatility on their overall performance. In addition to diversifying across asset classes, global macro hedge funds also invest in multiple regions around the world. This geographical diversification allows fund managers to capitalize on opportunities in both developed and emerging markets, further enhancing the potential for risk-adjusted returns. The investment process for global macro hedge funds typically begins with macroeconomic analysis and research. Fund managers and their research teams gather and analyze data from various sources, such as central banks, government agencies, and international organizations, to develop a comprehensive understanding of the global economic landscape. This analysis may include assessments of factors such as GDP growth, inflation, interest rates, and employment data, as well as evaluations of fiscal and monetary policies. By understanding the current state of the global economy and anticipating future trends, fund managers can identify potential investment opportunities and risks. Once they have a thorough understanding of the macroeconomic landscape, global macro hedge fund managers can identify potential investment opportunities. This often involves analyzing the impact of macroeconomic trends on various asset classes and geographies, as well as assessing the potential for changes in market sentiment. In addition, fund managers may consider the implications of geopolitical events, such as elections, trade disputes, and military conflicts, on financial markets. By assessing the interplay between macroeconomic trends and geopolitical developments, managers can develop investment theses that drive their portfolio decisions. After identifying potential investment opportunities, global macro hedge fund managers must execute trades and implement risk management strategies to capitalize on their insights. This may involve taking long or short positions in various asset classes, such as stocks, bonds, currencies, or commodities. Fund managers must also carefully manage risk, as global macro strategies often involve the use of leverage and derivative instruments, which can magnify both gains and losses. Risk management techniques may include setting position limits, employing stop-loss orders, and using various hedging strategies to mitigate potential losses. Hedging involves taking offsetting positions in related securities or derivatives to reduce the impact of adverse market movements on a portfolio. For example, a fund manager who is long on a particular currency might take a short position in a related currency pair to hedge against potential losses if the original currency were to decline in value. Similarly, a fund manager with a long position in a country's equity market might hedge against potential losses by shorting a stock index or purchasing put options on that index. By employing these and other hedging strategies, global macro hedge funds can mitigate some of the risks associated with their investment positions, helping to protect investor capital and enhance risk-adjusted returns. In addition to employing hedging strategies, global macro hedge fund managers must also monitor and manage their overall portfolio risk exposure. This involves regularly reviewing the fund's positions to ensure that they remain consistent with the manager's investment thesis and risk tolerance. Risk management tools, such as Value at Risk (VaR) and stress testing, can help fund managers quantify the potential impact of adverse market events on their portfolios. By regularly monitoring their risk exposure and making necessary adjustments, global macro hedge fund managers can better navigate volatile markets and reduce the likelihood of significant losses. Global macro hedge funds have the ability to invest in multiple markets and asset classes, including stocks, bonds, currencies, commodities, and derivatives. This diversification helps spread investment risk and potentially enhance returns by capitalizing on opportunities in different regions and sectors. Global macro hedge funds have the flexibility to adjust their investment strategies and allocations based on changing market conditions. They can take both long and short positions, allowing them to profit from both rising and falling markets. This adaptability enables fund managers to capitalize on market trends and potentially generate positive returns in various economic environments. By investing across different countries and regions, global macro hedge funds can benefit from a broader perspective on global economic trends and events. They can take advantage of geopolitical developments, economic indicators, and monetary policy decisions that affect multiple markets. This global market exposure provides unique opportunities for generating alpha and managing risk. One of the primary challenges faced by global macro hedge funds is the volatility and uncertainty inherent in global financial markets. Economic conditions, political events, and market sentiment can change rapidly, making it difficult for fund managers to accurately predict and capitalize on market trends. To address this challenge, global macro hedge fund managers must remain nimble and adaptive, continuously updating their investment theses and adjusting their portfolio positions in response to changing market conditions. This requires a deep understanding of macroeconomic and geopolitical factors, as well as the ability to synthesize complex information quickly and effectively. Global macro hedge funds must also navigate a complex web of regulatory and compliance requirements, which can vary by jurisdiction and asset class. These requirements may include reporting obligations, limits on leverage, and restrictions on certain investment activities. To ensure compliance with these rules, global macro hedge fund managers must invest significant resources in developing and maintaining robust compliance programs. Failure to comply with applicable regulations can result in substantial fines, reputational damage, and even the closure of the fund. Investors in global macro hedge funds typically have high expectations for performance and risk management. As a result, fund managers must be transparent about their investment process, risk management practices, and historical performance to attract and retain investor capital. This often involves engaging in extensive due diligence processes, during which investors scrutinize the fund's investment strategy, track record, and operational infrastructure. Global macro hedge fund managers must be prepared to address investor concerns and demonstrate their ability to deliver strong risk-adjusted returns in a variety of market conditions. Performance evaluation is an essential aspect of investing in global macro hedge funds. Investors typically assess a fund's performance using various metrics, such as absolute returns, risk-adjusted returns, and performance relative to a benchmark or peer group. Some commonly used risk-adjusted performance metrics include the Sharpe ratio, which measures the excess return per unit of risk, and the Sortino ratio, which focuses on downside risk. These metrics can help investors compare the performance of different funds while accounting for the level of risk taken by the manager. When evaluating the performance of a global macro hedge fund, it's important to compare its returns to relevant benchmarks. These benchmarks can provide context for the fund's performance and help investors determine whether the fund is generating value relative to other investment opportunities. For example, a global macro hedge fund focused on currency trading might be compared to a currency index, while a fund that invests primarily in equities might be benchmarked against a global stock index. By comparing the fund's performance to these benchmarks, investors can assess whether the fund's investment strategy is delivering returns that outperform the broader market or the specific asset class it targets. Evaluating risk-adjusted returns is essential when assessing the performance of global macro hedge funds. It is not sufficient to evaluate returns in isolation; the level of risk taken by the fund manager must also be considered. Risk-adjusted measures such as the Sharpe ratio, which considers the fund's volatility alongside its returns, provide insight into how effectively the fund manager is generating returns relative to the amount of risk taken. A higher Sharpe ratio indicates better risk-adjusted performance. Investors should also consider the consistency of the fund's performance over time. It is important to evaluate the fund's track record during various market conditions to assess its ability to navigate different economic and geopolitical environments successfully. Global macro hedge funds offer diversification, the potential for absolute returns, and exposure to global economic trends and geopolitical events. These funds employ a top-down investment approach, focusing on macroeconomic factors and political events. The investment process of global macro hedge funds involves macroeconomic analysis, identification of investment opportunities, and the implementation of trades with a keen focus on risk management. Effective risk management is crucial in mitigating the risks associated with investing in global macro strategies. However, global macro hedge funds face challenges such as market volatility, regulatory compliance, and the need to meet investor expectations. Through careful evaluation of performance metrics, comparison to relevant benchmarks, and consideration of risk-adjusted returns, investors can make informed decisions about allocating capital to global macro hedge funds.What Is a Global Macro Hedge Fund?

Importance and Relevance of Global Macro Hedge Funds

Characteristics of Global Macro Hedge Funds

Investment Strategy and Approach

Focus on Global Economic and Political Factors

Diversification Across Asset Classes and Geographies

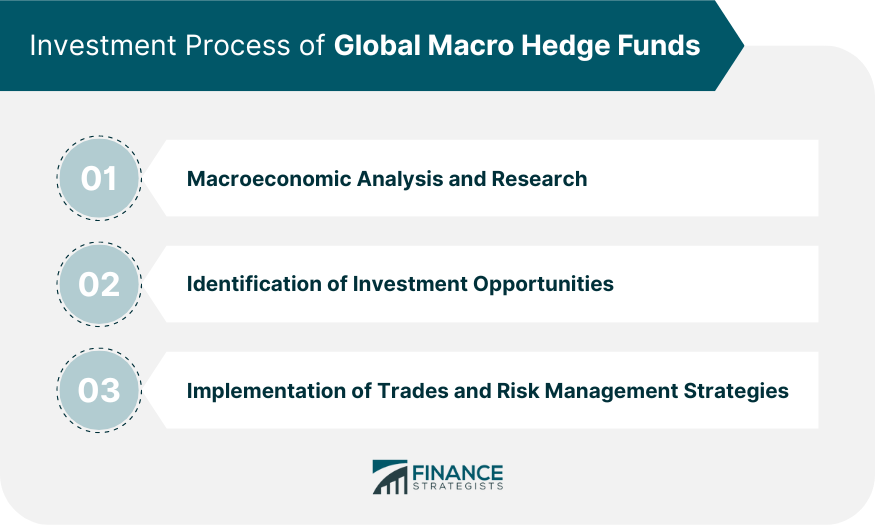

Investment Process of Global Macro Hedge Funds

Macroeconomic Analysis and Research

Identification of Investment Opportunities

Implementation of Trades and Risk Management Strategies

Risk Management in Global Macro Hedge Funds

Hedging Strategies to Mitigate Risks

Monitoring and Managing Portfolio Risk Exposure

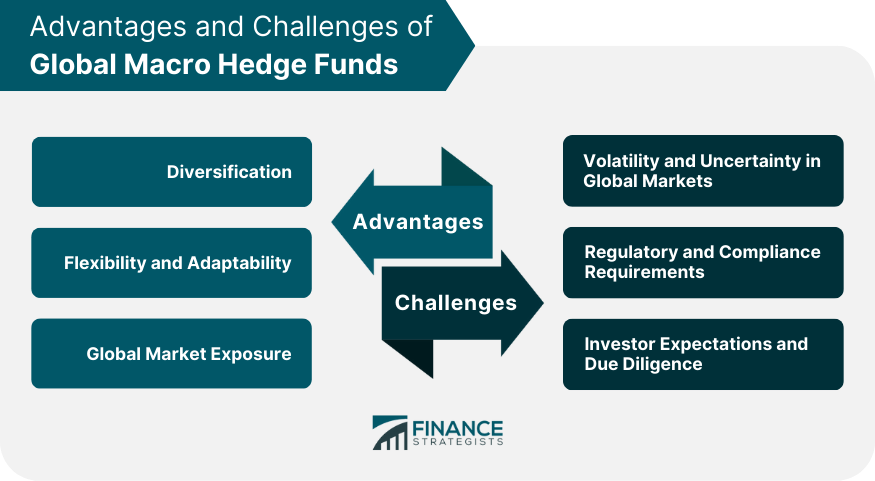

Advantages of Global Macro Hedge Funds

Diversification

Flexibility and Adaptability

Global Market Exposure

Challenges in Global Macro Hedge Funds

Volatility and Uncertainty in Global Markets

Regulatory and Compliance Requirements

Investor Expectations and Due Diligence

Performance Evaluation and Benchmarking

Metrics Used to Evaluate Performance

Comparison to Relevant Benchmarks

Assessment of Risk-Adjusted Returns

The Bottom Line

Global Macro Hedge Fund FAQs

Global Macro Hedge Funds are investment vehicles that employ strategies based on macroeconomic analysis to profit from global market trends and events.

Global Macro Hedge Funds invest in various asset classes, including stocks, bonds, currencies, and commodities, based on their analysis of global economic and political factors.

Risks in Global Macro Hedge Funds include market volatility, geopolitical events, liquidity risks, and potential losses due to incorrect macroeconomic predictions.

Global Macro Hedge Funds are typically managed by experienced hedge fund managers and investment teams with expertise in macroeconomic analysis and trading strategies.

Investing in Global Macro Hedge Funds can provide potential benefits such as diversification, exposure to global markets, and the potential for generating returns in various market conditions.