Tax-deferred growth refers to the process of investing your money in accounts where taxes on the earnings are postponed until the funds are withdrawn. This allows your investments to grow without being hindered by taxes, which can lead to significant long-term benefits. One key aspect of tax-deferred growth is that the investments grow on a pre-tax basis. This means that the funds deposited into these accounts have not yet been subjected to income taxes. As a result, more money is available for investing, which can lead to higher potential returns over time. Tax-deferred growth works by allowing your investments to grow without the burden of taxes. When you invest in a tax-deferred account, any interest, dividends, or capital gains generated by the investments are not taxed as long as the funds remain in the account. Instead, taxes are applied only when the funds are withdrawn, usually during retirement. This approach to taxation offers investors a significant advantage, as it allows their investments to compound more rapidly than they would in a taxable account. Over the long term, this tax-deferred compounding can result in a much larger nest egg for retirement. Tax-deferred growth is an essential component of a successful long-term investment strategy. It enables investors to maximize their returns by minimizing the impact of taxes on their investments. By delaying taxes on investment earnings, individuals can take advantage of the power of compounding, which helps their investments grow more rapidly. Moreover, since individuals often have a lower tax rate during their retirement years, deferring taxes on investment earnings can result in paying less in taxes overall. This can lead to significant savings, which can be used to further enhance one's financial security in retirement. Individual Retirement Accounts (IRAs) are tax-advantaged accounts specifically designed for long-term retirement savings. There are two main types of IRAs: Traditional IRAs and Roth IRAs. Both offer tax-deferred growth, but they differ in how contributions and withdrawals are taxed. Traditional IRAs allow individuals to make tax-deductible contributions, which reduces their taxable income in the current year. The earnings in the account grow tax-deferred, and taxes are paid upon withdrawal in retirement. Roth IRAs, on the other hand, are funded with after-tax dollars, and withdrawals in retirement are tax-free, provided certain conditions are met. Employer-sponsored retirement plans, such as 401(k) and 403(b) plans, are another type of tax-deferred account. These plans are offered by employers and allow employees to contribute a portion of their pre-tax income to the account. The contributions reduce the employee's taxable income, and the earnings in the account grow tax-deferred until they are withdrawn in retirement. In many cases, employers also offer matching contributions, which can significantly boost an employee's retirement savings. Additionally, some employer-sponsored retirement plans offer a Roth option, allowing employees to choose between pre-tax and after-tax contributions. Health Savings Accounts (HSAs) are tax-advantaged accounts designed to help individuals save for qualified medical expenses. HSAs are available to those enrolled in a high-deductible health plan (HDHP). Contributions to an HSA are made with pre-tax dollars, and the earnings in the account grow tax-deferred. Withdrawals from an HSA for qualified medical expenses are tax-free, providing a triple tax advantage. Additionally, after the age of 65, individuals can withdraw HSA funds for non-medical expenses without penalty, although income taxes will apply. This feature makes HSAs another valuable tool for tax-deferred growth and long-term financial planning. One of the primary benefits of tax-deferred growth is the potential for significant tax savings. By investing in tax-deferred accounts, individuals can reduce their current taxable income, leading to lower income taxes in the present. Additionally, since withdrawals are often made during retirement when income and tax rates are typically lower, tax-deferred growth can result in overall lower tax liabilities. Moreover, by delaying taxes on investment earnings, investors can take advantage of the power of compounding, which allows their investments to grow more rapidly. Over the long term, this can lead to a much larger nest egg for retirement, providing greater financial security. Compound interest is a powerful financial concept that allows your investments to grow exponentially over time. In tax-deferred accounts, compound interest works in your favor by allowing your earnings to be reinvested without being taxed. This enables your investments to grow at an accelerated rate compared to taxable accounts. The longer you hold investments in a tax-deferred account, the more significant the impact of compounding becomes. Over time, this can result in a substantial difference in the total value of your investments, making tax-deferred growth a crucial aspect of long-term financial planning. Tax-deferred growth is a key component in building a substantial retirement income. By minimizing the impact of taxes on your investments and taking advantage of compound interest, you can accumulate a larger nest egg for your retirement years. This can provide you with a more comfortable and secure retirement. Moreover, tax-deferred accounts like IRAs and 401(k) plans often provide more flexible withdrawal options during retirement compared to taxable accounts, allowing retirees to better manage their income streams and tax liabilities. This can help individuals achieve a more stable and predictable retirement income. One of the main drawbacks of tax-deferred growth is the limited access to funds. In most cases, withdrawals from tax-deferred accounts before the age of 59½ are subject to a 10% early withdrawal penalty in addition to income taxes. This can create a significant financial burden if you need to access your funds in an emergency or for other unplanned expenses. To avoid these penalties, it's essential to maintain an emergency fund outside of your tax-deferred accounts and to carefully plan your financial needs before tapping into your retirement savings. Required Minimum Distributions (RMDs) are mandatory withdrawals from certain tax-deferred accounts, such as Traditional IRAs and 401(k) plans, beginning at age 73. The amount of the RMD is based on your account balance and life expectancy, and failure to take the required distribution can result in a substantial tax penalty. RMDs can create challenges for investors by forcing them to withdraw funds from their tax-deferred accounts, which can result in higher taxable income and increased tax liabilities. To mitigate the impact of RMDs, individuals can consider strategies such as converting Traditional IRA funds to a Roth IRA or using the funds to purchase a Qualified Longevity Annuity Contract (QLAC). While tax-deferred growth offers many benefits, it's important to remember that taxes are still due upon withdrawal. For some individuals, particularly those who may have a higher income during retirement, the tax implications of withdrawing from tax-deferred accounts can be significant. To minimize the tax impact, individuals can implement strategies such as diversifying their retirement income sources with a mix of taxable, tax-deferred, and tax-free accounts, or carefully planning their withdrawals to avoid pushing themselves into a higher tax bracket. It's essential to consult with a financial advisor or tax services professional to develop a tailored withdrawal strategy that suits your individual circumstances. One of the most effective ways to maximize tax-deferred growth is to start investing early. The earlier you begin contributing to tax-deferred accounts, the more time your investments have to grow and compound. This can lead to a significant difference in the total value of your investments when it's time to retire. In addition to starting early, it's essential to consistently contribute to your tax-deferred accounts over time. Regular contributions, even if they are small, can have a substantial impact on the growth of your investments. To fully take advantage of tax-deferred growth, it's important to contribute as much as possible to your tax-deferred accounts. By maximizing your contributions, you can reduce your current taxable income and potentially benefit from employer matching contributions (if available). Each tax-deferred account has specific contribution limits set by the IRS, which may change annually. Be sure to stay informed about these limits and adjust your contributions accordingly to make the most of your tax-deferred savings. Diversification is a crucial aspect of any successful investment strategy, and it's equally important within tax-deferred accounts. By spreading your investments across various asset classes, such as stocks, bonds, and real estate, you can reduce the risk of significant losses due to market fluctuations. A well-diversified portfolio within your tax-deferred accounts can help ensure that your investments continue to grow, even during periods of market volatility. This can lead to more consistent returns and a greater accumulation of wealth over time. Tax-deferred growth is a powerful tool for long-term financial planning, offering significant advantages such as tax savings, the power of compound interest, and the potential for a more substantial retirement income. By investing in tax-deferred accounts like IRAs, employer-sponsored retirement plans, and HSAs, individuals can minimize the impact of taxes on their investments and maximize their potential returns. However, there are also some drawbacks to consider, such as limited access to funds, required minimum distributions, and tax implications upon withdrawal. To make the most of tax-deferred growth, it's essential to implement strategies like starting early, contributing the maximum allowable amount, and diversifying investments. Planning for retirement is a critical aspect of long-term financial success. By understanding and taking advantage of tax-deferred growth, individuals can build a solid foundation for their future financial security. It's essential to regularly review and adjust your retirement plan, taking into consideration changes in tax laws, contribution limits, and your individual circumstances. By carefully planning and investing in tax-deferred accounts, you can work toward a comfortable and secure retirement, ensuring that you have the resources to enjoy your golden years to the fullest.What Is Tax-Deferred Growth?

Types of Tax-Deferred Accounts

Individual Retirement Accounts (IRAs)

Employer-Sponsored Retirement Plans

Health Savings Accounts (HSAs)

Advantages of Tax-Deferred Growth

Tax Savings

Compound Interest

Retirement Income

Disadvantages of Tax-Deferred Growth

Limited Access to Funds

Required Minimum Distributions (RMDs)

Tax Implications Upon Withdrawal

Strategies for Maximizing Tax-Deferred Growth

Starting Early

Contributing the Maximum Allowable Amount

Diversifying Investments

Final Thoughts

Tax-Deferred Growth FAQs

Tax-deferred growth refers to the investment gains made within an account that are not taxed until withdrawn from the account.

Some types of tax-deferred accounts include individual retirement accounts (IRAs), employer-sponsored retirement plans, and health savings accounts (HSAs).

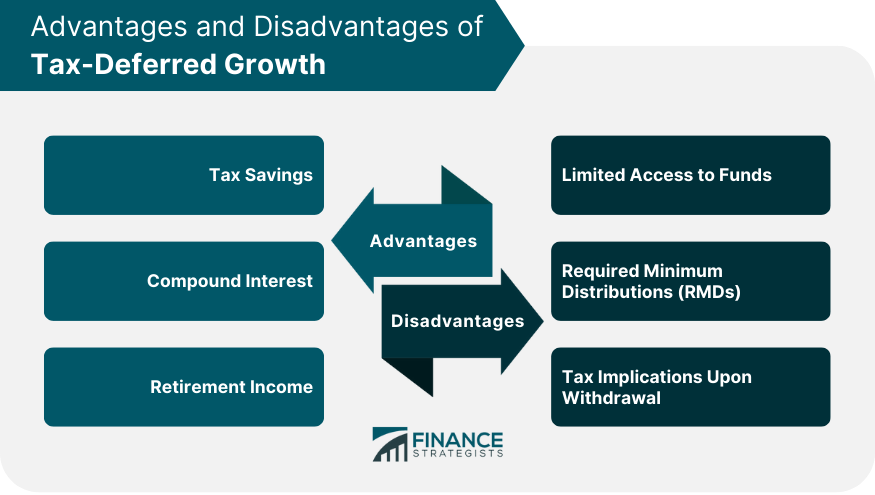

The advantages of tax-deferred growth include potential tax savings, compound interest, and a source of retirement income.

The disadvantages of tax-deferred growth include limited access to funds, required minimum distributions (RMDs), and tax implications upon withdrawal.

You can maximize the benefits of tax-deferred growth by starting early, contributing the maximum allowable amount, and diversifying your investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.