Cryptocurrencies are a type of digital or virtual currency that utilizes cryptography for security, making them resistant to counterfeiting. It operates on decentralized platforms, primarily based on blockchain technology. A blockchain is a distributed ledger system where all transactions across a network of computers are recorded, validated, and permanently stored in blocks. Each block is linked to the one before and after it, creating a secure and immutable chain of records. This decentralized nature ensures that cryptocurrencies are not controlled by any single entity, giving them the characteristic of being trustless, as transactions don't require a trusted intermediary, like a bank, to process or verify them. The value of cryptocurrencies can be highly volatile, and their use has raised concerns for potentially illegal activities due to anonymity factors. However, they also offer several benefits, such as lower transaction fees, financial inclusion, and enhanced security features. Cryptocurrency prices can swing wildly in very short periods. News about government regulations, advancements in crypto technology, or broad economic issues can lead to sudden spikes or drops in cryptocurrency values. Investors new to the crypto space might be caught off-guard by these swift changes, and there's always the risk that they could face significant losses if they buy at a high price and then the value crashes. Cryptocurrencies operate outside central banking systems. This decentralized nature makes them unique but also means there's usually no central body ensuring things are on the up and up. So, if something goes wrong, like fraud or theft, getting help or recovering lost funds can be a real challenge. Without consistent regulations, users could unknowingly participate in activities deemed illegal in some jurisdictions. Furthermore, the absence of a centralized system can sometimes make transactions less transparent, leaving room for manipulations. Even though the underlying technology of cryptocurrencies is secure, the places where people buy, sell, and store them might not be. Exchanges, online wallets, and even personal computer systems can be targets for hackers. Additionally, scams related to new cryptocurrency projects, called ICOs (Initial Coin Offerings), can trick people into investing money in non-existent or shady ventures. With the rise of cryptocurrency's popularity, more malicious actors are being drawn to the space, seeking to exploit naive or uninformed users. Protective measures are always evolving, but users must remain vigilant and informed. Every cryptocurrency owner has a private key, a sort of password, that allows access to their digital coins. If you lose this key, you lose your coins. There's no "Forgot my password" option, and without the key, the coins become inaccessible. This permanent nature of crypto assets means that one simple mistake can result in irreversible consequences. Traditional currencies are usually backed by something tangible, like gold, or the strength of a country's economy. Cryptocurrencies don't have that. Their value comes from what people believe they're worth, which can be based on factors like how useful they are or how many people are buying into the hype. This speculative nature can make their value very unpredictable. Moreover, as the crypto market matures, the actual utility of many tokens and coins is being tested, with some failing to find long-term real-world applications. Tactics like "pump and dump" schemes involve artificially inflating (pumping) the price of a cryptocurrency to attract unsuspecting investors, only to sell off (dump) at the peak, causing the price to crash and leaving those new investors at a loss. Additionally, "whales," or large holders of cryptocurrencies, often possess the power to sway market prices significantly through large trades or strategic movements. Their actions can create waves in the market, sometimes leaving smaller traders in vulnerable positions. Cryptocurrencies, due to their decentralized nature, have the potential to shift the dynamics of traditional financial systems. Their growing adoption and integration might destabilize conventional systems by providing an alternative to fiat currencies, which can, in turn, impact a country's monetary policy. Governments and central banks worldwide are now keenly observing cryptocurrency trends, aware that these digital assets might influence national economic strategies and the stability of the traditional financial ecosystem. Cryptocurrency, particularly Bitcoin, has been under scrutiny due to the energy-intensive processes involved in its mining. These "proof-of-work" algorithms require vast amounts of computational power, leading to significant energy consumption. As a result, concerns over the carbon footprint and environmental impact of cryptocurrency operations have grown. One of the most alarming is the potential for a 51% attack, where a single entity gains control of the majority of a network's computational power. This control can enable them to double-spend coins or halt transactions, undermining the trustworthiness of the entire system. Additionally, smart contracts, which are self-executing contracts with terms of agreement between parties directly written into code, can also possess bugs or vulnerabilities. Many banks are hesitant to embrace cryptocurrencies, leading to difficulties for businesses and individuals in converting or transferring crypto assets seamlessly. Moreover, the diverse range of cryptocurrencies and blockchain platforms often leads to software and platform incompatibilities. This diversity means that software built for one cryptocurrency or blockchain might not work with another without significant adjustments, creating operational hiccups and inefficiencies in the process. Each country can have its unique stance on crypto, leading to a patchwork of laws and regulations across the globe. Some countries may embrace the technology, while others may impose strict restrictions or outright bans on crypto usage, trading, and mining. This varying landscape poses challenges for businesses and individuals alike, as they may face legal consequences or barriers when dealing with crypto across borders. There are varied tax treatments of crypto assets and transactions across different countries. In some places, selling or trading cryptocurrency might be seen as a taxable event, while in others, only spending cryptocurrency triggers tax liabilities. Without a proper understanding or lack of standardized guidance, crypto users might inadvertently accumulate unexpected tax liabilities, leading to potential legal complications. The rise of social media and online forums has played a significant role in shaping public perceptions and behaviors regarding cryptocurrencies. However, with this vast influx of information, there's also a surge of misinformation. Many individuals, especially newcomers to the crypto scene, might place too much trust in unverified online sources, leading them to make poorly informed decisions. Additionally, the FOMO (Fear of Missing Out) phenomenon can lead to irrational investment behaviors, with individuals buying into a cryptocurrency not based on its merit but simply because they don't want to "miss out" on potential gains. There are concerns about cryptocurrencies facilitating money laundering, terrorism financing, and other illegal activities. Additionally, the ethical implications of certain cryptocurrencies being used to bypass sanctions or support unauthorized activities raise questions about their broader societal impact and the responsibility of users and developers within the ecosystem. Cryptocurrencies represent a groundbreaking technological advancement with both significant potential and inherent risks. However, the volatile nature of their value underscores the need for cautious investment. The lack of regulatory oversight raises concerns about fraud and legality, while security vulnerabilities in exchanges and wallets require constant vigilance. The permanence of private key loss underscores the need for responsible ownership. The speculative value and lack of tangible backing challenge traditional currency concepts. Systemic risks include market manipulation, macroeconomic impacts, and environmental concerns. Blockchain vulnerabilities and integration challenges bring forth technological risks, while legal and regulatory uncertainties create complexities. Misinformation, criminal use, and ethical dilemmas highlight behavioral and societal risks. Ultimately, understanding and navigating these multifaceted risks are crucial for fostering a responsible and beneficial evolution of the cryptocurrency landscape.What Are Cryptocurrencies?

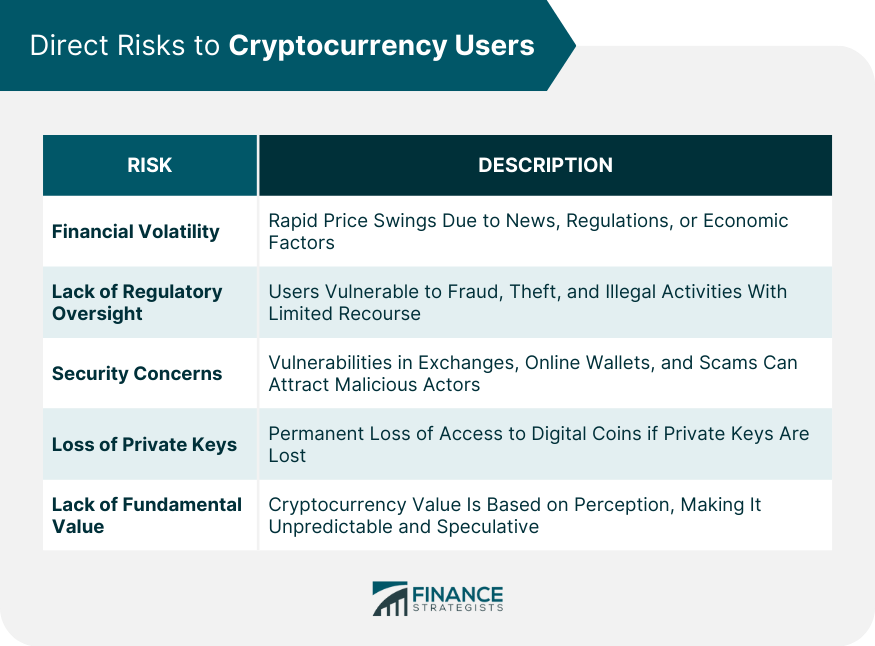

Direct Risks to Cryptocurrency Users

Financial Volatility

Lack of Regulatory Oversight

Security Concerns

Loss of Private Keys

Lack of Fundamental Value

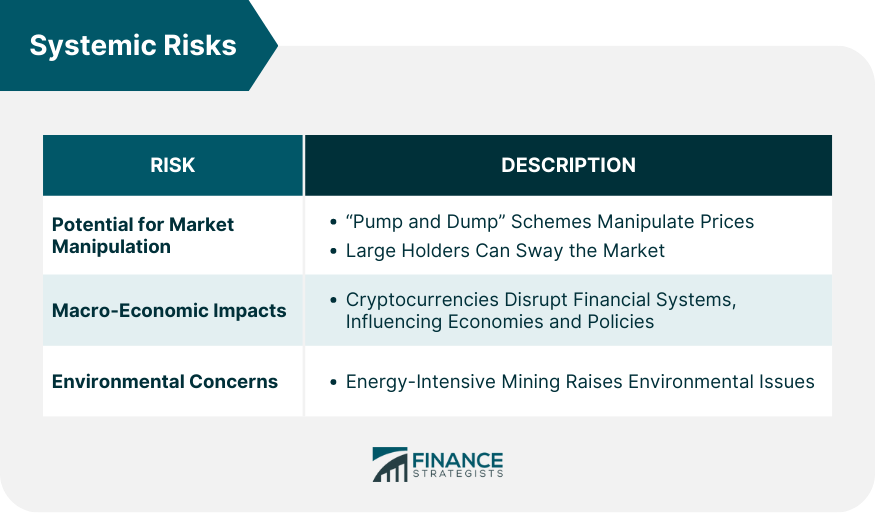

Systemic Risks

Potential for Market Manipulation

Macro-Economic Impacts

Environmental Concerns

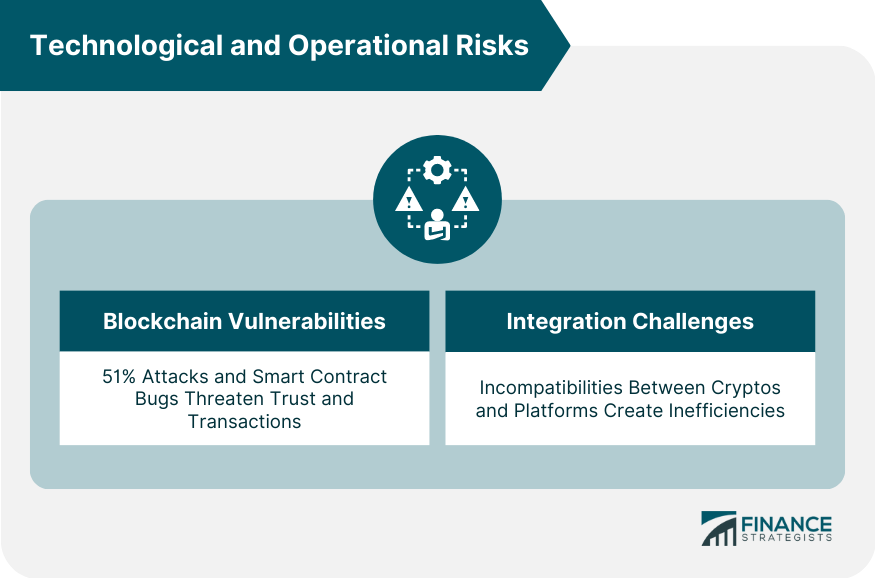

Technological and Operational Risks

Blockchain Vulnerabilities

Integration Challenges

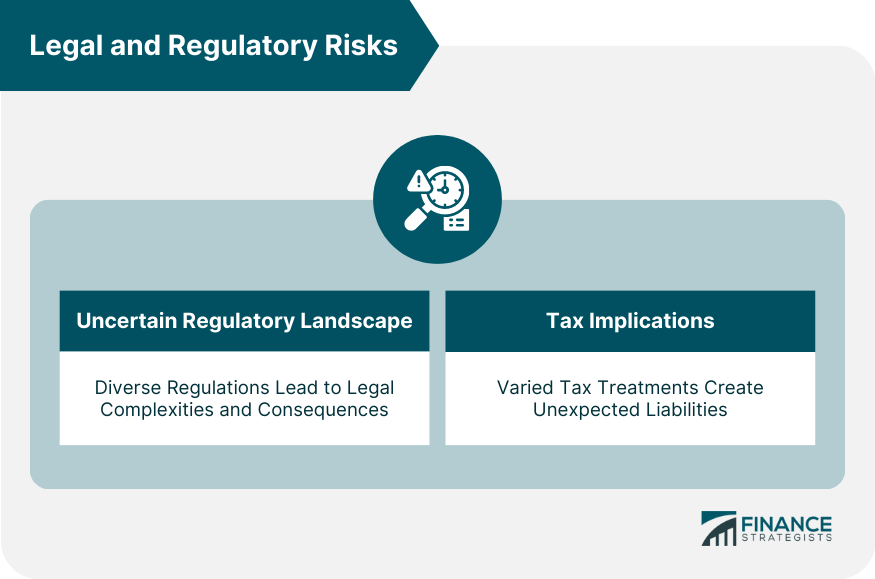

Legal and Regulatory Risks

Uncertain Regulatory Landscape

Tax Implications

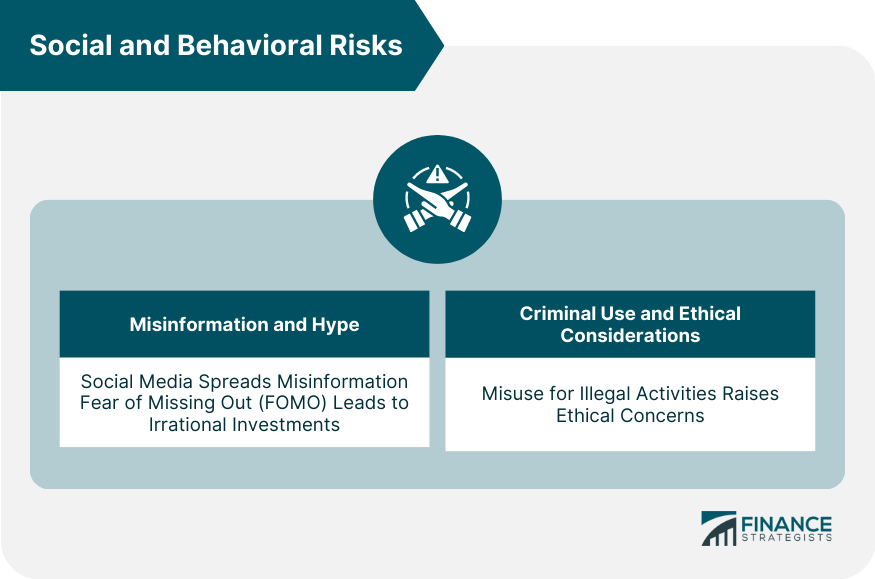

Social and Behavioral Risks

Misinformation and Hype

Criminal Use and Ethical Considerations

Conclusion

Cryptocurrency Risks FAQs

Cryptocurrency risks refer to potential uncertainties and dangers associated with digital currencies, like Bitcoin, due to their decentralized nature and lack of regulation.

Market volatility leads to rapid price fluctuations in cryptocurrencies, posing the risk of substantial financial losses or gains for investors and traders.

The absence of strong regulatory oversight in the cryptocurrency space can lead to fraud, theft, and illegal activities, making users vulnerable to scams and unauthorized transactions.

Security risks encompass hacking of exchanges and wallets, fraudulent initial coin offerings (ICOs), and exposure to online scams, jeopardizing users' investments and personal data.

Cryptocurrency mining, especially proof-of-work algorithms like Bitcoin's, consumes considerable energy, leading to environmental concerns and raising questions about the sustainability of these digital assets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.