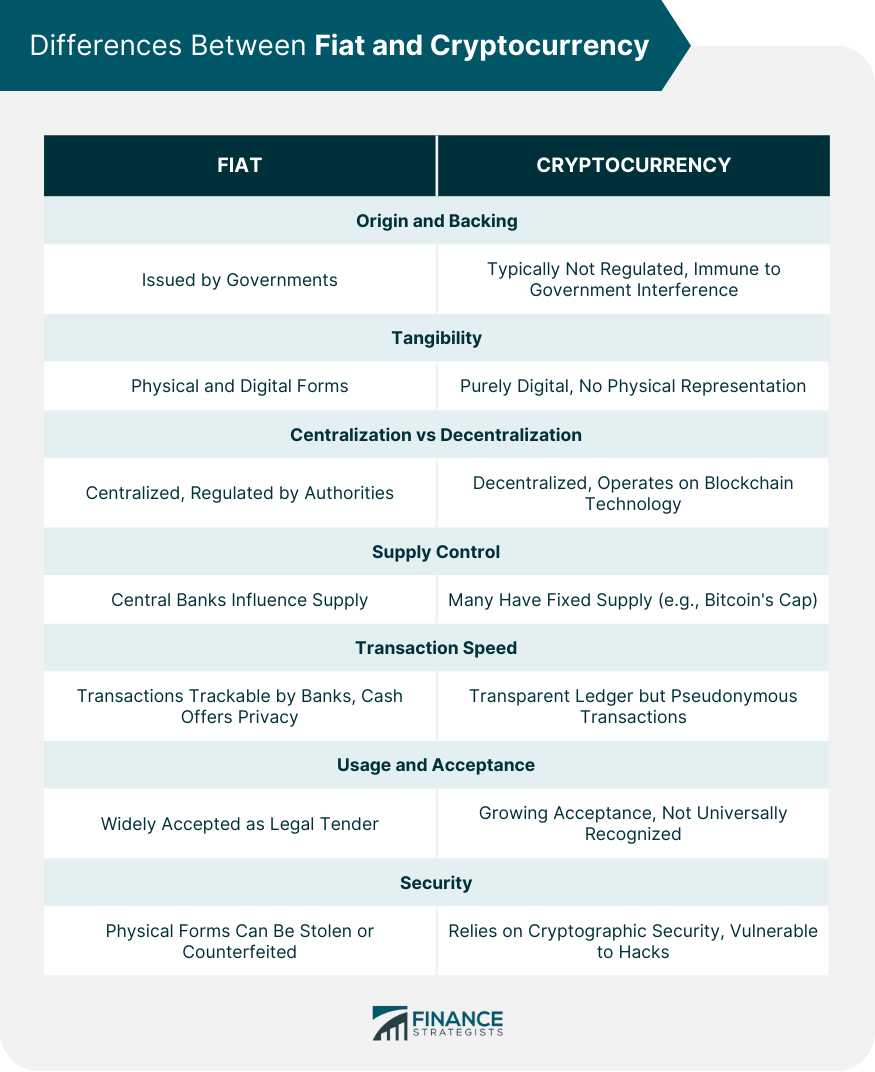

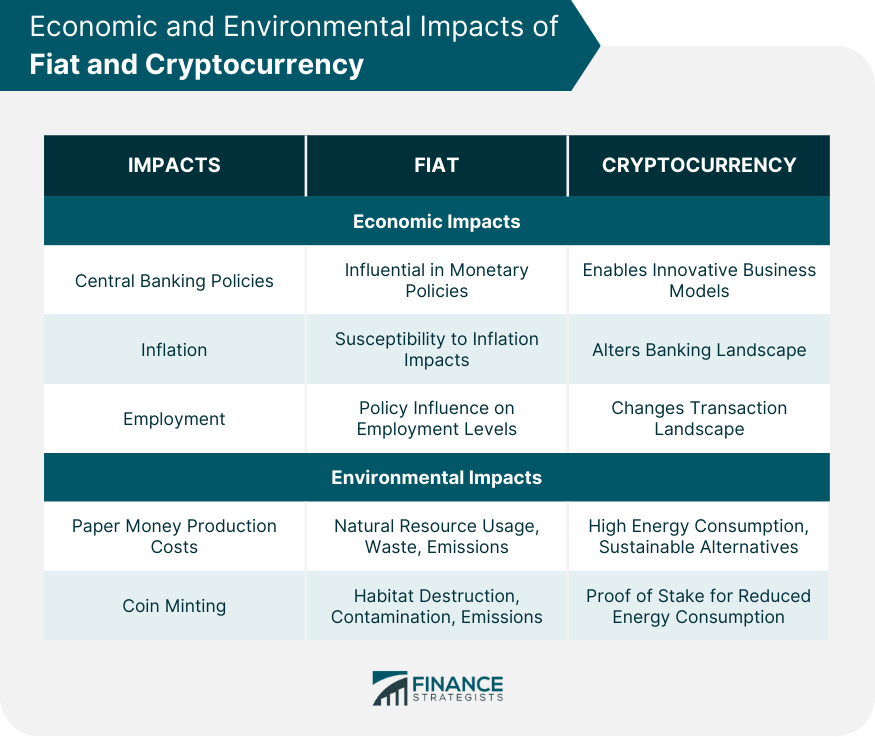

Differentiating between fiat and cryptocurrency is crucial to comprehend the evolving landscape of finance and the inherent strengths and challenges each form of currency presents. Fiat money, recognized universally as the traditional form of currency, is government-issued and finds its value predominantly from the trust and confidence of the people who use it. It's centralized, regulated by national banks, and is physically tangible, coming in forms like coins and notes. On the other hand, cryptocurrency is a digital or virtual currency that utilizes cryptography for security, making it nearly impossible to counterfeit. One of the primary appeals of cryptocurrencies is the potential for financial transactions without the need for middlemen, leading to reduced fees. Fiat money is a type of currency issued by governments, declared as legal tender for transactions within its jurisdiction, but not backed by a physical commodity such as gold or silver. Instead, its value stems from the trust and confidence of its users and the stability of the issuing government. The primary purpose of fiat money is to act as a medium of exchange, a unit of account, and a store of value in an economy. Given its non-reliance on physical commodities, it allows governments and central banks the flexibility to manage economic policies, control inflation, and respond to financial crises more directly. The benefits of fiat money include its inherent flexibility, which allows for the effective management of monetary policy and economic stabilization techniques like quantitative easing. It also enables economic adjustments in response to global financial dynamics. However, since it's not backed by tangible assets, fiat money can be prone to inflation or even hyperinflation. Moreover, over-reliance on the trust of its users means that economic downturns or loss of confidence in the government can impact the value of the currency, leading to economic instability. Cryptocurrency is a type of digital or virtual currency that employs cryptographic techniques to secure its transactions, control the creation of new units, and verify the transfer of assets. Unlike traditional currencies, cryptocurrencies operate on decentralized platforms based on blockchain technology—a distributed ledger enforced by a network of computers or "nodes." Initially designed as an alternative to traditional financial systems, cryptocurrencies promise peer-to-peer transactions without the need for intermediaries, aiming for decentralization, transparency, and immutability. They also offer potential solutions for issues like financial inclusion and currency hyperinflation in troubled economies. However, cryptocurrencies come with substantial drawbacks. Their value can be highly volatile, often fluctuating wildly within short periods, making them a risky investment. They have also been associated with illicit activities due to their pseudonymous nature. Additionally, significant energy consumption, especially with proof-of-work mechanisms like that used by Bitcoin, poses environmental concerns. Origin and Backing: Fiat money has its roots in the traditional banking system and is issued and regulated by governments. Its value is based on the trust and confidence of those who use it. While cryptocurrencies are typically not issued or regulated by any central authority, making them theoretically immune to government interference or manipulation. Tangibility: Fiat exists in both physical (like coins and banknotes) and digital formats. Physical fiat can be held, spent, or saved in tangible form. While cryptocurrency is purely digital and has no physical representation. One cannot hold a Bitcoin or Ethereum coin, for instance, but one can own digital tokens represented by cryptographic keys. Centralization vs Decentralization: Fiat currencies are centralized, meaning they are controlled and regulated by governmental authorities or central banks. While most cryptocurrencies are decentralized, operating on a technology called blockchain, which is a distributed ledger spread across many nodes or computers. Supply Control: Central banks can influence the supply of fiat currency, for example, by implementing policies like quantitative easing. While many cryptocurrencies have a fixed supply. For instance, Bitcoin has a capped supply of 21 million coins, ensuring its scarcity. Transaction and Processing Speed: Traditional bank transactions, especially international ones, can take days to settle and often come with processing fees. While cryptocurrency transactions can settle in minutes to hours, irrespective of geographical boundaries. However, transaction speeds can vary based on network congestion and the chosen cryptocurrency. Privacy and Transparency: While digital fiat transactions can be tracked by banks and governmental agencies, cash transactions offer a level of privacy. Transactions are recorded on a public ledger (for most cryptocurrencies), providing transparency. However, the identity of the person behind a transaction is pseudonymous, offering a mix of transparency and privacy. Usage and Acceptance: Fiat is widely accepted worldwide for goods and services, given its status as a legal tender mandated by governments. While growing in popularity, cryptocurrencies are not universally accepted and rely on merchants or service providers willing to accept them. Security: Physical forms can be stolen or counterfeit, while digital forms can be susceptible to hacks and fraud when stored in banks. While cryptocurrencies rely on cryptographic security, making them highly secure. However, they are not immune to hacks, especially when stored in insecure wallets or exchanges. Central Banking Policies: Central banks play a pivotal role in determining monetary policies. Changes in these policies can lead to shifts in savings, investment behaviors, and even global trade dynamics. Inflation: Fiat money can be subject to inflation, which erodes the purchasing power of money over time. In extreme cases, hyperinflation can make a currency practically worthless and disrupt an entire nation's economy. Employment: Central banking policies can influence employment levels. By adjusting rates, central banks can indirectly influence borrowing costs, business investments, and thus, job creation. Costs of Paper Money Production: Producing banknotes requires natural resources and produces waste and emissions. The inks and security features also have environmental costs associated with their production and disposal. Coin Minting: Mining operations can cause habitat destruction and soil and water contamination while refining processes can release harmful emissions. Potential for New Business Models: Cryptocurrencies enable innovative business models, such as decentralized finance (DeFi) platforms, which can offer financial services without traditional intermediaries. They also enable smart contracts, which automatically execute contractual obligations when certain conditions are met. Impact on Banking: Cryptocurrencies offer alternative methods for transactions and savings. While some banks are adapting by integrating crypto services, others view them as threats to their revenue streams and business models. Energy Consumption of Mining: Proof-of-work cryptocurrencies, like Bitcoin, require vast amounts of computational power and energy to mine new coins and validate transactions. This has raised concerns about the carbon footprint of such operations, especially when they rely on non-renewable energy sources. Sustainable Alternatives: Many newer cryptocurrencies are adopting more sustainable consensus mechanisms, like proof of stake. These methods aim to maintain network security and validate transactions without the extensive energy consumption associated with traditional mining. Understanding the distinctions between fiat money and cryptocurrencies is essential in navigating the evolving financial landscape. Fiat, being government-issued and reliant on user trust, offers flexibility in monetary policy but is susceptible to inflation and economic instability during crises. On the other hand, cryptocurrencies leverage cryptographic security and decentralization, enabling peer-to-peer transactions and innovative business models like DeFi and smart contracts. While fiat's impact spans central banking policies, inflation, and employment, its environmental footprint arises from paper money production and coin minting. Cryptocurrencies, while introducing new business paradigms and altering banking dynamics, grapple with energy-intensive mining practices. Yet, the emergence of sustainable alternatives like proof of stake promises a greener future. As the financial world continues to evolve, recognizing the strengths and weaknesses of both fiat and cryptocurrencies is pivotal for informed decision-making in this dynamic realm.Fiat vs Cryptocurrency Overview

What Is Fiat Money?

What Is Cryptocurrency?

Differences Between Fiat and Cryptocurrency

Economic and Environmental Impacts of Fiat and Cryptocurrency

Fiat

Economic Impacts

Environmental Impacts

Cryptocurrency

Economic Impacts

Environmental Impacts

Conclusion

Fiat vs Cryptocurrency FAQs

The key distinction lies in their nature: fiat is government-issued physical or digital currency backed by trust, while cryptocurrency is decentralized digital currency secured by cryptography.

Fiat's value comes from user trust and confidence in the issuing government, as well as its acceptance as legal tender for transactions.

Cryptocurrencies enable peer-to-peer transactions without intermediaries, potentially reducing fees and enhancing transaction speed.

Cryptocurrencies can experience wild price fluctuations due to factors such as market sentiment, regulatory developments, and limited historical adoption.

Fiat's environmental impact arises from resource-intensive paper money production and coin minting. Cryptocurrencies, especially proof-of-work-based ones like Bitcoin, raise concerns due to energy-intensive mining, though alternatives like proof of stake aim for sustainability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.