AML (Anti-Money Laundering) regulations for cryptocurrencies have emerged as a cornerstone in the evolving digital financial landscape. These regulations, designed to combat illicit activities like money laundering, terrorist financing, and fraud, mandate that crypto platforms adopt practices such as thorough user identity verification (KYC) and continuous transaction monitoring. Central to the AML framework is the obligation to report suspicious activities to regulatory authorities. While some view these regulations as an encroachment on the decentralized ethos of cryptocurrencies, many believe they are essential. They not only ensure the security and legitimacy of crypto transactions but also play a pivotal role in fostering trust, thereby promoting wider adoption of cryptocurrencies in mainstream financial systems. Regulating cryptocurrency transactions is paramount in curbing money laundering, terrorism financing, and other illegal trades. With an encrypted and decentralized system, tracking and identifying the origins and destinations of transactions is challenging, making it a ripe platform for malevolent actors. Beyond protecting against illicit activities, AML regulations help to legitimize the entire crypto industry. Users, investors, and other stakeholders are more likely to trust and use crypto platforms they believe are under some form of oversight, ensuring transparency and safety. AML compliance is a key factor in making cryptocurrencies palatable to traditional financial institutions and skeptical individuals. By addressing security concerns, the chances of mainstream adoption increase significantly. An essential aspect of any AML framework, CDD requires crypto platforms to verify the identity of their customers. This ensures that platforms can trace and monitor their user base, preventing any illicit actors from accessing the platform. By consistently monitoring transactions, platforms can detect and report suspicious activities. Automated systems, combined with artificial intelligence, can flag unexpected transaction patterns or high-value transactions, which might indicate money laundering or other illicit activities. Crypto platforms are required to inform regulatory authorities about suspicious transactions. This collaboration ensures that potential threats are rapidly addressed, safeguarding both the platform and its users. Maintaining detailed transaction records is essential. By storing data on transactions, platforms can assist regulatory bodies in any investigations, further emphasizing their commitment to transparency and security. The FATF, a global entity, introduced guidelines focusing on how the global community should address crypto-related money laundering. These guidelines provide a framework, urging countries to adopt regulations to prevent the misuse of cryptocurrencies. Europe’s approach towards AML for cryptocurrencies is encapsulated in the EU's 5th and 6th AML directives. These regulations emphasize transparency, obligating crypto platforms to implement strict KYC (Know Your Customer) procedures and maintain detailed records. The Financial Crimes Enforcement Network (FinCEN) under the U.S. Treasury has set forth requirements specifically for the United States. These regulations focus on stringent reporting and monitoring, targeting both exchanges and wallet providers. One of the biggest challenges faced by regulators is the inherently decentralized nature of cryptocurrencies. This structure, devoid of a central authority, makes it difficult to impose and monitor compliance effectively. Cryptocurrencies offer pseudo-anonymity. While transactions are recorded on the blockchain, personal identities aren't directly linked to transaction and wallet addresses, making it challenging to identify culprits behind suspicious activities. As technology evolves, so do methods to bypass regulations. The use of privacy coins like Monero, mixers, and off-chain transactions complicate the efforts of regulators. Given the ever-evolving nature of the crypto landscape, it's crucial for platforms to regularly update their compliance procedures, ensuring they stay ahead of potential risks. Having staff that are well-versed with AML requirements is fundamental. Through regular training, platforms can ensure their teams are always prepared to handle AML-related scenarios. Platforms that deploy advanced technologies like AI and machine learning in transaction monitoring will be more adept at identifying suspicious activities, making them more compliant with AML regulations. Proactive collaboration with other crypto platforms and regulators can help share knowledge and best practices, enhancing the overall AML compliance framework. AML regulations for cryptocurrencies have become fundamental in shaping the trajectory of the digital finance realm. Their core aim is twofold: to combat financial malpractices such as money laundering and to reinforce the legitimacy of crypto transactions. The regulations pivot around vital components, including Customer Due Diligence, vigilant transaction monitoring, and punctual reporting to authorities. Despite challenges like the decentralized essence of cryptocurrencies and the cloak of pseudo-anonymity they offer, there's a palpable move towards improved global cooperation and innovative technological solutions. This stride is aimed at fortifying security without curtailing innovation. For the seamless integration of cryptocurrencies into mainstream finance, adhering to these regulations and adopting best practices, from regular protocol updates to harnessing AI-driven technologies, is not just preferable but imperative.What Are AML Regulations for Cryptocurrencies?

Purpose of AML Regulations for Cryptocurrencies

Protection Against Illegal Activities

Ensure the Legitimacy of Crypto Transactions

Promote Wider Adoption

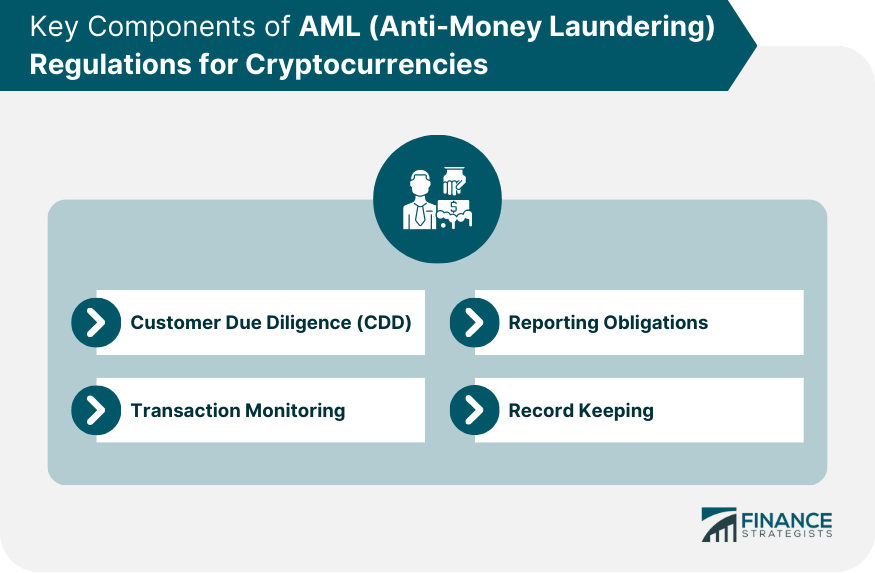

Key Components of AML Regulations for Cryptocurrencies

Customer Due Diligence (CDD)

Transaction Monitoring

Reporting Obligations

Record Keeping

Global AML Regulations for Cryptocurrencies

FATF (Financial Action Task Force) Guidelines

EU's 5th and 6th Anti-Money Laundering Directives

U.S. Treasury's FinCEN Requirements

Challenges in Implementing AML Regulations for Cryptocurrencies

Decentralized Nature of Cryptocurrencies

Pseudo-Anonymity

Emerging Technological Challenges

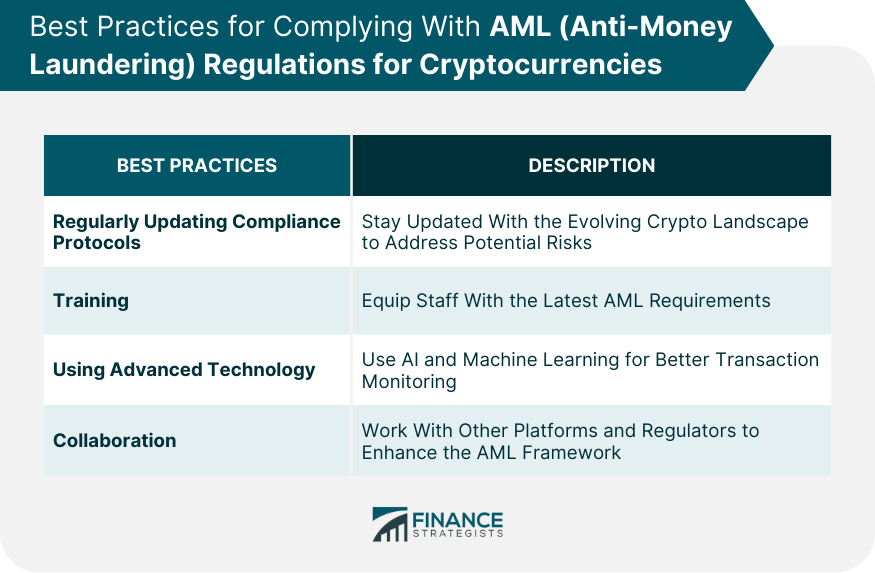

Best Practices for Complying With AML Regulations for Cryptocurrencies

Regularly Updating Compliance Protocols

Training

Use of Advanced Technology

Collaboration

Conclusion

AML Regulations for Cryptocurrencies FAQs

AML (Anti-Money Laundering) regulations for cryptocurrencies are a set of rules and guidelines designed to prevent illicit activities like money laundering using digital currencies. They're essential to ensure the legitimacy and security of crypto transactions, thereby promoting wider trust and adoption.

These regulations can require individual users to undergo thorough identity verification processes (KYC) before using crypto platforms. While they add an extra layer of security, they may reduce the pseudonymous nature that some users appreciate about cryptocurrencies.

Yes, organizations like the Financial Action Task Force (FATF) provide global guidelines on AML for cryptocurrencies. While these guidelines offer a framework, individual countries might have their specific regulations based on local concerns and financial systems.

While the decentralized nature of cryptocurrencies poses challenges, AML regulations often focus on points of centralization, like exchanges and wallet providers. By enforcing strict compliance on these entities, regulators can exert some control over the decentralized world of crypto.

While AML regulations introduce certain constraints, they also legitimize the industry, potentially attracting more mainstream adoption. The key is balancing between regulatory oversight and fostering innovation, ensuring a secure yet flourishing crypto ecosystem.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.