A 403(b) plan, also known as a tax-sheltered annuity (TSA) plan, is a retirement savings option available to employees of certain tax-exempt organizations. These organizations include schools, hospitals, and non-profit entities. The primary objective of a 403(b) plan is to assist employees in building a retirement nest egg by offering tax advantages and long-term investment opportunities tailored to the non-profit sector. The purpose of a 403(b) plan is to provide employees of tax-exempt organizations with a vehicle to save for retirement while benefiting from tax advantages. These plans play a vital role in helping employees secure their financial future by allowing them to contribute a portion of their income toward retirement savings. The importance of a 403(b) plan lies in its ability to offer tax advantages, higher contribution limits, employer contributions, and investment options tailored to the needs of non-profit employees. It empowers individuals to take control of their retirement planning and work towards financial security during their post-employment years. To participate in a 403(b) plan, individuals must be employed by a qualifying tax-exempt organization. Eligible employees have the choice to enroll in the plan voluntarily. By participating, employees can take advantage of the benefits and opportunities offered by the 403(b) plan to grow their retirement savings. 403(b) plans have contribution limits set by the Internal Revenue Service (IRS) to ensure compliance with tax regulations. For 2024, the annual contribution limit is $23,000 for individuals under 50 years old. Those aged 50 and above have the option to make additional catch-up contributions of up to $7,500 per year. Participants can contribute to their 403(b) plan through pre-tax salary deferrals. This means that contributions are deducted from their income before taxes are calculated. It allows participants to reduce their taxable income for the year, potentially lowering their overall tax liability. Many employers offering 403(b) plans provide additional incentives for employee participation. One common incentive is employer matching contributions. Under this arrangement, the employer matches a portion of the employee's contribution, up to a specific percentage or dollar amount. Employer matches are essentially free money that employees can add to their retirement savings, increasing their overall account balance. 403(b) plans offer a range of investment options to suit different risk preferences and financial goals. These options may include mutual funds, annuities, and other investment vehicles. Participants can select from the investment options made available by their plan administrator. This flexibility empowers participants to tailor their investment strategy according to their risk tolerance and desired returns. 403(b) plans provide significant tax advantages that can enhance participants' retirement savings efforts. One of the main benefits of a 403(b) plan is the tax-deferred growth of investments. Contributions made to the plan, as well as the subsequent earnings, grow on a tax-deferred basis. This means that participants do not pay taxes on the growth until they make withdrawals during retirement. Tax-deferred growth allows investments to potentially accumulate more over time, as the earnings are reinvested without being reduced by annual tax obligations. Contributions made to a traditional 403(b) plan are pre-tax, which means that they are deducted from the participant's income before taxes are applied. This results in a reduced taxable income for the year, potentially lowering the participant's overall tax liability. By taking advantage of pre-tax contributions, participants can allocate more of their earnings toward retirement savings. Some 403(b) plans offer a Roth option, known as a Roth 403(b). With this option, participants contribute to their 403(b) plan on an after-tax basis. While these contributions do not provide an immediate tax benefit, qualified withdrawals during retirement are tax-free. The Roth 403(b) option can be advantageous for individuals who anticipate being in a higher tax bracket during retirement or who prefer tax-free withdrawals in later years. 403(b) plans have higher contribution limits compared to individual retirement accounts (IRAs). This allows participants to contribute more money to their retirement savings each year, potentially accelerating the growth of their nest egg. The higher contribution limits are particularly beneficial for individuals who have the means to save a larger portion of their income. Participants aged 50 and above have the opportunity to make catch-up contributions to their 403(b) plan. This provision allows older individuals who may have fallen behind on their retirement savings to make additional contributions beyond the regular limits. Catch-up contributions provide a valuable opportunity for these individuals to bridge the savings gap and make significant progress toward their retirement goals. 403(b) plans offer portability, meaning that participants can maintain their retirement savings when changing employers. This provides flexibility and avoids disruption in the retirement savings process. Participants may also have the option to consolidate their 403(b) plans with other retirement accounts, simplifying their overall retirement portfolio management and potentially reducing administrative fees. One potential drawback of 403(b) plans is the limited selection of investment options compared to other retirement savings vehicles. Participants may have fewer choices when it comes to specific investment strategies or asset classes. It is important for individuals to carefully assess the available investment options and determine if they align with their desired investment approach and risk tolerance. 403(b) plans impose penalties for early withdrawals. If participants withdraw funds from their 403(b) account before reaching age 59½, they may be subject to a 10% penalty in addition to regular income taxes. These penalties are intended to discourage participants from tapping into their retirement savings prematurely, promoting long-term savings habits and financial stability. Once participants reach the age of 73, they are required to start taking minimum distributions from their 403(b) plans. These required minimum distributions (RMDs) ensure that participants withdraw a portion of their savings and pay taxes on the distributed amount. It is essential to plan for RMDs to avoid penalties and maintain compliance with IRS regulations. 403(b) plans may involve various fees and expenses, such as administrative fees, investment management fees, and transaction costs. These fees can impact the overall returns on investments and reduce the growth potential of the retirement savings. Participants should carefully review the fee structure of their 403(b) plan, compare it to other available options, and consider the potential impact on their long-term savings. The rules and regulations governing 403(b) plans can evolve over time. Changes may include adjustments to contribution limits, withdrawal rules, and tax implications. Participants should stay informed about any updates or modifications to ensure compliance and make appropriate adjustments to their retirement strategy. One key component to understanding the benefits of 403(b) plans is examining how they stack up against other popular retirement plans. Both 403(b) and 401(k) plans offer similar tax advantages, matching contributions from employers, and catch-up provisions. The main difference lies in the types of employers that offer these plans. 403(b) plans are primarily offered to employees of tax-exempt organizations like schools, hospitals, and churches, whereas 401(k) plans are common in the private sector. In terms of investment options, 401(k) plans typically offer a wider array compared to 403(b) plans. While both 403(b) plans and traditional IRAs offer pre-tax contributions, the major benefit of a 403(b) plan is the potentially higher contribution limit and the possibility of matching contributions from employers, features that traditional IRAs lack. However, traditional IRAs often offer greater investment flexibility, unlike the more restricted choices in 403(b) plans. The primary difference between 403(b) plans and Roth IRAs lies in their tax treatment. Contributions to 403(b) plans are made pre-tax, reducing your taxable income now but requiring you to pay taxes upon withdrawal in retirement. On the other hand, Roth IRA contributions are made post-tax, so you don't receive a tax break now, but qualified distributions in retirement are tax-free. Additionally, Roth IRAs have income eligibility requirements, whereas 403(b) plans do not. 403(b) plans offer valuable benefits and advantages for employees of tax-exempt organizations who seek to maximize their retirement savings. With tax advantages, higher contribution limits, employer contributions, and investment options tailored to the needs of non-profit employees, 403(b) plans can significantly contribute to long-term financial security. However, it is important to consider the potential drawbacks and limitations of 403(b) plans, including limited investment options, early withdrawal penalties, required minimum distributions, plan fees, and changing regulations. By understanding these factors, individuals can make informed decisions and effectively navigate their 403(b) plans to achieve their retirement goals. Carefully evaluating the features of a 403(b) plan, seeking professional advice, and staying informed about updates in regulations can empower individuals to make the most of their retirement savings opportunities. By leveraging the benefits and managing the challenges, participants can work towards a secure financial future during their retirement years.What Is a 403(b) Plan?

Definition

Purpose and Importance

How 403(b) Plans Work

Eligibility and Participation

Contribution Limits and Options

Employer Contributions and Matches

Investment Options

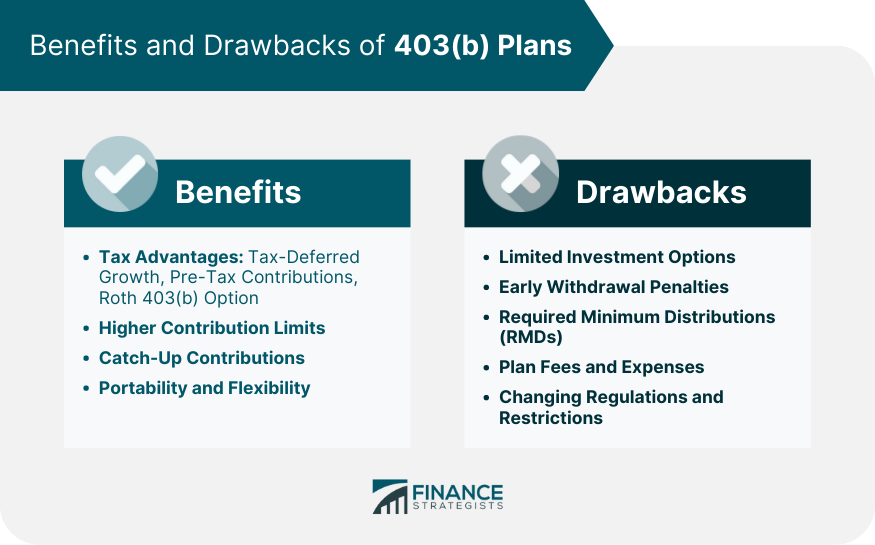

Benefits of 403(b) Plans

Tax Advantages

Tax-Deferred Growth

Pre-Tax Contributions

Roth 403(b) Option

Higher Contribution Limits

Catch-Up Contributions

Portability and Flexibility

Drawbacks of 403(b) Plans

Limited Investment Options

Early Withdrawal Penalties

Required Minimum Distributions (RMDs)

Plan Fees and Expenses

Changing Regulations and Restrictions

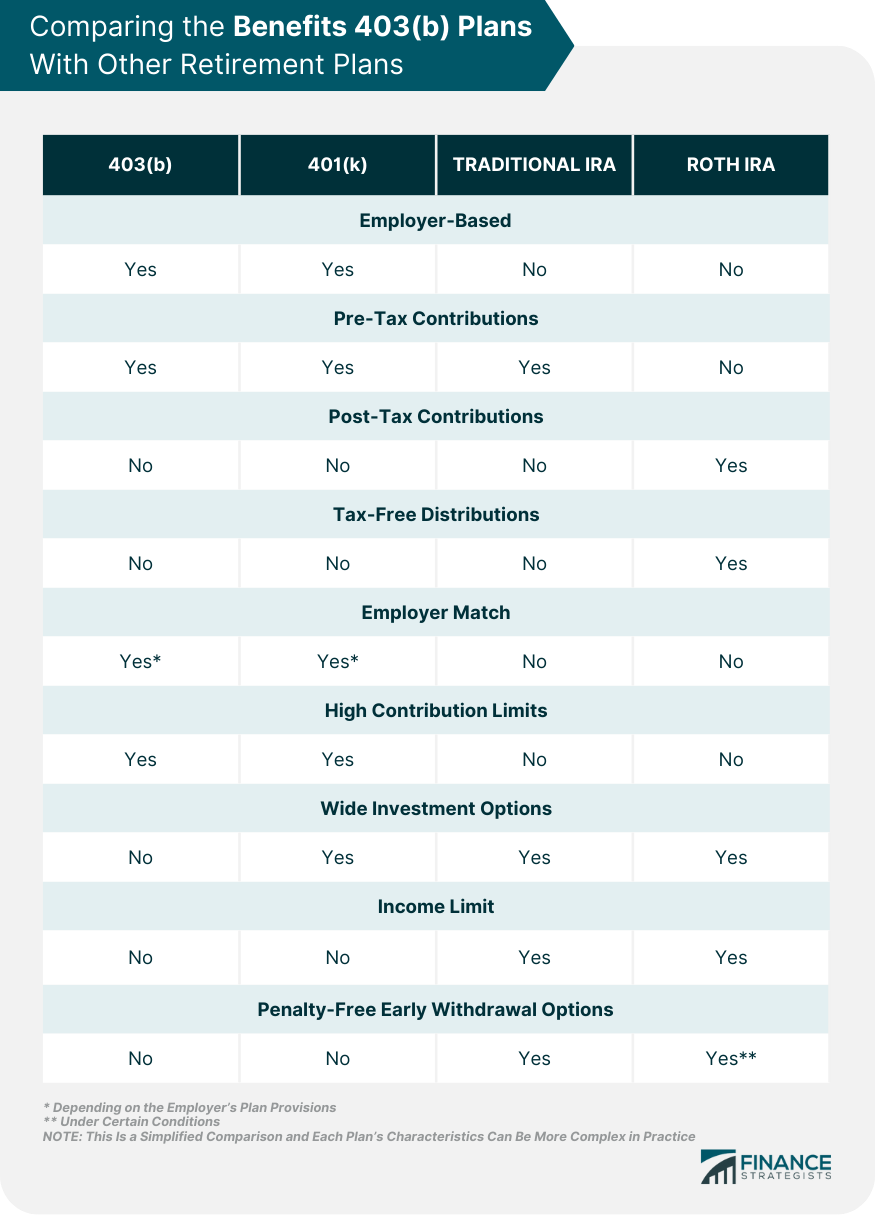

Comparing the Benefits 403(b) Plans With Other Retirement Plans

403(b) vs 401(k)

403(b) vs Traditional IRA

403(b) vs Roth IRA

Conclusion

Benefits of 403(b) Plans FAQs

Benefits of 403(b) plans include tax advantages, higher contribution limits, employer matches, investment options, and portability.

The maximum amount you can contribute to a 403(b) plan in 2023 is $22,500. If you are 50 years old or older, you can make catch-up contributions of $7,500, bringing your total contribution limit to $30,000.

Yes, 403(b) plans provide tax-deferred growth and pre-tax contributions, reducing your taxable income and allowing investments to grow without immediate tax implications.

Many employers offering 403(b) plans provide employer matches, which are additional contributions to your plan based on a percentage of your own contributions.

A5: Yes, 403(b) plans offer portability, allowing you to maintain your retirement savings and transfer them to a new employer's plan or an individual retirement account (IRA).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.