The maximum 403(b) contribution refers to the highest amount that an individual can contribute to their 403(b) retirement plan in a given tax year. This figure is determined by the Internal Revenue Service (IRS), and it comprises both the employee's elective deferrals and any employer contributions. However, the IRS sets specific limits on the amount an employee can contribute from their salary, also known as the elective deferral limit. They aim to ensure fairness in the tax system by limiting the extent to which high earners can benefit from the tax advantages of 403(b) plans. Second, they protect the fiscal interests of the government by capping the amount of tax-deferred income flowing into these plans. The IRS sets a limit on the total contributions, including both elective deferrals and employer contributions, that can be made to a 403(b) retirement plan each year. The maximum 403(b) contribution for 2024 is $23,000. This is the total amount that you can contribute to your 403(b) plan from your salary before taxes. Employees who are 50 or older can make catch-up contributions of $7,500 in 2024, bringing their total contribution limit to $30,500. The total contributions include all elective deferrals, employer contributions, and after-tax contributions if allowed by the plan. However, it is essential to verify the current limit, as the IRS may adjust this amount periodically to account for inflation. The annual addition limit for 403(b) plans is the lesser of $69,000 or 100% of the employee's includible compensation. In other words, the total amount that an employee can contribute to their 403(b) plan, including employer contributions and employee elective salary deferrals, cannot exceed $69,000. Includible compensation is the amount of taxable wages and benefits that the employee received in their most recent full year of service. For example, if an employee earns $50,000 in includible compensation, they can contribute up to $69,000 to their 403(b) plan. However, if an employee earns $100,000 in includible compensation, they can still only contribute up to $69,000 to their 403(b) plan. If the total employer and employee contributions to a 403(b) plan exceed the annual addition limit, the plan may be out of compliance with IRS regulations. If this happens, the plan administrator may need to correct the mistake by reducing the employee's contributions or by returning excess contributions to the employee. The IRS typically reviews the maximum contribution and elective deferral limits annually. This review considers changes in the cost of living to ensure that the limits maintain their value in real terms. These adjustments are usually announced towards the end of the year and come into effect on January 1 of the following year. It is essential to stay updated on these changes to avoid inadvertently exceeding the contribution limits and potentially incurring penalties. The IRS regulations play a significant role in determining the maximum contribution limit to a 403(b) retirement plan. The IRS sets these limits and reviews them annually, taking into account changes in the cost of living. These regulations serve to keep the contribution limits in line with economic conditions, thereby preserving the real-world value of the limits. The age of the plan participant also influences the maximum contribution limit. The IRS provides for catch-up contributions, which allow individuals aged 50 and above to contribute more than the standard limits to their 403(b) plans. In 2024, the catch-up contribution limit is $7,500. This provision allows older individuals, who may be closer to retirement and potentially have more financial resources, to save more for their retirement. Contributions to a traditional 403(b) plan are made on a pre-tax basis, which means that they reduce your taxable income for the year. This could potentially place you in a lower tax bracket and result in significant tax savings. Moreover, these contributions and their earnings grow tax-deferred until withdrawal, offering an effective way to compound your retirement savings. Maximizing your 403(b) contributions also optimizes the potential for long-term growth of your retirement savings. Due to the power of compound interest, even small increases in your contributions can lead to substantial growth over time. By consistently contributing the maximum amount allowed, you increase the money that is working for you, potentially leading to a larger nest egg when you retire. Many employers offer matching contributions as part of their 403(b) retirement plans. These matching contributions often come with certain conditions, typically requiring you to contribute a certain percentage of your salary to qualify for the match. By maximizing your contributions, you stand a better chance of taking full advantage of your employer's match, effectively receiving "free money" towards your retirement savings. To ensure you are maximizing your 403(b) contributions, it's wise to regularly review and, if necessary, adjust your contribution amounts. This is particularly important in years when the IRS increases the contribution limits. By reviewing your contributions annually, or whenever you experience a significant change in your financial circumstances, you can ensure that you are always contributing as much as possible to your retirement savings. If you are aged 50 or above, you have the opportunity to make catch-up contributions to your 403(b) plan. These contributions are in addition to the standard contribution limits, allowing you to save more for retirement. Making catch-up contributions can be a highly effective strategy for boosting your retirement savings, particularly if you got a late start on saving or if you have already reached the standard contribution limits. If your employer offers matching contributions, be sure to contribute enough to qualify for the full match. Failing to do so means leaving "free money" on the table. Remember, employer matching contributions count towards the total contribution limit, but not the elective deferral limit, so they can help you save more for retirement without exceeding the limits. If you receive additional income during the year, such as a bonus, an inheritance, or winnings, consider contributing some or all of it to your 403(b) plan. This can be an easy way to boost your retirement savings without impacting your everyday budget. Keep in mind, however, that these contributions are subject to the same IRS limits as regular contributions. So, you'll need to ensure that you don't exceed the maximum contribution limit for the year. One common mistake to avoid is exceeding the maximum contribution limit for your 403(b) plan. If you contribute more than the allowable limit, you may face an excess contribution penalty from the IRS. To avoid this, it's important to track your contributions carefully throughout the year and adjust them if necessary to stay within the limits. Another common mistake is failing to take full advantage of employer-matching contributions. Some individuals contribute less than the amount needed to qualify for the full match, effectively leaving "free money" on the table. To avoid this, always aim to contribute at least enough to qualify for your employer's full matching contribution. As the IRS typically increases the contribution limits each year to keep up with inflation, failing to increase your contributions accordingly means you're not maximizing your potential savings. Additionally, as your income increases over time, you should ideally be saving a higher dollar amount, even if you continue to save the same percentage of your income. Understanding the maximum contribution limit for 403(b) retirement plans is crucial for optimizing savings. The IRS determines these limits to ensure fairness and protect fiscal interests. The elective deferral limit for 2024 is $23,000, with an additional $7,500 catch-up contribution for individuals aged 50 and above. The total contribution, including employer contributions, cannot exceed $69,000 or 100% of includible compensation, whichever is lower. Maximizing 403(b) contributions offers significant benefits, such as tax savings, long-term growth potential, and employer-matching contributions. To make the most of these plans, one should regularly review and adjust contribution amounts, utilize catch-up contributions, and leverage employer-matching contributions. Common mistakes to avoid include exceeding the maximum contribution limit, failing to take advantage of employer matching, and not adjusting contribution amounts over time.What Is the Maximum 403(b) Contribution?

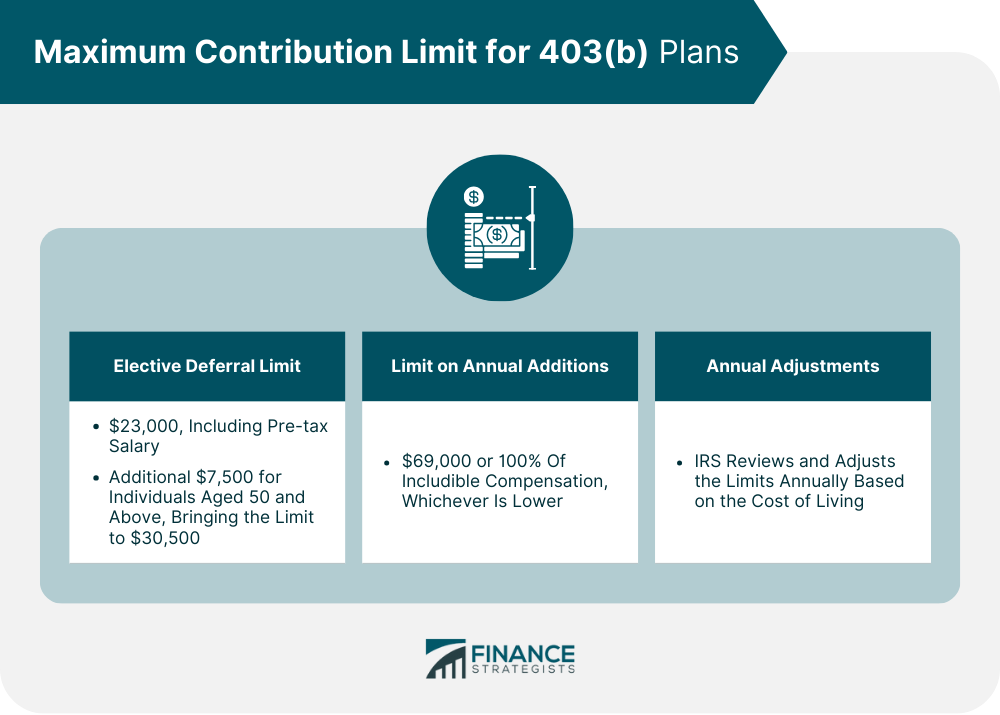

Maximum Contribution Limit for 403(b) Plans

Elective Deferral Limit

Limit on Annual Additions

Annual Adjustments to the Maximum Contribution Limit

Factors Influencing the Maximum Contribution Limit

Internal Revenue Service (IRS) Regulations

Age-Related Contribution Limits

Importance of Maximizing 403(b) Contributions

Tax Benefits

Long-Term Growth

Employer Matching Contributions

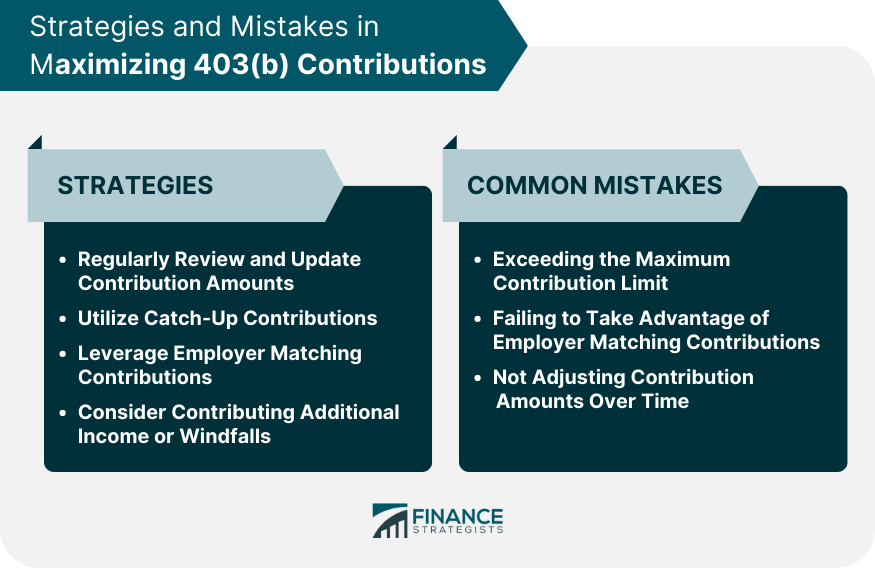

Strategies for Maximizing 403(b) Contributions

Regularly Review and Update Contribution Amounts

Utilize Catch-Up Contributions

Leverage Employer Matching Contributions

Consider Contributing Additional Income or Windfalls

Common Mistakes in Maximizing 403(b) Contributions

Exceeding the Maximum Contribution Limit

Failing to Take Advantage of Employer Matching Contributions

Not Adjusting Contribution Amounts Over Time

Conclusion

Maximum 403(b) Contribution FAQs

The maximum 403(b) contribution refers to the highest amount you can contribute to your 403(b) plan in a year. This limit is set by the IRS and includes both your contributions and your employer's contributions. As of 2023, the maximum total contribution limit was $66,000.

The elective deferral limit is the maximum amount that you can contribute from your salary to a 403(b) plan in a year. As of 2023, this limit was $22,500 for individuals under age 50.

You can maximize your 403(b) contributions by contributing as much as you can up to the IRS limits, making catch-up contributions if you're age 50 or above, taking full advantage of any employer-matching contributions, and increasing your contributions whenever your financial situation allows.

If you exceed the maximum contribution limit for your 403(b) plan, you may face an excess contribution penalty from the IRS. To avoid this, it's important to keep track of your contributions throughout the year.

While maximizing your contributions can be an effective strategy for building retirement savings, everyone's financial situation is different. Therefore, it's important to consider your income, financial goals, and retirement timeline when deciding how much to contribute to your 403(b) plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.