Call risk refers to the potential financial implications for bondholders when a bond issuer exercises their right to redeem, or "call," their outstanding bonds before the maturity date. Callable bonds often come with a predetermined call price and call date, allowing the issuer to repurchase the bonds at their discretion. Investors face call risk when they invest in callable bonds, as they may receive lower returns if the issuer calls the bonds earlier than expected. Fixed-income securities, such as bonds, provide a predictable stream of income for investors. However, when investing in callable bonds, the uncertainty of the call feature can disrupt this predictability, leading to call risk. Understanding the concept of call risk and its potential impact on an investment portfolio is essential for investors looking to navigate the fixed-income market. Call risk can stem from various factors, including interest rates, the issuer's financial condition, market conditions, and regulatory changes. When interest rates decline, issuers can refinance their debt at a lower cost by calling their existing bonds and issuing new bonds at lower rates. This scenario is unfavourable for bondholders, as they may have to reinvest the proceeds from the called bonds at lower interest rates, reducing their overall returns. If a bond issuer's financial condition improves, they may choose to call their existing bonds to reduce their interest expenses or restructure their debt. This decision can adversely affect bondholders, who may have to reinvest the proceeds at lower rates or face challenges finding similar investment opportunities. Changes in market conditions, such as increased demand for the issuer's products or services, can improve the issuer's financial position, making it more likely that they will call their bonds. Consequently, investors may face call risk if the bonds are redeemed earlier than expected. Regulatory changes can also influence the likelihood of an issuer calling their bonds. For example, tax law changes or changes in industry regulations may encourage issuers to call their bonds to take advantage of new financing options or comply with updated requirements. Various types of callable securities include callable bonds and preferred stocks. Callable bonds are debt securities that grant the issuer the right to redeem the bonds before their maturity date. Some common types of callable bonds include: Municipal bonds are issued by state and local governments to fund public projects. These bonds may be callable, allowing the issuer to redeem them before maturity to refinance their debt or adjust their borrowing costs. Corporate bonds are debt securities issued by corporations to raise capital. Some corporate bonds are callable, allowing the issuer to redeem them before their maturity date to reduce interest expenses or restructure their debt. Mortgage-backed securities (MBS) are a type of asset-backed security backed by mortgages. MBS may be callable, allowing the issuer to redeem them before their maturity date if mortgage prepayment rates increase or the issuer wants to restructure their portfolio. Preferred stocks represent an ownership stake in a company, and they typically provide a fixed dividend payment. Some types of preferred stocks are callable, including: Callable preferred stocks grant the issuing company the right to redeem the shares at a predetermined price before their maturity date. This option allows the issuer to reduce their dividend expenses or adjust their capital structure. Convertible preferred stocks are a type of preferred stock that can be converted into a predetermined number of common shares at the shareholder's discretion. These stocks may also be callable, allowing the issuer to redeem them before their conversion date to limit dilution or control their capital structure. Investors can assess call risk by considering several factors, including yield to call (YTC), yield to worst (YTW), call price and call date, and bond duration and convexity. Yield to Call measures the potential return on a callable bond if it is redeemed on its call date. YTC can help investors determine if a callable bond is suitable by comparing its return to other bonds with similar risk profiles. Yield to Worst is the lowest possible yield an investor can receive from a bond, considering all possible call and maturity scenarios. YTW helps investors gauge the minimum return they can expect from a callable bond, factoring in call risk. The call price is the predetermined price at which the issuer can redeem the bond, while the call date is the earliest date the bond can be called. Investors should evaluate the call price and call date to understand the potential impact of call risk on their investment. Duration measures a bond's sensitivity to interest rate changes, while convexity measures the rate at which the bond's duration changes as interest rates fluctuate. By analyzing a bond's duration and convexity, investors can better understand how call risk might affect the bond's price and yield in different interest rate environments. Investors can manage call risk through various strategies, including diversification, laddering bond portfolios, utilizing bond funds and ETFs, and monitoring interest rate movements. Investors can mitigate call risk by diversifying their bond portfolios with non-callable bonds or callable bonds with different call dates. This strategy helps reduce the overall impact of call risk on their fixed income investments. Laddering involves investing in bonds with different maturities, spreading the reinvestment risk over time. This approach helps mitigate call risk by ensuring that not all bonds in the portfolio are subject to being called at the same time. Investing in bond funds or exchange-traded funds (ETFs) can help manage call risk by providing exposure to a diversified portfolio of bonds, reducing the impact of individual callable bonds being redeemed early. Keeping a close eye on interest rate trends can help investors anticipate potential call risk. If interest rates are declining, investors may consider adjusting their bond portfolio to minimize the impact of bonds being called. Various call protection mechanisms and call provisions can help mitigate the impact of call risk on investors. A call protection period is a specified timeframe during which the issuer cannot call the bond. This feature provides investors with a degree of certainty regarding the bond's income stream and helps minimize call risk. Make-whole call provisions require the issuer to pay bondholders a premium, typically based on the present value of future coupon payments, if the bond is called early. This provision compensates investors for the potential loss of income due to the early redemption of the bond. Soft call provisions allow the issuer to call the bond only under specific conditions, such as a change in credit rating or a significant event affecting the issuer's financial position. This provision can help protect investors by limiting the circumstances under which the bond can be called. Step-up callable bonds feature a coupon rate that increases over time, typically in conjunction with call dates. This structure incentivizes the issuer to call the bond as the coupon rate increases, providing investors with higher yields if the bond is not called early. Call risk can have several implications for investors, including reinvestment risk, price risk, income risk, and credit risk. Reinvestment risk occurs when investors must reinvest the proceeds from a called bond at a lower interest rate than the original bond. This scenario can lead to lower returns and negatively impact an investor's overall fixed-income portfolio performance. Price risk refers to the potential loss in the market value of a callable bond due to changes in interest rates or the likelihood of the bond being called. If interest rates decline, the bond's price may increase, reflecting the higher likelihood of the bond being called, leading to capital losses for investors who need to sell the bond before it is called. Income risk arises when the issuer calls a bond, reducing the predictable income stream for the investor. Callable bonds can disrupt an investor's income planning, especially if the bond is called at an inopportune time or if the investor cannot find a suitable replacement investment. Credit risk is the possibility that the bond issuer will default on their interest or principal payments. While not directly related to call risk, credit risk can impact the likelihood of a bond being called, as issuers with improved credit ratings may be more likely to call their bonds to refinance at lower interest rates. Investors must understand call risk when navigating the fixed income market, as it can significantly impact their investment returns and portfolio performance. By recognizing the causes, types, and implications of call risk, investors can make more informed decisions about their fixed-income investments. Effectively managing and mitigating call risk is essential for investors seeking to maximize their fixed-income portfolio performance. Employing strategies such as diversification, laddering, utilizing bond funds and ETFs, and monitoring interest rate movements can help investors minimize the potential negative impact of call risk. Investors can navigate callable securities by understanding various call protection mechanisms and call provisions, measuring call risk through metrics such as YTC and YTW, and assessing the potential implications of call risk on their investment portfolio. Investors can mitigate call risk and achieve their financial goals by carefully evaluating callable securities and employing prudent investment strategies. In order to effectively manage your investments and mitigate call risk, consider seeking the assistance of a professional wealth management service. Wealth management experts can help you create a diversified investment portfolio, employ effective investment strategies, and monitor your investments to ensure maximum returns. What Is Call Risk?

Causes of Call Risk

Declining Interest Rates

Issuer's Financial Condition

Market Conditions

Regulatory Changes

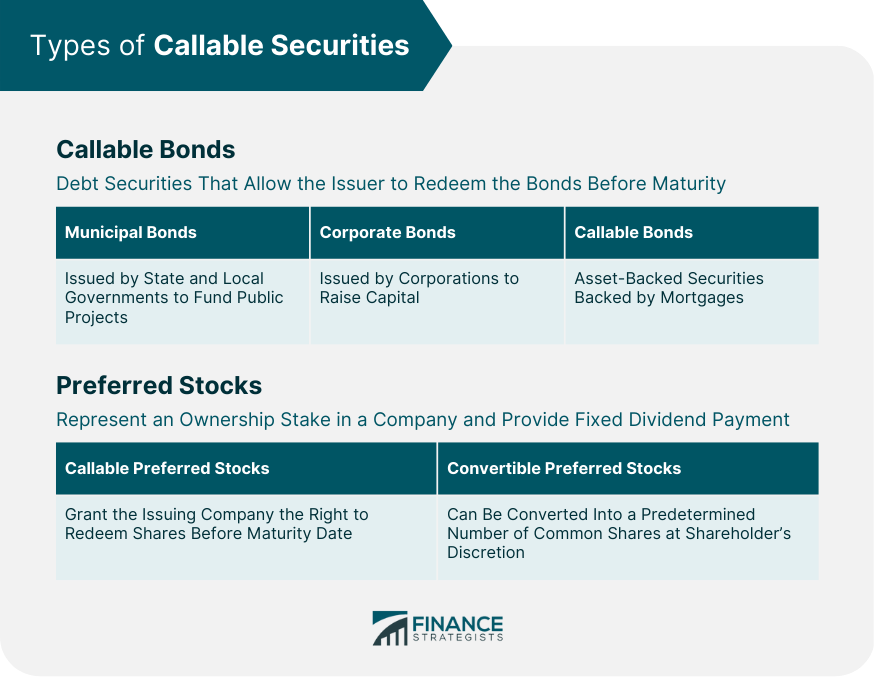

Types of Callable Securities

Callable Bonds

Municipal Bonds

Corporate Bonds

Mortgage-Backed Securities

Preferred Stocks

Callable Preferred Stocks

Convertible Preferred Stocks

Measuring Call Risk

Yield to Call (YTC)

Yield to Worst (YTW)

Call Price and Call Date

Duration and Convexity

Managing Call Risk

Diversification

Laddering Bond Portfolios

Utilizing Bond Funds and ETFs

Monitoring Interest Rate Movements

Call Protection and Call Provisions

Call Protection Period

Make-Whole Call Provisions

Soft Call Provisions

Step-Up Callable Bonds

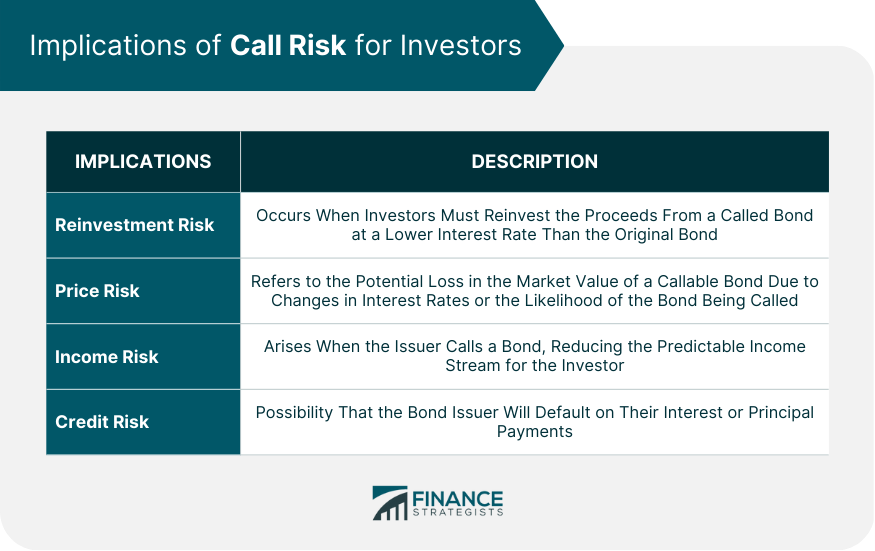

Implications of Call Risk for Investors

Reinvestment Risk

Price Risk

Income Risk

Credit Risk

Final Thoughts

Call Risk FAQs

Call risk refers to the potential financial implications for bondholders when a bond issuer exercises their right to redeem, or "call," their outstanding bonds before the maturity date.

Investors can manage call risk through various strategies, including diversification, laddering bond portfolios, utilizing bond funds and ETFs, and monitoring interest rate movements.

Call risk can have several implications for investors, including reinvestment risk, price risk, income risk, and credit risk.

Investors can assess call risk by considering several factors, including yield to call (YTC), yield to worst (YTW), call price and call date, and bond duration and convexity.

Understanding the concept of call risk and its potential impact on an investment portfolio is essential for investors looking to navigate the fixed-income market and make informed decisions about their investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.