Employer contributions refer to the funds that employers allocate to their employees' retirement plans, either through matching programs, profit-sharing, or other methods. These contributions play a significant role in supporting employees' retirement savings and fostering a culture of financial wellness within the organization. Employer contributions enhance employees' retirement savings, helping workers achieve long-term financial goals. These also serve as an attractive incentive for employee retention and satisfaction, sharing the responsibility of retirement planning between workers and employers. In these employer-sponsored retirement plans, companies may offer matching contributions based on employees' own contributions or make discretionary contributions, regardless of worker participation. Similar to 401(k) plans, 403(b) plans cater to employees of non-profit organizations, public schools, and certain religious institutions. Employers may provide matching or discretionary contributions to boost employees' retirement savings. Designed for state and local government employees and certain non-governmental organizations, 457 plans may also include employer matching or discretionary contributions to support workers' retirement goals. In traditional pension plans, employers guarantee a specific monthly benefit to employees upon retirement. The employer is responsible for funding and managing the plan, which typically involves making regular contributions to a pooled investment fund. SEP plans allow self-employed individuals and small business owners to make tax-deductible contributions to their employees' retirement accounts, often with higher contribution limits than traditional IRAs. Designed for small businesses with 100 or fewer employees, SIMPLE plans require employers to make either matching or non-elective contributions to their employees' retirement accounts. Employers can choose various formulas for matching employee contributions, such as a dollar-for-dollar match or a percentage-based match up to a certain limit. Employers may set their own eligibility requirements for matching contributions, such as a minimum length of service or specific employee classifications. Employers may choose to make discretionary profit-sharing contributions to their employees' retirement accounts, based on company performance and other factors. Profit-sharing contributions can be allocated to employees using various formulas, such as a pro-rata distribution based on salary or a more complex method that considers age and years of service. Employers may allow employees to gain full ownership of employer contributions immediately upon receipt. Under a graded vesting schedule, employees gain ownership of employer contributions gradually over a specified period, usually in annual increments. With cliff vesting, employees become fully vested in employer contributions after a specific period of service, with no partial vesting in the interim. Employer contributions to qualified retirement plans are generally tax-deductible, reducing the employer's taxable income. Investments within retirement accounts grow tax-deferred, meaning that taxes are paid upon withdrawal rather than on annual gains. Offering competitive employer contributions can help attract and retain top talent, as employees are more likely to remain with a company that supports their long-term financial goals. Employer contributions can significantly boost employees' retirement savings, making it easier for workers to achieve a comfortable retirement. Employers can benefit from tax deductions for contributions to their employees' retirement plans, reducing a company’s overall taxable income and providing incentives to support retirement planning. By offering employer contributions, companies share the responsibility of retirement planning with their employees, fostering a culture of financial wellness and long-term financial security. Some employers may face financial constraints or budget limitations that hinder their ability to offer competitive employer contributions, impacting their ability to attract and retain talent. Managing retirement plans and employer contributions can be administratively complex, requiring dedicated resources and expertise to ensure compliance with regulations and plan requirements. Employers must navigate various regulations and requirements related to retirement plans and employer contributions, which can be challenging and time-consuming. Encouraging employees to actively participate in their retirement plans and take full advantage of employer contributions can be difficult, especially when faced with financial illiteracy or competing financial priorities. Employers can design a matching program that incentivizes employees to contribute to their retirement plans, encouraging higher savings rates and long-term employee commitment. Incorporating profit-sharing contributions can motivate employees to contribute to the company's success, as they directly benefit from improved financial performance. Employers can help employees make informed decisions about their retirement planning by offering educational resources, workshops, and access to professional financial advice. Offering a wide variety of investment options within retirement plans can cater to employees' diverse risk tolerances, time horizons, and financial goals, encouraging active participation and engagement. Employers should periodically review and adjust their contribution policies to ensure they remain competitive and effective in supporting employees' retirement planning needs. Employer contributions play a vital role in supporting employees' retirement planning efforts, offering financial incentives for participation and fostering a culture of financial wellness. By providing competitive employer contributions, companies can attract and retain top talent while sharing the responsibility of retirement planning. It is essential for employers to actively support their employees' retirement planning efforts through competitive employer contributions, educational resources, and ongoing communication. By doing so, employers can contribute to their employees' long-term financial security and overall satisfaction. Continued education and communication with employees about retirement planning and employer contributions can help them make informed decisions and maximize the benefits of their retirement plans. Employers should prioritize fostering a culture of financial wellness, ensuring their workforce is well-equipped for a secure retirement.What Are Employer Contributions?

Types of Retirement Plans With Employer Contributions

Defined Contribution Plans

401(k) Plans

403(b) Plans

457 Plans

Defined Benefit Plans

Traditional Pension Plans

Simplified Employee Pension (SEP) Plans

Savings Incentive Match Plan for Employees (SIMPLE) Plans

Factors Affecting Employer Contributions

Matching Contributions

Matching Formulas

Eligibility Requirements

Profit-Sharing Contributions

Discretionary Contributions

Allocation Formulas

Vesting Schedules

Immediate Vesting

Graded Vesting

Cliff Vesting

Tax Implications

Tax-Deductible Contributions

Tax-Deferred Growth

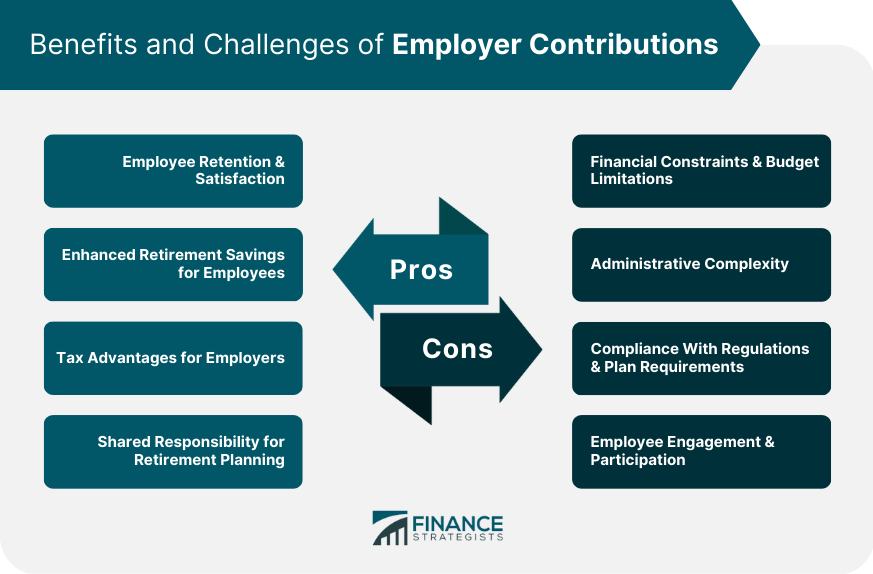

Benefits of Employer Contributions

Employee Retention and Satisfaction

Enhanced Retirement Savings for Employees

Tax Advantages for Employers

Shared Responsibility for Retirement Planning

Challenges and Barriers to Employer Contributions

Financial Constraints and Budget Limitations

Administrative Complexity

Compliance With Regulations and Plan Requirements

Employee Engagement and Participation

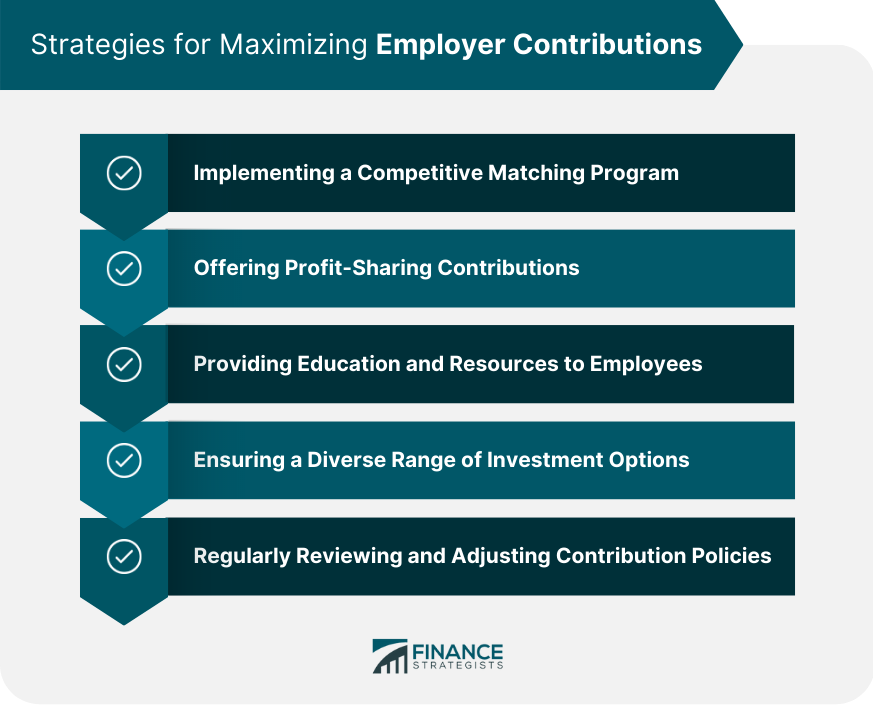

Strategies for Maximizing Employer Contributions

Implementing a Competitive Matching Program

Offering Profit-Sharing Contributions

Providing Education and Resources to Employees

Ensuring a Diverse Range of Investment Options

Regularly Reviewing and Adjusting Contribution Policies

Conclusion

Employer Contributions FAQs

Employer contributions are payments made by employers towards their employees' retirement plans, such as 401(k)s, pensions, or profit-sharing plans. These contributions are separate from the employee's salary and are usually a percentage of the employee's earnings.

The amount they contribute to retirement plans varies depending on the employer, plan type, and plan terms. Some employers may contribute a fixed dollar amount per employee, while others may match a percentage of the employee's contribution up to a certain limit. It's important to review your employer's plan to understand the contribution structure.

The advantages of receiving employer contributions to a retirement plan include building a larger nest egg for retirement, taking advantage of employer matching contributions, potentially receiving a higher retirement income, and reducing taxable income.

No, not all employers offer retirement plan contributions. It's important to review your employer's benefits package to determine if they offer any retirement plan contributions, and if so, what the contribution structure is.

Yes, employer contributions to a retirement plan can be vested, meaning the employee has earned the right to the contributions over time. Vesting schedules vary by employer and plan type but typically range from immediate vesting to vesting over several years. It's important to understand your employer's vesting schedule to ensure you receive the full benefits of the employer contributions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.