Burning cryptocurrency refers to the intentional process of permanently removing a specified number of tokens or coins from active circulation. This is often achieved by sending these tokens to an irreversible "burn" address, from which they can never be retrieved or spent. The primary purpose behind this act is multifaceted. Firstly, it helps regulate and control the token's supply in the market, which can influence its overall value. By deliberately reducing the number of tokens available, projects can potentially increase demand, thereby raising the value of the remaining tokens. Additionally, burning can be utilized to correct mistakes in token issuance, reward token holders, or achieve certain milestones within a project's developmental roadmap. By understanding the concept and rationale behind burning cryptocurrency, one gains insight into one of the crucial mechanisms that projects use to stabilize or enhance their token's economic dynamics. One of the primary reasons for burning cryptocurrency is to combat inflation. With a capped supply, the value of the currency can be maintained or even increased. By controlling the supply, projects can stabilize prices and ensure the longevity of the currency. Burning can serve as a mechanism to reward long-term holders. By reducing the overall supply, the relative proportion of the holdings of each investor can increase, thus enhancing the value of their investment. At times, there are tokens that may not be wanted or are considered redundant in the ecosystem. Burning helps in removing these unwanted tokens, ensuring that only the necessary ones remain in circulation. Token burns might be pre-planned, and set as milestones within a project's roadmap. These burns can signify growth or the achievement of certain goals and can be used as a strategy to attract and reassure investors. Software is not infallible. If there are errors or vulnerabilities detected in a token's code, one solution can be to burn the affected tokens and issue new ones that are free from those issues. A burn can also serve as a gesture of goodwill. By burning tokens, developers or founders can signal their commitment to the project's success and their belief in its long-term vision. The most common method involves sending tokens to an unrecoverable address. This address has no private key, ensuring that tokens sent there are forever inaccessible. Smart contracts can be designed with a built-in burn function, allowing tokens to be burned at certain intervals or under specific conditions. Some projects adopt a mechanism where they buy back tokens from the open market and then burn them. This not only reduces the supply but can also support the token's price in the market. Rebasing is a more complex mechanism where the token supply is adjusted automatically based on market conditions. It can result in tokens being burned or minted to achieve the desired price stability. Supply Reduction, Potentially Leading to Increased Scarcity and Value: By reducing the supply, tokens can become scarcer, which in theory, can drive demand and value upwards. Increased Trust and Transparency Within the Community: When projects burn tokens, especially in a transparent manner, it can foster trust with their community, as it showcases commitment and accountability. Provides Flexibility in Managing a Token's Economy: Token burning offers projects an additional tool in their arsenal to manage their token economy and influence market dynamics. Can Deter Spam Transactions or Prevent Malicious Actors: By introducing a cost (burning) for certain actions, projects can deter spammy or malicious activities within their ecosystem. Potential for Manipulation by Developers or Large Holders: There are concerns that token burns can be used by influential players to manipulate market dynamics to their advantage. Ineffectiveness if Done Without Clear Strategy or Rationale: Burning tokens without a clear purpose or strategy can be ineffective and even detrimental, causing confusion and potential devaluation. Can Be Viewed as a Gimmick if Not Used Judiciously: Overuse of burns or burning without genuine cause can make it seem like a gimmick, diluting its overall impact and value. Risks Related to Irreversible Actions and Mistakes: Burns are permanent. Mistakes made during the process, whether intentional or not, can't be undone. Binance, one of the largest cryptocurrency exchanges, regularly burns its native BNB token every quarter, a commitment set out in its whitepaper to reduce the total supply over time. Ripple has an escrow system where a specific amount of XRP is released monthly. Any unused portion of this release often gets sent back and burned. EOS has burned tokens in the past to counteract the inflationary pressures inherent in its network, showcasing a proactive approach to maintaining token value. Other projects like TRON and Stellar have also undertaken significant token burns, either as part of their roadmap or in response to specific market conditions. Token burns often create a buzz in the market, impacting investor sentiment. A well-timed and well-executed burn can boost confidence and positively influence market perception. While burns can lead to immediate price spikes due to hype, the long-term effects depend on the overall health and strategy of the project. Burning tokens can increase investor sentiment and boost confidence in the project, especially when done transparently and with a clear rationale. Cryptocurrency burning stands as a strategic tool for projects, aiming to regulate token supply, correct flaws, and signal commitment to long-term visions. Executed through methods like sending to a 'burn' address or deploying smart contracts, its multifaceted purposes range from combating inflation to rewarding loyal holders. Significant instances like Binance Coin's quarterly burns highlight the practice's prevalence. For investors, token burning can foster trust, influencing both short-term market dynamics and long-term project credibility. However, it's not without criticisms, including concerns over potential market manipulation and the irreversible nature of burns. As this mechanism becomes increasingly integrated into cryptocurrency project strategies, understanding its nuances, benefits, and potential pitfalls becomes essential for both developers and investors. Moreover, as the regulatory landscape evolves, projects must remain vigilant to ensure compliance while maximizing the benefits of token burns.What Is Burning Cryptocurrency?

Reasons for Burning Cryptocurrency

Manage Inflation and Control Supply

Redistribute or Reward Value to Holders

Remove Unwanted Tokens From Circulation

As Part of a Project’s Roadmap or Strategy

Rectify Mistakes or Bugs Within a Token’s Code

Demonstrate Commitment to the Project’s Long-Term Vision

Methods of Burning Cryptocurrency

Sending to a 'Burn' Address

Smart Contracts With Burn Functions

Buy-Back and Burn Mechanisms

Rebase Mechanisms

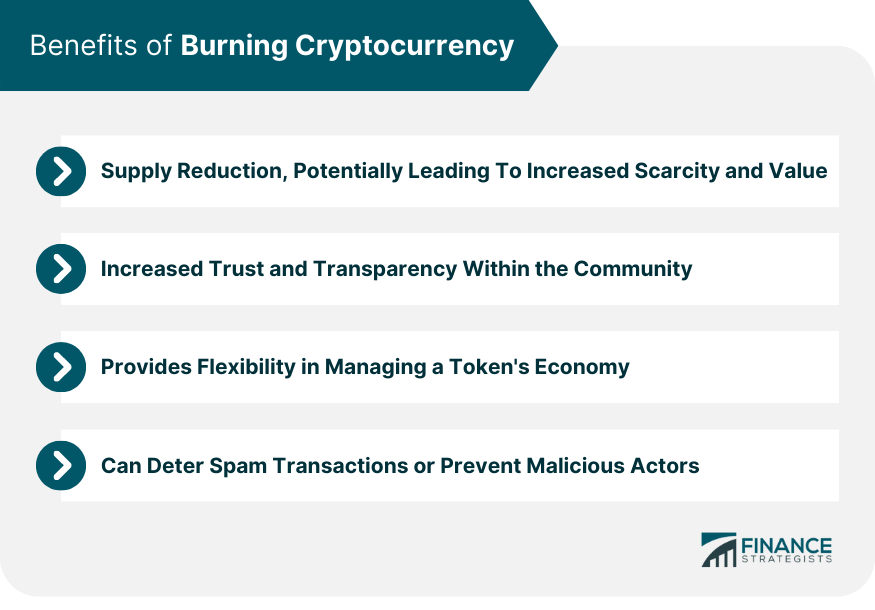

Benefits of Burning Cryptocurrency

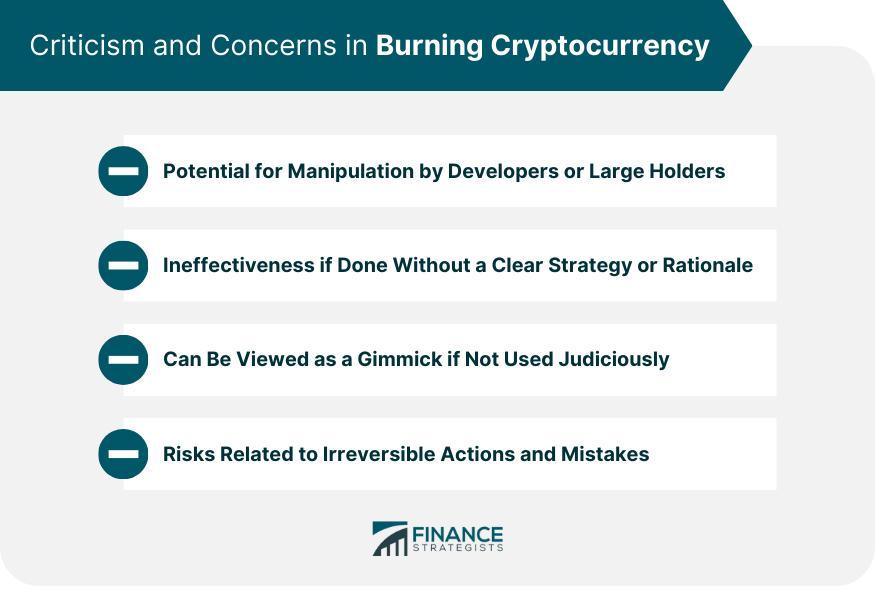

Criticism and Concerns in Burning Cryptocurrency

Notable Instances of Cryptocurrency Burns

Binance Coin (BNB) Quarterly Burns

Ripple's Escrow Release and Burn Mechanism

EOS's Token Burn to Combat Inflation

Other Notable Token Burn Events

Impact of Cryptocurrency Burning on Investors and the Market

Psychological Effects and Market Perception

Short-Term vs Long-Term Impacts on Token Price

Investor Sentiment and Confidence in the Project

Conclusion

Burning Cryptocurrency FAQs

Cryptocurrency burning is the deliberate process of removing a certain number of cryptocurrency tokens from circulation by sending them to an address where they can't be used or retrieved, effectively reducing the total supply.

Projects burn tokens for several reasons: to manage inflation, redistribute value to holders, remove unwanted tokens, achieve milestones in their roadmap, rectify bugs or mistakes in the token's code, and demonstrate commitment to the long-term vision of the project.

The primary methods include sending tokens to a 'burn' address, utilizing smart contracts with built-in burn functions, adopting buy-back and burn mechanisms, and employing rebase mechanisms.

Token burning can influence market perception, possibly leading to short-term price spikes. In the long run, if executed correctly, it can boost investor confidence in the project and potentially enhance the value of the remaining tokens due to increased scarcity.

Yes, different jurisdictions have varied perspectives on token burns, and there might be tax implications for holders during a burn event. Projects need to ensure they aren't inadvertently breaking any laws and stay updated on the evolving regulatory landscape.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.