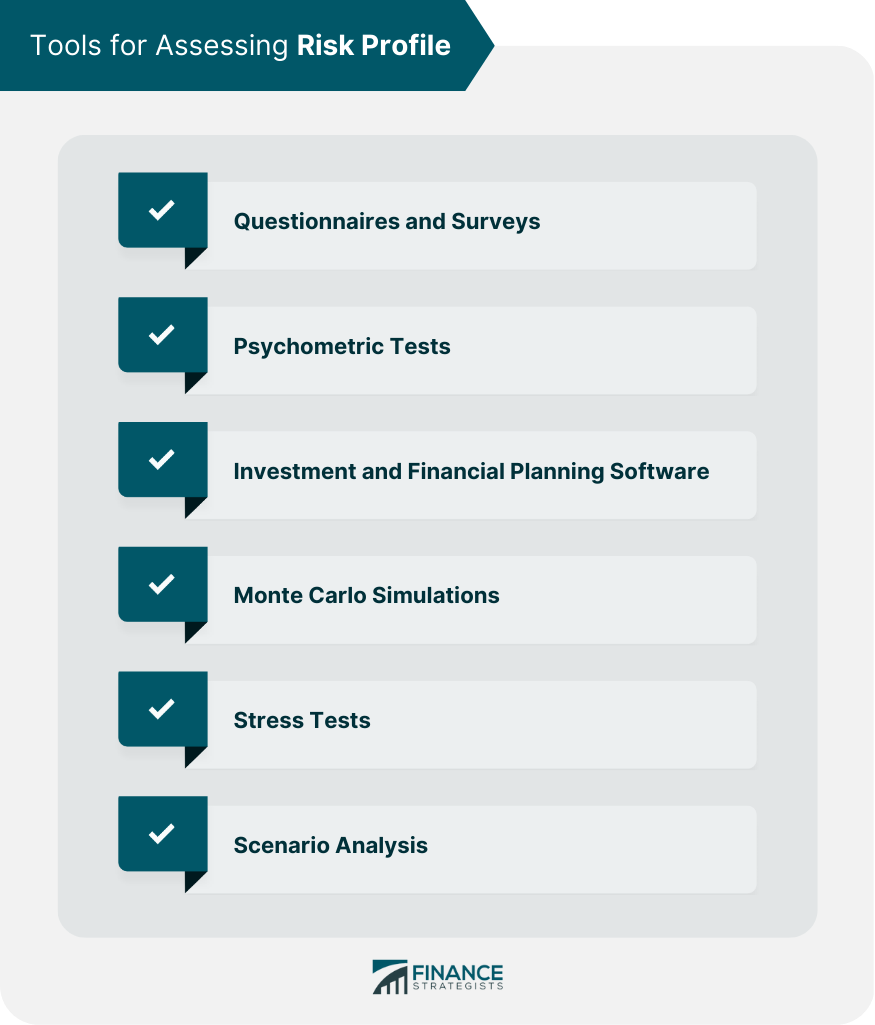

A risk profile is a term used to describe an individual or organization's attitude toward risks. A risk profile can be defined as the level of risk an individual or organization is willing to accept or tolerate when making decisions. Risk is essential to everyday life and understanding risk is crucial to making informed decisions about everything from investments to personal health. Want to know your risk profile? Click here. There are different types of risk profiles that you can create. The most common are listed below: This type of profile is for people who are risk-averse and want to avoid any type of loss. It is best suited for people who are in the early stages of their financial lives, have debt, or are close to retirement. A moderate risk profile is for people who are willing to take on some risk in order to potentially earn a higher return. This type of profile is suitable for people who are in the middle stages of their financial lives and have some savings. An aggressive risk profile is for people who are comfortable with high levels of risk and are willing to potentially lose a lot of money in order to earn a higher return. Investors are individuals or organizations that invest money in financial assets such as stocks, bonds, or real estate. When making investment decisions, it is essential to consider the level of risk associated with each investment. An investor's risk profile is the degree of risk they are willing to accept when making investment decisions. Understanding an investor's risk profile is essential for financial advisors who manage their clients' investment portfolios. Financial advisors can recommend investment strategies aligning with their client's goals and risk tolerance by understanding their client's risk profiles. Investors can also use their risk profile to evaluate their investment preferences and determine if their investment portfolio is consistent with their financial goals and risk tolerance. A financial advisor's risk profile is the level of risk they are willing to accept when making investment decisions on behalf of their clients. A financial advisor's risk profile is important because it determines the types of investments they recommend to their clients. For example, a financial advisor with a conservative risk profile is likely to recommend investments with lower levels of risk. In contrast, an advisor with an aggressive risk profile may recommend investments with a higher level of risk. Financial advisors must also understand their client's risk profiles to provide personalized investment advice. By understanding their client's risk profiles, they can recommend investment strategies aligning with their financial goals and risk tolerance. Insurance companies use risk profiles to assess the level of risk associated with insuring individuals, properties, or businesses. An insurance risk profile is the level of risk associated with a particular insurance policy. Insurance companies use risk profiles to determine the premiums for their insurance policies. Individuals or organizations with a higher risk profile will likely pay higher premiums for their insurance policies. When selecting insurance policies, understanding an insurance risk profile is essential for individuals and organizations. Individuals or organizations can choose insurance policies that offer appropriate coverage and premiums by understanding their risk profile. Employers use risk profiles to evaluate the level of risk associated with hiring job candidates or providing health insurance benefits to employees. An employer risk profile is the level of risk associated with a particular job or employee. Employers use risk profiles to assess the likelihood of potential health or financial risks associated with hiring a job candidate or providing health insurance benefits to employees. For example, an employer may use an employee's risk profile to determine the cost of health insurance premiums or the likelihood of a workplace injury. Understanding an employer risk profile is essential for job candidates and employees. By understanding their risk profile, job candidates can identify potential health or financial risks associated with a particular job. Employees can also use their risk profile to determine the level of health insurance coverage they require. Individuals have their risk profiles, which are the level of risk they are willing to accept when making decisions about their personal lives. Understanding an individual risk profile is important for making informed decisions about investments and personal health. For example, an individual with a conservative risk profile may prefer investments with lower levels of risk. In contrast, an individual with an aggressive risk profile may prefer investments with a higher level of risk. Perhaps the most obvious benefit is that it can help you make more informed investment decisions. By understanding your personal preferences and risk tolerance, you can avoid making decisions that may not be in your best interest. In addition to helping you with investment planning, a risk profile can also help you better understand and plan for your financial future. For example, perhaps you previously believed that retirement was decades away and therefore was not something you needed to worry about – but now realize it is only 10 years away. A risk profile can help you make the necessary adjustments to your retirement plan so that you are on track to have enough money saved up. Another benefit of having a risk profile is that it can help you become more aware of the risks you are taking with your money. By understanding which risks you are comfortable with and which ones you are not, you can learn to better manage your money and only invest in areas that are right for you. When thinking about investment risks, it is important to remember there is no such thing as "no risk," because even investments with the lowest risk profile will still come with some form of loss or level of volatility. One of the biggest dangers is that you may make uninformed or emotional investment decisions, which can lead to financial losses. Another danger is that you may not have a plan at all, which can leave you open to a number of different risks, including running out of money in retirement, not being able to pay for important expenses, or even becoming bankrupt. Creating an effective risk profile can be a valuable tool in helping you understand and manage your finances. Here are a few tips for creating one that is right for you: Start by assessing your investment goals. What do you hope to achieve with your investments? Think about your risk tolerance. How comfortable are you with risks, and how much are you willing to lose if things go wrong? Consider your financial situation. Do you have any debt? What is your current income and savings? Be honest with yourself. It is important to be truthful about your feelings and preferences when it comes to risk, otherwise, the profile will not be accurate. Update your profile regularly. Things change over time, so it is important to revisit your profile every once in a while and make any necessary adjustments. These tools are designed to give individuals, financial advisors, and insurance companies a better understanding of an individual's risk profile. Questionnaires and Surveys. These are the most common tools used to assess risk profiles. These tools ask questions about an individual's attitude toward risk and financial goals. Psychometric Tests. These tests measure an individual's personality traits and propensity for risk-taking behavior. The results of these tests can be used to provide personalized investment advice. Investment and Financial Planning Software. This software uses algorithms to analyze an individual's financial goals and risk profile to provide investment recommendations. Other Risk Assessment Tools. These include Monte Carlo simulations, stress tests, and scenario analysis. These tools are designed to simulate potential future outcomes and evaluate the level of risk associated with various scenarios. Understanding risk profiles is essential for making informed decisions about everything from investments to personal health. Tools such as questionnaires, surveys, psychometric tests, investment and financial planning software, and other risk assessment tools are available to assess risk profiles. By understanding their risk profiles, individuals, financial advisors, and insurance companies can make informed decisions about investments, insurance policies, and personal goals.What Is a Risk Profile?

Types of Risk Profile

Conservative

Moderate

Aggressive

This type of profile is best for people who are far from retirement age, have no debt, and have a significant amount of savings.Investor’s Risk Profile

Financial Advisor’s Risk Profile

Insurance Company’s Risk Profile

Employer’s Risk Profile

Individual’s Risk Profile

Benefits of Having a Risk Profile

Drawbacks of Not Having a Risk Profile

Tips for Creating an Effective Risk Profile

Tools for Assessing Risk Profile

The answers determine an individual's risk profile and provide personalized investment advice.

Conclusion

Risk Profile FAQs

A risk profile in investing measures an individual's or organization's tolerance for risk and the potential consequences of taking risks. It considers factors such as an individual's financial situation, investment experience, risk tolerance, and goals and objectives.

A risk profile is used in financial advising to assess a client's investment objectives and recommend investment options that match their risk profile. Financial advisors use various tools and techniques to determine a client's risk profile, such as questionnaires, interviews, and risk assessment software.

Understanding risk profiles is important for business owners to identify and assess potential risks associated with their business operations, such as market, operational, and regulatory risks. It helps them develop strategies to manage and mitigate these risks and ensure the long-term success of their business.

Insurance companies use risk profiles to assess potential risks associated with insuring individuals and businesses. They use various tools and methods to assess the risk profile, such as actuarial models, risk assessments, and underwriting guidelines, to determine their customers' premiums and coverage options.

Risk profile plays a significant role in various academic disciplines, such as finance, economics, psychology, and sociology. Researchers and academics study risk profiles to develop new theories and models to explain the behavior of individuals and organizations under different risk scenarios. They also study risk profiles to understand the impact of risk on individual and organizational behavior.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.