A 403(b) plan is a tax-advantaged retirement savings plan for certain employees of public schools, tax-exempt organizations, and ministers. On the other hand, Social Security is a federal program that provides a source of income for individuals or their survivors who are retired, disabled, or deceased. Understanding 403(b) plans and Social Security is pivotal in retirement planning. Both programs play a significant role in shaping an individual’s financial landscape post-retirement. By learning about these plans, you can make informed decisions about where to allocate your resources and how to maximize your financial security in your later years. These plans function differently, but both aim to ensure that you maintain a steady income stream once you've exited the workforce, thereby promoting financial stability and well-being throughout retirement. A 403(b) plan is a defined contribution plan offered to employees of tax-exempt organizations, public schools, and certain ministers. These plans allow employees to contribute a portion of their salary to a retirement account. Contributions are typically made pre-tax, which means they lower taxable income in the year they are made. 403(b) plans are exclusively for employees of tax-exempt organizations, which are defined under section 501(c)(3) of the Internal Revenue Code, public school employees, and certain ministers. These include teachers, school administrators, professors, government employees, nurses, doctors, and clergy. One of the significant benefits of 403(b) plans is their tax advantages. Contributions to these plans are made on a pre-tax basis, meaning they are exempt from income tax until withdrawal. The tax-deferred nature of these plans allows for the potential of increased compound growth over time. Many employers who offer 403(b) plans also provide matching contributions, effectively increasing the total contribution to the employee's account. This feature amplifies the savings potential and is a valuable benefit for those who have access to it. While 403(b) plans offer numerous benefits for retirement savings, they do come with certain limitations. 403(b) plans have an annual contribution limit set by the IRS, potentially restricting the amount of retirement savings for those relying solely on this type of plan. Withdrawing funds from your 403(b) account before age 59½ usually triggers a 10% early withdrawal penalty, plus regular income taxes, potentially reducing your retirement savings considerably. The maximum contribution limit to a 403(b) plan for 2024 is $23,000 per year for individuals under 50. Individuals aged 50 and above can make catch-up contributions to their 403(b) plans. These additional contributions help them boost their retirement savings as they approach retirement age. As of 2024, the catch-up contribution limit was an additional $7,500 per year. Normal distributions from a 403(b) plan can begin at age 59½. At this age, you can start taking money out of your 403(b) without incurring the 10% early withdrawal penalty. However, regular income tax still applies to the distributions. Once you reach age 72, the IRS requires you to start taking minimum distributions from your 403(b) plan each year. These required minimum distributions (RMDs) are calculated based on your life expectancy and account balance. As mentioned earlier, withdrawing from your 403(b) plan before age 59½ usually results in a 10% early withdrawal penalty in addition to income tax. There are some exceptions, however, such as severe financial hardship or disability. Social Security is a federal program that offers financial support to retirees, disabled individuals, and survivors of deceased workers. Established in the 1930s, the program is primarily funded by payroll taxes and aims to provide a safety net of income for people who are no longer working or cannot work. Almost all workers in the United States qualify for Social Security after accruing enough "credits" through their employment history. As of 2024, workers earn one credit for every $1,730 in earnings, with a maximum of four credits per year. To qualify for retirement benefits, you typically need 40 credits, which equates to 10 years of work. Social Security offers a number of key benefits that play a critical role in retirement planning. The primary benefit of Social Security is the provision of income replacement. Based on your earnings history, the program replaces a portion of your pre-retirement income, the extent of which varies according to your lifetime earnings and when you opt to start receiving benefits. Another significant benefit is the annual cost-of-living adjustments (COLAs). COLAs ensure that inflation does not erode the purchasing power of your Social Security benefits, thereby maintaining their value over time. Lastly, Social Security extends its benefits to the dependents of eligible workers. This feature allows spouses, children, and in some cases, parents to receive financial support, further bolstering the family's financial stability. While Social Security provides substantial benefits, it's important to understand that it also has certain limitations. Although Social Security provides income replacement, it only replaces a percentage of your pre-retirement income. For many, this may not be enough to maintain their desired lifestyle in retirement, necessitating additional savings or income sources. The funding of Social Security depends on the contributions of current workers, creating a degree of uncertainty for future retirees, especially given demographic shifts and increasing longevity. Depending on your income in retirement, a portion of your Social Security benefits may be subject to federal income tax, reducing the net benefit you receive. The primary way individuals contribute to Social Security is through payroll taxes. As of 2024, workers pay a 6.2% tax on their earnings up to a certain limit, while their employers also pay a matching 6.2%. Self-employed individuals contribute 12.4% to Social Security through the self-employment tax. This tax covers both the employer and employee portions of Social Security and Medicare taxes. The full retirement age (FRA) for Social Security is between 66 and 67, depending on the year you were born. At this age, you can claim your full Social Security benefit amount. You can start receiving Social Security benefits as early as age 62, but doing so will reduce your monthly benefit amount. Conversely, if you delay claiming Social Security beyond your full retirement age, your monthly benefit will increase. Social Security survivor benefits provide income for the surviving spouses and children of workers who have passed away. The amount of these benefits depends on the deceased's earnings and the survivor's age and relationship to the deceased. 403(b) plans and Social Security represent two different types of retirement income. A 403(b) plan provides income based on your contributions and any employer match, while Social Security benefits are based on your earnings history and the age you start taking benefits. Both 403(b) plans and Social Security can contribute significantly to your overall retirement income. By strategically managing these two sources of income, you can maximize your financial security in retirement. Withdrawals from your 403(b) plan can impact the taxation of your Social Security benefits. If your total income, including 403(b) distributions, exceeds certain thresholds, a portion of your Social Security benefits may be taxable. Even without 403(b) distributions, your Social Security benefits could be taxable if you have other substantial income. However, no more than 85% of your Social Security benefits will be subject to income tax. Maximizing your 403(b) and Social Security benefits can involve various strategies. You may want to contribute the maximum to your 403(b) plan, delay claiming Social Security until after your full retirement age, or consider a combination of these and other tactics based on your personal circumstances. In addition to your 403(b) plan and Social Security, you may have other retirement savings or income sources. These could include individual retirement accounts (IRAs), 401(k)s from past employers, pensions, annuities, and even part-time work in retirement. To create a comprehensive retirement plan that maximizes your 403(b) and Social Security benefits, you may want to consult with a financial advisor. These professionals can help you understand the nuances of retirement planning, make informed decisions, and develop a strategy tailored to your unique needs and goals. 403(b) plans and Social Security are significant components of retirement planning. 403(b) plans are tax-advantaged retirement savings accounts for employees of public schools, tax-exempt organizations, and certain ministers, while Social Security is a federal program providing income to retirees, disabled individuals, and survivors of deceased workers. By understanding and strategically managing both 403(b) plans and Social Security, you can optimize your retirement income and ensure financial security in your later years. However, the complex nature of these plans and their tax implications make it essential to seek professional guidance. Your retirement planning journey doesn't have to be a solo endeavor. Consider seeking the help of a financial advisor to guide you through the complexities of 403(b) plans and Social Security. With professional guidance, you can maximize your benefits and secure a financially stable retirement.Overview of 403(b) Plans and Social Security

Understanding 403(b) Plans

Definition of a 403(b) Plan

Detailed Description and Purpose

Who Qualifies for a 403(b) Plan?

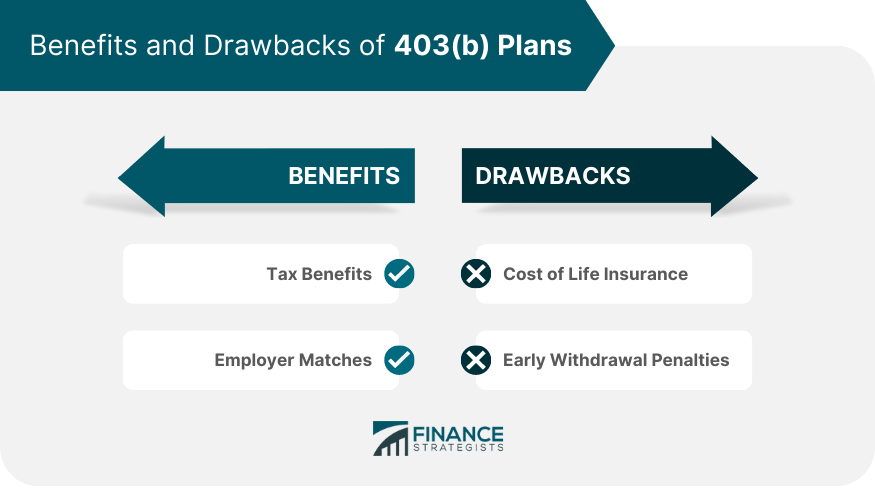

Benefits of 403(b) Plans

Tax Benefits

Employer Matches

Drawbacks of 403(b) Plans

Contribution Restrictions

Early Withdrawal Penalties

Contribution Limits in a 403(b) Plan

Withdrawal From a 403(b) Plan

Normal Distributions

Required Minimum Distributions (RMDs)

Early Withdrawal Penalties

Understanding Social Security

Definition of Social Security

Detailed Description and Purpose

Who Qualifies for Social Security?

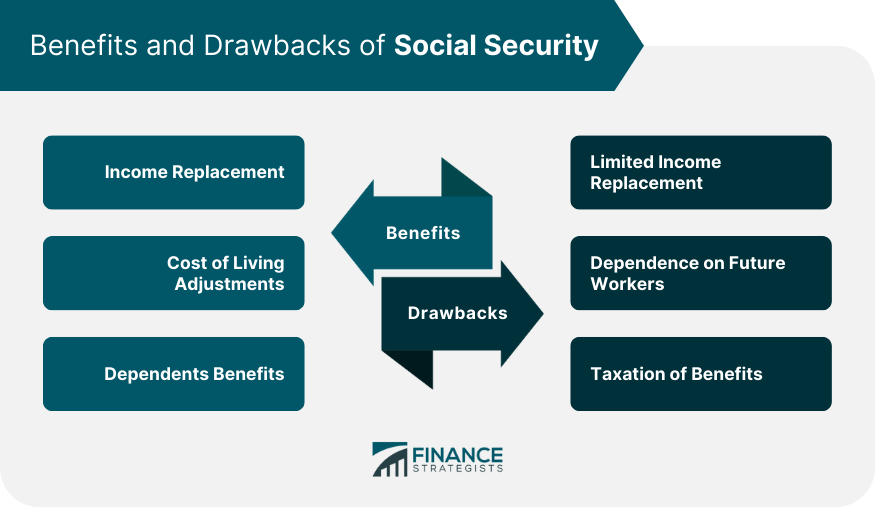

Benefits of Social Security

Income Replacement

Cost of Living Adjustments

Dependents Benefits

Drawbacks of Social Security

Limited Income Replacement

Dependence on Future Workers

Taxation of Benefits

How to Contribute to Social Security

Payroll Taxes

Self-Employment Contributions

Claiming Social Security Benefits

Full Retirement Age

Early or Late Retirement

Survivor Benefits

Relationship Between 403(b) and Social Security

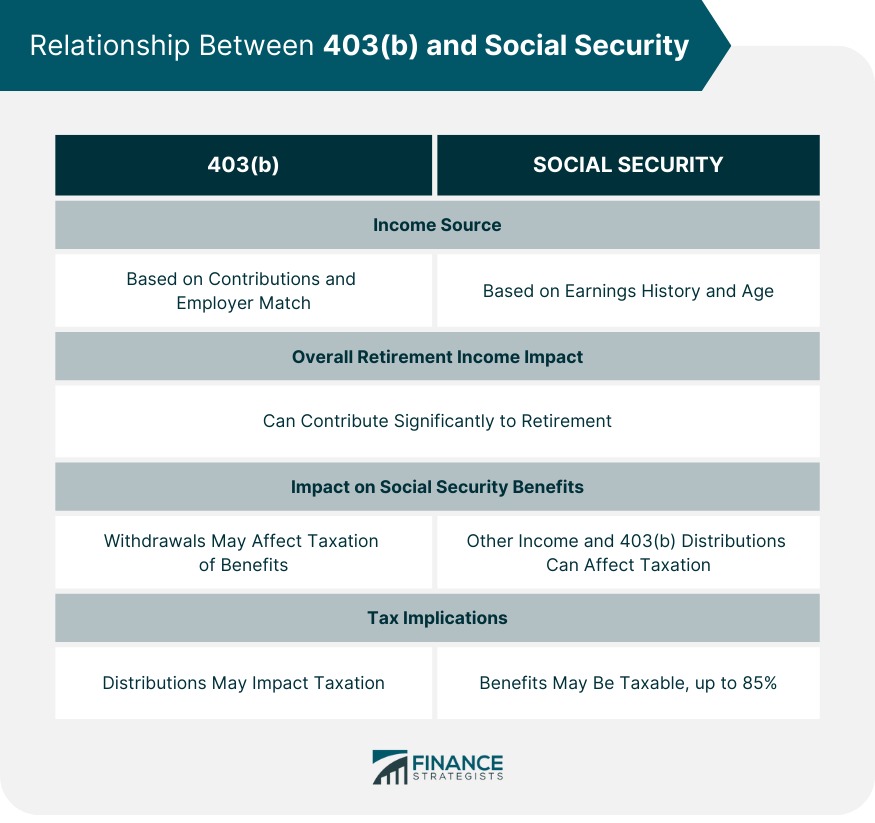

How 403(b) and Social Security Can Work Together

Differences in Income Sources

Effect on Overall Retirement Income

Impact of 403(b) Withdrawals on Social Security Benefits

Tax Implications

Social Security Benefits Taxation

Planning for Retirement With 403(b) and Social Security

Strategies for Maximizing Both 403(b) and Social Security Benefits

Role of Other Retirement Savings

Consulting With a Financial Advisor

The Bottom Line

403(b) Plans and Social Security FAQs

While both 403(b) plans and Social Security provide income in retirement, they differ in several ways. 403(b) plans are tax-deferred retirement savings plans funded by employee contributions and often employer matching, while Social Security is a federal program funded by payroll taxes, providing income based on your earnings history and the age you start taking benefits.

While Social Security provides a base of income in retirement, it's typically not sufficient to cover all your financial needs. Having a 403(b) plan can significantly enhance your retirement savings, providing additional income in your retirement years.

403(b) withdrawals can potentially increase the taxable portion of your Social Security benefits. If your total income, including 403(b) distributions, exceeds certain thresholds, a portion of your Social Security benefits may be taxable.

The best time to start taking withdrawals depends on your personal circumstances. Generally, you can start withdrawing from your 403(b) at age 59½ without penalty, and you can begin claiming Social Security benefits as early as age 62, though waiting can increase your monthly benefit.

Yes, you can contribute to a 403(b) plan and Social Security simultaneously. Contributions to a 403(b) plan are typically made through salary deferrals, while Social Security contributions are made via payroll taxes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.