There are two types of stocks: common and preferred stock. Stocks, also known as equity, are a security representing a holder's proportionate ownership of a corporation. Stockholders are therefore entitled to that portion of the corporation's assets and earnings. Companies issue stock in order to raise capital to finance future growth. Have questions about Stocks? Click here. There are two types of stocks: common and preferred stock. Despite its name, preferred stock isn't intrinsically superior to common stock. Unlike common stock, preferred stock doesn't come with the right to vote and has less potential to appreciate in price than common stock. However, preferred stock comes with the right to receive dividends prior to common stockholders and have a higher priority in getting paid back if the company goes bankrupt and is liquidated. Preferred stock gets its name because preferred shareholders are in a "preferred" position to receive dividend payments and be paid back first in the event of bankruptcy. Although preferred stock is still equity, in many ways it is more like a hybrid between stock and a bond. Preferred stock is like a bond because the income provided by preferred stock is more predictable than with common stock, is rated by major credit rating agencies, and is given higher priority than common stockholders. It is like equity because, unlike a bond, failing to pay preferred shareholders dividends does not put a company in default, and the stock can appreciate in price. The hybrid nature of preferred stock makes it a more attractive investment to certain investors. Preferred stock is characterized by a set of unique features that distinguish it from other investment vehicles. These features play a pivotal role in determining the attractiveness of preferred stock to investors and its place within their portfolios. Preferred stockholders are entitled to receive dividends before common stockholders, providing them with a consistent income stream. This preference ensures a certain level of stability in dividend payouts, making preferred stock an appealing option for income-oriented investors. However, it's important to note that dividends on preferred stock are not guaranteed and can be affected by the financial health of the issuing company. Unlike common stock, where dividend payouts can fluctuate based on the company's performance, preferred stockholders receive dividends at a predetermined rate. This fixed nature of dividends ensures predictability and offers investors a sense of security in terms of income generation. The fixed dividend rate is usually expressed as a percentage of the stock's par value, and it remains constant throughout the life of the stock. While common stockholders typically have voting rights in corporate matters, preferred stockholders often do not possess the same privileges. In most cases, preferred stockholders do not have voting rights, which means they have limited say in company decisions and policies. This lack of voting rights can be viewed as a trade-off for the dividend priority and stability that preferred stock offers. For investors seeking steady income without getting entangled in corporate governance matters, this can be a desirable feature. Convertible preferred stock adds another layer of flexibility to the investment. This type of preferred stock comes with the option to convert the shares into a predetermined number of common shares at a specified conversion ratio. This feature allows investors to benefit from potential capital appreciation of the underlying common stock while still enjoying the dividend advantages of preferred stock. Convertible preferred stock strikes a balance between income and growth potential, appealing to investors looking for a dual advantage. Preferred stock comes in various forms, each tailored to different investor preferences and risk appetites. Cumulative preferred stock guarantees that if the company temporarily suspends dividend payments, the unpaid dividends accumulate and must be paid before dividends can be distributed to common shareholders. This feature provides an extra layer of assurance to investors, as it ensures that missed dividend payments won't be lost but rather deferred until the company's financial situation improves. In contrast, non-cumulative preferred stock does not accumulate unpaid dividends. If the company skips a dividend payment, shareholders of non-cumulative preferred stock do not have a claim to the missed dividends. While these stocks generally offer higher dividend yields than their cumulative counterparts, they also carry a higher level of risk, as missed dividend payments are not recoverable. Participating preferred stock comes with the potential for additional dividends beyond the fixed rate. If the company's profits exceed a certain threshold, participating preferred shareholders are entitled to receive extra dividends. This feature allows investors to share in the company's success while still benefiting from the stability of preferred stock dividends. As mentioned earlier, convertible preferred stock provides the option to convert preferred shares into a predetermined number of common shares. This conversion can be advantageous if the company's common stock appreciates significantly, potentially offering investors both dividend income and capital gains. Callable preferred stock grants the issuing company the right to redeem or "call" the shares at a predetermined price after a specified date. While this provides flexibility to the company, it introduces an element of uncertainty for investors, as their investment could be redeemed earlier than expected. To compensate for this risk, callable preferred stock often offers higher dividend yields. Preferred stock offers a range of advantages that make it an appealing choice for certain types of investors. These advantages stem from the unique features and characteristics of preferred stock. Preferred stockholders receive dividends at a fixed rate, providing a predictable source of income. This stability is particularly attractive for retirees or investors seeking consistent cash flow to meet their financial needs. The dividend priority ensures that preferred stockholders are among the first to receive distributions, further solidifying the income stream's dependability. While preferred stock is known for its income-generating capabilities, it also presents the potential for capital appreciation. Convertible preferred stock, in particular, allows investors to benefit from an increase in the value of the underlying common stock. This dual advantage of income and growth potential can be especially appealing in a dynamic market environment. In the event of a company's liquidation or bankruptcy, preferred stockholders enjoy higher priority in asset distribution compared to common stockholders. This means that preferred stockholders are more likely to recover a portion of their investment before common stockholders receive anything. This added layer of security enhances the appeal of preferred stock for risk-conscious investors. While preferred stock offers several advantages, it is not without its risks. Investors should be aware of these potential pitfalls before incorporating preferred stock into their portfolios. Preferred stock prices can be sensitive to changes in interest rates. When interest rates rise, the fixed dividend rates offered by preferred stock may become less attractive in comparison to other investment options that provide higher yields. Consequently, investors might see the market value of their preferred stock holdings decrease, potentially leading to capital losses. Preferred stock, although less volatile than common stock, is not immune to market price fluctuations. Changes in market sentiment, company performance, or broader economic conditions can impact the market value of preferred stock. While the fixed dividend rate provides a measure of stability, investors should still be prepared for some degree of price volatility. In the unfortunate event of a company's default, preferred stockholders might face subordination risk. This means that they are farther down the line in terms of asset distribution compared to bondholders. As investors evaluate whether preferred stock aligns with their financial goals and risk tolerance, several key considerations come into play. Before investing in preferred stock, it's crucial to assess the issuer's ability to maintain consistent dividend payments. Researching the company's financial health, cash flow, and dividend history can provide valuable insights into the sustainability of the preferred stock's income stream. A company with a solid track record of dividend payments and a stable financial position is more likely to continue meeting its preferred stock dividend obligations. For investors interested in convertible preferred stock, careful evaluation of the conversion terms is essential. Analyzing the conversion ratio, conversion price, and any associated restrictions can help investors determine whether the potential for capital appreciation outweighs the benefits of fixed income. Additionally, understanding the conditions under which conversion can occur and the impact on the investor's overall portfolio is critical. Preferred stock should be evaluated in the context of an investor's broader portfolio and investment objectives. Comparing preferred stock to other investment options, such as common stocks, bonds, and other income-generating assets, can help investors make informed decisions. Assessing factors such as risk, return potential, liquidity, and diversification benefits will aid in determining the optimal allocation of preferred stock within the portfolio. Preferred stock is a hybrid investment blending stock and bond features, offers a balanced opportunity for investors. Its steady income stream caters to those seeking reliability, with fixed dividend rates ensuring predictable returns. The priority in asset distribution, especially during liquidation, enhances its appeal, appealing to risk-conscious investors. Moreover, convertible preferred stock provides potential capital growth, combining income and appreciation benefits. Nevertheless, vigilance is essential due to risks such as interest rate sensitivity, market price fluctuations, and subordination risk. When contemplating preferred stock, evaluating dividend stability, assessing convertibility terms, and comparing other investments are crucial. By aligning preferred stock with individual financial goals and risk appetite, investors can incorporate this versatile instrument effectively into their portfolios.Preferred Stock Definition

Why the Term "Preferred" ?

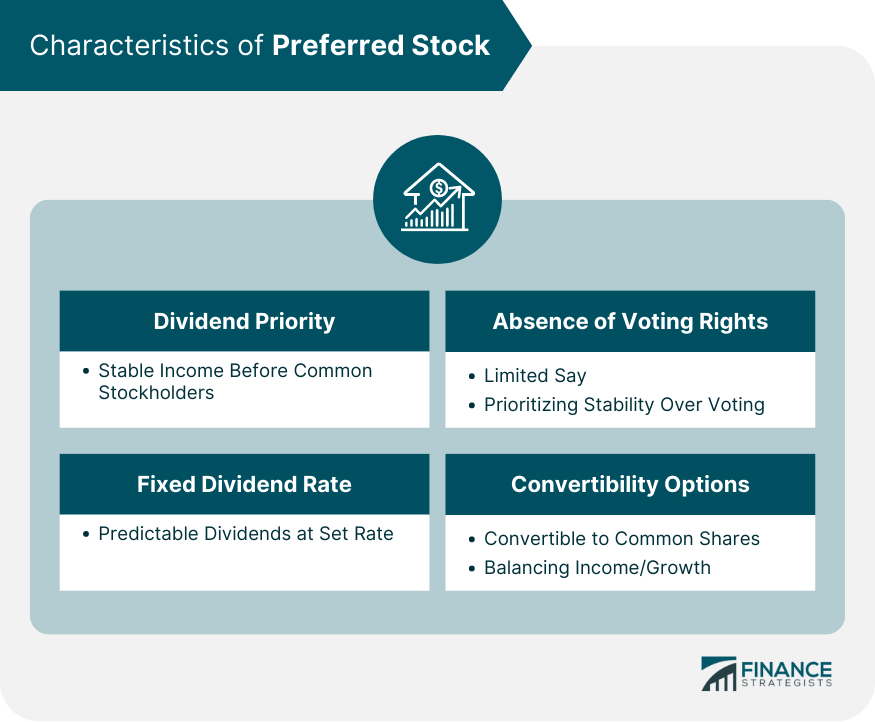

Characteristics of Preferred Stock

Dividend Priority

Fixed Dividend Rate

Absence of Voting Rights

Convertibility Options

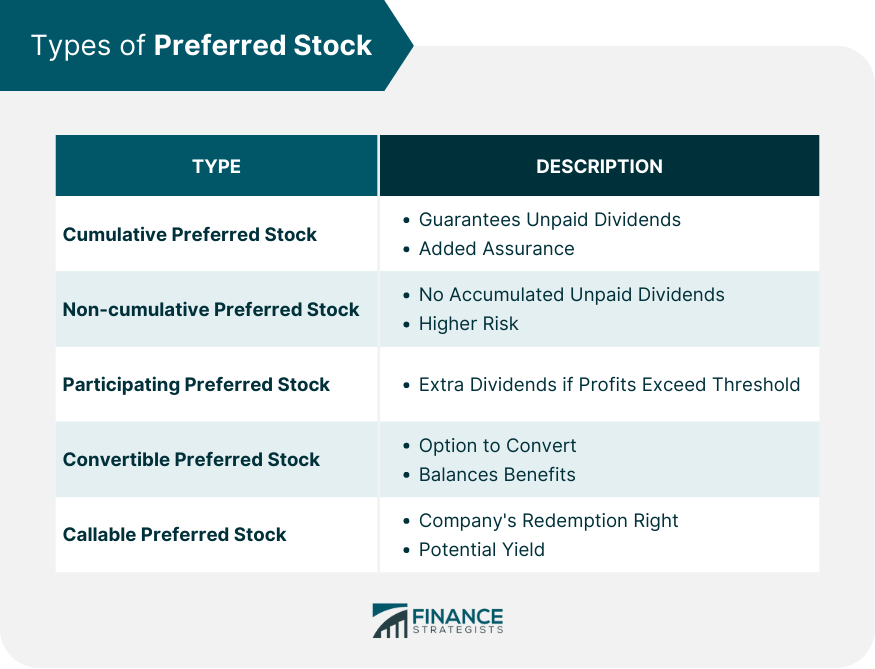

Types of Preferred Stock

Cumulative Preferred Stock

Non-cumulative Preferred Stock

Participating Preferred Stock

Convertible Preferred Stock

Callable Preferred Stock

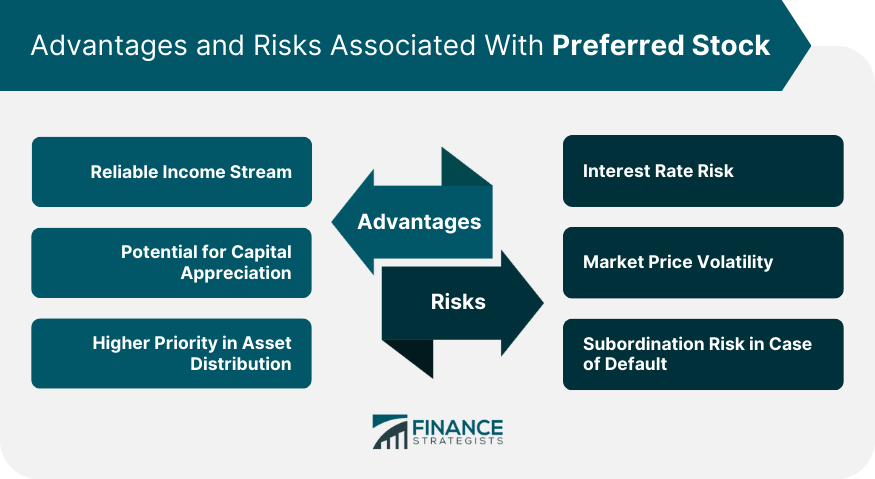

Advantages of Preferred Stock for Investors

Reliable Income Stream

Potential for Capital Appreciation

Higher Priority in Asset Distribution

Risks Associated With Preferred Stock

Interest Rate Risk

Market Price Volatility

Subordination Risk in Case of Default

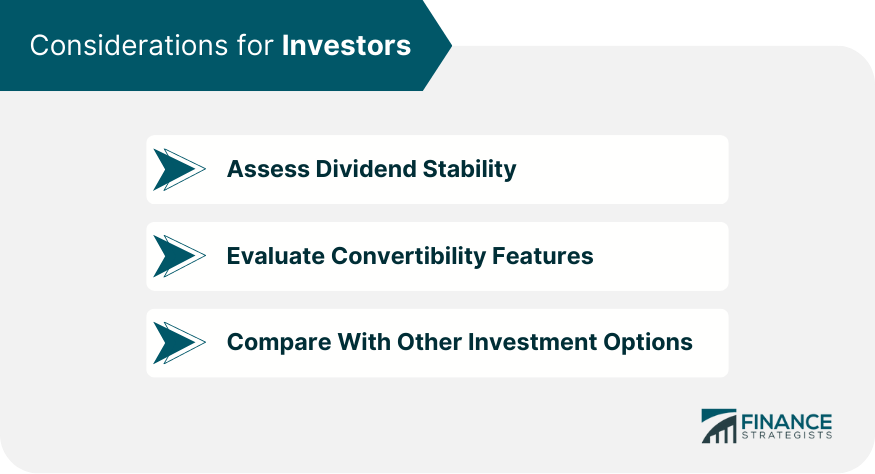

Considerations for Investors

Assess Dividend Stability

Evaluate Convertibility Features

Compare With Other Investment Options

Conclusion

Preferred Stock FAQs

Unlike common stock, preferred stock doesn’t come with the right to vote and has less potential to appreciate in price than common stock.

Despite its name, preferred stock isn’t intrinsically superior to common stock.

Preferred stock gets its name because preferred shareholders are in a “preferred” position to receive dividend payments and be paid back first in the event of bankruptcy.

Companies issue stock in order to raise capital to finance future growth.

Preferred stock is like a bond because the income provided is more predictable than common stock, is rated by major credit rating agencies, and is given higher priority than common stockholders. It is like equity because, unlike a bond, failing to pay preferred shareholders dividends does not put a company in default, and the stock can appreciate in price.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.