Tax exemption refers to a specific category of income, organization, or activity that is not subject to taxation by the government. It means that the income or organization is exempt from paying taxes to the government, resulting in a lower tax burden for the individual or entity. Tax-exempt income can include gifts, inheritances, and certain types of retirement income, such as contributions to a Roth IRA. Non-profit organizations, including charities and religious institutions, may also qualify for tax-exempt status. The rationale behind tax exemption is to encourage certain activities or organizations that benefit society or to provide relief for those who may have limited financial resources. However, it is important to note that not all income or organizations are eligible for tax exemption, and the rules regarding tax exemption can vary depending on the jurisdiction and the specific circumstances. Tax exemptions can be granted to individuals, businesses, or organizations, and they can apply to various taxes, including income, property, or sales taxes. Tax exemptions can help reduce the overall tax burden for taxpayers, allowing them to retain more of their earnings or assets. In some cases, tax exemptions can also result in a more equitable distribution of resources and benefits within society. The importance of tax exemption lies in its ability to encourage particular activities or behaviors that are considered beneficial to society. By providing tax breaks, governments can incentivize individuals and organizations to engage in activities that promote social welfare, economic growth, or other public policy objectives. Furthermore, tax exemptions can help level the playing field for certain entities, such as non-profit organizations, by reducing their financial burden and allowing them to compete more effectively with their for-profit counterparts. This can ultimately lead to a more vibrant and diverse economy and a more robust social safety net. In many jurisdictions, gifts and inheritances received by individuals are not considered taxable income, which means that the recipient does not have to pay taxes on the value of the assets received. This tax exemption is designed to encourage the transfer of wealth between generations and to support family members in need. However, there may be limits on the amount of gifts or inheritances that can be received tax-free, and some jurisdictions may impose taxes on the donor or the estate of the deceased. Retirement income, such as pension payments, Social Security benefits, or distributions from certain tax-advantaged retirement accounts, may also be partially or fully tax-exempt. This type of tax exemption is intended to support retirees in their golden years by reducing their tax burden and allowing them to retain more of their retirement income. The extent to which retirement income is tax-exempt may vary depending on the individual's income level, the source of the retirement income, and the specific tax laws in their jurisdiction. Charitable organizations are typically granted tax-exempt status because they provide essential services to society, such as education, health care, or poverty alleviation. By exempting charities from taxes, governments can help ensure that more resources are directed towards fulfilling their missions. To qualify for tax-exempt status, charitable organizations must meet specific criteria, such as being organized and operated exclusively for charitable purposes and not engaging in political lobbying or other activities that could compromise their tax-exempt status. Religious institutions, such as churches, mosques, and synagogues, are another example of tax-exempt organizations. These institutions are typically granted tax exemptions due to their spiritual and social contributions to society, such as providing religious education, spiritual guidance, or community support services. Like charities, religious institutions must meet specific criteria to qualify for tax-exempt status, and they are subject to certain restrictions and reporting requirements to maintain their tax exemptions. One of the primary benefits of tax-exempt status is the tax savings it provides. By being exempt from certain taxes, organizations can retain more of their income and assets, which can be used to further their missions and support their beneficiaries. Tax-exempt status can also help organizations attract financial support from donors, who may be more inclined to contribute if they know their donations are tax-deductible. This can be particularly important for non-profit organizations that rely on donations to fund their operations and programs. Tax-exempt organizations often have increased fundraising potential, as donors may be more likely to contribute when they can benefit from tax deductions for their donations. This can help organizations secure the necessary funding to maintain or expand their programs and services. Tax-exempt organizations may also be eligible for government grants and programs that are not available to for-profit entities. This can provide additional financial resources and support for organizations in fulfilling their missions and serving their communities. One of the drawbacks of tax-exempt status is that it may limit an organization's revenue sources. For example, non-profit organizations are often restricted from engaging in certain types of income-generating activities, which can make it more challenging to diversify their revenue streams and maintain financial stability. Tax-exempt organizations are generally prohibited from distributing profits to their shareholders or members, which can be a deterrent for potential investors or stakeholders who might otherwise be interested in supporting the organization. Tax-exempt organizations are subject to compliance and reporting requirements to maintain their tax-exempt status. These requirements can be time-consuming and burdensome, particularly for smaller organizations with limited resources. Failure to comply with these requirements can result in the loss of tax-exempt status and the imposition of penalties and fines. In some jurisdictions, these organizations are required to make certain financial and operational information publicly available, which can expose them to scrutiny and potential criticism from the public, media, or other stakeholders. Obtaining tax-exempt status typically involves a multi-step process that varies depending on the jurisdiction and the specific type of tax exemption being sought. In general, organizations seeking tax-exempt status must first ensure that they meet the necessary criteria and organizational requirements for the exemption. Next, organizations must complete and submit an application for tax-exempt status to the relevant tax authority, providing detailed information about their organizational structure, mission, programs, and finances. The tax authority will review the application and make a determination regarding the organization's eligibility for tax-exempt status. If the organization's application is approved, it will receive official documentation confirming its tax-exempt status and outlining any ongoing compliance and reporting requirements. Organizations must remain diligent in meeting these requirements to maintain their tax-exempt status and avoid potential penalties. Tax exemption plays an essential role in promoting social welfare, economic growth, and other public policy objectives by providing financial incentives for certain activities and behaviors. While tax-exempt status can offer significant benefits, such as tax savings and increased fundraising potential, it also comes with potential drawbacks, including limited revenue sources and compliance and reporting requirements. In summary, tax exemption is a valuable tool for promoting the public good and supporting the vital work of non-profit organizations and other tax-exempt entities. By carefully considering the benefits and drawbacks of tax-exempt status, organizations can make informed decisions about whether pursuing tax exemption aligns with their mission and goals.What Is Tax-Exempt?

Importance of Tax Exemption

Types of Tax-Exempt Income

Gifts and Inheritances

Retirement Income

Tax-Exempt Organizations

Charities

Religious Institutions

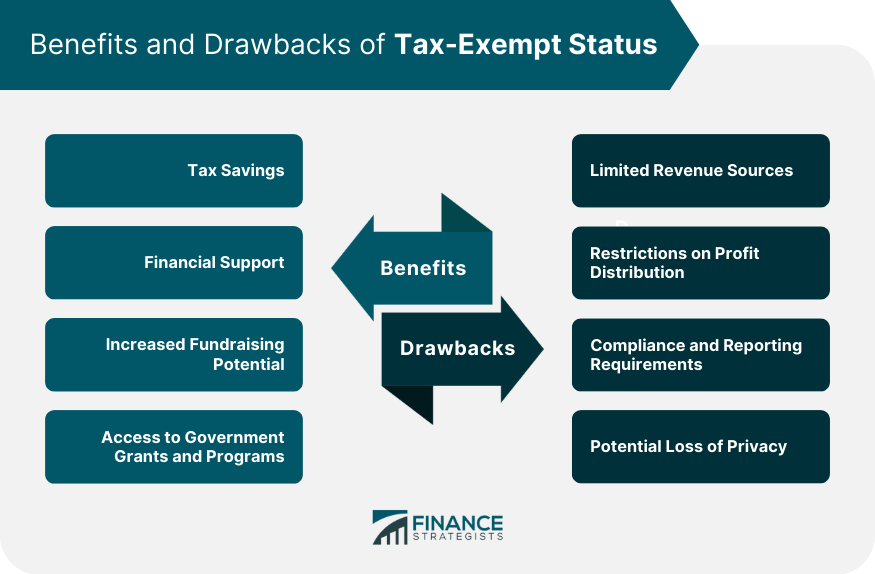

Benefits of Tax-Exempt Status

Tax Savings

Financial Support

Increased Fundraising Potential

Access to Government Grants and Programs

Drawbacks of Tax-Exempt Status

Limited Revenue Sources

Restrictions on Profit Distribution

Compliance and Reporting Requirements

Potential Loss of Privacy

How to Get Tax-Exempt Status

Final Thoughts

Tax-Exempt FAQs

Tax-exempt means that an individual or organization is exempt from paying certain taxes to the government, resulting in a lower tax burden.

To become tax-exempt, an organization must typically meet eligibility criteria and file an application with the relevant tax authority or agency.

Benefits of tax-exempt status can include lower tax burdens, access to funding from non-taxable sources, and potential public goodwill associated with non-profit status.

Drawbacks of tax-exempt status can include limited revenue sources, restrictions on profit distribution, compliance and reporting requirements, and potential loss of privacy.

No, not all non-profit organizations are automatically tax-exempt. Non-profit organizations must meet certain eligibility criteria and file an application for tax-exempt status.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.