Futures are contracts made between two parties obligating them to transact an asset at a given price at some predetermined future date. These contracts have expirations, conditions, and prices that are known upfront and are not subject to change. The price that is agreed upon while establishing the future is the price that must be paid for the underlying asset, regardless of changes in the market by the expiration. Underlying assets include physical commodities, such as precious metals or crude oil, as well as some other financial instruments like stock index futures or US treasury bonds. Have questions about Futures? Click here. Futures can be used by investors to speculate about the direction of the market and to hedge against losses. If an investor believes the price of a commodity will rise, then they may want to purchase futures contracts now and make a profit at their expiration. If they believe the price will fall, they may use futures to lock in the sale price for commodities they own to avoid incurring a loss when the price drops. They provide a mechanism for producers and consumers to hedge against unfavorable price movements. Additionally, they offer avenues for investors and traders to speculate on price movements. Futures also facilitate price discovery and ensure a more transparent trading environment. Hedgers are individuals or institutions that use futures contracts to protect against potential price changes in an asset they own or intend to own. For instance, a farmer might use futures to lock in a selling price for their crop, safeguarding against the possibility of falling prices. By locking in a specific price, hedgers can stabilize their expected income or costs, making financial planning more predictable. Speculators are traders who enter the futures market, not to hedge, but to profit from price changes. Unlike hedgers, they don't have an interest in the underlying asset. Their goal is to buy low and sell high (or vice versa) and they thrive on market volatility. While speculators can make significant profits, they also bear a substantial risk as they're exposed to potential large losses if the market moves against them. Arbitrageurs are participants who look for price discrepancies between markets or related products. When they identify a price difference, they simultaneously buy in the lower-priced market and sell in the higher-priced one, capturing a risk-free profit. Their activities promote price efficiency by ensuring that prices in different markets remain aligned. Each futures contract has its set of specifications detailing its terms. These include the size of the contract, delivery and payment dates, minimum price increments, and the product's quality and grade. Standardizing these details ensures that all participants know precisely what they're trading, promoting liquidity and transparency. Margin in futures trading refers to the good faith deposit made by both buyers and sellers to ensure they fulfill their contractual obligations. This deposit is a fraction of the contract's total value. Margins protect both parties and the clearinghouse against potential losses from adverse price movements. These requirements are regularly adjusted to reflect current market conditions. Clearinghouses act as intermediaries between buyers and sellers in the futures market, ensuring that all parties meet their contractual obligations. At the end of each trading day, clearinghouses mark-to-market all positions, adjusting traders' accounts based on daily price changes. This daily settlement process ensures that gains and losses are recognized and addressed promptly. Commodity futures pertain to contracts on tangible products like grain, oil, and gold. These contracts allow producers and consumers to hedge against unfavorable price fluctuations, ensuring stability in revenues or costs. Unlike commodity futures, financial futures are contracts on intangible assets like stock indices, interest rates, or bonds. They allow investors to hedge against potential adverse movements in financial markets or to speculate on future market directions. Currency futures are contracts on the exchange rate between two currencies. They offer businesses and investors a mechanism to hedge against unfavorable currency movements, especially in our interconnected global economy where exchange rate volatility can have significant implications. Spot prices, or the current market prices of an asset, play a pivotal role in determining futures prices. Futures prices tend to converge to spot prices as the expiration date approaches. This alignment ensures that arbitrage opportunities, which could destabilize the market, don't persist. The basis is the difference between the spot price of an asset and its futures price. As the expiration of a futures contract approaches, this difference narrows. However, unexpected factors can cause discrepancies, leading to basis risk. It's essential for traders and hedgers to understand and monitor basis risk as it can impact their investment or hedging strategies. Cost of carry refers to the costs associated with holding an asset over a period, such as storage costs for commodities or interest costs for financial assets. These costs influence the pricing of futures contracts, as they represent the difference between buying and holding an asset versus entering into a futures contract. Risk management is a significant advantage of futures contracts as they allow individuals and businesses to hedge against price fluctuations in underlying assets, thereby reducing potential financial losses. By locking in prices through futures, market participants can mitigate the impact of adverse price movements and ensure greater stability in their financial positions. Futures markets offer vast opportunities for speculators. By correctly predicting price movements, traders can generate substantial returns, even with a relatively small initial investment, due to the leveraged nature of futures trading. With a large number of participants and high transaction volumes, futures markets tend to be highly liquid. This liquidity ensures efficient price discovery and allows traders to enter or exit positions with ease. While leverage can amplify profits, it also magnifies potential losses. Traders can lose more than their initial investment, making futures a risky proposition for those who don't manage their positions carefully. When market movements lead to significant losses, traders may face margin calls, requiring them to deposit additional funds. Failure to meet these requirements can result in forced liquidation of positions, potentially at unfavorable prices. Futures contracts have set expiration dates. If a trader's position hasn't reached its desired profit level by the expiry, they might need to roll over to a new contract, incurring additional costs and risks. Futures can involve the transaction of a wide variety of assets, including: Physical commodities, like crude oil, corn, wheat, and so on Stock index futures, such as the S&P 500 index Currency futures, such as for the dollar (UDS), euro (EUR), or pound (GBP) Precious metals futures, such as for silver, gold, and platinum US Treasury futures, such as for bonds or other financial products Futures are financial contracts made between two parties, obligating them to transact an asset at a specified price on a predetermined future date. These contracts obligate two parties to transact an asset at a predetermined price on a future date, providing stability and certainty in uncertain market conditions. Futures play a vital role in risk management, enabling hedgers to protect against price fluctuations and providing avenues for speculators to capitalize on price changes. Additionally, futures markets foster efficient price discovery and liquidity, making them attractive to investors and traders alike. However, futures trading also comes with its share of disadvantages. The high leverage involved can lead to substantial losses if not managed carefully, and margin calls can force traders to inject additional funds or face forced liquidation. Moreover, the limited time horizon for contract expiry necessitates careful planning and consideration of rollover costs.Define Futures in Simple Terms

What Are Futures in Finance?

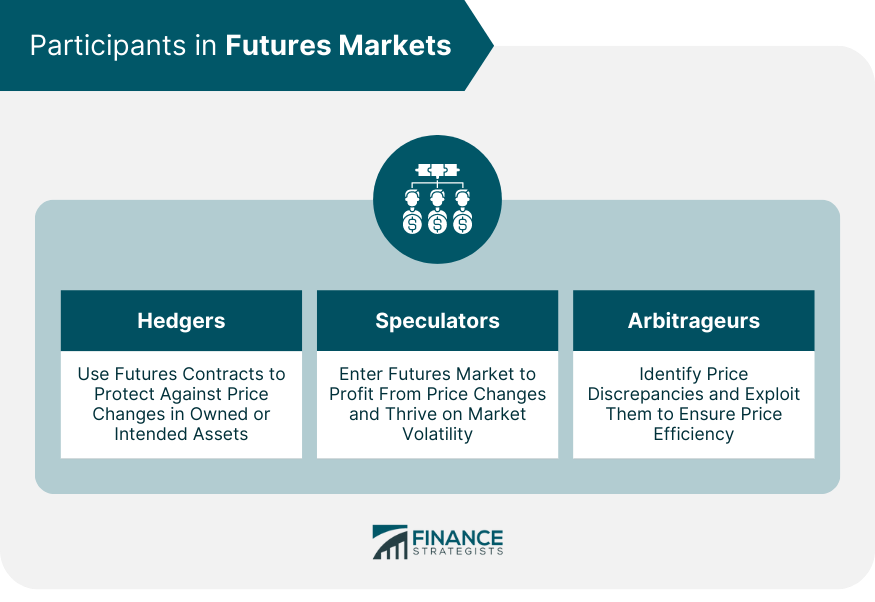

Participants in Futures Markets

Hedgers

Speculators

Arbitrageurs

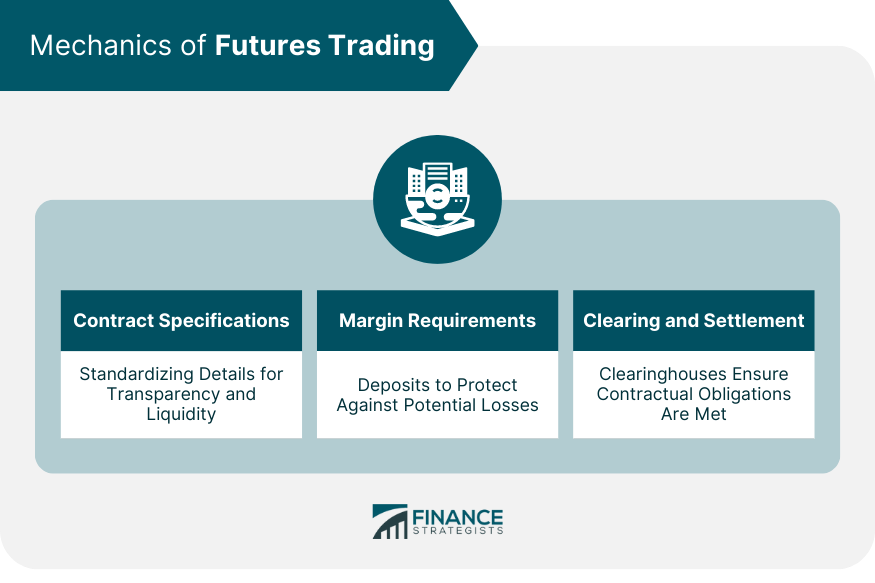

Mechanics of Futures Trading

Contract Specifications

Margin Requirements

Clearing and Settlement

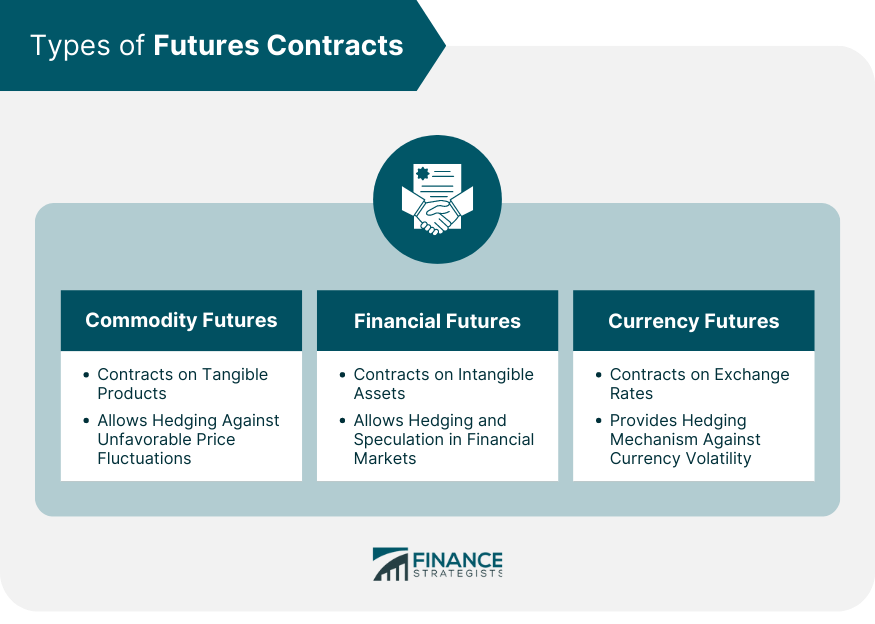

Types of Futures Contracts

Commodity Futures

Financial Futures

Currency Futures

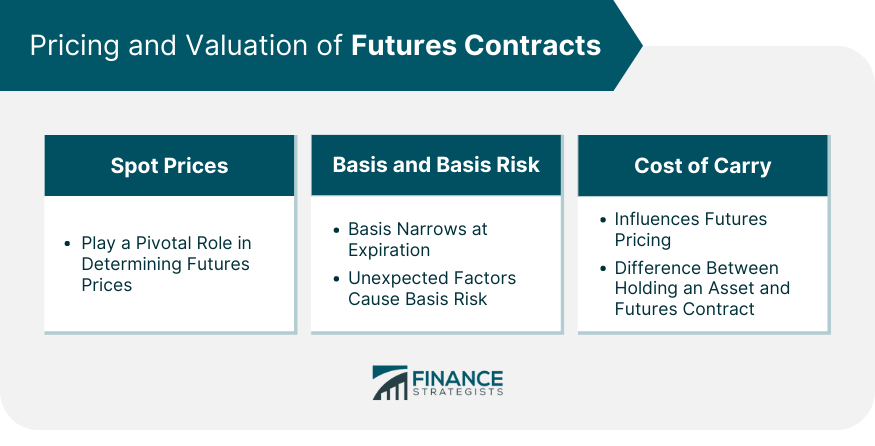

Pricing and Valuation of Futures Contracts

Spot Prices

Basis and Basis Risk

Cost of Carry

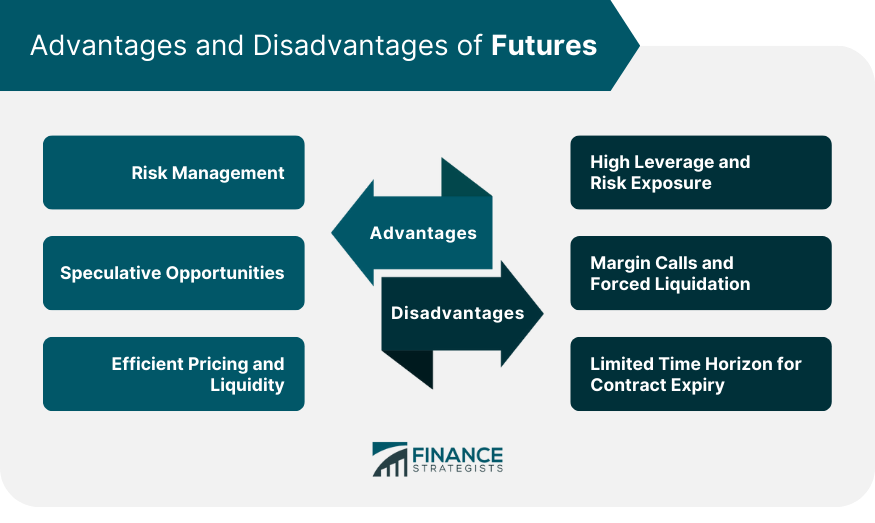

Advantages of Futures

Risk Management

Speculative Opportunities

Efficient Pricing and Liquidity

Disadvantages of Futures

High Leverage and Risk Exposure

Margin Calls and Forced Liquidation

Limited Time Horizon for Contract Expiry

Futures Examples

Conclusion

Futures FAQs

Futures are contracts made between two parties obligating them to transact an asset at a given price at some predetermined future date.

Futures can be used by investors to speculate about the direction of the market and to hedge against losses.

If an investor believes the price of a commodity will rise, then they may want to purchase futures contracts now and make a profit at their expiration.

If an investor believes the price will fall, they may use futures to lock in the sale price for commodities they own to avoid incurring a loss when the price drops.

Examples of assets available for futures trading include crude oil, corn, wheat, stock index futures (such as the S&P 500 index), currency, silver, gold, platinum, US Treasury notes and other financial products.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.