A 403(b) plan fee disclosure is a detailed report that provides essential information about the fees associated with a 403(b) retirement plan. The disclosure includes information on plan administration fees, investment fees, and individual service fees. It aims to provide transparency, enabling the plan participant to understand the costs related to their retirement savings account. These documents are not merely helpful addendums; they're a fundamental aspect of retirement planning. Full disclosure of fees can influence participants' decision-making, potentially impacting the overall value of their retirement savings. The significance of the fee disclosure lies not only in the transparency it brings, but also in its potential to empower participants in managing their retirement portfolios. The regulation and oversight of 403(b) plans and their fee disclosures come from the Employee Retirement Income Security Act (ERISA), a federal law enacted in 1974. ERISA mandates that all retirement plans, including 403(b) plans, must provide participants with comprehensive fee disclosure documents. This requirement ensures that plan participants have access to information that can inform their retirement planning decisions. The Department of Labor (DOL) sets specific guidelines for the content and delivery of these fee disclosures. These guidelines aim to protect the rights of plan participants by providing comprehensive information about the cost of different investment options available within the plan. The key stakeholders involved in 403(b) plan fee disclosures include plan administrators, financial advisors, plan participants, and regulatory agencies. Each stakeholder plays a crucial role in ensuring the process is effective, accurate, and compliant with regulatory guidelines. Plan administrators are responsible for providing fee disclosure documents to plan participants. Financial advisors interpret the fee information and assist plan participants in making informed decisions. Participants themselves are responsible for understanding the fee structure, while regulatory agencies ensure that the fee disclosure process adheres to set regulations. The primary objective of a 403(b) plan fee disclosure is to provide participants with a transparent understanding of the fees associated with their retirement savings. This transparency helps participants make informed decisions regarding their investment choices. Additionally, fee disclosures can improve plan efficiency. They can encourage competitive pricing among service providers, potentially reducing the overall cost for participants. Ultimately, comprehensive fee disclosure can lead to increased confidence and trust in the retirement plan and its management. Plan administration fees cover the cost of managing the 403(b) plan. They encompass services like record keeping, accounting, legal support, and customer service. These fees are generally shared among all plan participants and can be deducted from the plan assets or charged as a direct fee to each participant. These fees are essential to the smooth operation of the plan, ensuring that all aspects are running effectively. They are typically expressed as a percentage of plan assets and deducted from each participant's account balance. Investment fees and expenses are costs associated with the management of the investment options within the 403(b) plan. These fees are generally paid to the investment managers for managing the investment portfolios, and they directly impact the return on investments. It can include management fees, sales charges, and other costs related to the purchase or sale of investments. These fees are usually deducted directly from the investment returns, reducing the net return credited to the participant's account. Individual service fees are charged for specific services provided to individual plan participants. These fees are typically charged only to those who choose to avail themselves of certain plan features or services. Examples may include fees for taking out a plan loan, making a hardship withdrawal, or receiving personalized investment advice. Individual service fees are usually charged in addition to the general plan administration and investment fees. They can be significant, depending on the nature and frequency of the services provided. The prospectus is a document that details the specific investment options available within the 403(b) plan, including descriptions of the investment objectives, strategies, risks, and fees associated with each option. The prospectus can offer a comprehensive overview of each investment option's potential benefits and costs. Additionally, other written materials, such as quarterly or annual reports, provide important updates on the performance and costs of the investments within the plan. These documents detail the fees and expenses that were charged to a participant's account during the previous year. Annual fee disclosures also include comparative charts that allow participants to compare the fees and performance of different investment options within the plan. This comparative information can help participants make informed decisions about their investment choices for the upcoming year. Online tools and resources have become increasingly important methods for fee disclosure. Many plan providers now offer online portals where participants can access their account information, including details about the fees and expenses associated with their plan. Some providers also offer interactive tools that allow participants to estimate future account balances, taking into account the impact of fees and expenses. These online resources provide a convenient and accessible way for participants to stay informed about the costs associated with their 403(b) plan. In addition to the above-mentioned methods, plan providers may use other methods to disclose fees. These could include regular newsletters, educational seminars, or one-on-one meetings with financial advisors. The goal of these methods is to ensure that plan participants have multiple opportunities to understand and manage the fees associated with their retirement savings. By understanding the cost of different investment options, participants can choose the options that best fit their financial goals and risk tolerance. Knowing the fee structure can also help participants plan for retirement more effectively. For example, understanding that certain services or plan features come with additional fees can help participants decide whether or not to use these services or features. Fee disclosure can also lead to enhanced efficiency and competitiveness among 403(b) plan providers. By disclosing fees in a clear and consistent manner, providers can promote competition based on price and service quality. Moreover, fee transparency can push providers to streamline their operations and reduce costs, leading to lower fees for participants. In the long run, this can contribute to higher retirement savings and better financial outcomes for participants. By being transparent about the costs associated with a 403(b) plan, providers demonstrate their commitment to acting in the best interest of participants. Additionally, fee disclosure can help hold providers accountable for the services they deliver. If fees are high, participants may question whether they are getting good value for their money. This can motivate providers to continually improve their services and justify their fees. Fees can be structured in many different ways, making it difficult for participants to understand how much they are actually paying. For example, some fees may be deducted directly from a participant's account balance, while others may be deducted from the investment returns. Moreover, some fees may vary depending on the specific investment options chosen by the participant, further complicating the calculation. Some plan providers may receive compensation from investment managers for including certain investment options in their 403(b) plans. This could potentially influence the provider's decision-making process, leading to higher-cost investment options being included in the plan. While regulations require that these types of arrangements be disclosed to plan participants, understanding these conflicts and their potential impact on fees can be complex and challenging for participants. Despite the availability of fee information, many participants may not take the time to review and understand the fee disclosure documents. This could be due to a lack of financial literacy, a perception that the documents are too complex, or simply a lack of time. Whatever the reason, the lack of participant awareness can limit the effectiveness of fee disclosure in promoting informed decision-making and accountability. One best practice for 403(b) plan fee disclosure is to use clear and concise language. Complex financial terms and jargon can make fee disclosure documents difficult to understand. Using simple, plain language can help participants understand the costs associated with their plan. In addition to using plain language, it's important to present information in a clear, organized manner. Including a summary of key information at the beginning of the document and using headings and subheadings to break up the text can improve readability and comprehension. Timely and accurate disclosure is another best practice. Participants should receive fee disclosure documents on a regular basis and whenever significant changes occur in the plan's fee structure. Providing accurate, up-to-date information can help participants make informed decisions about their retirement savings. Moreover, the disclosure should be made in a format that is easily accessible to participants. This could mean providing hard copies of disclosure documents, making the information available online, or using other methods that meet the needs of the participant population. Plan providers should regularly review and update fee disclosure documents to ensure that they reflect the current fee structure of the plan. This not only ensures compliance with regulatory requirements but it also helps participants stay informed about any changes that may affect their retirement savings. Regular reviews can also help providers identify and address any areas of confusion or misunderstanding among participants. A 403(b) plan fee disclosure is a comprehensive report that provides essential information about the fees associated with a 403(b) retirement plan. It is a fundamental aspect of retirement planning, aiming to provide transparency and empower participants in managing their retirement portfolios. By understanding the costs related to their retirement savings account, participants can make informed decisions regarding investment choices, plan for retirement more effectively, and potentially impact the overall value of their retirement savings. The legal requirements and regulatory guidelines set by ERISA and the Department of Labor ensure that participants have access to comprehensive fee disclosure documents. Fee disclosure brings benefits such as enhanced plan efficiency, competitiveness among providers, and the promotion of trust and accountability. However, challenges such as fee calculation complexities, conflicts of interest, and participant awareness exist. Adhering to best practices, including clear and concise language, timely and accurate disclosure, and regular evaluation and updating of fee information, can improve fee disclosure efforts. What Is a 403(b) Plan Fee Disclosure?

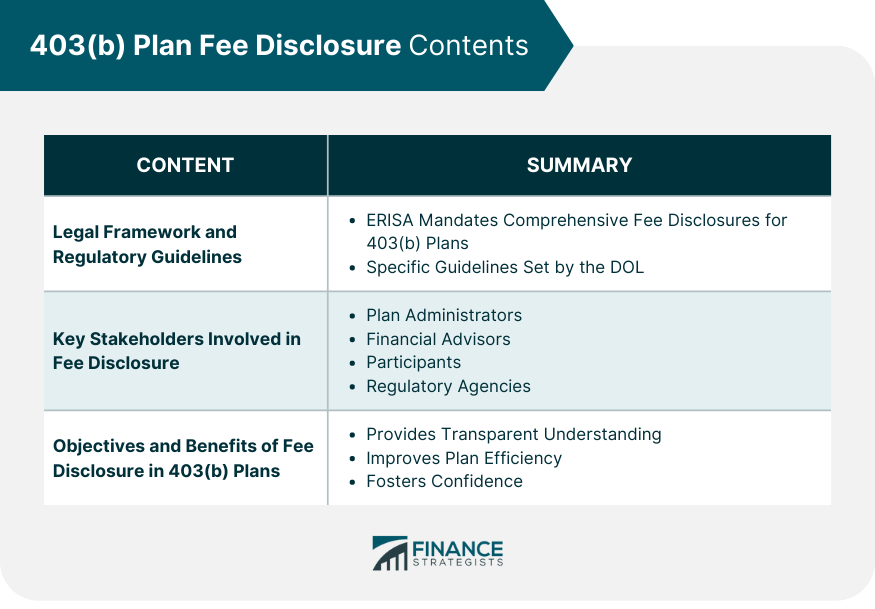

403(b) Plan Fee Disclosure Contents

Legal Framework and Regulatory Guidelines

Key Stakeholders Involved in Fee Disclosure

Objectives and Benefits of Fee Disclosure in 403(b) Plans

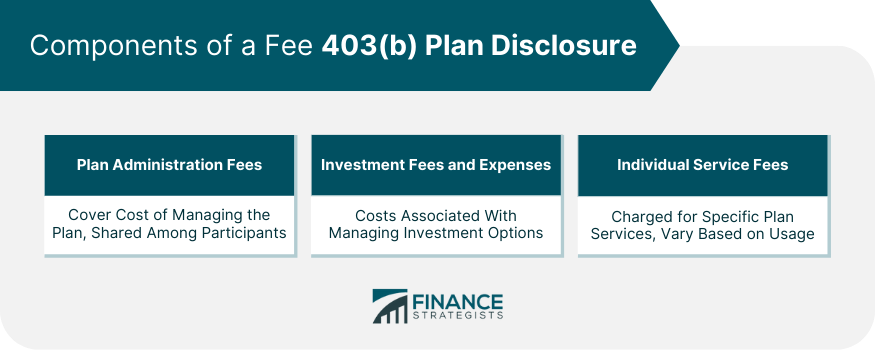

Components of a Fee 403(b) Plan Disclosure

Plan Administration Fees

Investment Fees and Expenses

Individual Service Fees

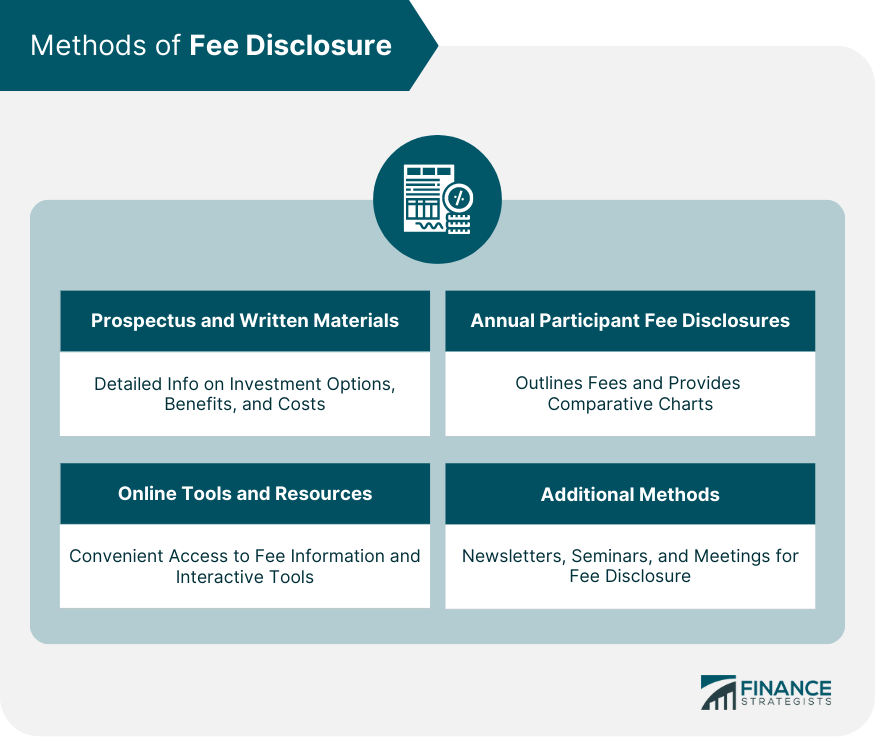

Methods of Fee Disclosure

Prospectus and Other Written Materials

Annual Participant Fee Disclosures

Online Tools and Resources

Additional Methods for Fee Disclosure

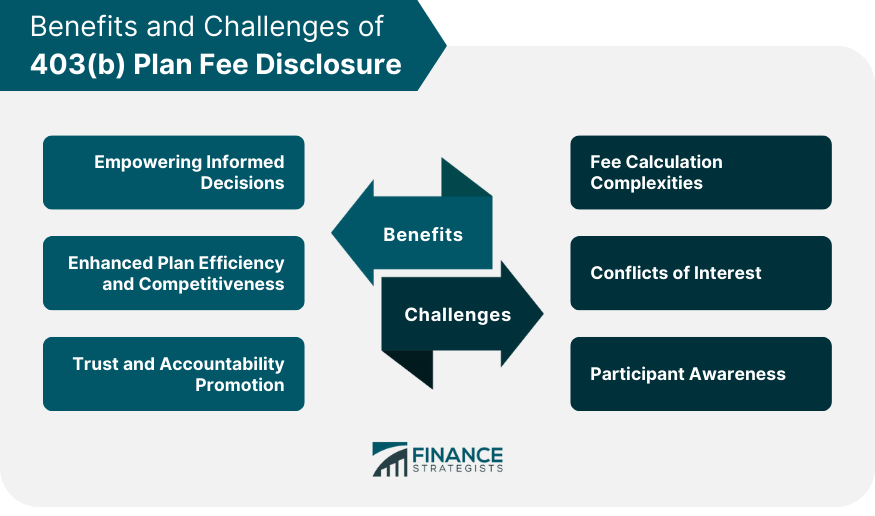

Benefits of 403(b) Plan Fee Disclosure

Empowering Informed Decisions

Enhanced Plan Efficiency and Competitiveness

Trust and Accountability Promotion

Challenges of 403(b) Plan Fee Disclosure

Fee Calculation Complexities

Conflicts of Interest

Participant Awareness

Best Practices for 403(b) Plan Fee Disclosure

Clear and Concise Language

Timely and Accurate

Regular Evaluation and Updating of Fee Information

Conclusion

403(b) Plan Fee Disclosure FAQs

A 403(b) plan fee disclosure is a report that provides information about the fees associated with a 403(b) retirement plan. It includes details about plan administration fees, investment fees, and individual service fees.

The key stakeholders include plan administrators, financial advisors, plan participants, and regulatory agencies. Each has a crucial role in ensuring the process is effective, accurate, and compliant with regulatory guidelines.

Fee disclosure is important because it provides transparency, enabling plan participants to understand the costs associated with their retirement savings. It empowers them to make informed decisions and contributes to the overall trust in the retirement plan and its management.

Challenges include the complexity of fee calculation, potential conflicts of interest, and participant awareness. Despite the availability of fee information, many participants may not take the time to review and understand the fee disclosure documents.

Best practices include using clear and concise language, ensuring timely and accurate disclosure, and regularly evaluating and updating fee information. Implementing these practices can help improve the effectiveness of fee disclosure.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.