Wealth managers are professionals who specialize in helping high-net-worth individuals (HNWI) and ultra-high-net-worth individuals (UHNWI) manage their overall financial affairs. They provide a comprehensive range of services, such as investment management or philanthropic planning. Usually, wealth managers only work with clients who can meet their minimum investment requirements. For example, some wealth management firms may require zero to a minimum of $250,000, while others may require $1,000,000 before a client can open an account. Wealth managers can offer similar services to other financial professionals. However, what sets them apart is their commitment to growing, preserving, and transferring wealth to the next generation, which requires a thorough understanding of their client’s entire financial landscape.

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. Wealth managers offer personalized financial advice, combining investment management, tax planning, and estate planning to maximize your wealth. They tailor strategies to your unique goals, ensuring a holistic approach to asset growth and preservation. Leverage their expertise to navigate market complexities and secure your financial future. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation Wealth managers can do a wide range of services in various aspects of finance and can offer a range of advanced wealth management services, such as the following: A considerable portion of the activities of wealth managers falls under the planning side of their services. All these activities are geared towards generating, optimizing, and preserving their client’s wealth, enabling it to be passed on to the next generation. These activities include comprehensive financial planning, retirement planning, estate planning, tax planning, insurance planning, and business planning. Sufficient planning for all these sectors protects a client’s assets and reduces risks associated with their investments. Wealth managers advise clients on their investment choices, offering the best portfolio design, diversification strategy, asset allocation, and risk management practices. For example, they may seek to balance both active and passive investment strategies to protect a client’s assets. They may also review existing portfolios and provide insights into new opportunities to increase returns. Overall, they use sophisticated techniques to explore how different circumstances can affect their client’s financial future and adjust their strategies accordingly. A notable activity of wealth managers rendered possible by their clients’ immense wealth is providing guidance and advice on charitable giving. Wealth managers can help clients establish foundations or trusts and design the best donation structure for their families. This process can include educating them about donating money effectively, helping them oversee and maintain the foundation, providing reports, and monitoring the impact of their philanthropic efforts. The fee structure for wealth managers may vary depending on the type of services offered. Most charge an annual fee based on the value of assets under management (AUM). This is usually at 1% to 3% annually. Individuals with more significant assets can sometimes pay significantly less, as the median AUM charge decreases as the value of a client’s investments grows. Wealth managers may also implement similar costs and fee structures as financial advisors. For instance, they can charge an hourly fee ranging from $100 to $500, a fixed fee, or a combination of both. They may also charge a performance-based fee and even earn income from commissions. Other associated costs include trading and brokerage expenses. Consider your net worth, expertise, priorities, and objectives to determine whether you need a wealth manager. If you have a considerable net worth, hiring a dedicated wealth manager will help you protect and grow your wealth. Accumulating and preserving wealth requires understanding financial concepts, risk management skills, and investment strategies. If you lack the time or the knowledge to manage your investments personally, a wealth manager can provide these services. Wealth managers are uniquely qualified to offer advice that could help you manage and grow your wealth, navigate complex financial decisions, and create effective strategies for preserving and transferring your assets to the next generation. Thus, by hiring a wealth manager, you can trust that your finances are managed by a professional experienced in all areas of personal finance. You will benefit from their long-term view and sound advice that considers your specific goals and objectives. Wealth management offers a myriad of benefits. Below are important considerations before hiring a wealth manager: Ensure your wealth manager has the necessary certifications and qualifications to provide expert advice. They may have any of the following, Certified Investment Management Analyst (CIMA), Certified Private Wealth Advisor (CPWA), or Certified Financial Planner (CFP). Additionally, verifying their credibility and identity through the Financial Industry Regulatory Authority’s (FINRA) Brokercheck database or the Securities Exchange Commission’s (SEC) Investment Adviser Public Disclosure website is essential. It would also be helpful to learn more about the financial firm that employs them. Check if they have an established history and track record in providing wealth management services. Consider their resources, staff size, service offerings, technology infrastructure, and licensing. Wealth managers all have different specialties and clientele. Some may specialize in ultra-high-net-worth individuals, while others cater to more modest portfolios. Make sure your wealth manager has experience managing portfolios similar to your own. A quality wealth manager will provide comprehensive advice, sound investing strategies, and reliable financial planning solutions suitable to your condition. By choosing the right wealth manager for your situation, you can ensure that your assets are appropriately managed. Ask your wealth manager about their investment strategies. For instance, you can check how aggressive or conservative they are and if it aligns with your risk tolerance. You can also learn about their portfolio diversification approach, which helps manage risk while pursuing returns. Additionally, you ask your prospective wealth manager about their communication style and how frequently they will update you on your investments. Asking these questions and gauging their response will help you choose a wealth manager whom you are comfortable working with. It is vital to determine if your wealth manager’s services can help you reach your financial goals. You can research the products and services different wealth managers offer to find one that suits your needs sufficiently. By reviewing various options first, you can select a qualified and experienced wealth manager who delivers the results you expect. This also helps you meet your financial goals while minimizing risks. Compare the costs of different wealth management firms to select the best one for you. The services of a quality wealth manager will likely cost more than those of a less experienced one, but the return on investment should be equal to their expertise and experience. Thus, ask a prospective wealth manager about the costs associated with their service and any other fees before signing a contract. Understanding all the costs involved in hiring a wealth manager can ensure you get the best value for your money. Wealth management and asset management are two closely related financial services. A wealth manager is a type of financial advisor but not all financial advisors are wealth managers. Both a wealth manager and an asset manager offer advice and strategies for investing in various financial instruments. However, some distinct differences separate the two. Clients need to be aware of these differences to select the financial professional that best meets their needs. A wealth manager generally focuses more on long-term planning and strategic advice when managing investments. They typically provide additional services such as estate planning, retirement planning, tax planning, and insurance services. Wealth managers often look at a client’s financial situation and structure their advice around helping clients reach their long-term goals. In contrast, an asset manager is focused more on short-term goals and specializes in creating portfolios of specific investments. Asset managers want to achieve a desired level of risk versus return over a given period. Generally speaking, they focus more on the returns investors receive from their investments rather than protecting them from market fluctuations or providing long-term advice. A wealth manager and a financial advisor differ in terms of the type of clients they cater to, the services they offer, the agencies that regulate them, their fees, and their qualifications. A wealth manager works with high-net-worth individuals and ultra-high-net-worth individuals, while a financial advisor can work with individuals of any wealth level. Although there is an overlap in the services they can provide, wealth managers focus on more advanced financial strategies that extend to legal planning and philanthropic gifting. Meanwhile, financial advisors typically have a broader range of services that become specialized when they get certifications from the FINRA. As such, most financial advisors are regulated by FINRA, while wealth managers are governed by the SEC when they work with clients of a particular net worth or reach a certain threshold for the assets they manage. In addition, wealth managers tend to charge higher fees than financial advisors due to their comprehensive strategies and expertise in structuring plans that take into account multiple factors over a long period of time. Whether you plan on hiring a wealth manager or a financial advisor, be sure to check if they specialize in the services you need so that you can select the best one for you. A wealth manager is a type of financial advisor typically associated with affluent clients. They offer thorough investment advice for the rich on retirement planning, estate planning, and risk and investment management. On top of the usual areas of finance, they focus on wealth preservation, including legacy planning, charitable giving, and other long-term financial plans. Their advanced strategies on investment ensure that their clients’ wealth is maximized and protected from market volatility. Although wealth managers are similar to financial advisors and asset managers, they differ in several areas. For instance, because of a wealth manager’s expertise and the range of their services, they tend to charge higher fees than a financial advisor or asset manager. Most wealth managers charge an annual fee depending on assets managed at around 1% to 3% yearly. They may also charge fixed, performance-based, or commission-based fees or an hourly fee of generally $100 to $500. Your amount of wealth, expertise, priorities, and goals will determine if you need to hire a wealth manager. Before working with one, learn about their credentials, background, philosophy, fees, and services provided.What Is a Wealth Manager?

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

What Does a Wealth Manager Do?

Planning Services

Investment Services

Philanthropic Services

Wealth Manager Fees

Do You Need a Wealth Manager?

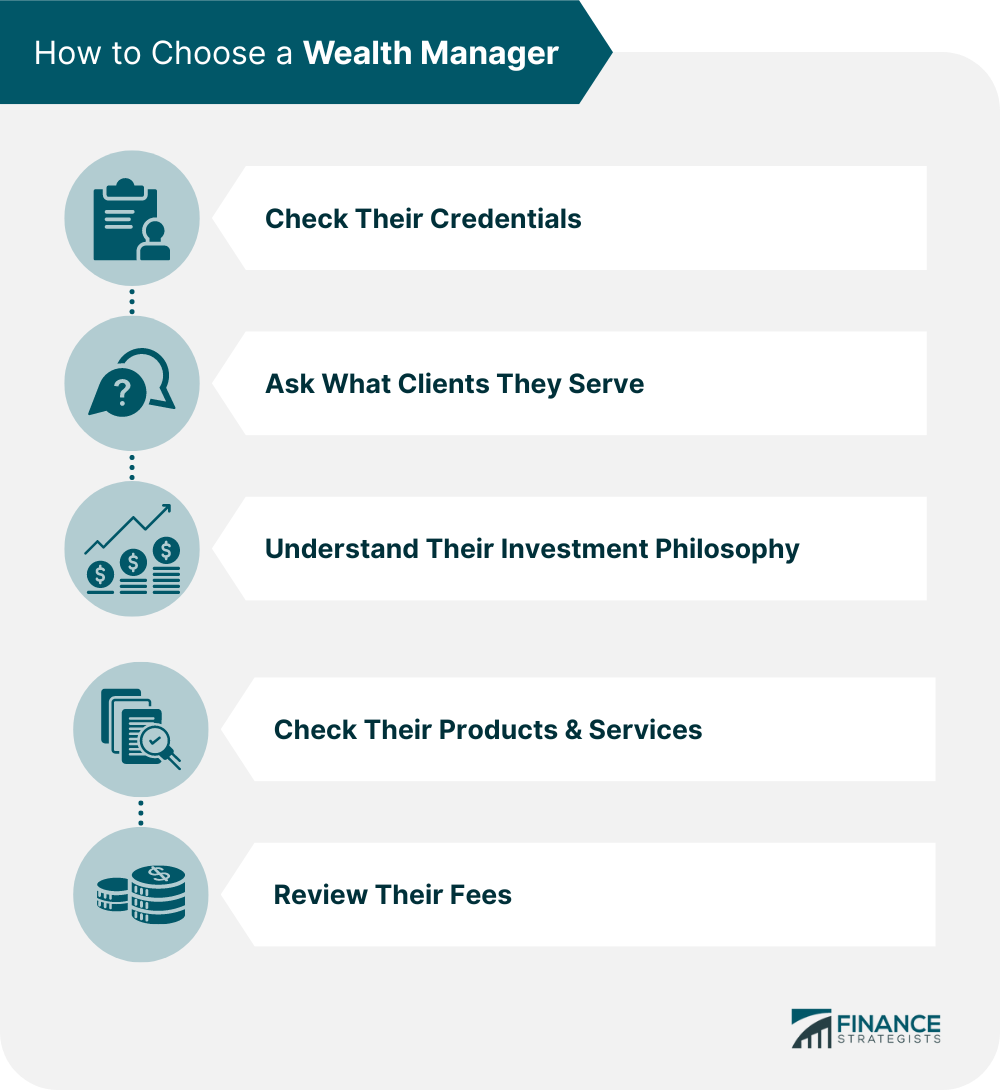

How to Choose a Wealth Manager

Check Their Credentials

Ask What Clients They Serve

Understand Their Investment Philosophy

Check Their Products & Services

Review Their Fees

Wealth Manager vs Asset Manager

Wealth Manager vs Financial Advisor

Final Thoughts

Wealth Manager FAQs

Wealth managers typically charge a fee of 1% to 3% of the assets they manage. They may also charge fixed, performance-based, or commission-based fees or an hourly fee ranging from $100 to $500.

An asset manager focuses on managing the assets that their clients own. In contrast, a wealth manager goes beyond asset management to provide comprehensive advice for the wealthy on retirement planning, estate planning, and risk and investment management.

A wealth manager provides investment advice and financial services to well-off clients. These services include asset management, investment strategy, portfolio construction, tax planning, estate planning, retirement planning, and risk management.

The value of a wealth manager depends on the amount of wealth, expertise, priorities, and goals a client has. For instance, clients who wish to maximize and protect their wealth from market volatility and other risks may benefit from hiring a wealth manager.

You may need to hire a wealth manager if you have significant assets and lack the time or knowledge to manage them personally. Wealth management services are also beneficial if you have complex financial goals that require more in-depth strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.