Dividend-paying stocks are a popular investment choice for many investors, particularly those looking for a steady source of income. These types of stocks are shares in a company that pay a portion of their profits to shareholders as regular dividends. Investors who own dividend-paying stocks receive a regular income stream from the dividends, which can help to supplement their investment returns. The purpose of investing in dividend-paying stocks can vary from one investor to another. For many investors, the primary goal is to generate a steady income stream from their investments. Dividend-paying stocks can provide this steady income stream, which can help to support retirement or other financial goals. Additionally, dividend-paying stocks may offer a lower level of risk compared to non-dividend-paying stocks, as the income from dividends can help to cushion against market volatility. There are several types of dividend-paying stocks available to investors. Each type of stock has its own unique characteristics, and investors may choose to invest in one or more types of stocks based on their investment goals and risk tolerance. Blue-chip stocks are large, well-established companies that are typically leaders in their respective industries. These stocks are considered to be less risky than other types of stocks, and they often pay dividends to shareholders. Blue-chip stocks are a popular choice for investors who are looking for a stable, long-term investment. Growth stocks are shares in companies that are expected to grow at a faster rate than the overall market. These stocks typically do not pay dividends, as the companies reinvest their profits back into the business to fuel growth. Growth stocks are a popular choice for investors who are willing to take on more risk in exchange for the potential for higher returns. High-yield stocks are stocks that offer a higher dividend yield than the overall market. These stocks may be riskier than other types of dividend-paying stocks, as the high dividend yield may be unsustainable in the long term. Investors who are considering investing in high-yield stocks should carefully evaluate the financial health of the company and the sustainability of the dividend yield. Dividend aristocrats are companies that have consistently increased their dividend payments to shareholders for at least 25 consecutive years. These companies are often well-established, and they have a track record of financial stability and consistent dividend payments. Dividend aristocrats are a popular choice for investors who are looking for a long-term, stable investment. There are several advantages to investing in dividend-paying stocks. These advantages may make dividend-paying stocks a good choice for investors who are looking for a steady source of income or who are interested in lower-risk investments. Dividend-paying stocks can provide a steady source of income to investors, as the companies pay out regular dividends to shareholders. This income can be used to supplement other sources of income, such as retirement savings or Social Security benefits. Dividend-paying stocks may offer some protection against inflation, as the income from dividends may increase over time. Many companies increase their dividend payments over time, which can help to keep pace with inflation and protect the purchasing power of the investor's income. Dividend-paying stocks may offer the potential for long-term growth, as the income from dividends can be reinvested back into the stock. Over time, the value of the stock may increase, which can lead to capital appreciation for the investor. Dividend-paying stocks may be less volatile than non-dividend-paying stocks, as the income from dividends can help to cushion against market fluctuations. While there are several advantages to investing in dividend-paying stocks, there are also some risks that investors should be aware of. Dividend-paying stocks may have limited potential for capital appreciation, as the companies may prioritize paying dividends over reinvesting profits back into the business. This can lead to slower growth and lower returns for investors. Dividend-paying stocks may be vulnerable to economic downturns, as companies may be forced to reduce or suspend dividend payments during times of financial hardship. This can be particularly concerning for investors who rely on dividend income to support their living expenses. Dividend-paying stocks are not guaranteed to pay out dividends, and there is always a risk that the company may cut or suspend dividend payments. This can lead to a significant loss of income for investors who rely on dividend payments to support their financial goals. Dividend payments are typically taxed as ordinary income, which can be a disadvantage for some investors. Investors who are in a higher tax bracket may pay a higher rate of tax on their dividend income, which can reduce the overall returns on their investment. Investors who are considering investing in dividend-paying stocks should carefully evaluate several factors before making a decision. The dividend yield is the amount of the dividend payment relative to the stock price. Investors should look for stocks with a high dividend yield, as this can provide a larger income stream. Investors should also consider the dividend growth rate, which is the rate at which the company has increased its dividend payments over time. Companies that have consistently increased their dividend payments may be a good choice for investors who are looking for long-term stability. The payout ratio is the percentage of the company's earnings that are paid out as dividends. Investors should look for companies with a payout ratio that is sustainable over the long term, as a high payout ratio may be a sign that the company is not reinvesting enough profits back into the business. Investors should carefully evaluate the financial health of the company before investing in dividend-paying stocks. Companies with strong financials and a track record of consistent dividend payments may be a good choice for investors. There are several ways to invest in dividend-paying stocks, including individual stock selection, exchange-traded funds (ETFs), mutual funds, and dividend-focused robo-advisors. Investors who have the time and expertise may choose to select individual stocks based on their own research and analysis. This can be a time-consuming process, but it can also provide the opportunity for higher returns. ETFs are investment funds that trade on a stock exchange like individual stocks. ETFs may invest in a variety of dividend-paying stocks, providing investors with a diversified portfolio of dividend-paying stocks. Mutual funds are investment funds that are managed by a professional fund manager. These funds may invest in a variety of dividend-paying stocks, providing investors with a diversified portfolio of dividend-paying stocks. Robo-advisors are digital investment platforms that use algorithms to provide investment advice and management. Some robo-advisors are focused on dividend-paying stocks, providing investors with a portfolio of dividend-paying stocks that are selected based on the investor's goals and risk tolerance. Dividend-paying stocks can provide investors with a steady source of income and may offer some protection against inflation and market volatility. However, these stocks also come with risks, including the limited potential for capital appreciation, vulnerability to economic downturns, and the possibility of dividend cuts or suspensions. When investing in dividend-paying stocks, investors should carefully evaluate several factors, including the dividend yield, dividend growth rate, payout ratio, and company financial health. Additionally, there are several ways to invest in dividend-paying stocks, including individual stock selection, ETFs, mutual funds, and robo-advisors. Ultimately, whether or not dividend-paying stocks are a good investment choice for a particular investor depends on their individual financial goals, risk tolerance, and investment strategy. For investors who are looking for a stable source of income and a lower level of risk, dividend-paying stocks may be a good choice. However, for investors who are willing to take on more risk in exchange for the potential for higher returns, other types of investments, such as growth stocks, may be a better fit. With the right strategy and approach, dividend-paying stocks can be a valuable addition to an investor's portfolio and can help to support their financial goals over the long term.What Are Dividend-Paying Stocks?

Types of Dividend-Paying Stocks

Blue-Chip Stocks

Growth Stocks

High-Yield Stocks

Dividend Aristocrats

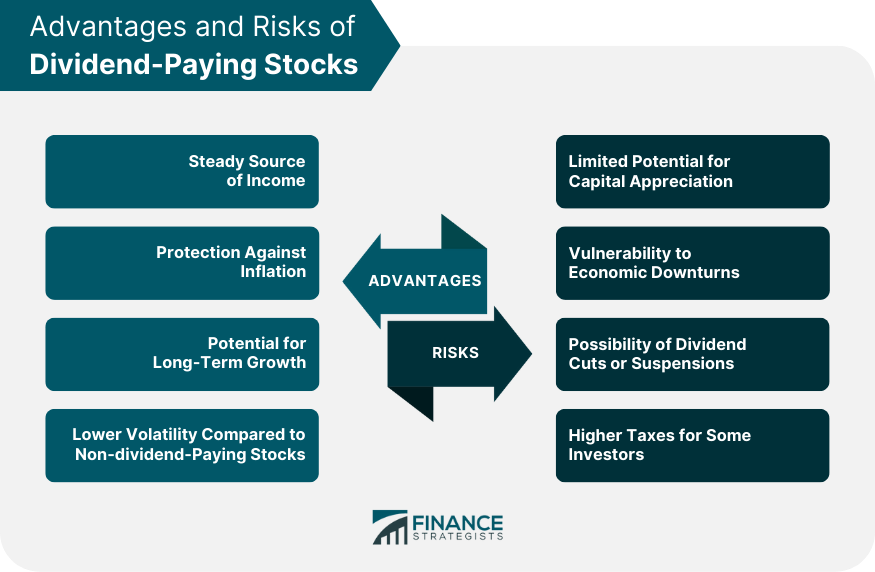

Advantages of Dividend-Paying Stocks

Steady Source of Income

Protection Against Inflation

Potential for Long-Term Growth

Lower Volatility Compared to Non-dividend-Paying Stocks

Risks of Dividend-Paying Stocks

Limited Potential for Capital Appreciation

Vulnerability to Economic Downturns

Possibility of Dividend Cuts or Suspensions

Higher Taxes for Some Investors

Factors to Consider When Investing in Dividend-Paying Stocks

Dividend Yield

Dividend Growth Rate

Payout Ratio

Company Financial Health

How to Invest in Dividend-Paying Stocks

Individual Stock Selection

Exchange-Traded Funds (ETFs)

Mutual Funds

Dividend-Focused Robo-Advisors

Final Thoughts

Dividend-Paying Stocks FAQs

Dividend-paying stocks are stocks that pay a portion of their profits to shareholders as regular dividends.

Dividend-paying stocks can provide a steady source of income, protection against inflation, and lower volatility compared to non-dividend paying stocks.

Dividend-paying stocks may have limited potential for capital appreciation, be vulnerable to economic downturns, and face the possibility of dividend cuts or suspensions.

Some types of dividend-paying stocks include blue-chip stocks, growth stocks, high-yield stocks, and dividend aristocrats.

You can invest in dividend-paying stocks through individual stock selection, exchange-traded funds (ETFs), mutual funds, and dividend-focused robo-advisors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.