A 403(b) plan is a valuable tool for retirement, providing a variety of options to manage and distribute your savings. After retirement, you can choose to take regular withdrawals, Required Minimum Distributions starting at age 73, or a lump sum distribution. However, these withdrawals are subject to federal income tax and potentially state taxes as well. You may also opt to roll over your 403(b) to an IRA or another retirement account, offering more flexibility. Annuities, another option within 403(b) plans, provide a steady stream of income but with specific considerations. Lastly, some plans allow for loans and hardship distributions, each with its own tax implications. Managing your 403(b) effectively requires understanding these nuances and possibly consulting a financial advisor for personalized guidance. A 403(b) plan allows for regular withdrawals once the participant reaches retirement age. You can opt to receive monthly, quarterly, or annual distributions depending on your needs. It's crucial to consider that the amount you withdraw will directly impact how long your retirement savings last. RMDs are obligatory, minimum yearly withdrawals that must be started by April 1 of the year following the year the participant reaches age 73. Not taking these mandatory distributions can result in substantial tax penalties, up to 50% of the amount not distributed. A lump-sum distribution is another option where you withdraw all your funds at once. This might seem tempting, but it could potentially push you into a higher tax bracket, resulting in more tax liability. Withdrawals from your 403(b) account are treated as ordinary income and are subject to federal income tax. The exact rate will depend on your total income and your federal tax bracket. If you make withdrawals before the age of 59 ½ , you may be subject to a 10% early withdrawal penalty. There are exceptions, such as death, disability, and certain medical expenses, which could allow for penalty-free early withdrawals. Spreading out your distributions can help manage your tax liability. You might also consider tax-efficient investment strategies or tax-loss harvesting to offset gains. The age of 59 ½ is important in 403(b) plans because it marks the end of the 10% early withdrawal penalty. This allows more flexibility in your retirement income strategy. Once you turn 73, you must start taking RMDs. This may impact your tax situation and your overall retirement income strategy, as these distributions are treated as taxable income. Rollover options are available when you retire or leave your job. You might roll over your 403(b) into an IRA or another employer's retirement plan. This can give you more investment options or potentially lower fees. To roll over your 403(b), you'll need to set up an IRA or another retirement account that accepts rollovers. Then, you'll need to request a direct rollover from your plan administrator. Direct rollovers, where funds are transferred directly from one retirement account to another, typically allow you to avoid any immediate tax consequences. However, a mistake could result in the distribution being treated as taxable income and potential penalties. Annuities provide a stream of income that you cannot outlive. When you annuitize your 403(b) plan, you agree to exchange your account balance for a regular income stream. You can choose to annuitize a portion or all of your 403(b) account. This can provide a stable, predictable income, but once annuitized, those funds are typically locked in and cannot be accessed in a lump sum. Annuities provide regular, predictable income and can be a good option for risk-averse retirees. However, they can be complex, and fees can be high. Additionally, your income might not keep pace with inflation. While not all plans permit them, loans and hardship distributions can provide access to your funds in cases of immediate and heavy financial need. Repayment is typically required for loans, while hardship distributions cannot be repaid. Loans must be repaid within five years, and payments generally must begin immediately. Interest is paid to your own account. Failure to repay a loan may result in it being treated as a taxable distribution. Unpaid loans can result in taxes and penalties. Hardship distributions are treated as taxable income and may also be subject to penalties if you're under the age of 59.5. Each 403(b) plan has unique terms. Be sure to read your summary plan description and any other documentation to understand your plan's specific rules. Financial advisors can provide guidance tailored to your personal situation. They can help with understanding your 403(b), investment choices, tax planning, and developing a sustainable retirement income strategy. Health care can be a significant expense in retirement. Consider a strategy for addressing these costs, including the potential use of Health Savings Accounts (HSAs), long-term care insurance, or Medicaid planning. Managing a 403(b) plan after retirement requires an understanding of various options and tax implications. Choices include regular withdrawals, Required Minimum Distributions after age 73, or a lump sum distribution, each with different tax consequences. Rolling over to an IRA can offer greater flexibility. Annuities provide a steady income, though with certain considerations. Moreover, some plans allow loans and hardship distributions, but these have specific tax implications too. To navigate these complexities, a financial advisor can provide tailored guidance. Finally, planning for potential healthcare costs is also crucial. It's clear that a 403(b) plan is a significant tool for post-retirement financial security, but using it effectively demands careful planning and consideration.Overview of How 403(b) Works After Retirement

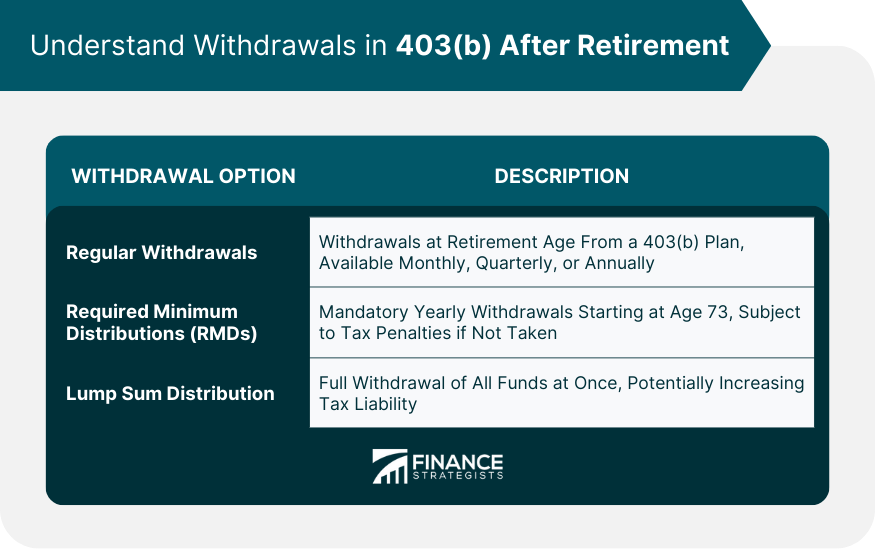

Understand Withdrawals in 403(b) After Retirement

Regular Withdrawals

Required Minimum Distributions (RMDs)

Lump Sum Distribution

Tax Implications of Withdrawals

Taxes on Distributions

Potential Penalties and Exceptions

Tax Strategies for Managing Distributions

Role of Age on 403(b) Plans After Retirement

Impact of Reaching Age 59 ½

Commencement of RMDs at Age 73

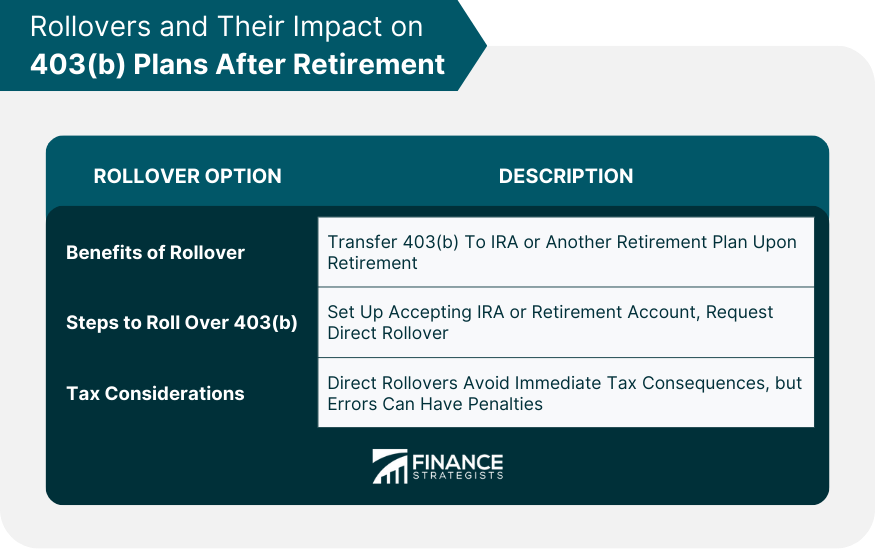

Rollovers and Their Impact on 403(b) Plans After Retirement

Benefits of Rollover

Steps to Roll Over a 403(b) to an IRA or Other Retirement Account

Tax Considerations During Rollovers

Annuities and Their Role in 403(b) Plans After Retirement

Basic Principles of Annuities

Utilize Annuities Within a 403(b) Plan

Assess the Benefits and Potential Drawbacks of Annuities

Loans and Hardship Distributions From a 403(b) After Retirement

Conditions for Taking Loans and Hardship Distributions

Procedures for Repaying a 403(b) Loan

Tax Implications of Loans and Hardship Distributions

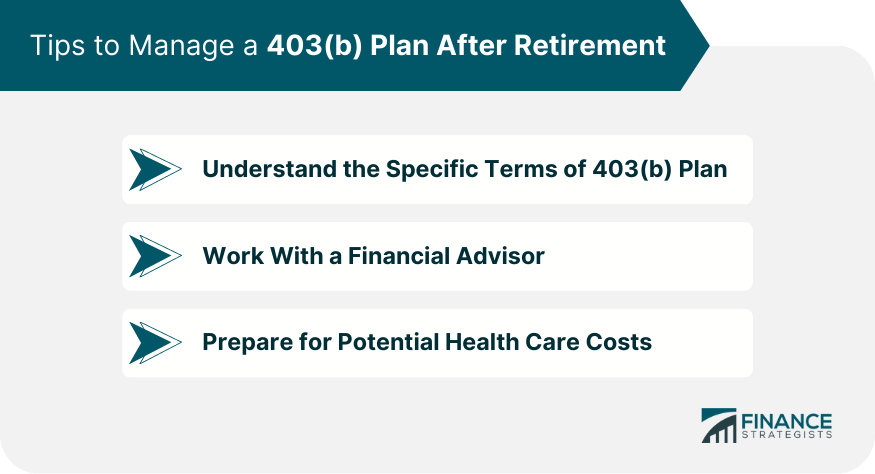

Tips to Manage a 403(b) Plan After Retirement

Understand the Specific Terms of 403(b) Plan

Work With a Financial Advisor

Prepare for Potential Health Care Costs

Conclusion

How 403(b) Works After Retirement FAQs

If you fail to take your RMDs after age 73, you could face a hefty penalty. The IRS may charge up to 50% of the amount you should have withdrawn but didn't.

Yes, if you perform a direct rollover, where the funds are transferred directly from your 403(b) to an IRA, you can avoid immediate taxes. However, when you start taking distributions from the IRA, those will be subject to regular income tax.

Annuities provide a regular, predictable stream of income, which is a major advantage for many retirees. However, the downsides include potential high fees, complexity, and the fact that your income may not keep up with inflation. Once annuitized, those funds typically cannot be accessed in a lump sum.

Not all 403(b) plans permit loans, but for those that do, loans can usually be taken for any reason. However, they must be repaid with interest within five years, and failure to do so could result in the loan amount being treated as a taxable distribution.

A financial advisor can help you understand your 403(b) plan, guide you on investment decisions, assist with tax planning, and help develop a sustainable retirement income strategy. Retirement planning can be complex, and a financial advisor can provide personalized advice based on your individual situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.