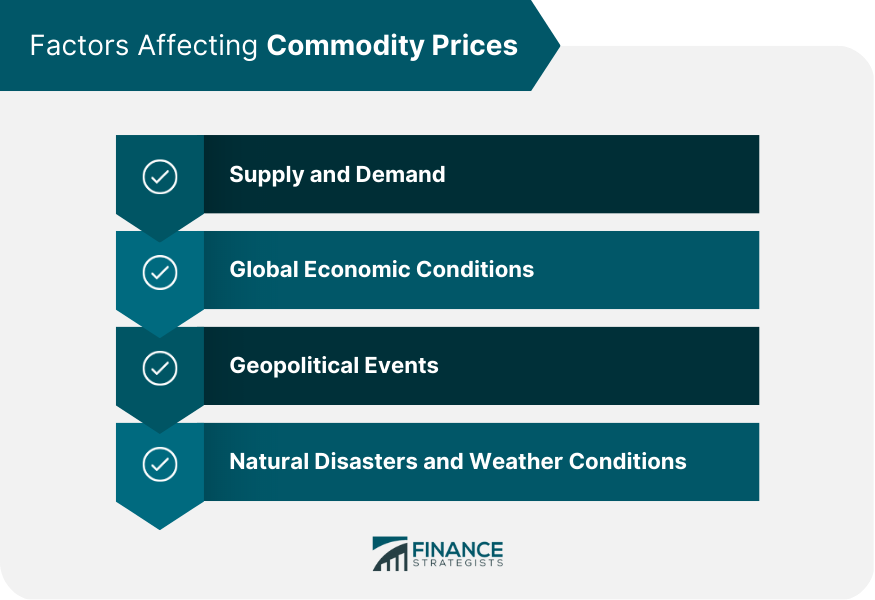

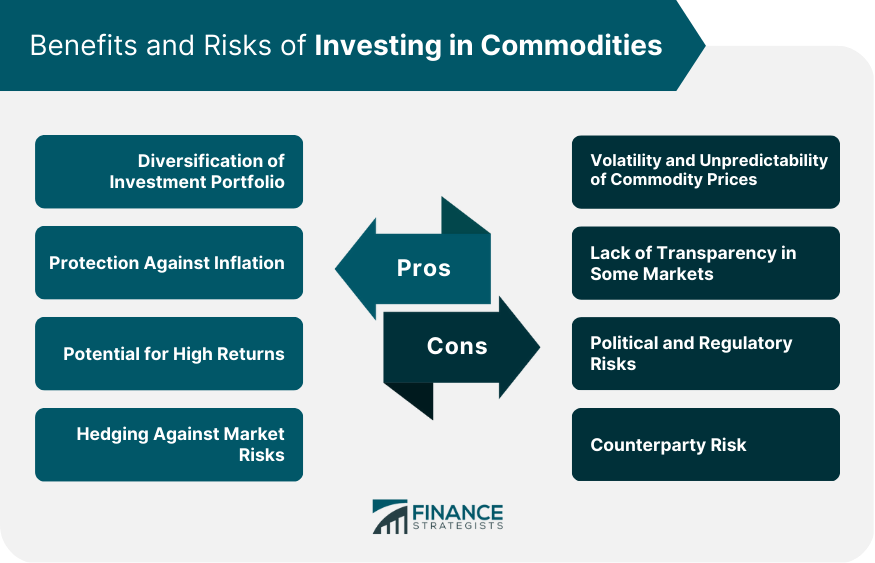

Commodities are a vital part of the global economy and are essential in the production of goods and services. The term "commodities" refers to raw materials such as metals, energy, agricultural products, and livestock. Commodities are traded in global markets, and their prices are influenced by a range of factors, including supply and demand, global economic conditions, geopolitical events, and natural disasters. Agricultural commodities refer to crops and livestock that are produced for food, fuel, and clothing. Examples of agricultural commodities include corn, wheat, soybeans, coffee, sugar, and cattle. Agricultural commodities are traded on global exchanges, and their prices are influenced by factors such as weather conditions, supply and demand, and government policies. Energy commodities refer to natural resources that are used to generate power, heat homes and businesses, and fuel transportation. Examples of energy commodities include crude oil, natural gas, coal, and gasoline. Energy commodities are traded on global exchanges, and their prices are influenced by factors such as global demand, geopolitical events, and supply disruptions. Metals are raw materials that are used in the production of a range of products, including electronics, construction materials, and jewelry. Examples of metals include gold, silver, copper, aluminum, and platinum. Metals are traded on global exchanges, and their prices are influenced by factors such as global demand, economic conditions, and geopolitical events. Livestock refers to domesticated animals that are raised for meat, milk, and other products. Examples of livestock include cattle, hogs, sheep, and poultry. Livestock is traded on global exchanges, and its prices are influenced by factors such as global demand, weather conditions, and government policies. Physical trading refers to the purchase and sale of actual commodities, such as gold, oil, or wheat. Physical trading involves the transportation and storage of the commodities and can be subject to logistical challenges and risks. Futures trading refers to the purchase and sale of contracts for the delivery of a commodity at a specified future date. Futures trading allows investors to hedge against price fluctuations or to profit from price movements in the commodity market. Futures contracts are traded on global exchanges, and their prices are influenced by factors such as global supply and demand, geopolitical events, and natural disasters. Options trading refers to the purchase and sale of options contracts that give the holder the right but not the obligation to buy or sell a commodity at a specified future date. Options trading allows investors to protect against price fluctuations while limiting their exposure to risk. Options contracts are traded on global exchanges, and their prices are influenced by factors such as global supply and demand, geopolitical events, and natural disasters. Commodity ETFs allow investors to gain exposure to a particular commodity or a basket of commodities without the need for physical ownership or futures contracts. Commodity ETFs are traded on global exchanges and are subject to the same risks and factors that affect commodity prices. The most significant factor affecting commodity prices is supply and demand. When demand for a commodity is high, and supply is low, the price of the commodity increases. Conversely, when demand for a commodity is low, and supply is high, the price of the commodity decreases. Global economic conditions can also have a significant impact on commodity prices. Economic growth and expansion can increase demand for commodities, which can drive up prices. Conversely, economic contraction can decrease demand, which can lead to lower commodity prices. In addition, the strength of a country's currency can also affect commodity prices. When a country's currency is strong, it can lead to lower commodity prices, as it becomes more expensive for buyers in other countries. Geopolitical events, such as wars, conflicts, and political instability, can also impact commodity prices. These events can disrupt supply chains, reduce production, and increase the cost of transportation, all of which can lead to higher commodity prices. For example, political unrest in oil-producing countries can lead to supply disruptions and higher oil prices. Natural disasters, such as hurricanes, floods, and droughts, can also impact commodity prices. These events can damage crops, disrupt supply chains, and impact transportation, all of which can lead to higher commodity prices. For example, droughts in key agricultural regions can lead to lower crop yields and higher prices for agricultural commodities such as corn and wheat. Commodities can provide diversification benefits to an investment portfolio. As commodities have historically had low correlation with traditional asset classes such as stocks and bonds, investing in commodities can help reduce the overall risk of an investment portfolio. Commodities can also protect against inflation. As commodity prices tend to rise during periods of inflation, investing in commodities can help offset the effects of inflation on an investment portfolio. Commodities can provide the potential for high returns. As commodity prices can be volatile, investors who correctly predict commodity price movements can realize significant gains. Commodities can also be used to hedge against market risks. For example, investing in commodities such as gold can help protect against declines in the stock market during periods of economic uncertainty. Commodity prices can be highly volatile and unpredictable, which can lead to significant losses for investors. For example, sudden changes in supply or demand can cause significant price swings in the commodity market. Some commodity markets may lack transparency, which can make it difficult for investors to accurately assess the risks and opportunities of investing in commodities. In addition, certain commodities, such as rare metals, may be subject to price manipulation. Political and regulatory risks can also impact commodity prices. Changes in government policies, such as trade tariffs or sanctions, can disrupt supply chains and lead to price volatility in the commodity market. Investing in commodities can also expose investors to counterparty risk. For example, in futures trading, investors may be exposed to the risk of default by the party on the other side of the trade. Investors can invest directly in physical commodities by purchasing and holding the actual commodity. This strategy can provide the most direct exposure to commodity price movements but may involve storage and transportation costs. Investing in commodity futures involves purchasing contracts for the delivery of a commodity at a future date. This strategy allows investors to profit from price movements in the commodity market but involves significant risks due to the volatility of commodity prices. Investing in commodity ETFs allows investors to gain exposure to a particular commodity or a basket of commodities without the need for physical ownership or futures contracts. Commodity ETFs can provide diversification benefits to an investment portfolio but are subject to the same risks and factors that affect commodity prices. Investors can also allocate a portion of their investment portfolio to stocks of companies that are involved in the production or distribution of commodities. This strategy can provide exposure to commodity prices while also providing the potential for growth and diversification benefits. Commodities are an essential part of the global economy and are traded in markets worldwide. Commodities can provide diversification benefits, protection against inflation, potential for high returns, and hedging against market risks. However, investing in commodities can also be risky due to the volatility and unpredictability of commodity prices, lack of transparency in some markets, political and regulatory risks, and counterparty risk. Investors can invest in commodities through direct investment in physical commodities, investment in commodity futures, investment in commodity ETFs, and allocation of portfolio to commodity-related stocks. As with any investment strategy, investors should carefully consider the risks and benefits of investing in commodities and consult with a financial advisor before making any investment decisions.What Are Commodities?

Types of Commodities

Agricultural Commodities

Energy Commodities

Metals

Livestock

How Commodities Are Traded

Physical Trading

Futures Trading

Options Trading

Exchange-Traded Funds (ETFs)

Factors Affecting Commodity Prices

Supply and Demand

Global Economic Conditions

Geopolitical Events

Natural Disasters and Weather Conditions

Benefits of Investing in Commodities

Diversification of Investment Portfolio

Protection Against Inflation

Potential for High Returns

Hedging Against Market Risks

Risks of Investing in Commodities

Volatility and Unpredictability of Commodity Prices

Lack of Transparency in Some Markets

Political and Regulatory Risks

Counterparty Risk

Strategies for Investing in Commodities

Direct Investment in Physical Commodities

Investment in Commodity Futures

Investment in Commodity ETFs

Allocation of Portfolio to Commodity-Related Stocks

Conclusion

Commodities FAQs

Commodities are raw materials that are used in the production of goods and services. They can be categorized into four main groups: agricultural commodities, energy commodities, metals, and livestock. Commodities are traded in global markets, and their prices are influenced by a range of factors, including supply and demand, global economic conditions, geopolitical events, and natural disasters.

Investing in commodities can provide diversification benefits to an investment portfolio, protection against inflation, potential for high returns, and hedging against market risks. Commodities have historically had low correlation with traditional asset classes such as stocks and bonds, making them an excellent addition to an investment portfolio.

The risks of investing in commodities include the volatility and unpredictability of commodity prices, lack of transparency in some markets, political and regulatory risks, and counterparty risk. Investors should carefully consider these risks before investing in commodities and consult with a financial advisor.

Investors can invest in commodities through direct investment in physical commodities, investment in commodity futures, investment in commodity ETFs, and allocation of portfolio to commodity-related stocks. Each of these investment strategies has its own advantages and risks, and investors should carefully consider their investment goals and risk tolerance before choosing a strategy.

Commodity prices are influenced by a range of factors, including supply and demand, global economic conditions, geopolitical events, and natural disasters. For example, sudden changes in supply or demand can cause significant price swings in the commodity market, while political and regulatory risks can impact commodity prices by disrupting supply chains and causing price volatility. Investors should stay informed about these factors to make informed investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.