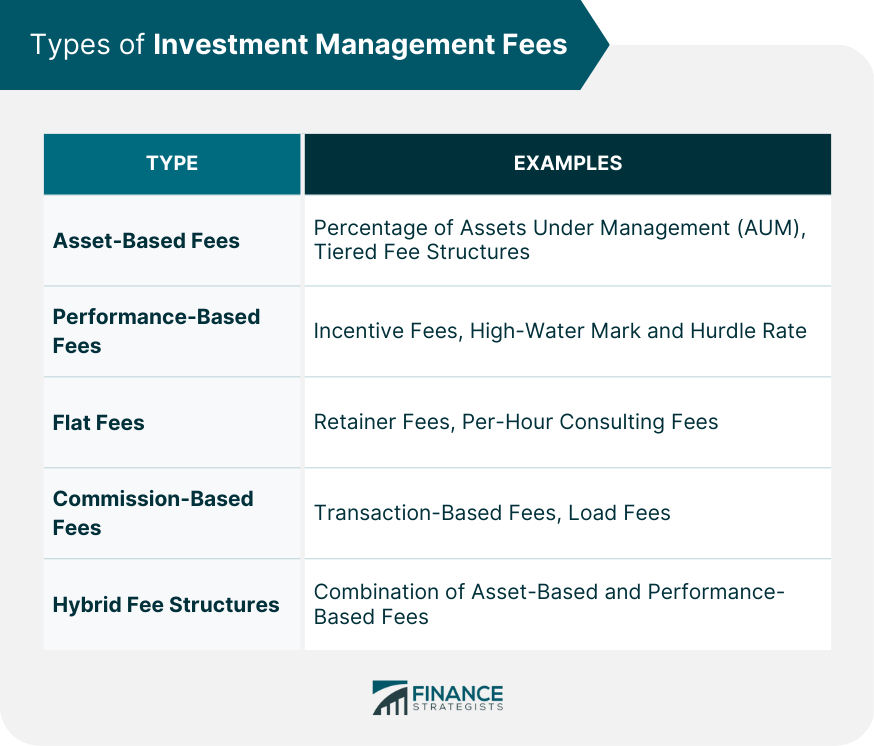

Investment management fees are fees charged by investment managers for managing investments on behalf of clients. Investment management fees play a crucial role in the overall financial success of an investor. Understanding the different types of fees and their potential impact on investment performance is essential for investors to make informed decisions. Many investment managers charge a fee based on a percentage of the total assets under management. This fee structure aligns the manager's incentives with the investor's, as the manager earns more when the portfolio value increases. In some cases, investment managers may offer tiered fee structures, where the percentage fee decreases as the assets under management increase. This approach can provide a discount for investors with larger portfolios. Performance-based fees, also known as incentive fees, are charged based on the investment manager's ability to outperform a predetermined benchmark or return target. These fees can motivate investment managers to perform better but may also encourage excessive risk-taking. To protect investors, some performance-based fee structures include a high-water mark or hurdle rate. A high-water mark ensures that a manager can only charge performance fees after recovering any previous losses. Some investment managers charge a flat retainer fee for their services, irrespective of the portfolio size or performance. This fee structure can provide predictability and transparency for investors. Investment managers may also charge an hourly rate for specific consulting services, such as financial planning or portfolio analysis. Commission-based fees are charged for executing trades or transactions within an investment portfolio. These fees can incentivize frequent trading, which may only sometimes align with the investor's best interests. Load fees are sales charges associated with buying or selling certain investment products, such as mutual funds. They can be front-end (charged at the time of purchase) or back-end (charged at the time of sale) and can significantly impact the overall cost of an investment. Some investment managers combine different fee structures, such as asset-based and performance-based fees, to create a more customized and flexible arrangement for their clients. Mutual fund fees can include management fees, 12b-1 fees (marketing and distribution fees), and load fees. These costs can vary widely among different funds, and it is essential to understand and compare them before investing. ETFs generally have lower fees than mutual funds, as they often passively track an index. However, investors should also consider the bid-ask spread and trading commissions when evaluating the total cost of owning an ETF. Hedge fund fees typically include a management fee and a performance fee. These fees can be quite high, as hedge funds often pursue complex investment strategies and require specialized expertise. SMAs are customized investment portfolios managed by professional investment managers. The fees for these services can vary depending on the level of customization and portfolio complexity. Active management generally involves higher fees, as investment managers need to research, analyze, and trade securities more frequently. Passive management, which typically involves tracking an index, often has lower fees. Investment managers may charge additional fees for highly customized portfolios tailored to the investor's specific needs, preferences, and goals. Investment managers may offer tax-efficient strategies to minimize taxes on investment gains, which can involve additional fees. These services can be valuable for investors in high tax brackets or with complex tax situations. Some investment managers provide financial planning and advice as part of their service offerings. This additional expertise may come with higher fees but can provide significant value to investors who require comprehensive financial guidance. Changes in the investment management industry, such as the rise of robo-advisors or passive investing, can affect fee structures and competition. Market demand for specific investment management services, such as sustainable investing or alternative investments, can influence fees as well. Increased competition among investment managers can lead to fee compression, ultimately benefiting investors by reducing the overall costs of investment management services. Fees can have a significant impact on long-term investment returns due to their compounding effect. High fees can erode investment gains over time, making it essential for investors to minimize costs whenever possible. Investing in low-cost passive funds, such as index funds or ETFs, can effectively minimize fees and improve long-term investment returns. Investors with sizable portfolios may have the leverage to negotiate lower fees with investment managers, potentially resulting in significant cost savings. Diversifying investments across different fee structures, such as a combination of active and passive funds, can help investors balance risk, return, and cost. While active management often comes with higher fees, some managers may consistently outperform their benchmarks, justifying the additional cost. Investors need to carefully weigh the potential benefits and risks of active management before making a decision. Investors should consider the interplay between investment risk, expected return, and fees when selecting investment management services. Striking the right balance can help optimize long-term investment performance while minimizing costs. The Investment Advisers Act of 1940 regulates investment advisers and their fee structures, requiring them to register with the Securities and Exchange Commission (SEC) and adhere to specific rules and requirements. Investment advisers have a fiduciary duty to act in their client's best interests, including disclosing all relevant fees and ensuring they are reasonable and fair. Investment advisers must provide a Form ADV, a comprehensive document detailing their fees, services, and other essential information. Investors should review this document carefully to understand the fees and services an investment manager provides. Investment vehicles like mutual funds and ETFs are required to disclose their fees in a prospectus and periodic shareholder reports, helping investors make informed decisions about their investments. Regulatory bodies have focused on increasing fee transparency in recent years, aiming to make it easier for investors to understand and compare fees among different investment managers and products. New regulations, such as the SEC's Regulation Best Interest (Reg BI), require brokers to act in their clients' best interests when making investment recommendations, which includes considering fees and costs. Investors should familiarize themselves with different fee structures and the terminology associated with investment management fees to make informed decisions. Reviewing fee schedules and disclosures, such as Form ADV or mutual fund prospectuses, can help investors compare fees among different investment managers and products. Investors should ask potential investment managers about their fee structures, any additional costs, and the services provided for those fees. Several online tools and resources can help investors compare fees and performance among different investment managers and products, making it easier to identify the most cost-effective options. Investment management fees are crucial to understand for investors as they can impact long-term investment returns. Different types of fees, such as asset-based, performance-based, flat fees, commission-based, and hybrid fee structures, can be charged based on various factors such as investment vehicles, services, and market conditions. High fees can erode investment gains over time, making it essential for investors to minimize costs through strategies such as passive investment options, fee negotiation, and diversification across fee structures. Regulatory considerations, such as the Investment Advisers Act of 1940 and fiduciary standards, require investment advisers to disclose fees and act in their clients' best interests. To make informed decisions, investors should understand fee structures and terminology, analyze fee schedules and disclosures, ask the right questions, and use online tools and resources for comparison. Ongoing monitoring and evaluation of fees and performance can also help investors make adjustments as needed, ensuring that their investment management services align with their financial goals and risk tolerance.What Are Investment Management Fees?

These fees cover the cost of managing and administering an investment portfolio and can vary depending on the number of assets being managed and the investment manager's fee structure.Types of Investment Management Fees

Asset-Based Fees

Percentage of Assets Under Management (AUM)

Tiered Fee Structures

Performance-Based Fees

Incentive Fees

High-Water Mark and Hurdle Rate

A hurdle rate requires that the manager achieves a minimum return before earning any performance fees.Flat Fees

Retainer Fees

Per-Hour Consulting Fees

Commission-Based Fees

Transaction-Based Fees

Load Fees

Hybrid Fee Structures

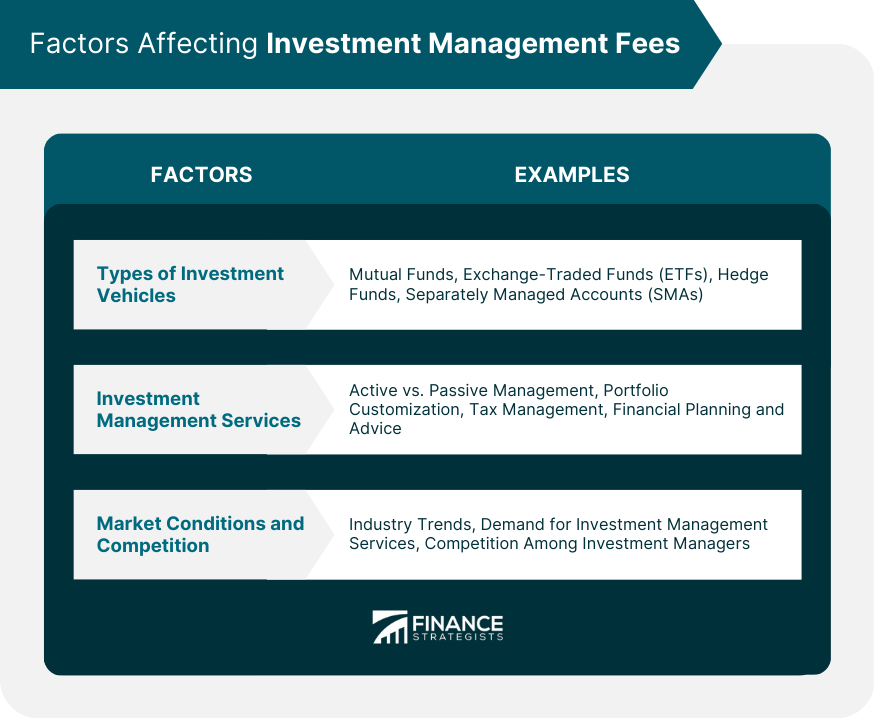

Factors Affecting Investment Management Fees

Types of Investment Vehicles

Mutual Funds

Exchange-Traded Funds (ETFs)

Hedge Funds

Separately Managed Accounts (SMAs)

Investment Management Services

Active vs. Passive Management

Portfolio Customization

These customized services can include tax management, socially responsible investing, or concentrated positions in certain sectors or asset classes.Tax Management

Financial Planning and Advice

Market Conditions and Competition

Industry Trends

Demand for Investment Management Services

Competition Among Investment Managers

Impact of Fees on Investment Returns

Compounding Effect of Fees

Fee Minimization Strategies

Passive Investment Options

Fee Negotiation

Diversification Across Fee Structures

Trade-Offs Between Fees and Performance

Active Management Fees vs. Potential Outperformance

Balancing Risk, Return, and Costs

Regulatory Considerations for Investment Management Fees

Legal and Regulatory Frameworks

Investment Advisers Act of 1940

Fiduciary Standards

Fee Disclosure Requirements

Form ADV

Prospectus and Shareholder Reports

Recent Regulatory Developments

Fee Transparency Initiatives

Best Interest Regulations

Tips for Evaluating and Comparing Investment Management Fees

Understanding Fee Structures and Terminology

Analyzing Fee Schedules and Disclosures

Asking the Right Questions

Using Online Tools and Resources for Comparison

Final Thoughts

Investment Management Fees FAQs

Investment management fees are fees charged by investment managers for managing investments on behalf of clients. These fees can vary in amount and may be charged as a percentage of assets under management or as a fixed fee.

Investment management fees can vary widely depending on the type of investment, the number of assets being managed, and the investment manager's fee structure. Typically, fees range from 0.25% to 2% of assets under management annually.

Investment management fees cover the cost of managing and administering an investment portfolio. This includes researching investments, monitoring market conditions, rebalancing portfolios, and providing investment advice.

Investment management fees may be negotiable, particularly for high-net-worth clients or institutional investors. However, fees are typically based on the investment manager's fee schedule and the client's investment needs.

Investors can minimize investment management fees by carefully evaluating investment managers' fee schedules and negotiating fees when possible. Another way to reduce fees is to invest in low-cost index funds or exchange-traded funds (ETFs) with lower management fees than actively managed funds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.