Asset management is the process of managing a client's entire portfolio of assets, including stocks, bonds, real estate, and other investments. Asset managers typically work with high-net-worth individuals or institutions, and their goal is to help clients achieve their financial goals by growing their wealth over time. Investment managers typically work with individuals or businesses of all income levels, and their goal is to help clients achieve their investment goals by selecting the right mix of assets and managing those assets effectively. The main difference between asset management and investment management is the scope of work. Asset managers typically have a broader focus, as they are responsible for managing all of a client's assets. Investment managers have a more narrow focus, as they are only responsible for managing a client's investment portfolio. Asset management typically focuses on high-net-worth individuals, foundations, endowments, and other institutions, while investment management caters to a broader range of clients, including retail investors. This difference in focus means that the services offered, and the strategies used, can vary significantly between asset and investment management. Different regulatory bodies oversee asset and investment management, with specific rules and regulations for each. It's important for investors to understand these regulations, as they can affect the types of investments available, the transparency of the investment process, and the protections offered to investors. Asset managers often focus on risk management, spreading investments across various asset classes to reduce exposure to any single asset. In contrast, investment managers might focus more on maximizing returns, which may involve higher-risk strategies. This distinction can have significant implications for the risk and return profile of the client's investments. Fees and cost structures also differ, with asset managers often charging a percentage of assets under management (AUM), while investment managers might charge a mix of fixed fees, performance fees, and AUM fees. The cost of these services can significantly affect the net return on investment, so it's important for investors to understand these costs before choosing a service. Asset management is a systematic approach to the governance and realization of value from the things that an individual or organization values or has a legal responsibility for. It involves maintaining and managing assets such as real estate, stocks, bonds, and cash in such a way that they grow over time and provide maximum value to the owner. It is a strategic decision-making process driven by the aim of achieving the best possible returns in light of the investor's specific risk appetite and goals. The primary goal of asset management is to grow and protect an individual's or institution's wealth by making the most of their assets. This goal is achieved by creating a balanced portfolio that is aimed at achieving long-term growth while mitigating risks. Asset managers employ a wide range of strategies and tools to achieve these goals, tailoring their approach based on the individual needs and risk tolerance of their clients. Key players in the asset management field include asset managers, who oversee the assets; clients, who entrust their assets to these managers; and various market intermediaries. The relationships between these players are governed by agreements that set out the terms of the asset management service, including risk management strategies, communication mechanisms, and performance benchmarks. Asset managers often use strategies like asset allocation and portfolio management to manage risks and meet the client's investment objectives. They also provide regular updates and reports about the assets' performance. They monitor market conditions, regulations, and other relevant factors, adjusting the client's portfolio as needed to optimize returns and protect the client's wealth. Tangible assets have a physical form and include assets like properties, equipment, and commodities. The value of these assets often depends on physical characteristics and market conditions. These assets can provide a steady income or potential capital appreciation, but they can also be costly to maintain and might be affected by factors like physical damage or changes in market demand. Intangible assets, like patents, trademarks, and copyrights, do not have a physical form but hold significant value for a business. These assets require a different management strategy, focusing on legal protections and leveraging the assets for financial gain. The management of these assets involves protecting their legal status, maximizing their use, and, where appropriate, monetizing them through licensing or sale. Financial assets include investments like stocks, bonds, mutual funds, and more. These assets are often the most volatile, with values closely tied to market conditions. The management of these assets involves monitoring market trends, making buy/sell/hold decisions, and managing risk through diversification and other strategies. Asset allocation strategies determine how a client's portfolio is spread across various asset classes. This diversification aims to reduce risk while optimizing returns. Asset allocation can vary based on a client's risk tolerance, investment goals, and time horizon. It's a dynamic process that may require adjustments as market conditions, client circumstances, or investment goals change. Diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. By spreading investments across various financial instruments and sectors, asset managers aim to yield higher returns and pose a lower risk of losing capital. This risk reduction is particularly valuable in volatile markets, where it can help protect the portfolio from significant losses. Investment management is a professional service that involves the management of securities like stocks and bonds and other assets, such as real estate, to meet specific investment goals. This service often includes elements of financial statement analysis, asset selection, stock selection, plan implementation, and ongoing monitoring of investments. The primary goal of investment management is to generate a high return on investments by buying and selling securities and other assets. This is achieved by creating an investment strategy that aligns with the client's risk tolerance and financial goals. Investment managers strive to balance the potential for return against the risks associated with different investments, aiming to achieve the best possible outcome for their clients. Key players in investment management include investment managers, who buy and sell securities; clients, who entrust their investments to these managers; and various financial intermediaries. The interactions between these players are crucial to the success of the investment management process, with clear communication and aligned expectations playing a key role. Investment managers often use strategies like financial analysis, asset selection, and plan implementation. They monitor investments and make adjustments based on market conditions and the client's changing needs and goals. Their role is to create a well-structured portfolio that matches the client's risk profile and investment objectives, optimizing the potential for return while minimizing risk. Equities, or stocks, represent ownership in a company. They offer high return potential, but they are also more volatile and carry a higher risk than some other investment types. Investing in equities requires careful analysis of company financials, industry trends, and market conditions. Bonds are debt securities that pay interest over a fixed period and return the principal amount on maturity. They are considered less risky than equities but also typically offer lower returns. Bond investing requires understanding interest rate trends, the credit quality of the issuer, and other factors that could impact the bond's return. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer diversification and professional management but may also come with higher fees and less control over individual investment decisions. Real estate investments can offer a steady income stream and potential appreciation but also come with risks like market downturns and property damage. These investments can be managed directly or through vehicles like real estate investment trusts (REITs). Alternative investments include hedge funds, private equity, commodities, and other non-traditional investments. These investments can offer high returns and diversification benefits but also come with high risks and costs. Investment managers use a range of strategies to achieve their client's investment goals. These strategies can include fundamental analysis, technical analysis, quantitative analysis, and more. The chosen strategy depends on the investment manager's philosophy, the client's risk tolerance and investment objectives, and the current market conditions. Portfolio construction is a key part of investment management. It involves selecting the right mix of investments to meet the client's goals while managing risk. This process considers factors like the client's risk tolerance, investment objectives, time horizon, and market conditions. Once the portfolio is constructed, it requires ongoing maintenance to ensure it continues to meet the client's objectives. This involves monitoring the portfolio's performance, rebalancing as needed, and making adjustments based on changes in market conditions or the client's circumstances. If you have a large portfolio of assets, you may need the comprehensive services of an asset manager. However, if you have a smaller portfolio or are just starting to invest, an investment manager may be a better fit. If you have specific investment goals, such as saving for retirement or college, you may need an investment manager who can help you create a personalized investment strategy. If you are comfortable with risk, you may be able to manage your own investments with the help of a financial advisor. However, if you are risk-averse, you may want to work with an asset manager who can help you minimize your risk. Asset management and investment management are two closely related fields, but there are some key differences between them. Asset managers typically have a broader focus, as they are responsible for managing all of a client's assets. Investment managers have a more narrow focus, as they are only responsible for managing a client's investment portfolio. Choosing the right type of management for your needs depends on your individual circumstances. If you have a large portfolio of assets or specific investment goals, you may need the comprehensive services of an asset manager. However, if you have a smaller portfolio or are just starting to invest, an investment manager may be a better fit. No matter which type of management you choose, it is important to work with a professional who understands your needs and goals. Wealth management advisors can help you create a customized investment strategy that meets your needs.Asset Management vs Investment Management: Overview

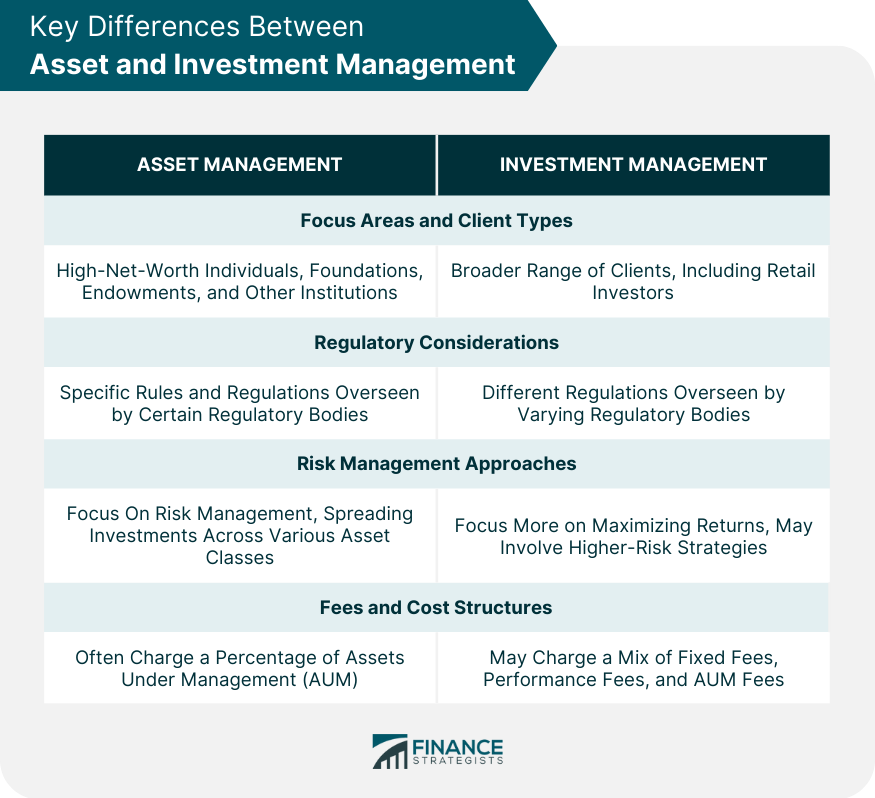

Key Differences Between Asset and Investment Management

Focus Areas and Client Types

Regulatory Considerations

Risk Management Approaches

Fees and Cost Structures

Understanding Asset Management

Definition

Goals and Objectives

Key Players Involved

Core Functions and Strategies

Various Forms of Assets

Tangible Assets

Intangible Assets

Financial Assets

Asset Allocation Strategies

Importance of Diversification in Asset Management

Understanding Investment Management

Definition

Goals and Objectives

Key Players Involved

Core Functions and Strategies

Different Types of Investment Instruments

Equities

Bonds

Mutual Funds

Real Estate Investments

Alternative Investments

Investment Strategies in Investment Management

Role of Portfolio Construction and Maintenance

Choosing the Right Fit for Your Unique Needs

Financial Situation

Investment Goals

Risk Tolerance

Bottom Line

Asset Management vs Investment Management FAQs

Asset management is a systematic approach that involves maintaining and managing assets like real estate, stocks, bonds, and cash to provide maximum value to the owner. It aims for long-term growth while mitigating risks.

Investment management is a professional service that involves managing securities like stocks, bonds, and other assets like real estate to meet specific investment goals. It focuses on generating high returns by buying and selling securities.

Asset management typically focuses on high-net-worth individuals and institutions, emphasizing long-term growth and risk management. Investment management caters to a broader range of clients, aiming to maximize returns often with higher-risk strategies.

Asset management involves strategies like asset allocation and portfolio management to manage risks and meet investment objectives. It also involves monitoring market conditions and adjusting the client's portfolio as needed.

Investment management includes functions like financial analysis, asset selection, and plan implementation. Investment managers monitor investments and make adjustments based on market conditions and the client's changing needs and goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.