Cryptocurrency cloud mining is a digital-age solution for those wanting to mine cryptocurrencies without the hassles of managing hardware. Instead of purchasing and setting up their own mining rigs, users rent computational power from cloud mining providers. These providers own vast data centers, typically in areas with cheaper electricity, and mine cryptocurrencies on behalf of their clients. Users receive a portion of the mined cryptocurrency based on their rented power. This method offers convenience and lower initial investment. However, it's essential to be cautious when choosing a provider due to the potential for scams in this relatively young industry. While cloud mining can be an entry point for novices, it's always vital to research and understand the associated costs, potential returns, and the credibility of the service provider. Cloud mining providers own and operate large data centers in regions with cheap electricity. Customers sign contracts to rent computing power, and the provider utilizes their data centers to mine on the customer's behalf. These platforms handle the hardware setup, maintenance, and software solutions. Their services typically span various cryptocurrencies, allowing users to choose their desired mining allocation. The most apparent benefit is financial savings. Users bypass the substantial electricity costs and the continual need for hardware updates and maintenance. Traditional mining rigs produce significant noise and heat. Cloud mining eradicates this inconvenience, making for a quieter and cooler home environment. With cloud mining, diversification becomes seamless. Users can split their resources across various coins, maximizing potential returns and hedging risks. The crypto space, being relatively young, has seen its fair share of scams. Cloud mining platforms are no exception, with numerous fraudulent sites duping unsuspecting investors. While the initial costs might be lower, the long-term profitability of cloud mining can sometimes pale compared to owning a personal rig, especially after deducting fees and overheads. If the provider's operations face issues or shut down, the user's mining operations cease, possibly leading to losses. Contracts can sometimes be complex, with hidden fees or clauses that can prove unfavorable to the user. Understanding the fine print is crucial. Platforms like Genesis Mining, Hashflare, and MinerGate has gained repute for their transparent operations and consistent payouts. While Genesis Mining boasts expansive contracts and robust security, Hashflare is lauded for its customizable plans. MinerGate, on the other hand, is known for its intuitive interface ideal for beginners. The profitability matrix of cloud mining intertwines with market dynamics and operational costs. Factoring in contract costs, potential earnings, and crypto volatility is essential to determine break-even points and expected returns. Cryptocurrency prices, mining difficulty, and pool success rates can drastically impact profitability. Market swings can alter earnings projections. It's pivotal to stay updated on market sentiments and adjust strategies accordingly. Opt for platforms with robust security protocols. Two-factor authentication and cold storage solutions are invaluable. Regular password changes, email alerts for account activities, and using dedicated devices can significantly bolster security. Cloud mining, centralized in regions with cheap electricity, often sourced from renewable sources, tends to be more energy-efficient than dispersed traditional mining. Many providers are now focusing on green energy solutions, reducing the overall carbon footprint of the crypto mining process. Research extensively, compare contract terms, and align choices with long-term goals. Regularly check earnings, optimize coin choices, and adjust strategies based on market movements. The crypto domain is fast-evolving. Keeping abreast of changes ensures proactive decision-making. Cryptocurrency cloud mining offers enthusiasts an opportunity to participate in the mining process without the burdens of owning and maintaining hardware. By renting computational power from cloud mining providers, users can avoid direct electricity and maintenance costs, enjoy a quieter living space, and diversify mining resources across multiple cryptocurrencies. However, the convenience comes with challenges, including the risk of scams, potential lower profits, and dependencies on the provider's reliability. Reputable platforms like Genesis Mining, Hashflare, and MinerGate have been recognized for their transparency. The economic implications of cloud mining, influenced by market dynamics, necessitate a thorough break-even and ROI analysis. Security is paramount, with measures like two-factor authentication being crucial. Environmentally, cloud mining's centralized nature often leads to more energy-efficient operations, with many providers shifting towards sustainability. For beginners, careful research, regular performance monitoring, and staying updated with industry trends are essential steps for success.What is Cryptocurrency Cloud Mining?

Mechanics of Cryptocurrency Cloud Mining

How Cloud Mining Operates

Roles of Cloud Mining Providers

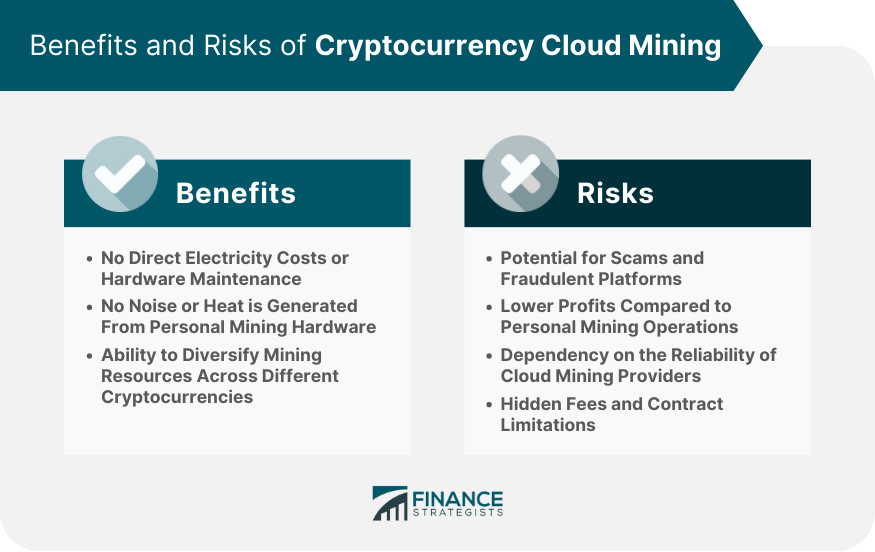

Benefits of Cryptocurrency Cloud Mining

No Direct Electricity Costs or Hardware Maintenance

No Noise or Heat is Generated From Personal Mining Hardware

Ability to Diversify Mining Resources Across Different Cryptocurrencies

Risks of Cryptocurrency Cloud Mining

Potential for Scams and Fraudulent Platforms

Lower Profits Compared to Personal Mining Operations

Dependency on the Reliability of Cloud Mining Providers

Hidden Fees and Contract Limitations

Popular Cryptocurrency Cloud Mining Platforms

Overview of Reputable Providers

Comparison of Features and Costs

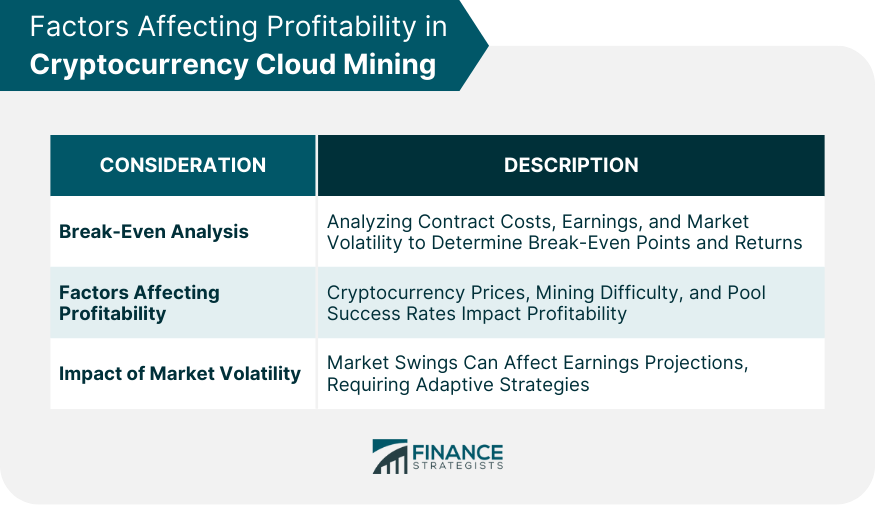

Economic Considerations in Cryptocurrency Cloud Mining

Break-Even Analysis and ROI

Factors Affecting Profitability

Impact of Cryptocurrency Market Volatility

Security Measures in Cryptocurrency Cloud Mining

Safeguarding Against Fraud and Hacks

Best Practices for Securing Cloud Mining Accounts

Environmental Perspective of Cryptocurrency Cloud Mining

Comparison With Traditional Mining in Terms of Energy Consumption

Sustainability Initiatives by Cloud Mining Providers

Tips for Getting Started With Cryptocurrency Cloud Mining

Choosing the Right Platform and Contract

Monitoring and Optimizing Performance

Staying Updated With Industry News and Trends

Conclusion

Cryptocurrency Cloud Mining FAQs

Cryptocurrency cloud mining is a process where individuals can participate in the mining of cryptocurrencies without owning or maintaining physical hardware. Instead, they lease or buy computing resources from third-party data centers specialized in crypto mining.

Unlike traditional mining, which requires owning and maintaining costly hardware and software, cryptocurrency cloud mining allows users to rent computing power from providers, eliminating the need for significant initial investments and ongoing hardware upkeep.

Yes, some risks include potential scams or fraudulent platforms, lower profits compared to personal mining operations, reliance on the reliability of cloud mining providers, and possible hidden fees or contract limitations.

Profitability in cryptocurrency cloud mining depends on several factors, including the cryptocurrency's market price, mining difficulty, contract costs, and potential hidden fees. While some find it profitable, it's essential to conduct a thorough break-even analysis before investing.

To bolster security, choose platforms with strong security protocols, enable two-factor authentication, regularly change passwords, and consider using dedicated devices for your cloud mining activities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.