Refinancing is replacing an existing loan with a new loan with different terms and conditions. This often involves paying off the original loan and taking out a new one with more favorable terms, such as a lower interest rate or a shorter loan term. Refinancing is a common strategy for managing debt and achieving financial goals. Refinancing primarily aims to obtain better loan terms that can save money, reduce risk, or provide access to additional funds. Borrowers may refinance to take advantage of lower interest rates, consolidate debt, or access equity in their homes. Before refinancing, it is crucial to evaluate your financial situation, identify your goals, and determine whether the potential benefits of refinancing outweigh the costs. Factors to consider include the current interest rates, your credit score, the remaining term of your existing loan, and the costs associated with refinancing. Rate-and-term refinancing involves replacing the existing mortgage with a new one that has a different interest rate, loan term, or both. Borrowers often choose this type of refinancing to secure a lower interest rate or to change from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. Cash-out refinancing allows borrowers to replace their existing mortgage with a new one for an amount greater than the remaining balance on the original loan. The difference between the old and new loans is paid to the borrower in cash, which can be used for various purposes, such as home improvements or debt consolidation. Cash-in refinancing involves the borrower bringing cash to the closing to pay down the loan balance, resulting in a smaller loan amount and potentially more favorable terms. This type of refinancing can help borrowers qualify for a lower interest rate, eliminate private mortgage insurance (PMI), or reduce their loan-to-value (LTV) ratio. Streamline refinancing is a simplified process available for certain types of loans, such as FHA and VA loans. It typically requires less documentation and has lower costs than traditional refinancing, making it an attractive option for borrowers looking to reduce their interest rate or change their loan terms with minimal hassle. While not technically refinancing, home equity loans and Home Equity Lines of Credit (HELOCs) allow borrowers to access the equity in their home without replacing their existing mortgage. Home equity loans provide a lump-sum payment, while HELOCs offer a revolving line of credit. Both options can be used for various purposes, such as home improvements or debt consolidation. One of the primary reasons borrowers choose to refinance is to secure a lower interest rate. A lower interest rate can lead to significant savings over the life of the loan and can also reduce monthly payments. Refinancing can shorten borrowers' loan terms, save money in interest payments and help build equity faster. This can be particularly beneficial for those who can afford higher monthly payments but want to repay their loan more quickly. By extending the loan term or securing a lower interest rate, refinancing can help borrowers reduce their monthly payments. This can free up cash for other financial goals or relieve those struggling to make their mortgage payments. Refinancing can effectively consolidate high-interest debt, such as credit card balances or personal loans. By rolling these debts into a new mortgage with a lower interest rate, borrowers can simplify their finances and potentially save money on interest payments. Cash-out refinancing allows borrowers to tap into their home equity to fund various expenses, such as home improvements, college tuition, or medical bills. This can be a cost-effective way to borrow money, as mortgage interest rates are typically lower than those for personal loans or credit cards. Borrowers with a loan-to-value ratio of more than 80% are often required to pay PMI. Refinancing can help reduce the LTV ratio, potentially allowing borrowers to eliminate PMI and lower their monthly payments. Refinancing can help borrowers transition from an ARM, which has a variable interest rate, to a fixed-rate mortgage, which offers a stable interest rate for the life of the loan. This can provide peace of mind and protect borrowers from future interest rate increases. Refinancing typically involves closing costs, which can include loan origination fees, appraisal fees, title search and insurance fees, and other expenses. Some loans may have prepayment penalties, which are fees charged by the lender if the borrower pays off the loan early. Before refinancing, borrowers should review their existing loan terms to determine if prepayment penalties apply. Mortgage points, also known as discount points, can be purchased to lower the interest rate on a new loan. Borrowers should consider whether the upfront cost of purchasing points is worth the potential interest savings. Refinancing often requires a new appraisal to determine the property's current value. Appraisal fees depend on the location and size of the property. A title search is conducted to ensure there are no outstanding liens on the property, and title insurance protects the lender and borrower against potential issues with the property's title. These fees can vary but should be considered when evaluating the cost of refinancing. Loan origination fees cover the lender's cost of processing the new loan. The escrow company charges escrow fees for handling the closing process and disbursing funds. These fees can vary depending on the loan amount and location. Before refinancing, borrowers should evaluate their financial situation, including their credit score, debt-to-income ratio, and employment stability. A strong financial profile can help borrowers secure more favorable loan terms. Borrowers should consider their financial goals, such as reducing monthly payments, paying off their mortgage more quickly, or accessing cash for home improvements or other expenses. This can help determine which type of refinancing is most appropriate. The break-even point is the time it takes for the monthly savings from refinancing to offset the upfront costs. Borrowers should calculate their break-even point to determine how long they need to stay in their home to benefit from refinancing. Predicting future interest rate changes can be challenging, but borrowers should consider the current economic climate and any potential rate fluctuations when deciding to refinance. Refinancing may be less advantageous if interest rates are expected to decrease in the near future. The benefits of refinancing are often realized over time, so borrowers should consider how long they plan to stay in their homes. If they expect to move within a few years, the upfront costs of refinancing may need to be recouped through the potential savings. Borrowers should shop around and compare loan offers from multiple lenders to find the best rates and terms. Online resources, local banks, and credit unions can all be sources of competitive loan offers. Borrowers can negotiate loan terms, such as interest rates and closing costs, with potential lenders. A strong credit score and a low debt-to-income ratio can provide leverage during negotiations. Credit scores significantly determine the interest rate and loan terms a borrower can qualify for. Borrowers should review their credit reports, correct errors, and improve their credit scores before refinancing. Once a borrower has chosen a lender and loan terms, they can lock in the interest rate to protect against potential rate increases during the loan process. Rate locks typically last for 30 to 60 days and may come with a fee. When refinancing, borrowers should consider whether a fixed-rate or adjustable-rate mortgage is best suited for their needs. Fixed-rate mortgages offer stability and predictability, while adjustable-rate mortgages can provide lower initial interest rates but come with the risk of rate increases over time. The refinancing process begins with submitting a loan application and providing the necessary documentation, such as pay stubs, tax returns, and bank statements. Borrowers should be prepared to provide accurate and complete information to ensure a smooth process. A home appraisal will be conducted to determine the current market value of the property. The appraisal is a crucial component of the refinancing process, as it affects the loan-to-value ratio and the amount the borrower can refinance. During the underwriting process, the lender evaluates the borrower's financial information and the property's value to determine whether to approve the loan. Borrowers may be asked to provide additional documentation or clarify information during this stage. Once the loan is approved, the borrower will attend a closing meeting to sign the loan documents and pay any outstanding fees or costs. The new loan will then be funded, and the proceeds will be used to repay the existing loan. After the closing, the old loan will be paid off, and the borrower will begin making payments on the new loan. Borrowers should ensure they understand their new payment schedule and any potential penalties for late payments. Refinancing too often can lead to increased costs and may negate the potential savings from lower interest rates. Borrowers should carefully evaluate the costs and benefits of refinancing and consider waiting if the potential savings are minimal. While extending the loan term can reduce monthly payments, it can also increase the total interest paid over the life of the loan. Borrowers should weigh the benefits of lower payments against the potential long-term costs. Borrowers should be cautious about borrowing more than necessary, as this can lead to increased debt and higher monthly payments. It's essential to evaluate the purpose of the additional funds and consider other financing options if necessary. Failing to consider the various fees and costs associated with refinancing can lead to an inaccurate assessment of the potential savings. Borrowers should ensure they clearly understand all costs involved and factor these into their decision-making process. Refinancing can affect the borrower's tax situation, particularly if they are rolling other debts into their mortgage or utilizing a cash-out refinance. Borrowers should consult with a tax professional to understand the potential tax implications of refinancing. Refinancing can provide numerous benefits, including lower interest rates, shorter loan terms, reduced monthly payments, and access to cash for various purposes. However, it is crucial for borrowers to carefully evaluate their financial situation, identify their goals, and weigh the potential benefits against the costs. Making informed decisions about refinancing involves researching and comparing lenders, understanding the various loan options available, and considering the potential pitfalls. Borrowers should also consider their credit scores, the length of time they plan to stay in their home, and the impact of refinancing on their taxes. Ultimately, the decision to refinance should align with the borrower's personal financial goals and objectives. By carefully evaluating their situation and considering the potential benefits and drawbacks, borrowers can make informed decisions that will help them achieve their financial goals and improve their overall financial well-being.What Is Refinancing?

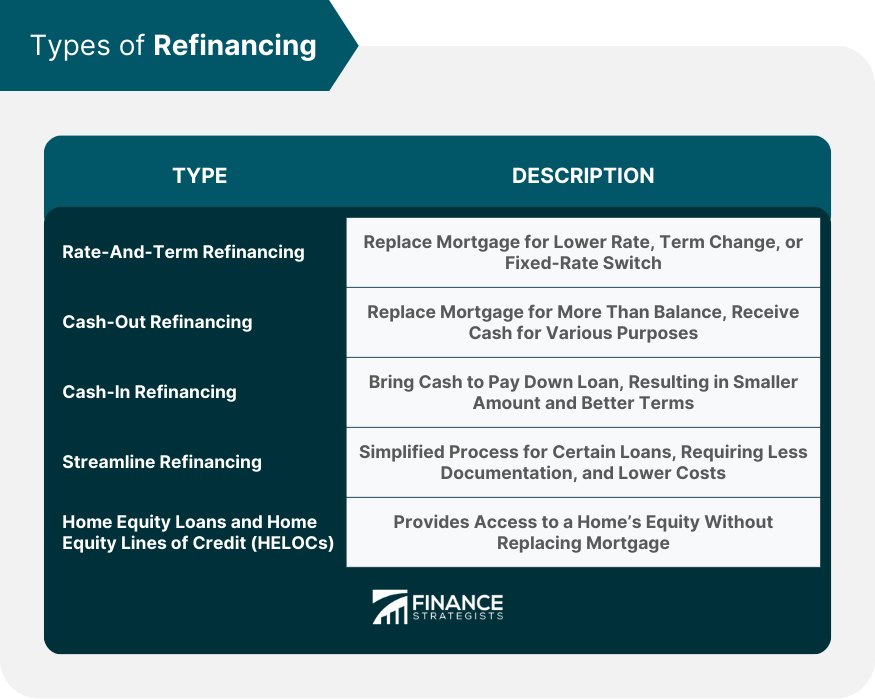

Types of Refinancing

Rate-and-Term Refinancing

Cash-Out Refinancing

Cash-In Refinancing

Streamline Refinancing

Home Equity Loans and Home Equity Lines of Credit (HELOCs)

Benefits of Refinancing

Lower Interest Rates

Shorter Loan Term

Lower Monthly Payments

Debt Consolidation

Access to Cash for Home Improvements or Other Expenses

Removal of Private Mortgage Insurance (PMI)

Shift from an Adjustable-Rate Mortgage (ARM) to a Fixed-Rate Mortgage

Costs of Refinancing

Closing Costs

Prepayment Penalties

Mortgage Points

Appraisal Fees

Title Search and Insurance Fees

Loan Origination Fees

Escrow Fees

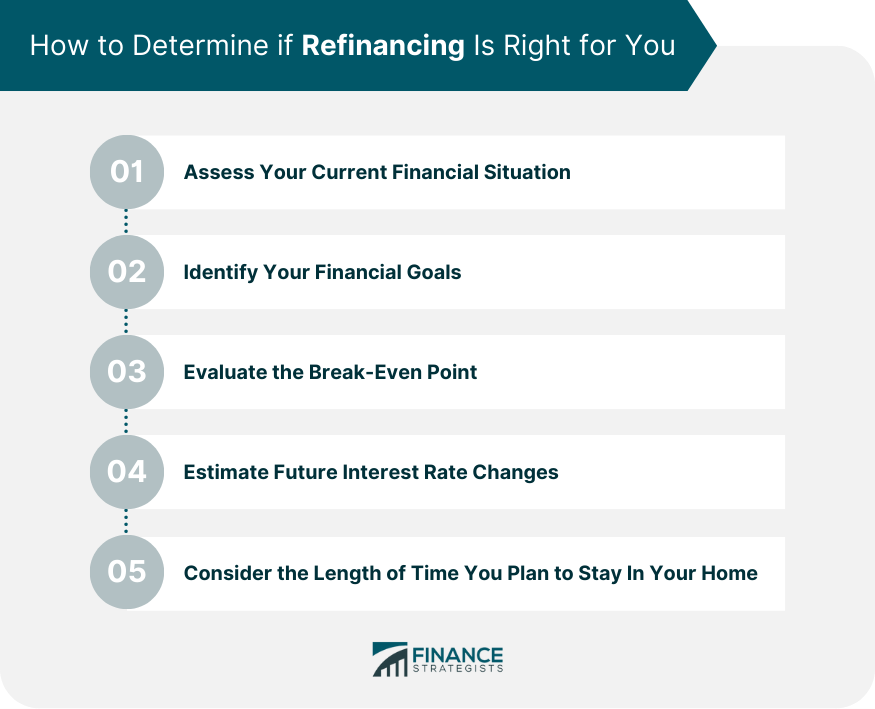

How to Determine if Refinancing is Right for You

Assess Your Current Financial Situation

Identify Your Financial Goals

Evaluate the Break-Even Point

Estimate Future Interest Rate Changes

Consider the Length of Time You Plan to Stay in Your Home

Choosing a Lender and Loan Terms

Researching and Comparing Lenders

Negotiating Loan Terms

Understanding the Importance of Credit Scores

Locking in the Interest Rate

Evaluating Fixed-Rate Versus Adjustable-Rate Mortgages

The Refinancing Process

Application and Documentation

Home Appraisal

Loan Underwriting

Closing on the New Loan

Paying Off the Old Loan

Refinancing Pitfalls to Avoid

Refinancing Too Frequently

Extending the Loan Term Excessively

Borrowing More Than Needed

Overlooking Fees and Costs

Failing to Consider the Impact on Taxes

Conclusion

Refinancing FAQs

Refinancing replaces an existing loan or debt obligation with a new one with more favorable terms, such as a lower interest rate or monthly payment.

You should consider refinancing your mortgage if you can secure a lower interest rate, reduce your monthly payment, or switch from an adjustable-rate mortgage to a fixed-rate mortgage.

The benefits of refinancing include lower interest rates, shorter loan term, lower monthly payments, debt consolidation, access to cash for home improvements or other expenses, and more.

Refinancing can affect your credit score, as it involves applying for a new loan or credit line. However, your credit score may improve in the long run if you make timely payments on the new loan.

Refinancing a mortgage may involve fees such as application fees, appraisal fees, title search fees, and loan origination fees. Considering these fees when deciding whether to refinance is important, as they can add up to thousands of dollars.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.