The term "403(b) Withdrawal Rules" pertains to the regulations surrounding the withdrawal of funds from a 403(b) retirement plan. Typically, such plans cater to employees of public schools, tax-exempt organizations, and certain ministers. The purpose of these rules is to govern when and how participants can withdraw their retirement savings, while also encouraging long-term saving by imposing penalties for early withdrawal. The impact on readers, specifically those enrolled in 403(b) plans, is significant as these rules directly influence their financial strategies and retirement planning. Understanding these rules can help participants avoid unnecessary penalties, optimize tax implications, and maximize their retirement income. By knowing when withdrawals can be made, under what circumstances, and the associated tax and penalty consequences, individuals can make informed decisions about their retirement funds. Withdrawing from a 403(b) plan is not as straightforward as it may seem. It is subject to strict rules to prevent misuse and ensure the longevity of your retirement savings. Generally, the earliest you can withdraw from your 403(b) plan without incurring penalties is at age 59 ½. Any withdrawals before this age are considered early withdrawals and may be subject to a 10% additional tax. Upon retirement or termination of employment, you are eligible to withdraw your funds from the 403(b) plan. However, any distributions will be subject to ordinary income tax. The IRS recognizes certain exceptions to the early withdrawal penalty. These include becoming disabled, incurring medical expenses exceeding 7.5% of your adjusted gross income, or being called to active duty as a military reservist. One of the fundamental aspects of 403(b) withdrawal rules is the 59½ rule. The rule is simple in theory but can lead to penalties if not properly understood. According to the IRS, a participant may begin to withdraw money from a 403(b) account after reaching age 59 ½ without having to pay a 10% early withdrawal penalty. This rule is created to encourage individuals to save for retirement and discourage them from using their retirement savings prematurely. Withdrawing funds before you reach age 59 ½ can result in a 10% penalty tax on the distribution in addition to the regular income tax. These penalties can erode your retirement savings significantly. The IRS mandates that account holders start taking a certain amount of money, known as a Required Minimum Distribution (RMD), from their retirement accounts by April 1 of the year following the year they turn 73. The RMD is the minimum amount you must withdraw from your 403(b) account each year when you reach age 73. The aim of the RMD rule is to ensure that people don't just accumulate retirement accounts but actually spend them during retirement. The RMD amount is calculated by dividing your 403(b) account balance as of the end of the previous year by a distribution period determined by the IRS. This distribution period is based on your life expectancy. The RMD rules require you to start withdrawing money from your 403(b) plan and can influence your withdrawal strategy in retirement. If you fail to take your RMD, the amount not withdrawn is taxed at 50%. The 72(t) rule provides a method to avoid the 10% early withdrawal penalty, providing an avenue for those who need to access their funds earlier. The 72(t) rule, named after the tax code that defines it, allows for penalty-free, early withdrawals from a 403(b) plan, provided they are part of a series of substantially equal periodic payments (SEPP). Under the 72(t) rule, you can take early withdrawals from your 403(b) plan as long as they're part of a SEPP plan, which lasts for five years or until you reach age 59 ½, whichever is longer. The IRS provides three methods to calculate SEPP: the required minimum distribution method, the fixed amortization method, and the fixed annuitization method. While the 72(t) rule provides flexibility, it also comes with its own set of challenges. Altering or stopping the payments before the end of the specified period could result in retroactive penalties. Understanding the penalties associated with early withdrawals from your 403(b) plan can save you a lot of trouble and money. If you withdraw funds from your 403(b) plan before reaching age 59 ½, you will typically have to pay a 10% early withdrawal penalty in addition to income tax on the amount withdrawn. The 10% early withdrawal penalty applies to most distributions before age 59 ½. However, there are some exceptions to this rule, such as when the distribution is made due to the account holder's disability, death, or under the 72(t) rule. Exceptions to the 10% penalty include distributions due to the account holder's death, becoming permanently disabled, or taking substantially equal periodic payments under the 72(t) rule. Other exceptions include withdrawals for medical expenses exceeding 7.5% of your adjusted gross income and distributions to military reservists while on active duty. When you withdraw money from your 403(b) plan, it is important to understand the tax implications. Withdrawals from a 403(b) plan are typically included in your taxable income for the year you make the withdrawal. If you made only pre-tax contributions to your 403(b) plan, your entire withdrawal is generally taxable. The IRS generally requires federal income tax withholding on 403(b) distributions. You may choose to have the withholding apply or waive it. In certain situations, you might need to make estimated tax payments to avoid underpayment penalties. To minimize the tax impact, consider spreading out your withdrawals over several years to avoid pushing yourself into a higher tax bracket in a single year. You might also consider converting your 403(b) to a Roth IRA, which allows tax-free withdrawals in retirement. One option that 403(b) participants may have access to is a loan provision. This can sometimes be a better choice than a withdrawal, depending on your situation. Some 403(b) plans allow participants to take loans against their account balance. This allows you to borrow money from your 403(b) plan and repay it with interest, typically through payroll deductions. While both allow access to your savings, a loan has to be repaid with interest, while a withdrawal does not. However, a loan is not taxed or penalized as long as it's repaid on schedule, while a withdrawal can be subject to income tax and potential penalties. The decision between taking a loan or a withdrawal depends on many factors, including your financial need, your ability to repay a loan, your age, and your plan rules. It's important to carefully weigh the benefits and drawbacks of each. When you decide to make a withdrawal from your 403(b) plan, you need to understand the process and requirements. Consider your financial situation and whether you'll be able to repay a loan without straining your budget. You should also think about how stable your income source is. A loan may be a better option if you're confident in your ability to pay it back in a timely manner. Both loans and withdrawals can negatively impact your retirement savings. With a loan, if you're unable to make repayments, your retirement savings may be impacted. On the other hand, a withdrawal directly reduces your retirement nest egg. A loan isn't taxed or penalized if repaid on schedule, unlike a withdrawal. A withdrawal from a 403(b) can subject you to income tax and potential early withdrawal penalties. With a loan, you're required to pay interest, increasing the cost of borrowing. With a withdrawal, no interest applies, but you lose the potential growth of those funds within your retirement account. Understanding the 403(b) Withdrawal Rules is crucial for retirement planning and making informed financial decisions. Key considerations include age criteria, the 59½ rule, and the RMD rule, which guide when you can begin withdrawing without penalty. Further, the 72(t) rule provides a method for penalty-free early withdrawals via SEPP. Yet, it's essential to remember that penalties apply for non-compliant early withdrawals, influencing both your retirement savings and tax obligations. Considering alternatives, such as 403(b) loans, can provide alternative avenues to access funds without enduring withdrawal penalties. Finally, knowing the process of initiating a 403(b) withdrawal, including the required documentation and common pitfalls to avoid, helps ensure a smooth transaction. Through comprehensive knowledge of these rules, individuals can maximize their retirement income and strategically plan their financial future.403(b) Withdrawal Rules Overview

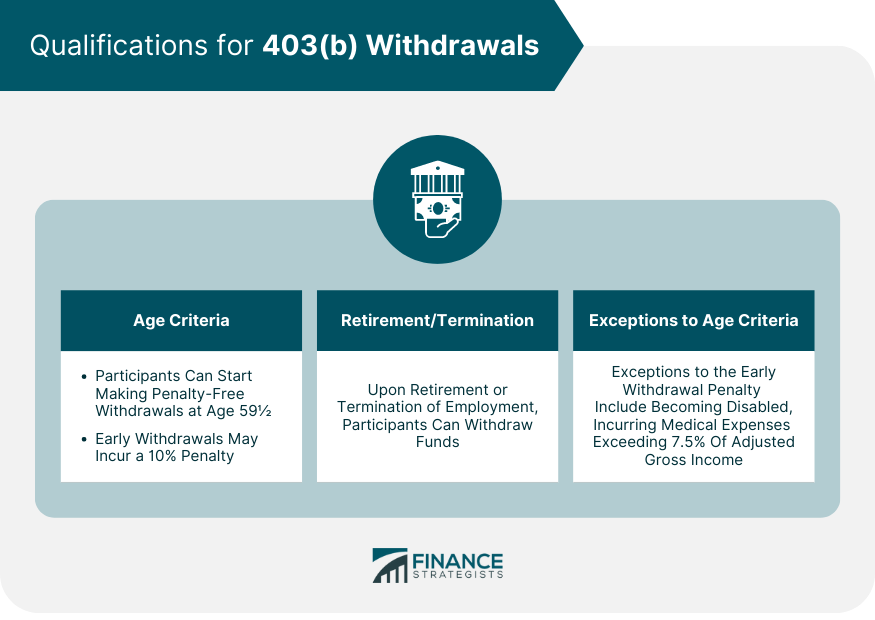

Qualifications for 403(b) Withdrawals

Age Criteria for 403(b) Withdrawals

Retirement or Termination of Employment

Exceptions to the Age Criteria

59½ Rule in 403(b) Withdrawals

Definition

Consequences of Early Withdrawals

Required Minimum Distribution (RMD) in 403(b) Withdrawals

Context of 403(b) Withdrawals

Calculation of RMD

Impact on Withdrawal Strategies

72(t) Rule and Substantially Equal Periodic Payments (SEPP) in 403(b) Withdrawals

72(t) Rule and SEPP

Utilizing Them to Make Early Withdrawals

Implications on 403(b) Withdrawals

Withdrawal Penalties for 403(b) Plans

10% Early Withdrawal Penalty

Circumstances Under Which Penalties Apply

Exceptions to the Penalty Rules

403(b) Withdrawals and Tax Implications

Taxability of 403(b) Withdrawals

Withholding and Estimated Taxes on 403(b) Withdrawals

Tax Strategies for 403(b) Withdrawals

403(b) Loans vs Withdrawals

403(b) Loans

Differences Between 403(b) Loans and Withdrawals

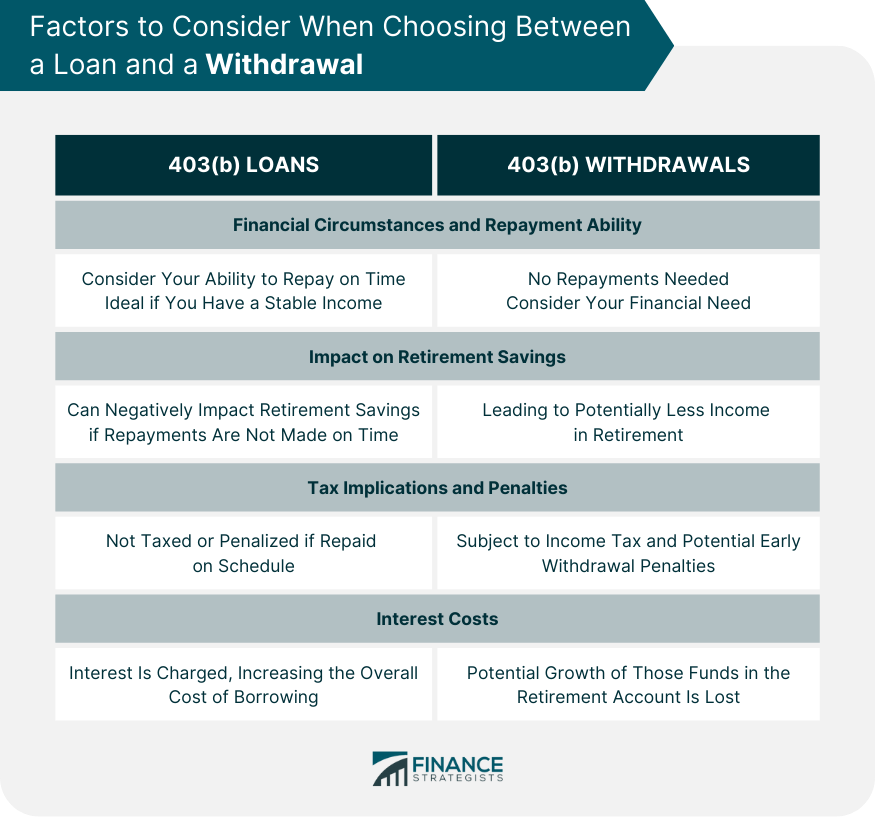

Factors to Consider When Choosing Between a Loan and a Withdrawal

Financial Circumstances and Repayment Ability

Impact on Retirement Savings

Tax Implications and Penalties

Interest Costs

Conclusion

403(b) Withdrawal Rules FAQs

The 403(b) Withdrawal Rules specify that participants can start making penalty-free withdrawals at the age of 59½. If you withdraw before this age, you may incur a 10% early withdrawal penalty unless certain exceptions apply. Additionally, at age 72, the IRS mandates that you begin taking Required Minimum Distributions (RMDs) from your 403(b) account.

The 59½ rule is a component of the 403(b) Withdrawal Rules, which stipulates that participants can start making withdrawals from their 403(b) plan without a 10% penalty once they reach the age of 59½. Early withdrawals may be subject to penalties unless specific exceptions apply.

The 403(b) Withdrawal Rules state that regular income tax applies to withdrawals. If you make an early withdrawal (before age 59½), a 10% penalty may apply, in addition to income tax, unless exceptions are met. Also, failing to take RMDs after age 73 can result in a tax penalty.

In the context of the 403(b) Withdrawal Rules, the 72(t) rule allows for penalty-free early withdrawals, provided they are part of a series of substantially equal periodic payments (SEPP). These payments should continue for at least five years or until you reach age 59½, whichever is longer.

According to the 403(b) Withdrawal Rules, a loan allows you to borrow money from your 403(b) plan, which is then repaid with interest, typically via payroll deductions. Unlike withdrawals, loans are not subject to income tax or penalties as long as they're repaid on schedule. Withdrawals, on the other hand, can be subject to income tax and potential penalties if made prematurely.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.