The 403(b) contribution limit refers to the maximum amount that an individual can contribute annually to their 403(b) retirement savings plan. This type of plan is typically offered to employees of public schools, certain tax-exempt organizations, and certain ministers. The contribution limit, determined by the Internal Revenue Service (IRS), varies each year due to inflation adjustments, and additional catch-up contributions are permitted for individuals aged 50 and above. Understanding the 403(b) contribution limit is crucial as it allows employees to optimize their retirement savings, reduce their taxable income, and plan for a secure financial future. In retirement planning, being aware of the contribution limit can help individuals make informed decisions about their savings and investment strategies, ultimately impacting their financial well-being in their retirement years. When it comes to contributing to a 403(b) retirement account, employees need to keep two key limits in mind. The first one is the cap on elective salary deferrals, meaning the portion of salary that an employee decides to put directly into the 403(b) account. In 2024, this limit stands at $23,000, an increase from $22,500 in 2023. For those aged 50 or above, they can add an extra $7,500 as catch-up contributions beyond the basic limit on elective deferrals. For employees who've shown a long-standing commitment of 15 years or more with the same eligible 403(b) employer, there's an opportunity to increase their elective deferral limit. The second limit pertains to annual additions, which include all contributions made by both employer and employee to all 403(b) accounts. This limit, in general, is the lower of $69,000 or 100% of the employee's compensation for their most recent year of service. The contributions made to a 403(b) plan can come from different sources and in various forms. Understanding these can help employees and employers plan their contributions effectively. This refers to the amounts contributed to the plan by the employee, deducted directly from their paycheck before taxes. The amount is determined by the employee up to the maximum annual contribution limit. Employers may choose to contribute to an employee's 403(b) plan. This can take the form of a matching contribution, where the employer matches a portion of the employee's own contributions, or a non-elective contribution, where the employer contributes regardless of the employee's contribution level. Non-elective contributions are those made by the employer that are not dependent on the amount the employee contributes. This could be a set percentage of the employee's compensation or a flat dollar amount. Non-elective contributions are beneficial to employees as they increase the total amount being contributed to the retirement plan without requiring additional financial commitment from the employee. One of the significant benefits of contributing to a 403(b) plan is the potential tax advantages it offers. However, exceeding the contribution limit can result in tax penalties, and understanding these implications is vital for effective retirement planning. Contributions to a 403(b) plan are made on a pre-tax basis, meaning the income you contribute is not subject to income tax at the time of contribution. This not only lowers your taxable income for the year but also allows your savings to grow tax-deferred until you withdraw in retirement. When you do withdraw, the amount is taxed as ordinary income, which may be at a lower tax bracket, depending on your retirement income. If you contribute more than the allowable limit to your 403(b) plan, you may be subject to a 6% excise tax on the excess contributions. This penalty applies for each year the excess amount remains in the account. To avoid this penalty, it's essential to carefully track your contributions and ensure you do not exceed the limit. While your 403(b) contributions are made with pre-tax dollars, there may be circumstances where your contributions could be partially or fully deductible. For instance, if you also contribute to a traditional IRA in the same year, your 403(b) contributions could impact the deductibility of your IRA contributions, depending on your income level and filing status. Several rules and regulations govern 403(b) contributions, established by the IRS. Adherence to these regulations is crucial to avoid penalties and ensure the benefits of your 403(b) plan. The IRS provides the guidelines for 403(b) plans, including who can participate, how much can be contributed, and when and how distributions can be made. Regular updates are often provided, including annual adjustments to contribution limits, so staying informed about these guidelines is necessary. Changes in your employment status can impact your ability to contribute to your 403(b) plan. If you change jobs and your new employer doesn't offer a 403(b) plan, you will not be able to continue making contributions. However, you generally have the option to roll over your accumulated savings to a new eligible retirement plan. In certain circumstances, 403(b) plans may allow loans and early withdrawals. However, these distributions may be subject to income tax and a 10% early withdrawal penalty if taken before age 59 ½. Specific rules regarding hardship withdrawals and loan provisions depend on the plan document. To get the most out of your 403(b) plan, it's crucial to develop a strategic approach to your contributions. Here are a few strategies to consider. The first step in maximizing your 403(b) contributions is understanding your financial goals and needs. How much will you need in retirement? What are your other sources of retirement income? By answering these questions, you can determine how much you need to contribute to meet your retirement goals. While it's essential to maximize your 403(b) contributions, don't overlook other retirement savings opportunities. This might include contributing to an IRA or a taxable investment account. Balancing your contributions can provide tax diversification and potentially increase your overall retirement savings. If you're getting a late start on retirement savings, make the most of catch-up contributions. These allow you to contribute extra to your 403(b) plan if you're aged 50 or older. Additionally, consider contributing more of your salary toward your retirement savings, if possible. Understanding the 403(b) contribution limit and its implications is vital for strategic retirement planning. These contributions, made by both employees and employers, offer tax advantages and can be a significant source of retirement income. Being aware of the consequences of exceeding these limits, such as tax penalties, can help individuals avoid unnecessary financial burdens. It's also important to stay informed about IRS guidelines and how life changes, like shifts in employment status, can affect your ability to contribute. Comparing 403(b) plans to other retirement savings options and balancing contributions across these can provide tax diversification and help maximize overall savings. Furthermore, for those getting a late start, taking advantage of catch-up contributions can help secure a more stable financial future. Ultimately, understanding and effectively leveraging the 403(b) contribution limit is a powerful tool for achieving retirement readiness.What are 403(b) Contributions?

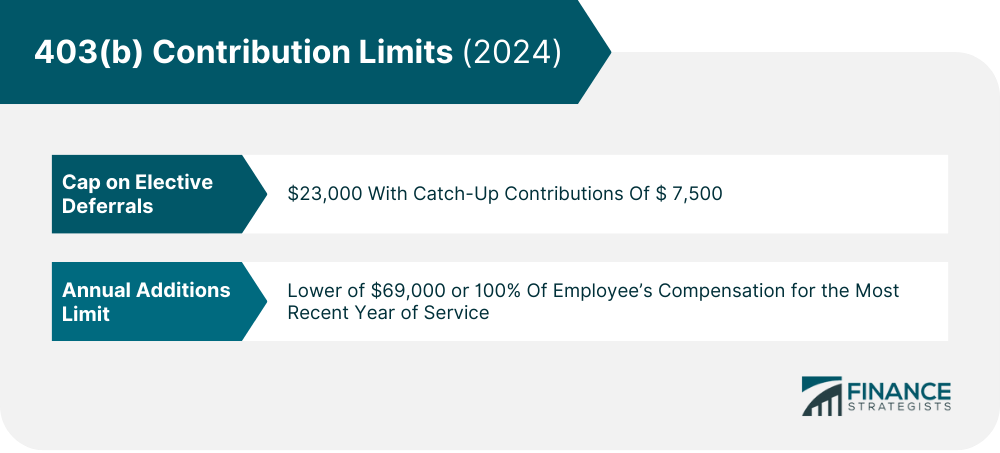

403(b) Contribution Limits

Cap on Elective Salary Deferrals

Annual Additions

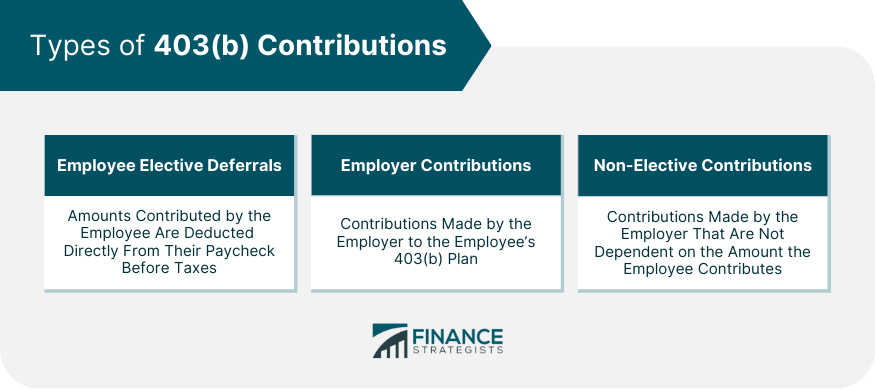

Types of 403(b) Contributions

Employee Elective Deferrals

Employer Contributions

Non-Elective Contributions

Tax Implications of 403(b) Contributions

Tax Advantages of Making 403(b) Contributions

Tax Penalties for Excess Contributions

Rules for Tax Deductibility

Rules and Regulations Governing 403(b) Contributions

Regulations from the Internal Revenue Service (IRS)

Effect of Changes in Employment Status

Rules Regarding Loans and Withdrawals

Strategies for Maximizing 403(b) Contributions

Understand Financial Goals and Needs

Balance 403(b) Contributions With Other Retirement Savings

Make Use of Catch-up Contributions

Conclusion

403(b) Contribution Limit FAQs

The 403(b) contribution limit is the maximum amount you can annually contribute to your 403(b) retirement savings plan. It is set by the IRS and is subject to change each year due to inflation adjustments.

While you can technically exceed the 403(b) contribution limit, doing so will likely result in a 6% excise tax on the excess contributions. This penalty applies for each year the excess amount remains in your account.

Employer contributions do not count towards your individual 403(b) contribution limit. The limit applies only to the amount you personally contribute.

To maximize your savings, consider utilizing employer contributions, which do not count towards your individual contribution limit. Also, if you are 50 or older, you can take advantage of additional catch-up contributions.

If you change jobs and your new employer does not offer a 403(b) plan, you won't be able to continue making contributions. However, you typically have the option to roll over your accumulated savings to a new eligible retirement plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.