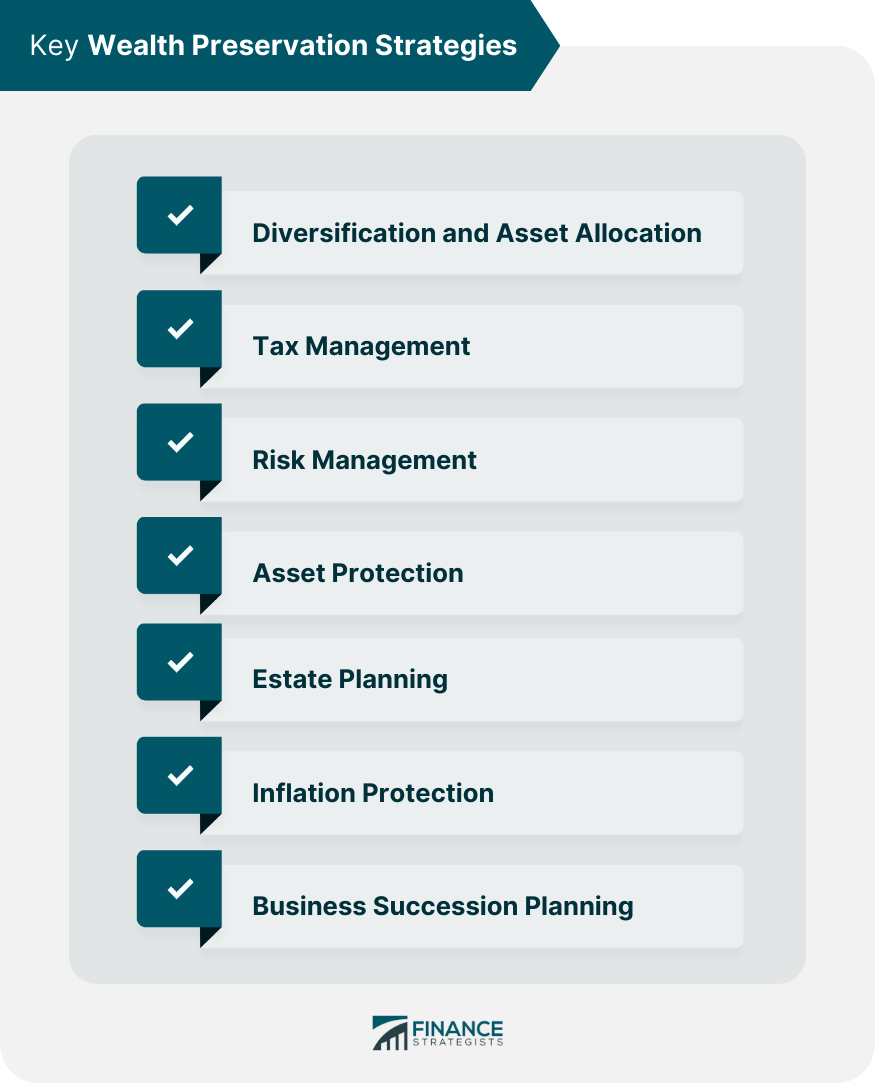

Wealth preservation is a critical aspect of financial planning, as it focuses on protecting and maintaining the value of assets accumulated over time. It is particularly important for high-net-worth individuals and families, who face unique challenges and opportunities related to their wealth. Wealth preservation strategies aim to minimize potential risks, protect against unforeseen events, and ensure the long-term viability of assets. They often include diversification, tax management, risk management, and estate planning, among other tactics.

Diversification is a fundamental wealth preservation strategy, as it involves spreading investments across various asset classes to reduce risk and enhance returns. Diversification helps protect against market volatility and the potential underperformance of a single asset class or investment. Equities, or stocks, represent ownership in a company and can offer potential capital appreciation and dividend income. A well-balanced portfolio typically includes a mix of domestic and international equities. Fixed income investments, such as bonds and treasury bills, provide regular interest income and can help stabilize a portfolio during periods of market volatility. Real estate investments, including direct property ownership and real estate investment trusts (REITs), can offer diversification, income, and potential capital appreciation. Alternative investments, such as private equity, hedge funds, and commodities, can provide additional diversification and potential for higher returns, albeit with higher risk and complexity. Tax-loss harvesting is a strategy that involves selling underperforming investments to offset capital gains taxes on other investments, thereby reducing the overall tax burden. Municipal bonds are debt securities issued by local governments, which typically provide tax-free interest income, making them an attractive option for investors in high tax brackets. Tax-advantaged accounts, such as individual retirement accounts (IRAs) and 401(k) plans, can help defer taxes on investment gains and potentially reduce the overall tax burden. Gift taxes and estate tax strategies, such as annual exclusion gifting and establishing irrevocable trusts, can help transfer wealth to heirs while minimizing taxes. Trusts and other legal structures, such as family limited partnerships (FLPs) and limited liability companies (LLCs), can provide tax advantages and protect assets from potential creditors and lawsuits. Life insurance can help protect a family's financial security by providing a death benefit to beneficiaries in the event of the insured's death. Umbrella liability insurance provides additional coverage beyond standard homeowner's and auto insurance policies, protecting against large liability claims and lawsuits. Long-term care insurance can help cover the costs of long-term care services, such as assisted living or nursing home care, protecting assets from being depleted to cover these expenses. Options and other derivative instruments can be used as a hedging strategy to protect a portfolio from market volatility and potential losses. Inverse exchange-traded funds (ETFs) are designed to move in the opposite direction of a specific index, providing a hedge against market declines. Limited liability companies (LLCs) can help protect personal assets from business liabilities, making them an attractive option for business owners and investors. Family limited partnerships (FLPs) can be used to transfer assets within a family while providing asset protection and potential tax benefits. Offshore trusts can provide additional asset protection and privacy, as they are established in jurisdictions with favorable laws and regulations. Offshore banking can offer increased privacy and asset protection, along with potential tax advantages, depending on the jurisdiction and account structure. Revocable trusts can be used to manage and distribute assets during the grantor's lifetime and after death, while maintaining control and flexibility. Irrevocable trusts offer greater asset protection and tax benefits, as assets placed in the trust are permanently removed from the grantor's estate. Donor-advised funds allow individuals to make charitable contributions and receive immediate tax deductions while maintaining control over the timing and recipients of the grants. Charitable remainder trusts can provide income to the grantor and beneficiaries during their lifetimes, with the remaining assets being donated to a designated charity upon the grantor's death. Treasury Inflation-Protected Securities (TIPS) are government-issued bonds that adjust with inflation, providing a hedge against rising prices. Inflation-linked bonds, issued by corporations or governments, have their principal and interest payments adjusted for inflation, offering protection against rising prices. Real estate investments can provide a hedge against inflation, as property values and rental income often increase with rising prices. Commodities, such as gold and other precious metals, can serve as a store of value during times of inflation, providing a hedge against rising prices. Business valuation is an essential component of succession planning, as it helps determine the fair market value of a business and informs the transfer strategy. Buy-sell agreements are legally binding contracts that establish the terms for transferring ownership of a business in the event of an owner's death, disability, or departure. Employee stock ownership plans (ESOPs) are a tax-advantaged strategy for transferring business ownership to employees, providing potential tax benefits and fostering employee commitment to the company. Implementing wealth preservation strategies is crucial for safeguarding and maintaining assets over the long term. These strategies help protect against potential risks, minimize taxes, and ensure the efficient transfer of wealth to future generations. Financial advisors play a vital role in developing and implementing wealth preservation strategies tailored to an individual's or family's unique circumstances and goals. By working with a trusted advisor, individuals can navigate the complexities of wealth preservation and ensure their assets are protected and preserved for the long term. Wealth preservation is an ongoing process that requires regular monitoring and adjustments to account for changes in personal circumstances, market conditions, and tax laws. By staying informed and engaged, individuals can effectively protect and grow their wealth over time.Wealth Preservation Strategies: Overview

Diversification and Asset Allocation

The Role of Diversification in Wealth Preservation

Asset Allocation Strategies

Equities

Fixed Income

Real Estate

Alternative Investments

Tax Management Strategies

Tax-Efficient Investment Strategies

Tax-Loss Harvesting

Municipal Bonds

Tax-Advantaged Accounts

Estate Tax Planning

Gift and Estate Tax Strategies

Trusts and Other Legal Structures

Risk Management

Insurance Strategies

Life Insurance

Umbrella Liability Insurance

Long-Term Care Insurance

Hedging Strategies

Options and Derivatives

Inverse ETFs

Asset Protection

Legal Structures

Limited Liability Companies (LLCs)

Family Limited Partnerships (FLPs)

Offshore Strategies

Offshore Trusts

Offshore Banking

Estate Planning

Wills and Trusts

Revocable Trusts

Irrevocable Trusts

Charitable Giving Strategies

Donor-Advised Funds

Charitable Remainder Trusts

Inflation Protection

Inflation-Protected Securities

Treasury Inflation-Protected Securities (TIPS)

Inflation-Linked Bonds

Real Assets

Real Estate

Commodities

Business Succession Planning

Business Valuation

Ownership Transfer Strategies

Buy-Sell Agreements

Employee Stock Ownership Plans (ESOPs)

Conclusion

The Importance of Implementing Wealth Preservation Strategies

The Role of Financial Advisors in Wealth Preservation

The Ongoing Process of Maintaining and Adjusting Wealth Preservation Strategies

Wealth Preservation Strategies FAQs

Wealth preservation strategies refer to the techniques and methods used to protect and safeguard wealth from potential risks and threats, such as market downturns, taxes, inflation, and unexpected events like lawsuits or health issues.

Some common wealth preservation strategies include diversification of assets, asset protection trusts, insurance coverage, tax planning, and charitable giving. Wealthy individuals may also consider setting up family trusts or offshore accounts.

Diversification can help with wealth preservation by spreading assets across different types of investments, such as stocks, bonds, real estate, and alternative investments. This can help reduce the risk of losses due to a decline in a single asset class or market sector.

Asset protection trusts are legal structures that hold and protect assets from potential creditors, lawsuits, and other claims. These trusts can be established in domestic or offshore jurisdictions and can provide significant benefits for high-net-worth individuals seeking to preserve their wealth.

Wealth preservation strategies are important because they help individuals protect and preserve the wealth they have accumulated over time. Without proper planning and implementation, wealth can be subject to a range of risks and threats that could erode or deplete it over time. By taking proactive steps to safeguard their wealth, individuals can help ensure their financial security and protect their legacy for future generations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.