A tax-sheltered annuity (TSA) is a type of retirement savings plan that offers tax advantages to employees of certain organizations, such as public schools, non-profit organizations, and religious institutions. These plans allow individuals to save for retirement by contributing pre-tax income, which then grows tax-deferred until withdrawn during retirement. The primary purpose of a TSA is to help eligible employees save for retirement while enjoying tax benefits. The tax advantages provided by TSAs encourage long-term savings and investment, which can result in a more comfortable retirement. TSAs are also attractive options due to their flexibility in investment choices and the potential for employer contributions. Incorporating a TSA into retirement planning can provide a valuable source of income during retirement years. By taking advantage of the tax benefits and investment options, individuals can build a diverse retirement portfolio tailored to their specific financial goals. Employees of public schools, non-profit organizations, and certain religious institutions are eligible to participate in 403(b) plans. As of 2024, the annual contribution limit for 403(b) plans is $23,000 for individuals under the age of 50, and an additional catch-up contribution of $7,500 for those aged 50 or older. 403(b) plans offer a variety of investment options, including mutual funds, annuities, and other types of investment products. State and local government employees, as well as certain non-governmental employees, are eligible for 457(b) plans. Similar to 403(b) plans, the annual contribution limit for 457(b) plans is $23,000 for individuals under the age of 50, and an additional catch-up contribution of $7,500 for those aged 50 or older. 457(b) plans offer a range of investment options, such as mutual funds, annuities, and other types of investment products. A Traditional IRA is a type of tax-deferred retirement account that allows individuals to make pre-tax contributions. The earnings within the account grow tax-deferred until withdrawn in retirement. Roth IRAs are retirement accounts funded with after-tax contributions. Although contributions are not tax-deductible, earnings grow tax-free, and qualified withdrawals during retirement are also tax-free. A Simplified Employee Pension (SEP) IRA is a type of retirement plan designed for self-employed individuals and small business owners. Employers can make tax-deductible contributions on behalf of eligible employees. A Savings Incentive Match Plan for Employees (SIMPLE) IRA is a retirement plan that allows both employers and employees to make contributions. Employers are generally required to match employee contributions up to a certain percentage. Contribution limits for IRAs vary based on the type of IRA and individual circumstances. As of 2024, the annual contribution limit for Traditional and Roth IRAs is $7,000 for individuals under the age of 50 and $8,000 for those aged 50 or older. SEP-IRAs and SIMPLE IRAs have different contribution limits based on employer and employee contributions. IRAs offer a wide range of investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more, allowing individuals to create a diversified retirement portfolio. First, determine if you are eligible for a TSA based on your employment status and the type of organization you work for. Choose a reputable plan provider that offers a range of investment options and competitive fees. Consult your employer or a financial advisor for recommendations. Based on your risk tolerance, financial goals, and investment horizon, select a diversified mix of investment options, such as stocks, bonds, mutual funds, and annuities. Establish a regular contribution schedule to your TSA, either through payroll deductions or by making manual contributions. Consider maximizing your contributions, if possible, to take full advantage of the tax benefits and potential for growth. Regularly review your TSA account performance and make adjustments as needed to ensure your investments align with your evolving financial goals and risk tolerance. You can choose to withdraw the entire account balance in a single payment, but this may result in a significant tax liability. Annuity payments provide a steady stream of income over a specified period or for the rest of your life, offering a reliable source of retirement income. Installment payments allow you to withdraw a specific amount of money at regular intervals, such as monthly or annually, providing more control over your retirement income. Withdrawals made before the age of 59½ may be subject to a 10% early withdrawal penalty and regular income taxes, unless specific exceptions apply, such as disability or certain medical expenses. Starting at age 73, you must begin taking RMDs from your TSA, calculated based on your account balance and life expectancy. Failing to take RMDs can result in significant tax penalties. One of the primary benefits of TSAs is the tax-deferred growth of investments. This allows individuals to potentially accumulate more savings over time compared to taxable accounts. TSAs offer a variety of investment options, allowing individuals to tailor their portfolios to their risk tolerance and financial goals. Some TSAs, such as 403(b) and 457(b) plans, may include employer contributions, which can further enhance retirement savings. TSAs are portable, meaning individuals can roll over their account balances to another TSA or eligible retirement plan when changing jobs. Although TSAs are designed for long-term retirement savings, individuals may access their funds under certain circumstances, such as financial hardship, without incurring penalties. Withdrawals made from TSAs before the age of 59½ may be subject to a 10% early withdrawal penalty, in addition to regular income taxes. Starting at age 73, individuals with TSAs must begin taking Required Minimum Distributions (RMDs), which are calculated based on their account balance and life expectancy. Unlike regular savings or investment accounts, TSAs have restrictions on accessing funds, which can be a disadvantage for those who need liquidity. TSAs may have fees and expenses associated with account management, investment products, and plan administration, which can impact overall returns. While both TSAs and Traditional IRAs offer tax-deferred growth, TSAs generally have higher contribution limits and may include employer contributions. Traditional IRAs, on the other hand, are available to a broader range of individuals, regardless of employment status. TSAs and Roth IRAs both provide tax advantages, but the nature of those advantages differs. TSAs offer tax-deferred growth, while Roth IRAs offer tax-free growth and tax-free qualified withdrawals. Contribution limits for TSAs are generally higher than those for Roth IRAs. Both TSAs and 401(k) plans offer tax-deferred growth, higher contribution limits, and the possibility of employer contributions. However, TSAs are primarily designed for employees of public schools, non-profits, and religious institutions, while 401(k) plans are more common in the private sector. TSAs, as defined contribution plans, allow individuals to contribute a specific amount and choose their investment options, while defined benefit plans provide a predetermined retirement benefit based on factors such as salary and years of service. Defined benefit plans are more traditional pension plans, whereas TSAs offer more flexibility and control for the individual. A Tax-Sheltered Annuity (TSA) is a retirement savings plan that offers tax advantages to employees of certain organizations, such as public schools, non-profit organizations, and religious institutions. TSAs allow individuals to contribute pre-tax income, which grows tax-deferred until withdrawn during retirement. There are different types of TSAs, including 403(b) plans, 457(b) plans, and Individual Retirement Accounts (IRAs). TSAs offer several benefits, including tax-deferred growth, flexibility in investment options, potential for employer contributions, portability between employers, and access to funds in specific circumstances. However, they also have drawbacks, such as early withdrawal penalties, required minimum distributions, limited access to funds, and fees and expenses. When compared to other retirement savings options, TSAs have higher contribution limits than Traditional and Roth IRAs but are primarily designed for employees of specific organizations. TSAs and 401(k) plans share similarities but have different eligibility requirements, while defined benefit plans offer a predetermined retirement benefit based on factors such as salary and years of service. Consult an insurance broker, financial advisor, or a professional in tax services to determine whether a TSA is the right choice for your unique circumstances and long-term financial goals.What Is a Tax-Sheltered Annuity (TSA)?

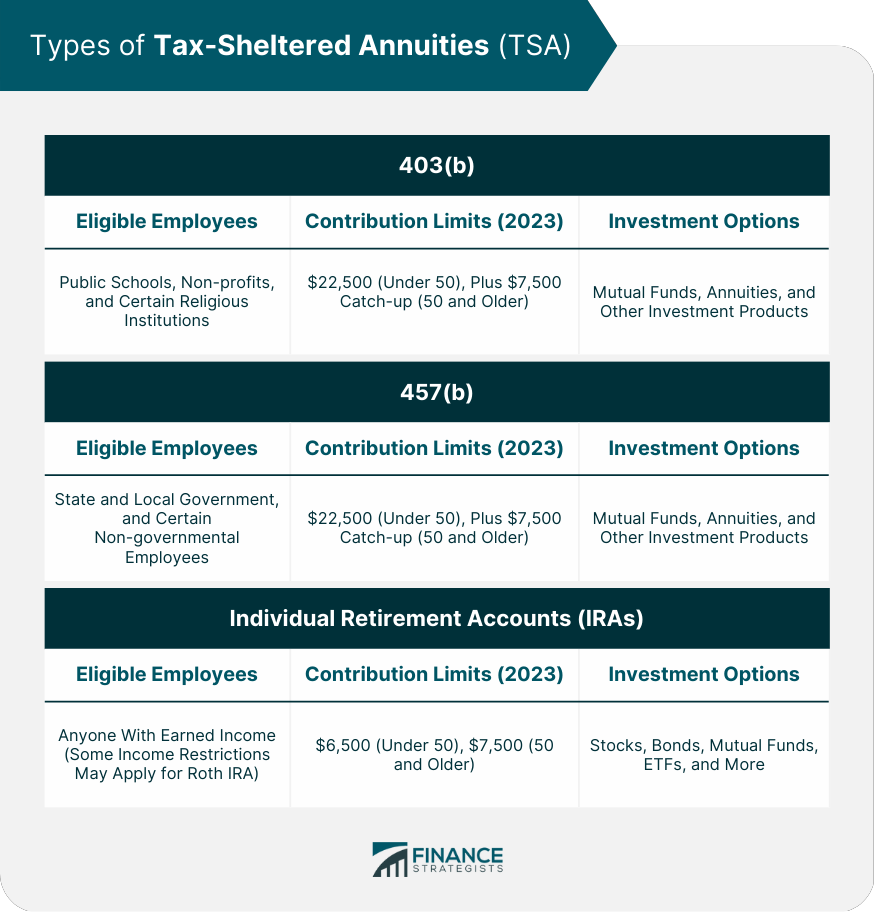

Types of Tax-Sheltered Annuities

403(b) Plans

Eligible Employees

Contribution Limits

Investment Options

457(b) Plans

Eligible Employees

Contribution Limits

Investment Options

Individual Retirement Annuities (IRA)

Traditional IRA

Roth IRA

SEP-IRA

SIMPLE IRA

Contribution Limits

Investment Options

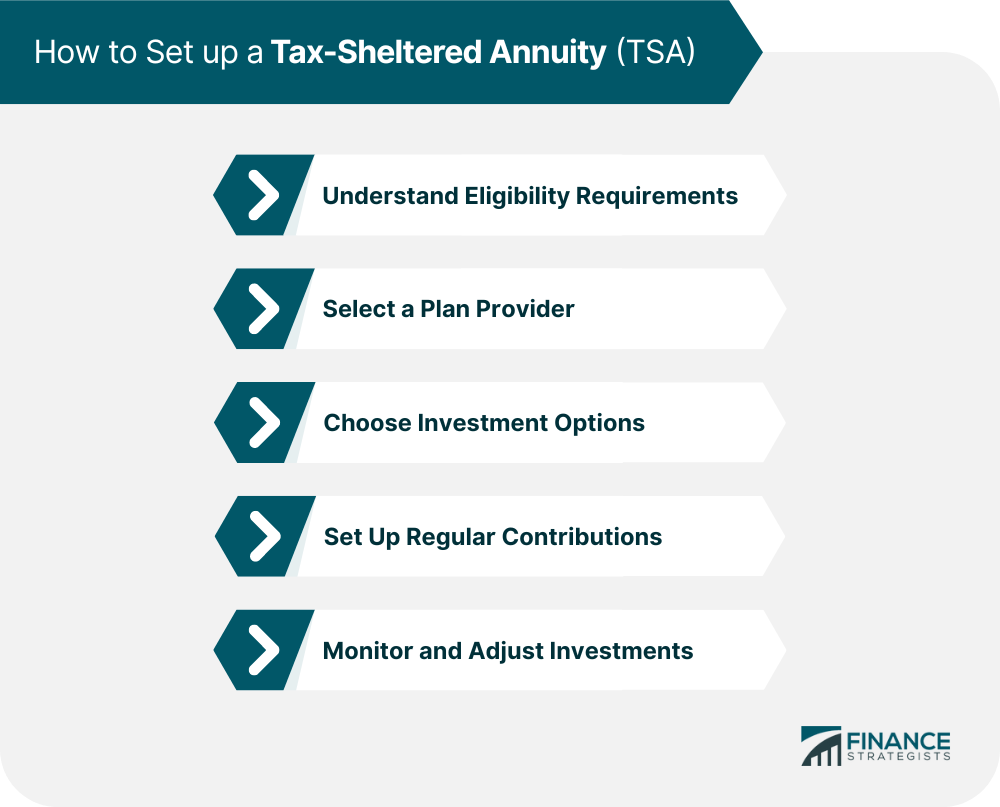

How to Set up a Tax-Sheltered Annuity

Understand Eligibility Requirements

Select a Plan Provider

Choose Investment Options

Set up Regular Contributions

Monitor and Adjust Investments

Distribution Options and Rules for Tax-Sheltered Annuities

Withdrawal Options

Lump-Sum Distribution

Annuity Payments

Installment Payments

Early Withdrawal Penalties and Exceptions

Required Minimum Distributions (RMDs)

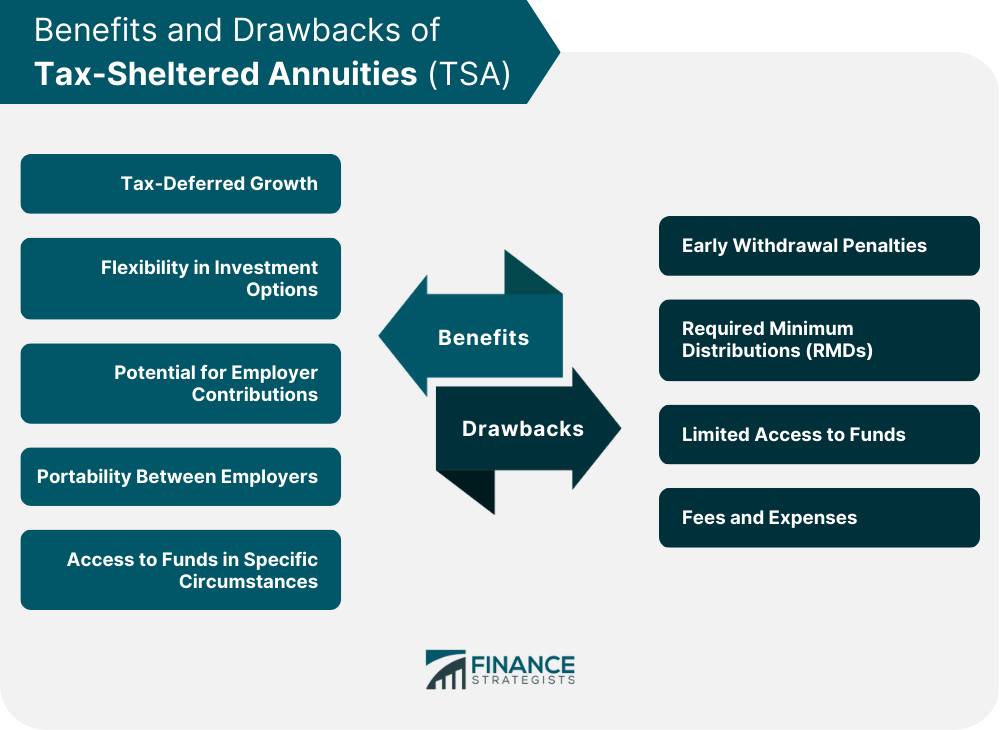

Advantages of Tax-Sheltered Annuities

Tax-Deferred Growth

Flexibility in Investment Options

Potential for Employer Contributions

Portability Between Employers

Access to Funds in Specific Circumstances

Disadvantages of Tax-Sheltered Annuities

Early Withdrawal Penalties

Required Minimum Distributions (RMDs)

Limited Access to Funds

Fees and Expenses

Comparison With Other Retirement Savings Options

TSA vs Traditional IRA

TSA vs Roth IRA

TSA vs 401(k)

TSA vs Defined Benefit Plans

Final Thoughts

Tax-Sheltered Annuity (TSA) FAQs

A Tax Sheltered Annuity (TSA), also known as a 403(b) plan, is a retirement savings plan offered to employees of public schools, certain non-profit organizations, and some government agencies. It allows employees to contribute a portion of their salary to an account on a pre-tax basis, meaning that the money they contribute is not subject to income taxes until it is withdrawn from the account.

A Tax Sheltered Annuity (TSA) is a type of retirement savings plan that allows employees to contribute a portion of their salary on a pre-tax basis. The contributions are then invested in a variety of investment options, such as mutual funds or annuities. The account grows tax-free until the employee reaches retirement age, at which point they can begin to withdraw funds from the account.

Tax Sheltered Annuities (TSAs) are available to employees of public schools, certain non-profit organizations, and some government agencies. Eligibility for a TSA depends on the employer and the type of organization they work for.

There are several advantages to contributing to a Tax Sheltered Annuity (TSA). Firstly, contributions are made on a pre-tax basis, meaning that employees can reduce their taxable income and save on taxes. Additionally, the account grows tax-free, which can help to maximize the growth of retirement savings. Lastly, many TSAs offer a variety of investment options, which can allow employees to tailor their retirement savings plan to their individual needs and goals.

Yes, there are restrictions on withdrawing funds from a Tax Sheltered Annuity (TSA). The IRS imposes a penalty of 10% on withdrawals made before age 59 1/2, unless the withdrawal is made due to certain qualifying events, such as disability or death. Additionally, withdrawals from a TSA are subject to income taxes, which can further reduce the amount of money the employee receives.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.