A 403(b) retirement plan is a type of tax-sheltered annuity plan specifically designed for employees of public schools, certain tax-exempt organizations, and certain ministers. This plan is named after the section of the Internal Revenue Code that established it, and it enables employees to save for retirement by making pre-tax contributions. These contributions are invested, and any earnings on the investments are not taxed until they are distributed, typically during retirement. Deciding to quit your job is a major life decision that comes with numerous financial implications. This is especially true if you have benefits tied to your employment, such as a 403(b) retirement plan.

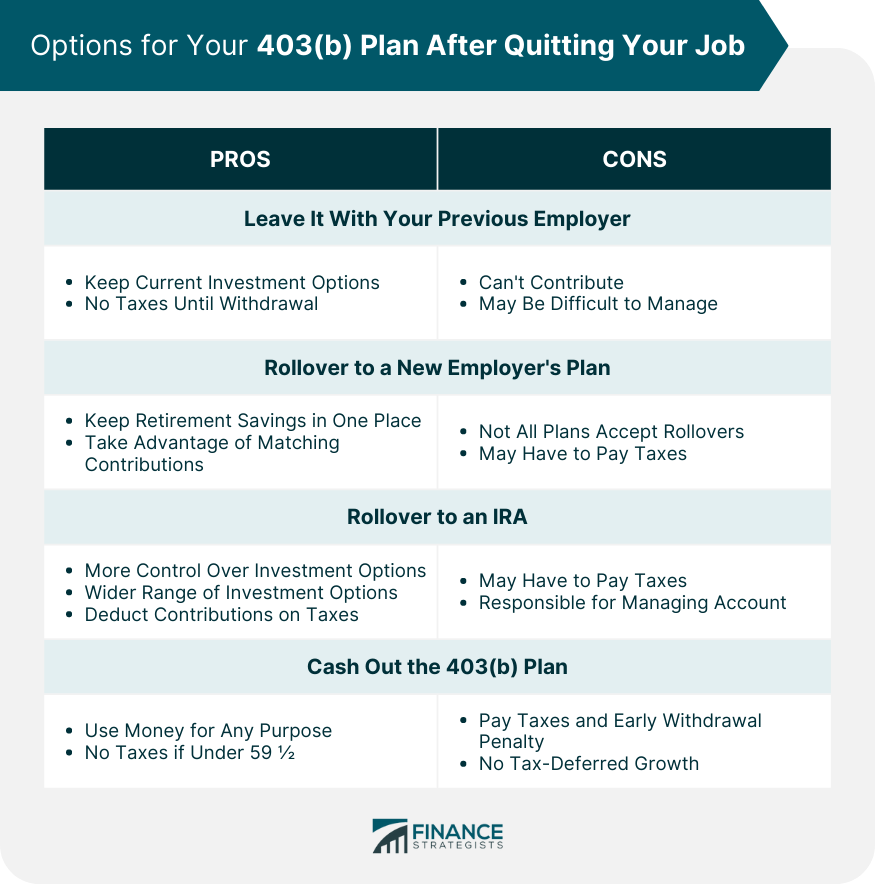

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. A non-profit lawyer planning to join a private firm was concerned about her 403(b) plan. We explored options like rolling it into an IRA for broader investment choices, or transferring to her new employer's 401(k) to maintain the tax-deferred status. Post-transition, she found her retirement savings effectively adapted to her new role, benefiting from the IRA's varied options. This ensured her financial goals were still on track, aligning her retirement strategy with her career change. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation The first thing to understand when you quit your job is that your 403(b) plan doesn't disappear. The money you have already contributed to the plan remains yours. Your account stays intact, regardless of your employment status. Even if you are no longer contributing to your 403(b) plan after quitting, your invested funds can continue to grow based on the performance of the underlying investments. This means that the balance in your account could increase over time due to compound interest, dividends, and capital gains. When you quit your job, your employer will cease any matching contributions to your 403(b) plan. This is because employer contributions are tied to your contributions and your employment status. Depending on your employer's vesting schedule, you might not be entitled to all of the employer contributions in your account at the time of your departure. While your contributions are always 100% vested (i.e., they are yours to keep), the same is not always true for employer contributions. If you quit before you are fully vested, you could forfeit some or all of your employer's contributions. One option for handling your 403(b) plan after quitting your job is to simply leave it with your previous employer. This means that the money will stay invested in the plan, and it can continue to grow tax-deferred until you begin making withdrawals. There can be advantages to this option. For example, you might prefer the investment options in your 403(b) plan to those available in an IRA. Also, if you have at least $5,000 in the account, federal law prohibits your former employer from forcing you out of the plan. On the downside, you can no longer contribute to the plan, and you might find it harder to manage the account if you are no longer in regular contact with your former employer. If you're moving to a new job that offers a 401(k) or another eligible retirement plan, you might be able to rollover your 403(b) plan to your new employer's plan. This is generally a good option if you want to keep your retirement savings all in one place, and your new employer's plan offers good investment options. However, not all employer plans accept rollovers, so you'll need to check the rules of your new employer's plan. The rollover process typically involves contacting the administrator of your 403(b) plan and initiating a direct rollover to your new employer's plan. The timeline for the rollover can vary, but it usually takes a few weeks. During this time, the money is not invested, which means it is not exposed to market risk, but it also means it is not growing. The rollover should be a non-taxable event as long as it is completed within 60 days. However, if the money is accidentally paid to you instead of being directly rolled over to the new plan, it will be considered a distribution and subject to taxes and possibly early withdrawal penalties. Another option for your 403(b) plan after quitting is to rollover the money to an Individual Retirement Account (IRA). IRAs come in two main types: traditional and Roth. Both offer a wide range of investment options, and both have potential tax advantages. Traditional IRAs are similar to 403(b) plans in that contributions are often tax-deductible, and earnings are not taxed until they are distributed. Roth IRAs are funded with after-tax dollars, but qualified distributions are tax-free. The process of rolling over to an IRA is similar to the process of rolling over to a new employer's plan. It involves contacting your 403(b) plan administrator and initiating a direct rollover to the IRA. It's important to specify that you want a direct rollover to avoid any tax withholdings. Rollovers from a 403(b) plan to a traditional IRA are usually non-taxable events. However, if you decide to rollover your 403(b) plan to a Roth IRA, you will have to pay taxes on the money in the year of the conversion since Roth IRAs are funded with after-tax dollars. Cashing out your 403(b) plan is an option, but it's generally not a good one unless you're facing severe financial hardship. If you cash out your plan before you reach age 59 ½, not only will you owe taxes on the full amount of the distribution, but you'll also be hit with a 10% early withdrawal penalty. Cashing out your 403(b) plan can push you into a higher tax bracket, resulting in a large tax bill. And remember, the money you withdraw will no longer be growing tax-deferred for your retirement. While the range of options available to you when you quit your job may seem daunting, considering some key factors can help you make the best decision for your unique circumstances. Your current financial situation should be one of the first things you consider when deciding what to do with your 403(b) plan. If you have a significant amount of high-interest debt, for instance, you might consider withdrawing some of your retirement funds to pay off that debt, despite the potential tax implications and penalties. However, if you're in a stable financial position, you may prefer to leave your funds untouched and let them continue growing for retirement. Your retirement goals should also play a significant role in your decision. If your aim is to retire early, for example, you might prefer the flexibility and investment options of an IRA over leaving your money in your previous employer's 403(b) plan. Alternatively, if you plan to work until traditional retirement age and have a large balance in your 403(b), leaving the money in the plan or rolling it over to your new employer's plan may provide the most straightforward path to meet your goals. The tax implications of your decision can be significant. Withdrawing funds, especially if you are under the age of 59 ½, can result in taxes and penalties that significantly reduce the amount of money you receive. On the other hand, a rollover, if done correctly, can allow you to continue deferring taxes on your retirement savings. Your age and the timing of your decision are also critical. If you are close to retirement age, your options may be different from someone who is in the early stages of their career. For instance, you may want to avoid making any decisions that could trigger a taxable event and thus increase your income during a year when you might already be transitioning into a lower income bracket. Furthermore, if you're under the age of 59 ½, you should be aware that certain decisions, such as cashing out your 403(b) plan, can trigger an early withdrawal penalty. There are exceptions to this rule, however, such as if you leave your job in or after the year you turn 55. After quitting a job, several options are available for handling your 403(b) retirement plan. You can maintain the account with your previous employer, rollover to a new employer's plan, rollover to an IRA, or cash out the plan. Each option comes with its own set of implications. Maintaining the account and rollovers provide continued growth of your funds, while cashing out may lead to tax penalties. Proper financial planning is crucial to ensure a secure and comfortable retirement. Professional financial advice can be invaluable in navigating the complex financial and tax implications of handling a 403(b) plan post-employment. Each individual's situation is unique. Therefore, it's recommended to do thorough research and consult with a financial advisor to make the most informed decisions about your 403(b) retirement plan when you leave your job.Overview of 403(b) Retirement Plan

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Immediate Impact on 403(b) Plan When You Quit Your Job

Maintaining the Account

Account Remains in Your Name

Invested Funds Can Continue to Grow

Loss of Employer Contributions

No Longer Receive Employer Contributions

May Not Be Fully Vested in Employer’s Contributions

Options for Your 403(b) Plan After Quitting Your Job

Leave It With Your Previous Employer

How This Works

Advantages and Disadvantages

Rollover to a New Employer's Plan

Eligibility Considerations

Procedure and Timeline for Rolling Over

Tax Implications

Rollover to an Individual Retirement Account (IRA)

Types of IRAs and Their Benefits

Process of Rolling Over to an IRA

Tax Implications

Cash Out the 403(b) Plan

Penalty for Early Withdrawal

Tax Implications

Considerations When Choosing an Option

Current Financial Situation

Future Retirement Goals

Tax Implications

Age and Timing Considerations

The Bottom Line

403(b) Retirement Plan and the Impacts of Quitting Your Job FAQs

When you quit your job, your 403(b) plan remains intact. However, employer contributions cease, and you might lose some funds depending on the vesting schedule. You can choose to leave the plan as is, rollover to a new employer's plan or an IRA, or cash out the plan.

No, you cannot continue contributing to your 403(b) after you quit your job. However, your investments within the plan can continue to grow.

Cashing out your 403(b) plan can result in significant tax implications. The entire amount is considered taxable income, and if you're under the age of 59 ½, you'll likely face a 10% early withdrawal penalty as well.

Yes, if your new employer's plan accepts rollovers, you can move your 403(b) plan to your new employer's plan. This process involves a direct transfer and is usually not a taxable event.

The decision depends on your individual circumstances, financial goals, and the specifics of the plans. Each option has its own pros and cons, so it's advisable to consult with a financial advisor.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.