An inherited 403(b) plan, also known as a beneficiary 403(b) plan, is a retirement savings account that has been passed on to a designated beneficiary after the death of the original account owner. Like the standard 403(b) plan, it is a tax-advantaged retirement plan often used by employees of public schools, tax-exempt organizations, and certain ministers. However, once it passes into the hands of the beneficiary, the rules governing distributions, tax implications, and plan management differ substantially from those of the original 403(b) plan. The defining characteristic of an inherited 403(b) plan is that it's been bequeathed to a beneficiary, often a spouse, child, or other family member of the deceased account holder. This plan type is structured to ensure the continuation of the account's tax-advantaged status while providing the beneficiary with access to the assets in the account. It's worth noting that inherited 403(b) plans require careful management to avoid unintended tax consequences and to ensure the most efficient use of the inherited assets. In general, there are no specific age requirements to become a beneficiary of a 403(b) plan. The account holder is free to designate any person, regardless of age, as their beneficiary. However, the beneficiary's age can significantly influence the distribution rules once the 403(b) plan has been inherited. For instance, if a beneficiary is under the age of 59 ½, they might typically face a 10% early withdrawal penalty for distributions from a retirement plan. However, with inherited 403(b) plans, this early withdrawal penalty is waived, allowing beneficiaries of any age to access their inherited assets without incurring this particular penalty. The relationship between the deceased account holder and the beneficiary has a considerable impact on the rules governing the inherited 403(b) plan. In particular, spouses have unique rights and options when inheriting a 403(b) plan. For example, a surviving spouse can choose to treat the inherited 403(b) plan as their own, potentially allowing for a longer deferral of required minimum distributions (RMDs). On the other hand, non-spouse beneficiaries, such as children, grandchildren, or non-related individuals, have different rules. They may be subject to earlier RMDs and may not have the option to treat the inherited plan as their own. The particular nuances associated with the beneficiary's relationship to the deceased account holder highlight the importance of understanding these details when managing an inherited 403(b) plan. 403(b) plans are governed by a combination of federal laws and the specific provisions set by the plan provider. Thus, the details of the plan's rules and provisions can influence who can inherit the 403(b) plan and how it can be managed. Some plans may allow only direct relatives to be named as beneficiaries, while others may permit non-relative beneficiaries. Furthermore, the plan provisions can also dictate the available distribution options and the timeline for these distributions. Understanding these plan-specific rules is crucial for beneficiaries. It ensures that they can manage the inherited plan effectively and in accordance with the set guidelines. Proper documentation is a key aspect of establishing eligibility to inherit a 403(b) plan. After the death of the account holder, the named beneficiary will need to provide proof of identity and possibly a copy of the death certificate to the plan administrator. The plan provider may have specific forms or paperwork that the beneficiary must complete to claim the inherited plan. The importance of proper documentation cannot be overstated, as it forms the basis for the beneficiary's claim to the inherited 403(b) assets. Keeping copies of all completed forms and correspondence with the plan provider is a good practice to ensure a smooth transition of the account. This means withdrawing all of the funds in the account at once. While this can provide immediate access to the funds, it also has tax implications. The entire distribution is subject to income tax in the year it is taken, which could potentially push the beneficiary into a higher tax bracket. A lump-sum distribution also ends the tax-advantaged status of the inherited assets. Once taken out of the 403(b) plan, the funds no longer enjoy the benefit of tax-deferred growth. While a lump-sum distribution might be suitable in some circumstances, such as a pressing financial need, it's essential to understand these implications before choosing this option. Another option is the stretch distribution, which involves taking distributions over the beneficiary's life expectancy. This approach, also known as the life expectancy method, can allow for a longer period of tax-deferred growth of inherited assets. It can also potentially spread the tax liability over many years, possibly resulting in less tax paid overall. The Internal Revenue Service (IRS) provides life expectancy tables that beneficiaries can use to calculate their annual required minimum distributions under this method. However, the stretch distribution option is not available to all beneficiaries, with recent changes under the Secure Act limiting its availability primarily to spouses and certain eligible designated beneficiaries. Transferring the funds to an inherited IRA is another distribution option for non-spouse beneficiaries of a 403(b) plan. An inherited IRA, also known as a beneficiary IRA, operates under similar rules to the inherited 403(b) plan. However, transferring the funds to an inherited IRA can provide the beneficiary with a broader range of investment options, depending on the IRA provider. When conducting a transfer, it's crucial to ensure it's done as a trustee-to-trustee transfer to avoid a taxable event. The beneficiary will need to establish the inherited IRA in the name of the deceased account holder for the benefit of the beneficiary, and the funds must be moved directly from the 403(b) plan to the inherited IRA. Distributions from an inherited 403(b) plan are generally included in the beneficiary's taxable income in the year they are received. The income is taxed at the beneficiary's regular income tax rate. It's also worth noting that while the 10% early withdrawal penalty that typically applies to distributions before age 59 ½ does not apply to distributions from inherited 403(b) plans, there are exceptions. For instance, if a surviving spouse chooses to treat the inherited 403(b) as their own and then takes distributions before reaching age 59 ½, the early withdrawal penalty could apply. The beneficiary's tax bracket can significantly impact the tax liability associated with distributions from an inherited 403(b) plan. Beneficiaries in a higher tax bracket will owe more in taxes on the distributions than those in a lower tax bracket. Consequently, understanding one's tax bracket and how it might change in the future is a key consideration when planning distributions from an inherited 403(b) plan. The tax bracket of the beneficiary can also influence the choice of distribution strategy. A beneficiary in a high tax bracket might choose to use the stretch distribution option to spread the tax liability over many years, while one in a lower tax bracket might opt for a lump sum distribution to take advantage of their current lower tax rate. One crucial area of compliance is the required minimum distributions (RMDs). Failure to take these required distributions can result in a penalty equal to 50% of the amount that should have been withdrawn. The rules around RMDs from inherited 403(b) plans can be complex, particularly with recent changes under the Secure Act. Therefore, beneficiaries should carefully consider these rules when planning their distribution strategy or seek guidance from a tax or financial professional to ensure compliance. Inherited 403(b) plan funds can impact the beneficiary's overall retirement strategy, especially if the beneficiary has other retirement accounts. Coordinating distributions from the inherited 403(b) plan with withdrawals from other retirement accounts, such as a 401(k) or an IRA, can help create a more efficient retirement income strategy. For example, strategically choosing from which account to take distributions can potentially manage the tax liability more effectively. It can also help ensure that the beneficiary maximizes the benefits of the tax-advantaged status of these accounts. Such an approach, however, requires a comprehensive understanding of the tax and distribution rules of each retirement account type. Another consideration is the potential for rollovers from the inherited 403(b) plan to other retirement accounts. Non-spouse beneficiaries have the option to transfer the inherited 403(b) plan funds to an inherited IRA. This rollover can offer advantages, such as a wider range of investment options. However, the rollover rules for inherited 403(b) plans are complex and must be followed carefully to avoid unintended tax consequences. In particular, the funds must be moved in a trustee-to-trustee transfer to avoid mandatory withholding for taxes, and the inherited IRA must be correctly titled to maintain the tax-advantaged status of the funds. If the beneficiary already has a retirement account, such as a 401(k) or an IRA, it can complicate the management of the inherited 403(b) plan. While a spouse beneficiary has the option to roll over the inherited 403(b) plan into their own retirement account, non-spouse beneficiaries do not have this option. Therefore, a beneficiary with an existing retirement account will need to manage the inherited 403(b) plan separately, taking into account the different rules and tax implications for each account. Professional advice can be beneficial in such situations to ensure the most effective management of the different retirement assets. In the case of a divorce, an ex-spouse might be named as the beneficiary of a 403(b) plan. Depending on the terms of the divorce agreement, the ex-spouse may remain the beneficiary after the account holder's death. In this case, the inherited 403(b) plan would generally be treated as though the ex-spouse were a non-spouse beneficiary. This situation underscores the importance of keeping beneficiary designations up to date and considering the impact of major life changes on these designations. It also highlights another potential complexity in managing an inherited 403(b) plan. Disabled beneficiaries may qualify as "eligible designated beneficiaries" under the Secure Act, which allows them to use the life expectancy method for distributions, effectively stretching out the distributions over a longer period. However, the definition of "disabled" for this purpose is strictly defined by the IRS, and the beneficiary may need to provide proof of their disability to qualify. This special provision can provide significant tax advantages for disabled beneficiaries, but it requires careful planning and documentation to ensure compliance. An inherited 403(b) plan, also known as a beneficiary 403(b) plan, is a retirement savings account that is passed on to a designated beneficiary after the original account holder's death. Eligibility to inherit a 403(b) plan is not age-restricted, but age does influence distribution rules. The relationship to the deceased account holder, such as being a spouse or non-spouse beneficiary, affects the rules and options available. Specific plan rules and provisions, along with proper documentation, also play a role in eligibility determination. When it comes to distribution options, beneficiaries can choose between a lump sum distribution, stretch distribution, or transferring funds to an inherited IRA. Tax considerations are important, as different options have varying tax implications. Coordinating with other retirement accounts and understanding rollover options are essential. Special circumstances, such as an existing retirement account or divorce settlements, require careful management. Seeking professional guidance can help beneficiaries navigate the complexities of managing an inherited 403(b) plan effectively.What Is an Inherited 403(b) Plan?

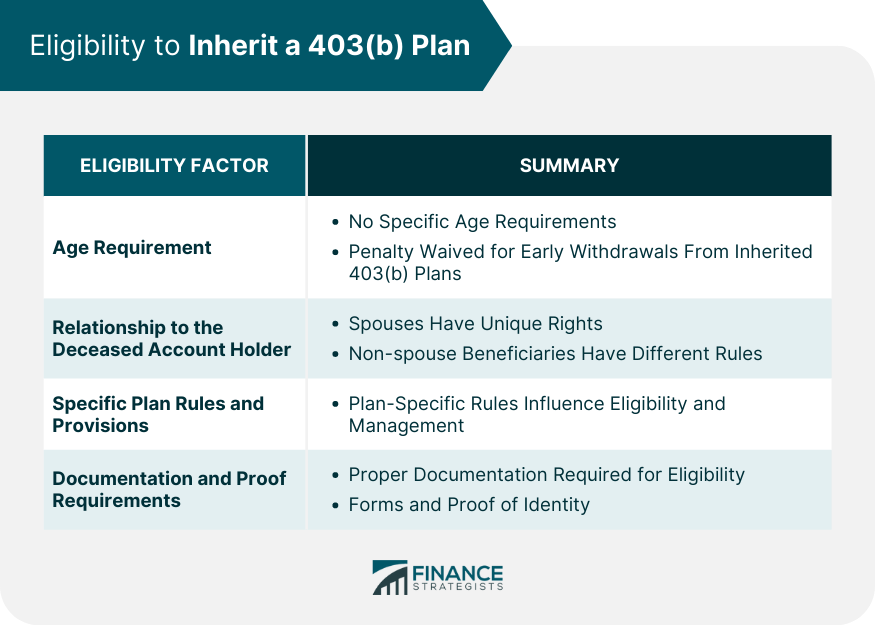

Eligibility to Inherit a 403(b) Plan

Age Requirement

Relationship to the Deceased Account Holder

Specific Plan Rules and Provisions

Documentation and Proof Requirements

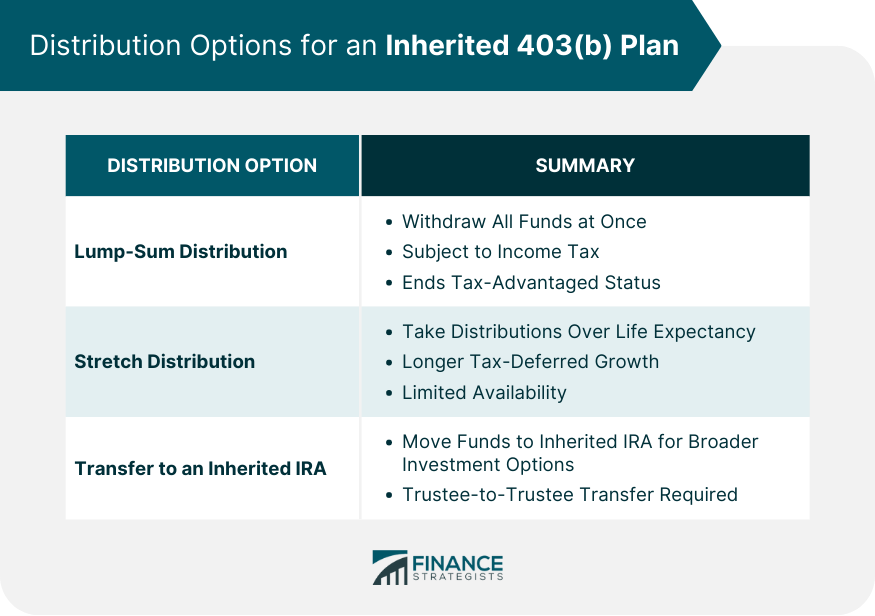

Distribution Options for an Inherited 403(b) Plan

Lump-Sum Distribution

Stretch Distribution

Transfer to an Inherited IRA

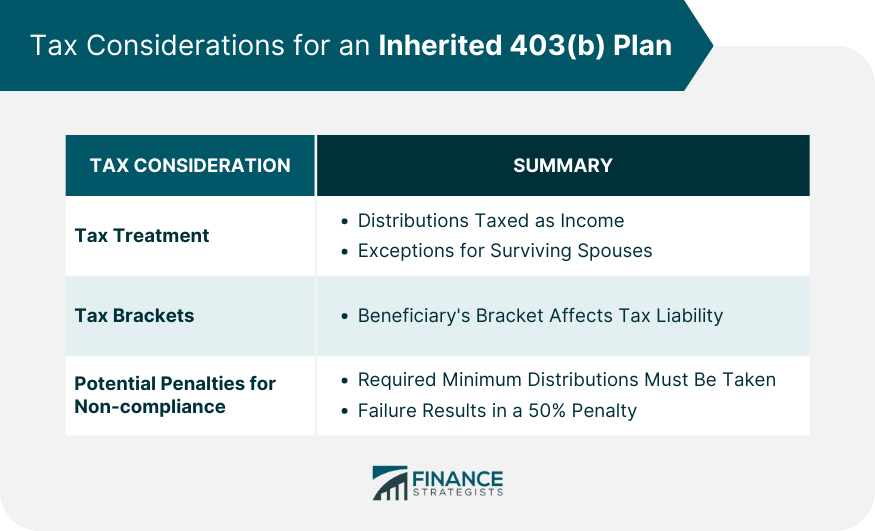

Tax Considerations for an Inherited 403(b) Plan

Tax Treatment

Tax Brackets

Potential Penalties for Non-compliance

Inherited 403(b) Plan Impact on Other Retirement Accounts

Coordinating With Other Retirement Accounts

Rollover Options and Implications

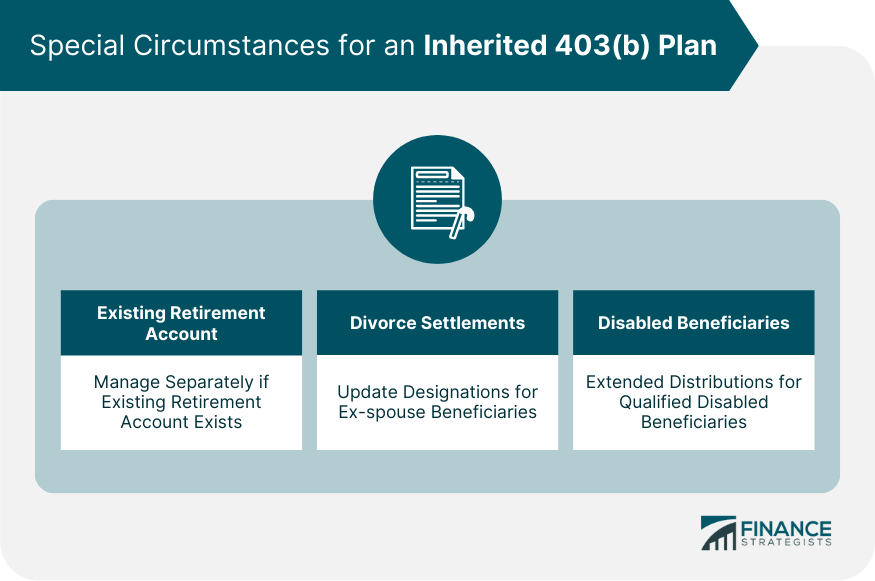

Special Circumstances for an Inherited 403(b) Plan

Existing Retirement Account

Divorce Settlements

Disabled Beneficiaries

Conclusion

Inherited 403(b) Plan FAQs

An inherited 403(b) plan is a retirement savings account passed on to a designated beneficiary after the original account holder's death.

Any individual or entity designated as a beneficiary by the original account holder can inherit a 403(b) plan. However, specific distribution rules apply based on the beneficiary's relationship to the deceased.

Distributions from an inherited 403(b) plan are generally subject to income tax. The amount of tax depends on the beneficiary's tax bracket and the timing and amount of the distributions.

Non-spouse beneficiaries can transfer the inherited 403(b) plan funds to an inherited IRA. However, the rollover must be done correctly to avoid unintended tax consequences.

The most significant potential penalty is for not taking required minimum distributions (RMDs). The penalty for failing to take RMDs is 50% of the amount that should have been withdrawn.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.