Real estate investing refers to the process of acquiring properties to generate income, build wealth, or diversify investments. It differs from other investment types, such as stocks and bonds, because it involves tangible assets. Real estate investing involves purchasing property, either residential or commercial, with the intent to generate income from rental payments, property appreciation, or both. Unlike stocks and bonds, real estate investments are tangible assets that can be physically utilized, managed, and improved upon. There are various types of real estate investments, each with its own characteristics and potential returns. The following are some common types of real estate investing: Residential properties are properties designed for people to live in, such as single-family homes, townhouses, and apartments. Single-Family Homes: Single-family homes are standalone houses meant for one family, and they typically generate income through long-term rentals. Multi-Family Homes: Multi-family homes, such as duplexes, triplexes, and apartment buildings, consist of multiple individual living units and can provide higher returns due to multiple tenants. Vacation Rentals: Vacation rentals are properties rented out on a short-term basis to travelers, often providing higher rental income compared to long-term rentals. Commercial properties are designed for businesses and can include office buildings, retail stores, and industrial warehouses. Office Buildings: Office buildings are commercial properties that house various types of businesses and generate income through rent paid by the tenants. Retail Stores: Retail properties are buildings used for retail businesses, such as shopping centers and standalone stores, which earn income through rent and lease agreements. Industrial Warehouses: Industrial properties include warehouses and manufacturing facilities, which generate income from tenants operating in industries such as logistics, manufacturing, and storage. Real Estate Investment Trusts (REITs) are companies that own and manage income-producing real estate properties, allowing investors to invest in a diversified portfolio of properties without directly owning or managing them. Publicly Traded REITs: Publicly traded REITs are listed on stock exchanges, allowing investors to buy shares and earn income through dividends and capital appreciation. Non-Traded REITs: Non-traded REITs are not listed on stock exchanges, offering potentially higher returns but also greater illiquidity and risks compared to publicly traded REITs. Mortgage REITs (mREITs): Mortgage REITs invest in mortgages, mortgage-backed securities, and other real estate-related debt, generating income from the interest on these investments. Real estate investing involves various steps, from researching and selecting properties to managing them and generating revenue. This section will discuss the different stages of real estate investing. Before investing in real estate, it is crucial to conduct thorough research and identify suitable properties that align with investment goals. Market Analysis: Investors should analyze the local real estate market, considering factors such as supply and demand, vacancy rates, and rental rates. Property Analysis: Investors should evaluate potential properties, assessing factors such as location, property condition, and expected returns. Financial Analysis: Investors should analyze the financial aspects of potential properties, including purchase price, financing options, and projected cash flow. After selecting a property, investors need to secure financing and complete the acquisition process. Down Payment: Investors typically need to provide a down payment, which is a percentage of the purchase price, to secure a mortgage for the property. Mortgage Financing: Investors often use mortgage financing to cover the remaining cost of the property, with various loan options available depending on the investor's credit score, financial history, and property type. Closing Process: The closing process involves finalizing the property purchase, including signing legal documents, transferring funds, and obtaining the property deed. Effective property management is essential for successful real estate investing, as it ensures the property is well-maintained and generates consistent income. Maintenance and Repairs: Regular maintenance and timely repairs help preserve the property's value and ensure it remains attractive to tenants. Tenant Screening: Thorough tenant screening helps to minimize vacancy rates and ensure reliable income from responsible tenants who pay rent on time and respect the property. Legal Compliance: Investors must comply with local and federal regulations, such as fair housing laws and building codes, to avoid fines and legal issues. Real estate investing offers various benefits, such as diversification, passive income, and tax advantages, making it an attractive investment option. Investing in real estate allows investors to diversify their portfolios, reducing overall investment risk. Asset Class Diversification: Real estate investments offer exposure to a different asset class compared to stocks and bonds, reducing the impact of market fluctuations. Geographic Diversification: Investing in properties across different geographic locations can further diversify an investor's portfolio and reduce risk associated with local economic downturns. Property Type Diversification: Diversifying across various types of properties, such as residential, commercial, and industrial, can help mitigate risks associated with specific sectors. Real estate investing can generate passive income through rental payments, allowing investors to earn money without actively working. Rental income from tenants provides a consistent stream of revenue, which can be used to cover property expenses or supplement an investor's income. Real estate properties tend to appreciate in value over time, offering the potential for capital gains upon selling the property. Investors can use leverage to acquire more properties with less capital, potentially increasing their overall returns. Despite the potential benefits, real estate investing also comes with drawbacks, such as illiquidity, high capital requirements, and management responsibilities. Real estate investments are generally illiquid, meaning they cannot be quickly converted into cash without potentially incurring a loss. Real estate investments typically require a long-term commitment, as selling a property can take time and may involve substantial transaction costs. The ability to sell a property quickly and profitably depends on market conditions, which can be unpredictable and vary by location. Investors may have difficulty accessing the equity in their properties without selling or refinancing, which can be costly and time-consuming. Real estate investing often requires significant upfront capital, making it challenging for some investors to enter the market. Purchasing a property typically requires a substantial down payment, which can be a barrier for investors with limited funds. In addition to the down payment, investors must also cover closing costs, such as appraisal fees, title insurance, and legal fees. Property maintenance and repairs can be costly and may require additional capital outlays over time. For investors who prefer not to invest in real estate directly, there are alternative investment options, such as stocks, bonds, and mutual funds. Investing in the stock market involves buying shares of publicly traded companies, providing potential for capital appreciation and dividend income. Capital Appreciation: Stock prices can increase over time, offering investors the potential for capital gains upon selling their shares. Dividend Income: Some companies pay dividends to their shareholders, providing a source of passive income. Liquidity: Stocks are generally more liquid than real estate investments, allowing investors to buy and sell shares more easily and quickly. Bonds are debt securities issued by governments, corporations, or other entities, providing investors with regular interest payments and a return of principal at maturity. Steady Income: Bonds typically pay interest at fixed intervals, providing investors with a predictable income stream. Lower Risk: Bonds are generally considered lower risk than stocks, as they have a higher claim on the issuer's assets and cash flow. Diversification: Investing in bonds can help diversify an investment portfolio, reducing overall risk. Mutual funds and Exchange-Traded Funds (ETFs) are investment vehicles that pool investors' money to invest in a diversified portfolio of stocks, bonds, or other assets. Diversification: Mutual funds and ETFs offer instant diversification, spreading risk across a broad range of investments. Professional Management: These funds are managed by professional portfolio managers, who make investment decisions on behalf of the investors. Liquidity: Mutual funds and ETFs can typically be bought and sold easily, providing investors with more liquidity than direct real estate investments. Real estate investing offers potential benefits, such as diversification, passive income, and tax advantages, but it also comes with drawbacks like illiquidity and high capital requirements. Investors should carefully consider their financial goals, risk tolerance, and available resources before deciding whether real estate investing is right for them. For those seeking alternative investments, options like stocks, bonds, and mutual funds can provide exposure to different asset classes and varying levels of risk and return.What Is Real Estate Investing?

Types of Real Estate Investing

Residential Properties

Commercial Properties

Real Estate Investment Trusts (REITs)

How Real Estate Investing Works

Research and Property Selection

Financing and Acquisition

Property Management

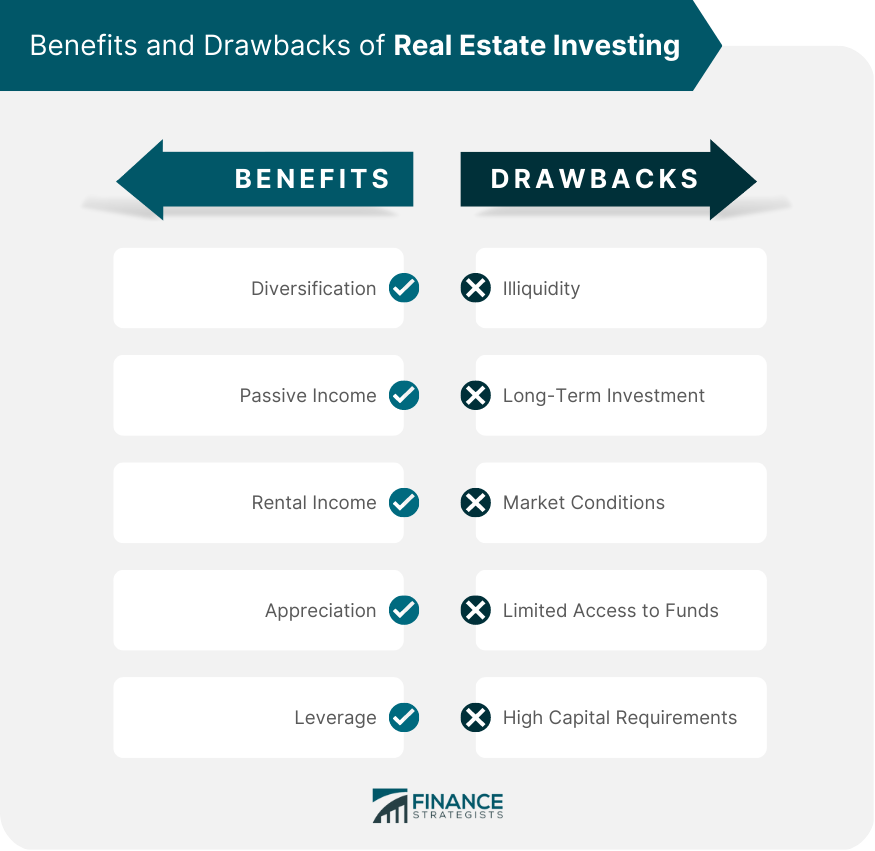

Benefits of Real Estate Investing

Diversification

Passive Income

Rental Income

Appreciation

Leverage

Drawbacks of Real Estate Investing

Illiquidity

Long-Term Investment

Market Conditions

Limited Access to Funds

High Capital Requirements

Alternatives to Real Estate Investing

Stock Market Investing

Bonds

Mutual Funds and Exchange-Traded Funds (ETFs)

Conclusion

Real Estate Investing FAQs

Real estate investing is the purchase, ownership, management, rental, or sale of real estate for profit.

Real estate investing works by acquiring a property, either by purchasing or leasing, and generating income through rental income or appreciation when the property is sold.

Benefits of real estate investing include passive income, long-term appreciation, tax advantages, and diversification of investment portfolio.

Risks of real estate investing include market fluctuations, maintenance costs, vacancy rates, property damage, and unforeseen expenses.

To get started with real estate investing, research the market, create a budget, seek financing, and consider hiring a professional to guide you through the process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.