Rollover is a term frequently used in the world of retirement savings, representing the process of moving funds from one retirement account to another. When contemplating retirement plans, particularly in the context of job transitions, a rollover can be an essential tool to consolidate your savings and maintain their tax-advantaged status. It's a strategy for keeping your retirement planning seamless and well-coordinated, regardless of your career path's twists and turns. Essentially, rollovers allow you to carry forward your retirement savings, bypassing potential taxes and penalties associated with early withdrawal. Thus, by effectively managing rollovers, you can optimize your retirement planning, ensuring your funds are working hard for your future, even when your career circumstances change.

An individual might consider a 401(k) to 403(b) rollover under several circumstances. Perhaps you're transitioning from a for-profit company, which offered a 401(k) plan, to a non-profit organization, school, or hospital with a 403(b) plan. Instead of managing two separate accounts, a rollover might make sense to consolidate your retirement savings. It's a convenient way to keep all your retirement assets under one roof and a strategic move that can aid in achieving long-term financial goals. One of the primary benefits of rolling over a 401(k) to a 403(b) is the ability to consolidate accounts. This consolidation reduces the number of accounts you need to manage and monitor. It can make it easier to see your overall financial picture and ensure that your investment strategy aligns with your retirement goals. A rollover could also potentially provide access to investment options that are better aligned with your financial goals or risk tolerance. For example, the 403(b) may have specific investment choices that aren't available in your 401(k). Depending on your individual needs and objectives, these new options could be more beneficial. While the 403(b) might offer certain investment options that are appealing, it might also have fewer choices overall compared to a 401(k). This could be a disadvantage if 403(b) does not offer the types of investments you are interested in or if it lacks the diversity you desire. Fees can significantly impact the growth of your retirement savings over time. If the fees associated with the 403(b) are higher than those of the 401(k), your savings might not grow as rapidly or as much as they might have otherwise. These increased costs could potentially offset any benefits gained from the rollover. Determining eligibility for a 401(k) to 403(b) rollover largely depends on the specific plan rules of both your old 401(k) and your new 403(b). Generally, both plans must permit such rollovers. The IRS allows these types of rollovers, but individual plan rules may vary. For example, some 403(b) plans might not accept rollovers, or your 401(k) might have stipulations about when you can move your money. Therefore, always perform due diligence to avoid unnecessary complications, and never hesitate to seek expert advice for a better understanding of these rules. Understanding the rollover process is essential to successfully transferring your funds without any unnecessary penalties or taxes. Here's a detailed walk-through: Reach out to your current 401(k) plan administrator to understand the steps necessary to initiate a rollover. Simultaneously, verify with your new 403(b) plan administrator that they accept incoming rollovers. Clear communication with your plan administrators will ensure a smooth transition and prevent any unexpected issues during the rollover process. There are generally two types of rollovers: direct and indirect. A direct rollover, or trustee-to-trustee transfer, involves the funds moving directly from your old plan to the new one without you touching the money. This method is generally simpler and avoids potential tax complications. On the other hand, an indirect rollover allows you to have temporary access to your funds but comes with a strict time limit to deposit them into the new plan. Once you've decided on the rollover type, fill out any necessary paperwork provided by your plan administrators. This documentation will detail the amount you want to roll over and where and how the money should be transferred. It's crucial to complete this step carefully, as inaccuracies or omissions may lead to unnecessary delays or complications. Ensure the funds have been deposited into your 403(b) account once the transfer is initiated. This final step is just as important as the previous ones, as it verifies that your funds have reached their intended destination safely and correctly. One of the significant benefits of a rollover is the ability to maintain the tax-deferred status of your retirement savings. However, mishandling the process could lead to unexpected taxes and penalties. In a direct rollover, the money is not considered taxable income because it never comes into your possession. Therefore, it maintains its tax-deferred status and will only be taxed upon withdrawal in retirement. Essentially, it's a process designed to continue the tax efficiency of your retirement savings, contributing to their potential growth. With an indirect rollover, the distribution is temporarily considered taxable income. The plan administrator of the 401(k) is typically required to withhold 20% of federal income taxes. If you want to roll over the entire distribution, you must replace that 20% out-of-pocket. However, if you successfully complete the rollover within 60 days, you can recoup this withholding when you file your taxes. Failure to comply with this timeframe, on the other hand, would lead to a potentially significant tax burden. While a 401(k) to 403(b) rollover can be an excellent financial move, some common pitfalls could harm your retirement savings if not avoided. If you're performing an indirect rollover and don't roll over the full amount (including the 20% withheld for taxes), the IRS will consider the unrolled amount as a distribution, subject to taxes and possibly an early withdrawal penalty. Careful planning and attention to detail can prevent this misstep, preserving the full value of your retirement savings. Again, with indirect rollovers, the 60-day window is critical. Missing this deadline will cause the entire amount to be considered a distribution, leading to the potential for taxes and penalties. It's essential to plan the timing of your rollover strategically, keeping this strict deadline in mind. Before initiating a rollover, thoroughly research the investment options, fees, and rules of your new 403(b). Transitioning to a plan with high fees or poor investment options could impact the growth of your savings negatively. Knowledge is power in retirement planning, so take the time to understand all aspects of your new plan before making the leap. While a 401(k) to 403(b) rollover may be the best choice for some, it's not the only option for managing your retirement savings when transitioning jobs. If your old 401(k) has excellent investment options or low fees, it might make sense to leave your money where it is. However, you'll need to ensure you can manage multiple retirement accounts effectively. This option allows you to keep benefiting from a plan you're comfortable with and save you from potentially making rushed or uninformed decisions. Another option is to roll over your 401(k) into an Individual Retirement Account (IRA). IRAs typically offer a wider array of investment options than employer-sponsored plans and might have lower fees. However, make sure to compare the benefits and rules of an IRA with those of your new 403(b) before making a decision. While generally not recommended due to the tax implications and potential early withdrawal penalties, taking a cash distribution is an option. This decision should only be made after careful consideration, as it can significantly reduce your retirement savings. Navigating retirement planning, including the complexities of 401(k) to 403(b) rollovers, is a crucial task, one that could significantly impact your financial future. Understanding the benefits, drawbacks, and steps involved in a rollover can aid you in making informed decisions. However, it's important to remember that your unique financial goals and circumstances should dictate the best approach. A 401(k) to 403(b) rollover might offer account consolidation and better-aligned investment options, but it could also introduce higher fees or limited choices. Before making any moves, thoroughly research your new plan's rules and features, or consider alternatives like leaving money in your old 401(k) or rolling it over to an IRA. Don't hesitate to seek professional retirement planning services for personalized guidance that aligns with your long-term financial goalsWhat Is a Rollover?

Exploring 401(k) to 403(b) Rollovers

Rationale Behind the Move

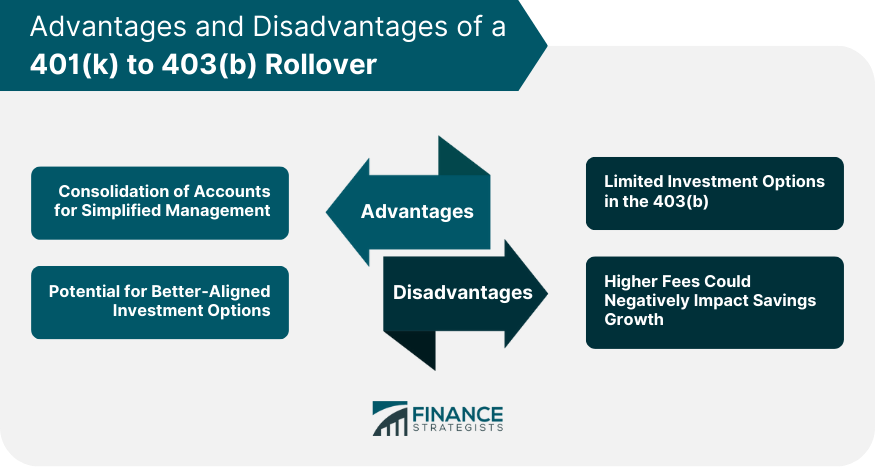

Potential Advantages of 401(k) to 403(b) Rollovers

Consolidation of Accounts for Simplified Management

Potential for Better-Aligned Investment Options

Potential Disadvantages of 401(k) to 403(b) Rollovers

Limited Investment Options in the 403(b)

Higher Fees Could Negatively Impact Savings Growth

Eligibility for a 401(k) to 403(b) Rollover

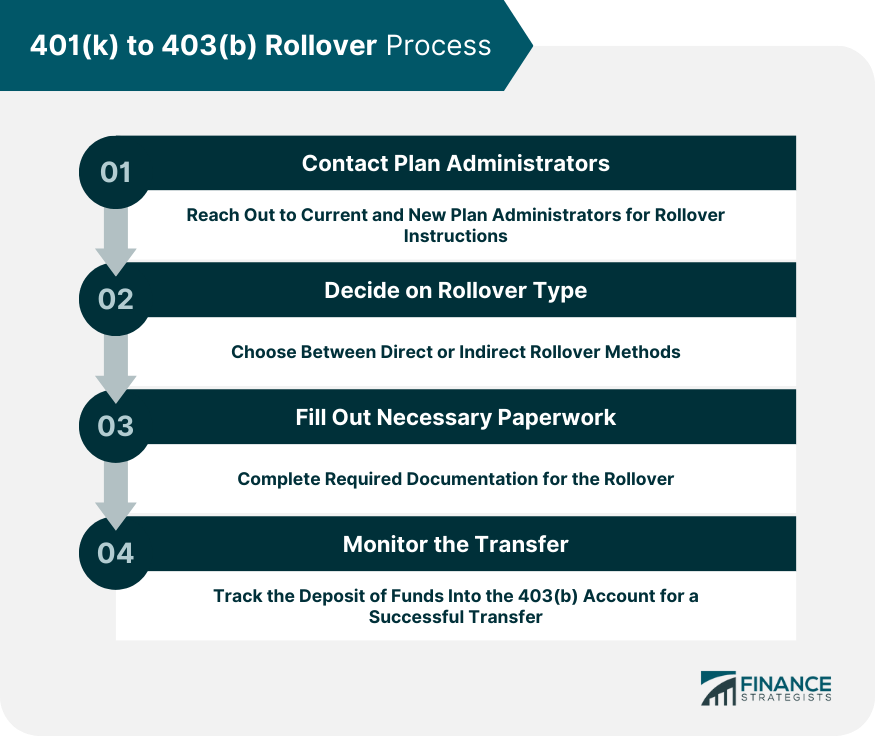

Step-By-Step Process of a 401(k) to 403(b) Rollover

Contact Your Plan Administrators

Decide on the Type of Rollover

Fill Out the Necessary Paperwork

Monitor the Transfer

Tax Implications of a 401(k) to 403(b) Rollover

Direct Rollover

Indirect Rollover

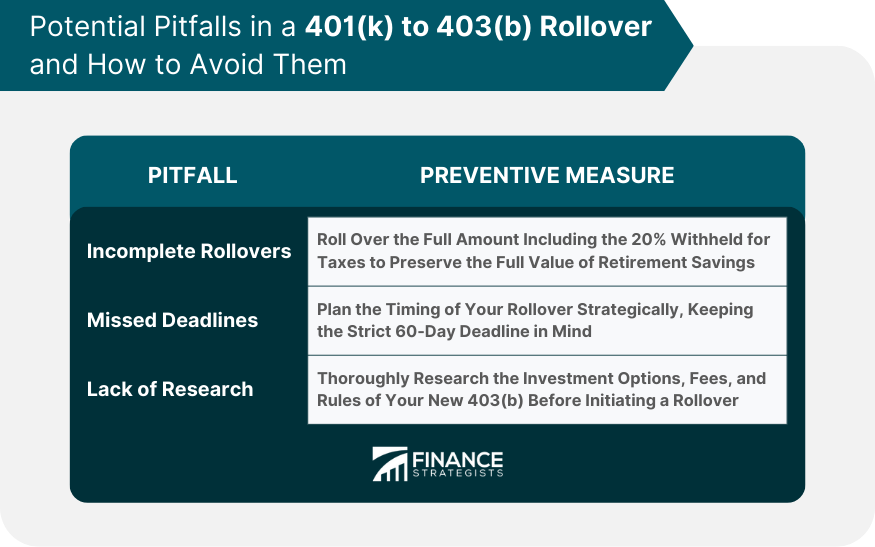

Potential Pitfalls and How to Avoid Them

Incomplete Rollovers

Missed Deadlines

Lack of Research

Alternatives to 401(k) to 403(b) Rollovers

Leave Your Money in Your Old 401(k)

Roll Over Into an IRA

Take a Cash Distribution

The Bottom Line

Understanding 401(k) to 403(b) Rollovers FAQs

A 401(k) to 403(b) rollover is a process of transferring retirement funds from a 401(k) account to a 403(b) account, often initiated when transitioning jobs.

The advantages can include the consolidation of accounts for simplified management, the potential for better-aligned investment options, and the continuation of tax-advantaged growth.

Yes, potential disadvantages may include limited investment options or higher fees in the 403(b), which could negatively impact long-term savings growth.

The tax implications depend on the type of rollover. Direct rollovers maintain tax-deferred status, while indirect rollovers may incur temporary withholding taxes.

Alternatives include leaving your money in the old 401(k), rolling over into an Individual Retirement Account (IRA), or taking a cash distribution.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.