A 403(b) plan is a tax-sheltered retirement savings account designed primarily for employees of public schools, non-profit organizations, and certain ministers. Named after section 403(b) of the Internal Revenue Code, it allows employees to make pre-tax contributions from their salary, reducing their overall taxable income. The contributions and any earnings on those contributions grow tax-free until they are withdrawn, usually in retirement. 403(b) plans offer a number of benefits to participants. Firstly, they offer immediate tax relief because contributions are made pre-tax, reducing an individual's taxable income. Secondly, the earnings on the contributions are tax-deferred, meaning you don't pay taxes on the growth of your investments until you start withdrawing the money in retirement. Lastly, many 403(b) plans also offer employer matching, which can significantly increase the total amount of savings. Employer match in a 403(b) plan refers to a scenario where an employer contributes additional money to an employee's 403(b) account based on the amount the employee contributes. For example, an employer might match 50% of the employee's contributions up to 6% of their salary. In such a case, if an employee contributes 6% of their income, the employer would contribute an additional 3%, effectively giving the employee a significant boost in their total retirement savings. The percentage and terms of the employer match can vary by employer, and some may even choose to match employee contributions dollar for dollar up to a certain limit. Therefore, understanding the specific matching policy of one's employer is crucial to maximizing retirement savings. Annual additions refer to the total amount of contributions made to a 403(b) plan in a year, including both employee deferrals and employer matching contributions. As of 2024, the IRS limit on annual additions to a 403(b) plan is $69,000 or 100% of an employee's includible compensation for the most recent year, whichever is less. This limit is per employer and includes all contributions made on behalf of the employee. The employee's salary often plays a significant role in determining the employer match limit. Many employers set their match as a percentage of the employee's salary. For example, an employer might contribute a dollar-for-dollar match up to 5% of the employee's salary. The employer's matching formula is another crucial factor. Some employers may offer a dollar-for-dollar match, while others may only match 50 cents on the dollar. Moreover, some employers may have a cap on their match, such as matching contributions only up to a certain amount. IRS rules require that 403(b) plans not to favor highly compensated employees. For instance, if a 403(b) plan provides matching contributions, the matching formula must satisfy certain non-discrimination tests. The IRS allows individuals aged 50 and over to make additional catch-up contributions to their 403(b) plans. As of 2024, the catch-up contribution limit is $7,500. These catch-up contributions are in addition to the annual limit on contributions, providing older individuals a chance to boost their retirement savings. The IRS monitors 403(b) plans to ensure they adhere to contribution limits and non-discrimination rules. If a plan is found to exceed the contribution limits, the IRS may demand corrective action, which could involve returning excess contributions to the employee. If the plan fails the non-discrimination tests, the plan may lose its tax-advantaged status. The employer match in a 403(b) plan can be viewed as a significant financial benefit – essentially, free money added to an employee's retirement savings. It's part of the employee's compensation package that directly contributes to their long-term financial health. The prospect of an employer match often provides a compelling incentive for employees to consistently contribute to their 403(b) plan. In essence, by contributing to their retirement savings, employees unlock additional funds from their employer. The employer match feature can significantly bolster the total amount an employee is able to save for retirement. This additional funding helps employees build a larger retirement nest egg more quickly than they could through their contributions alone. Like the employee's own contributions, the employer's matched amount also enjoys tax-deferred growth. This means that the matched funds, along with any earnings they generate, are not subject to tax until they are withdrawn in retirement, allowing for a larger growth over time. Despite the many benefits of employer matching, there are some constraints to bear in mind. One key limitation is the cap on total contributions that can be made to a 403(b) plan in a given year. This includes the combined amount of both employee and employer contributions, which for 2024 is capped at $69,000 or 100% of the employee's salary, whichever is less. The employer has discretion over whether to offer matching contributions and, if they do, the terms of the match. Some employers may choose to match a certain percentage of the employee's contribution, while others might set a flat rate. Employers may also choose to implement a vesting schedule, requiring employees to work for a certain number of years before they gain full ownership of the employer-contributed funds. Employers are also free to change their matching contribution strategy as their financial situation changes. As a result, employees cannot always depend on a consistent match year after year. Regular communication with the employer about the status and future of the match program is always advised. To illustrate the impact of an employer match, let's consider an example. If an employee earns $50,000 annually and contributes 6% of their salary to their 403(b) plan, they will contribute $3,000 per year. If their employer matches 50% of the employee's contributions up to 6% of their salary, the employer will contribute an additional $1,500 per year. Over 30 years, assuming a 7% average annual return, these contributions could grow to over $300,000. Exceeding the limit on contributions to a 403(b) plan can have significant consequences. If an employee contributes more than the annual limit, they may need to withdraw the excess contributions. These withdrawals may be taxed as income and could also incur a 10% early withdrawal penalty if the employee is under 59 ½ years of age. To maximize the employer match without crossing the limit, employees should aim to contribute at least as much as their employer is willing to match. If the employer matches 50% of contributions up to 6% of the employee's salary, the employee should contribute at least 6% of their salary to take full advantage of the match. Additionally, employees should monitor their contributions to ensure they do not exceed the annual limit on contributions. While both 403(b) and 401(k) plans offer employer matching, there may be differences in the matching formula used by employers. However, the annual limit on contributions, which includes both employee and employer contributions, is the same for both types of plans, standing at $69,000 as of 2024. Unlike 403(b) and 401(k) plans, SIMPLE IRA plans have a mandatory employer contribution. Employers must either match employee contributions dollar for dollar up to 3% of the employee's compensation or make a non-elective contribution of 2% of the employee's compensation to all eligible employees. The total annual contribution limit for SIMPLE IRA plans is also lower, at $16,000 for 2024. 457(b) plans, which are offered by the government and certain non-profit employers, also allow for employer matching contributions. However, unlike 403(b) plans, 457(b) plans are not subject to the same non-discrimination testing, which may give employers more flexibility in providing matching contributions. The annual limit on contributions is the same as for 403(b) and 401(k) plans. Grasping the 403(b) employer match limit is critical for maximizing your retirement savings. By fully understanding these limits, you can effectively use your employer's match to augment your retirement fund while avoiding tax complications and potential penalties. The employer match limit impacts how you strategize for retirement savings. Ideally, you want to contribute enough to receive the full employer match, as it is essentially "free money." On the flip side, it's crucial to avoid exceeding the total annual contribution limit to dodge financial penalties. Employees should always aim to contribute at least as much as their employer is willing to match. Employers, on the other hand, must clearly communicate the match policy and ensure they follow non-discrimination rules. Both parties need to keep track of total contributions to avoid exceeding IRS limits.Overview of the 403(b) Plan

Benefits and Features of a 403(b) Plan

What Is an Employer Match in a 403(b) Plan?

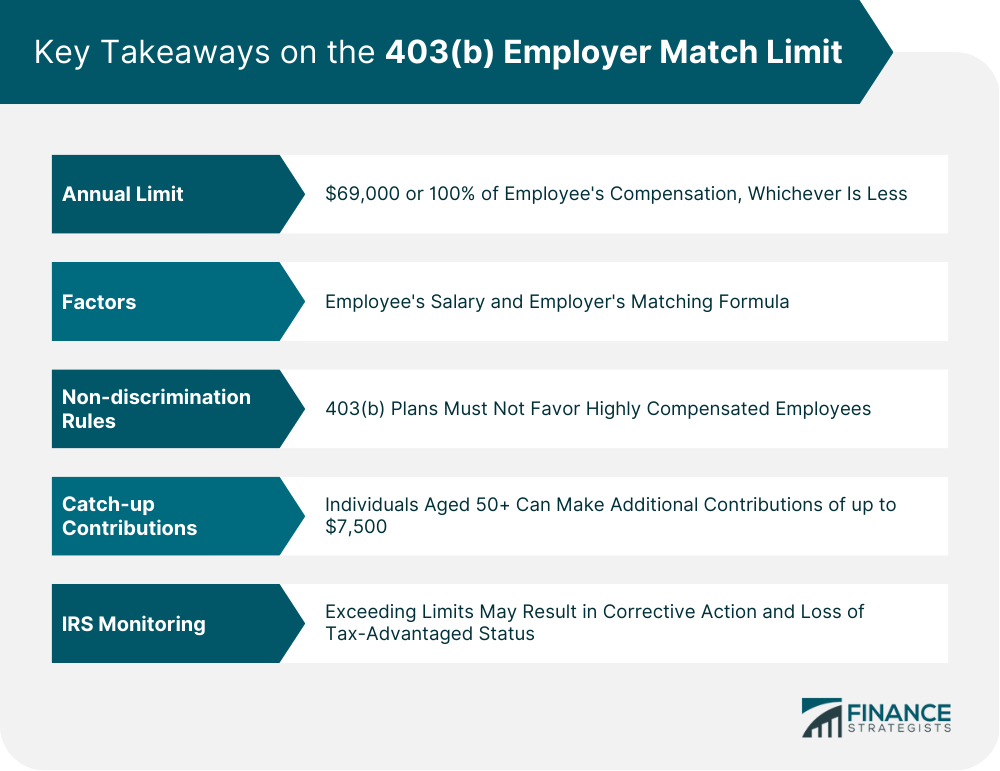

Understanding the 403(b) Employer Match Limit

Annual Limit on Employer Contributions

Definition of Annual Additions

Current Limit as of 2024

Factors That Influence the Employer Match Limit

Employee's Salary

Employer's Matching Formula

IRS Rules and Regulations on 403(b) Employer Match Limit

Non-discrimination Rules

Catch-up Contributions

IRS Audits and Penalties for Exceeding Limits

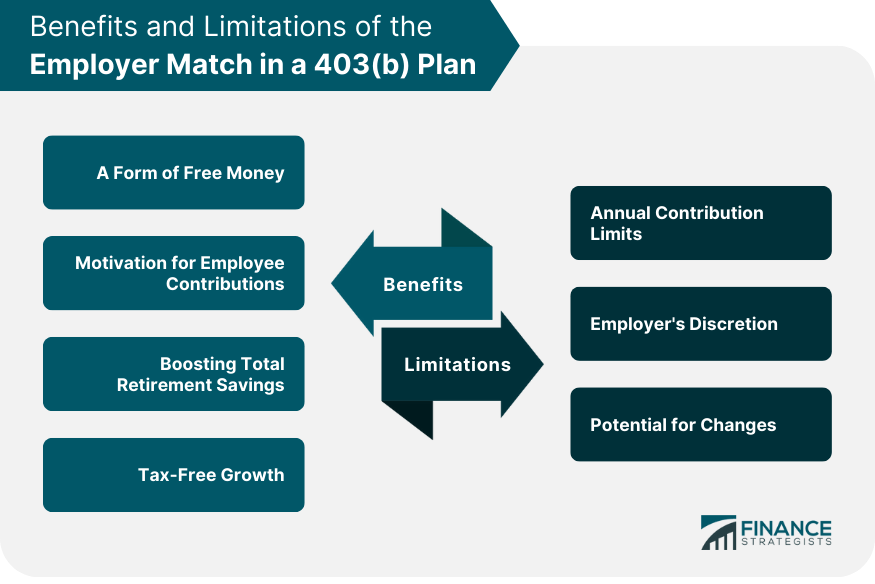

Benefits of the Employer Match in a 403(b) Plan

A Form of Free Money

Motivation for Employee Contributions

Boosting Total Retirement Savings

Tax-Free Growth

Limitations and Restrictions on the Employer Match in a 403(b) Plan

Annual Contribution Limits

Employer's Discretion

Potential for Changes

Case Studies and Scenarios

Sample Calculations of Employer Match

Impact of Exceeding the Limit

Strategies to Maximize Employer Match Without Crossing the Limit

Comparison of Employer Match Limits Among Other Retirement Plans

403(b) vs 401(k)

403(b) vs SIMPLE IRA

403(b) vs 457(b)

Final Thoughts

403(b) Employer Match Limit FAQs

For 2023, the total contribution limit, which includes both employee and employer contributions to a 403(b) plan, is $66,000 or 100% of the employee's salary, whichever is less.

If the total contributions exceed the limit, excess contributions may need to be withdrawn and may be subject to income tax and potentially an early withdrawal penalty.

Absolutely. Understanding the employer match limit can help you maximize your retirement savings. You should aim to contribute enough to get the full employer match without exceeding the total contribution limit.

The total contribution limit, including the employer match, is the same for 403(b), 401(k), and 457(b) plans. However, SIMPLE IRA plans have a lower total contribution limit.

No, the total contributions to a 403(b) plan, including both employee and employer contributions, cannot exceed the annual limit set by the IRS.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.