The rise of cryptocurrencies has extended beyond digital trades; now, many seek to buy tangible assets, like houses, using this novel form of payment. Here's a brief guide: Find a Seller: Not all sellers accept cryptocurrencies. Use specialized real estate platforms or agents experienced in crypto transactions. Choose a Trusted Wallet: Ensure you have a secure digital wallet to store, send, and receive cryptocurrencies. Hardware wallets are recommended for large transactions. Agree on Value: Cryptocurrencies are volatile. Both parties must agree on a conversion rate or use a stablecoin pegged to traditional currency. Use an Escrow Service: To protect both parties, use a reputable escrow service familiar with crypto. They'll hold the funds until all terms are met. Handle Taxes and Regulations: Different regions have varying rules for crypto-based transactions. Consult with a local financial advisor. While buying a house with cryptocurrencies might sound straightforward, there are critical factors that potential buyers should consider. Cryptocurrencies are infamous for their price volatility. A Bitcoin's worth today might change dramatically within just a week. This can pose challenges in pricing real estate, which typically is a stable asset. Using cryptocurrency to purchase property can trigger taxable events. In many jurisdictions, selling or using cryptocurrency might be considered a capital gain, which could lead to tax liabilities. It's imperative to consult with tax professionals to understand potential obligations. The regulatory environment surrounding cryptocurrencies remains in flux in many countries. While some nations have embraced digital currencies, others have imposed strict regulations or outright bans. Navigating this landscape is crucial to avoid potential legal pitfalls. Once you've weighed the considerations and decided to proceed, the following steps can guide the purchasing process. Begin by identifying sellers and real estate agencies open to cryptocurrency transactions. As the trend is still developing, this pool might be limited but it is growing steadily. Not all agents are familiar with crypto transactions. Having one who understands both real estate and digital currency dynamics can be invaluable. Determining the crypto equivalent of a property's price can be tricky due to crypto's volatile nature. Both parties must agree on a fixed rate or a specific valuation mechanism, like linking the price to a mainstream crypto exchange. Given the decentralized nature of cryptocurrencies, trust plays a pivotal role. Employing a reliable, crypto-friendly escrow service ensures that both parties are protected during the transaction. After agreeing on terms, ensure all legal documentation reflects the agreed-upon crypto terms. Once everything is in place, the cryptocurrency can be transferred, and the property deed can be handed to the buyer. Crypto transactions can be faster than traditional bank transfers, especially for international purchases, streamlining the buying process. Cryptocurrency offers a degree of privacy unmatched by traditional payment methods, appealing to those prioritizing discretion. For those looking to buy properties abroad, cryptocurrencies can simplify the often complex web of international transactions. If not executed promptly, transaction delays could lead to significant price discrepancies due to cryptocurrency volatility, affecting the final purchase price. Government stances on crypto transactions, especially sizable ones like property purchases, might shift, leading to unforeseen complications. Crypto transactions require the utmost security. Ensuring secure wallets, using trusted networks, and verifying all transaction details are crucial to prevent scams or losses. As the world becomes more digitally inclined, the convergence of real estate and digital currencies is expected to intensify. Staying updated on local and global cryptocurrency regulations is vital to ensure future transactions remain compliant. The future might see properties being tokenized, where ownership is represented by digital tokens on a blockchain. This could revolutionize property ownership and investment. To navigate the evolving realm, collaboration with legal, financial, and technical experts versed in both real estate and cryptocurrencies is advisable. Purchasing real estate with cryptocurrencies is an emerging trend, bridging digital finance with tangible assets. Key considerations include crypto's notorious volatility, which can challenge stable real estate pricing, tax implications that might trigger unexpected liabilities, and an ever-evolving regulatory landscape. Despite these challenges, benefits such as transactional speed, privacy, and a simplified process for international buys make it an attractive option for some. Future prospects like tokenized real estate on blockchain platforms may further streamline the process. Essential steps involve thorough research, partnering with knowledgeable real estate agents, using trusted escrow services, and meticulous attention to security and regulatory compliance. For anyone venturing into this fusion of property and digital currency, consulting experts across real estate, legal, and financial domains is paramount. As the digital world grows, the synergy between real estate and cryptocurrency is poised to redefine traditional property transactions.Buying a House With Cryptocurrencies: Overview

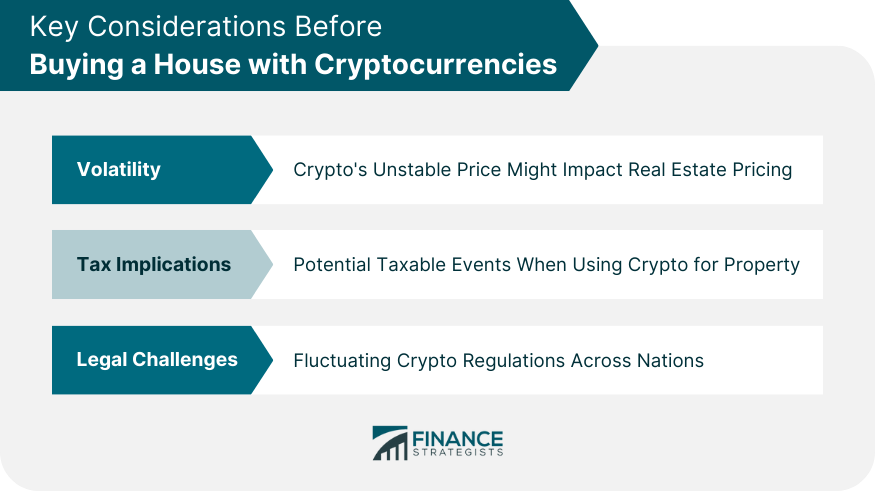

Key Considerations Before Buying a House With Cryptocurrencies

Volatility: Understanding the Price Fluctuations of Cryptocurrencies

Tax Implications

Legal Challenges

Steps to Buy a House With Cryptocurrencies

Research

Secure a Real Estate Agent With Crypto Experience

Valuation and Pricing

Escrow Services

Finalizing the Transaction

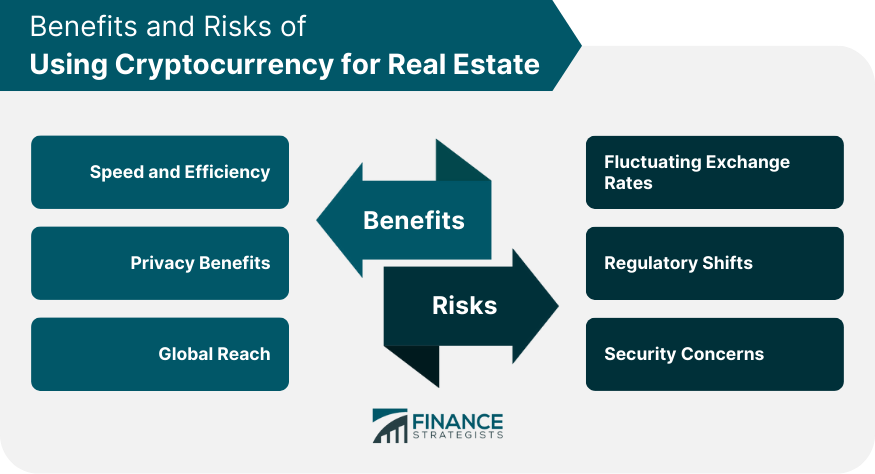

Benefits of Using Cryptocurrency for Real Estate Transactions

Speed and Efficiency

Privacy Benefits

Global Reach

Potential Risks in Buying a House With Cryptocurrencies

Fluctuating Exchange Rates

Regulatory Shifts

Security Concerns

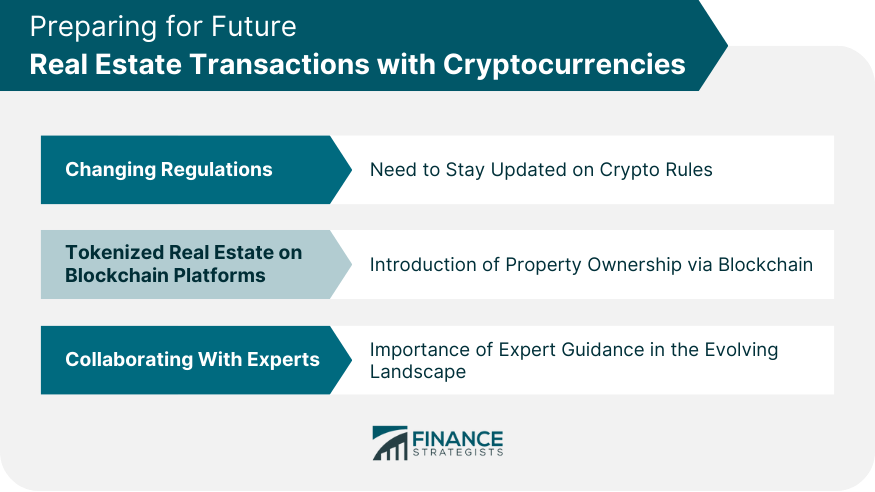

Preparing for Future Real Estate Transactions With Cryptocurrencies

Changing Regulations

Tokenized Real Estate on Blockchain Platforms

Collaborating With Experts

Bottom Line

How to Buy a House With Cryptocurrencies FAQs

Begin by researching real estate agencies and sellers accepting cryptocurrencies. Ensure you consult with professionals, like real estate agents, familiar with crypto transactions to guide you.

The primary risks include cryptocurrency's price volatility, potential regulatory shifts affecting the transaction's legality, and security threats like hacks or scams during the transfer process.

To manage volatility, both buyer and seller can agree on a fixed rate or a specific valuation mechanism, such as basing the price on a mainstream crypto exchange rate at a particular time.

Yes, in many jurisdictions, using cryptocurrency for property purchases may trigger capital gains tax or other tax liabilities. It's essential to consult with a tax professional before finalizing the transaction.

Yes, cryptocurrencies can simplify international property transactions due to their global nature. However, always be aware of regulatory and legal considerations in both the buyer's and seller's countries.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.