The meteoric rise of cryptocurrencies has ushered in a new era of financial possibilities. From Bitcoin's humble beginnings to the myriad of tokens available today, the crypto landscape offers vast opportunities. As digital currencies permeate mainstream finance, it's essential to navigate their evolving place in tax structures. The IRS, for instance, treats cryptocurrencies as property, making the dynamics of taxation unique from traditional currencies. It's easy to get wrapped up in the thrill of trading and potentially profiting from crypto transactions. However, overlooking the tax implications can lead to hefty penalties down the road. Every crypto investor, whether new or seasoned, needs to recognize the importance of adhering to tax regulations to safeguard their investments. Additionally, being proactive in understanding the tax requirements can help in strategic planning and maximizing returns. Form 1099-B is a document issued by brokers and barter exchanges that summarizes the proceeds of transactions. In the context of cryptocurrencies, this form serves as a record of your crypto sales or trades throughout the tax year. Notably, even if you don't receive a Form 1099-B, you're still responsible for reporting all transactions. This underscores the significance of personal record-keeping. Traditional stock brokers aren't the only entities sending out Form 1099-B. Today, many cryptocurrency exchanges issue this form to their users. It acts as a gesture of transparency, ensuring that crypto traders are aware of the taxable events they've triggered throughout the year. However, due to the decentralized nature of cryptocurrencies, not all platforms provide this form, making personal diligence paramount. While Form 1099-B provides a summary of sales and trades, Form 8949 is where investors report the sale and disposition of capital assets, including cryptocurrencies. Think of Form 1099-B as a precursor, helping you complete Form 8949 accurately. While both forms intersect, each serves a distinct purpose in the overarching taxation process. On the form, there's a section dedicated to describing the property that was sold. In crypto terms, this typically denotes the type of token or coin traded. Accurately detailing this information can ease the assessment process for tax professionals. Furthermore, this clarity benefits investors by providing a concise snapshot of their yearly crypto activities. These two dates play a pivotal role in calculating potential capital gains or losses. The acquisition date determines the original value or cost basis of the crypto, while the sale date reflects its value at the time of selling or trading. Knowing the duration between these dates also aids in discerning whether a gain or loss is short or long term, which can affect tax rates. This section denotes the revenue earned from selling a cryptocurrency. Reflecting on this figure can offer insights into one's investment strategies and outcomes. Moreover, it's pivotal to ensure this amount's accuracy as it directly impacts the calculated tax liability. Your crypto's original cost is pivotal. This section requires noting the initial investment amount or the cost basis. It serves as a benchmark against the sale price, ultimately helping derive the gain or loss. A precise cost basis aids in an accurate tax calculation and can influence investment decisions in the future. Sometimes, adjustments to the gain or loss figures are necessary due to various financial activities. This section accommodates such tweaks, ensuring the final reported figure aligns with reality. Staying vigilant about noting any adjustments can shield investors from inadvertently misreporting their taxable income. Trading one cryptocurrency for another might seem like a straightforward swap. Still, for taxation purposes, it's a taxable event. The IRS views this as two separate actions – selling one cryptocurrency and buying another. Hence, investors need to be meticulous in tracking the value of each currency during these trades. Selling crypto for fiat currency is the most direct taxable event. Here, the capital gain or loss is the differential between the initial cost of the crypto and the received amount when selling. Familiarizing oneself with this process can simplify the often intricate tax filing procedures associated with cryptocurrencies. Making purchases using crypto? Tax implications accompany that action. It's pivotal to realize that spending cryptocurrency is treated as selling it, making the transaction taxable. Given the potential fluctuations in crypto's value, it's crucial to capture its worth at the exact transaction time. Mining or earning cryptocurrency is not just a technical endeavor but also a taxable one, as it's treated as income. When that crypto is subsequently sold or traded, another taxable event ensues. Ensuring clear records from the outset – from mining to disposition – can simplify the taxation process considerably. Given crypto's multifaceted transactions, tracking each one manually can quickly become daunting. Fortunately, there's an array of software solutions automating this task, offering organized records and enhanced accuracy. Leveraging these tools can immensely reduce the burden during tax seasons. With your transaction records in hand, cross-referencing them with Form 1099-B becomes essential. This alignment ensures comprehensive accounting of all activities and can highlight any potential discrepancies. Regular checks can also streamline tax filings, making the process less cumbersome. Occasionally, there might be discrepancies between personal records and Form 1099-B. Addressing these inconsistencies head-on is crucial to ensure accurate tax filing. Swift actions, coupled with open dialogue with the issuing exchange, can rectify potential pitfalls and maintain tax compliance. After grasping Form 1099-B's details, the data needs to migrate to Schedule D of Form 1040, where all capital gains and losses get reported. This transfer aids the IRS in discerning your tax obligations. Properly filling out these sections ensures you neither overpay nor underpay your due taxes. Mistakes happen, and there might be overlooked transactions from prior tax years. Routinely reviewing and reconciling past transactions ensures that errors get addressed. Such diligence can safeguard against potential penalties and ensure consistent compliance with tax regulations. Crypto assets' holding duration determines their associated tax rate. Those held under a year result in short-term capital gains, while assets held longer fall into the long-term category. Differentiating between these two can be pivotal, as each has distinct tax implications that can considerably impact your tax liability. Ignoring tiny transactions, often dubbed as "dust," is a common oversight. However, tax regulations mandate reporting all transactions, irrespective of their size. To stay compliant, ensure every trade, no matter how minuscule, gets its due attention and is recorded. Cryptocurrencies introduce unique events like airdrops or staking rewards, each with its tax implications. Being uninformed or misinterpreting these can lead to misreporting. Regularly updating one's knowledge about evolving crypto events and their tax treatments can prevent such pitfalls. Cryptocurrencies are notorious for their volatility. Their value can swing dramatically between transactions. Overlooking these shifts can lead to inaccuracies in tax reporting. Continuous monitoring and documentation of these fluctuations can assist in maintaining a precise record, ensuring accurate tax filings. The evolving landscape of cryptocurrency has introduced a complex yet essential layer of taxation. Grasping the nuances of Form 1099-B and understanding its crucial role in crypto transactions is imperative for every investor. This form serves as a cornerstone for reporting sales, trades, and other taxable events, emphasizing the importance of meticulous record-keeping. Not only does accurate documentation protect from potential penalties, but it also fosters strategic planning to maximize returns. As the crypto world continues to expand, so does the spectrum of its tax implications. By remaining informed and proactive, investors can ensure they navigate this digital frontier confidently and compliantly, securing the fruits of their investments.Overview of Cryptocurrency Investments and Taxation

Understanding Form 1099-B for Cryptocurrency Transactions

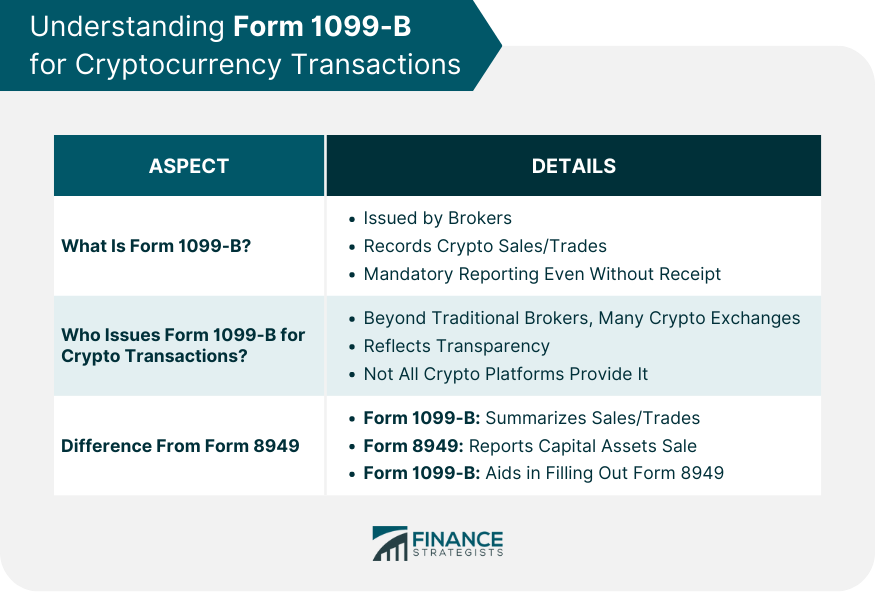

What Is Form 1099-B?

Who Issues Form 1099-B for Crypto Transactions?

How Does It Differ From Other Tax Forms Like Form 8949?

Main Components of Form 1099-B

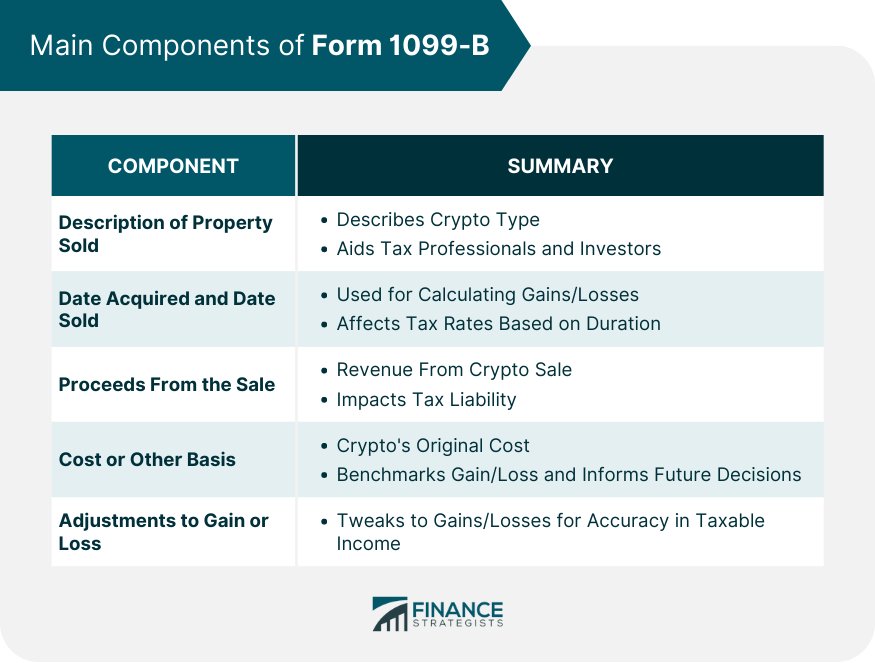

Description of Property Sold

Date Acquired and Date Sold

Proceeds From the Sale

Cost or Other Basis

Adjustments to Gain or Loss

Deciphering Crypto Tax Events Triggering Form 1099-B

Trading One Cryptocurrency for Another

Selling Cryptocurrency for Fiat Currency

Using Cryptocurrency for Goods or Services

Receiving Mined or Forked Cryptocurrency

Importance of Keeping Detailed Crypto Transaction Records

Tools and Software Solutions for Tracking Crypto Transactions

Matching Transactions With the Reported Data on Form 1099-B

Addressing Discrepancies or Missing Information

How to Report Crypto Transactions Using Form 1099-B

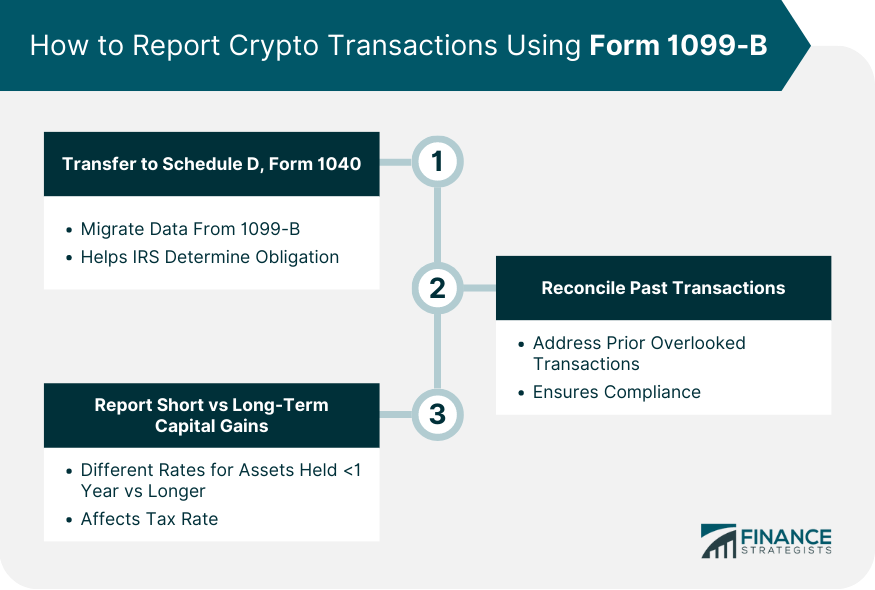

Transfer Information From Form 1099-B to Schedule D of Form 1040

Reconcile With Previously Reported or Unreported Transactions

Report Short-Term vs Long-Term Capital Gains

Common Mistakes and How to Avoid Them

Overlooking Small Transactions or "Dust"

Misinterpreting the Nature of Specific Transactions

Failing to Account for Changes in Crypto Valuation Between Transactions

Bottom Line

Crypto Investor’s Guide to Form 1099-B FAQs

Form 1099-B is a document issued by brokers and crypto exchanges summarizing the proceeds from your cryptocurrency sales or trades throughout the tax year.

While Form 1099-B provides a summary of sales and trades, Form 8949 is where investors report the sale and disposition of capital assets, including cryptocurrencies.

These dates determine potential capital gains or losses, with the duration between them indicating whether a gain or loss is short or long term.

Data from Form 1099-B needs to be transferred to Schedule D of Form 1040, where all capital gains and losses are reported for tax purposes.

Overlooking small transactions, misinterpreting events like airdrops or staking rewards, and failing to account for crypto valuation changes between transactions are common pitfalls.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.