A traditional individual retirement account (IRA) is a retirement account that an individual opens independently from an employer's retirement plan. It allows annual contributions with pre-tax money, which helps in saving more over time and reducing the current tax burden. A pre tax deduction is any amount subtracted from an employee's gross pay before withholding taxes from the paycheck. These funds contributed are then invested in stocks, bonds, mutual funds, or other securities where they can grow tax-deferred. The account holder can accumulate wealth until retirement with an option to withdraw at age 59 ½ or older. Upon retirement, you can begin withdrawing the funds from your traditional IRA account, which may be taxed as ordinary income. Aside from the benefit of tax-deductible contributions, it also provides flexible withdrawal rules.

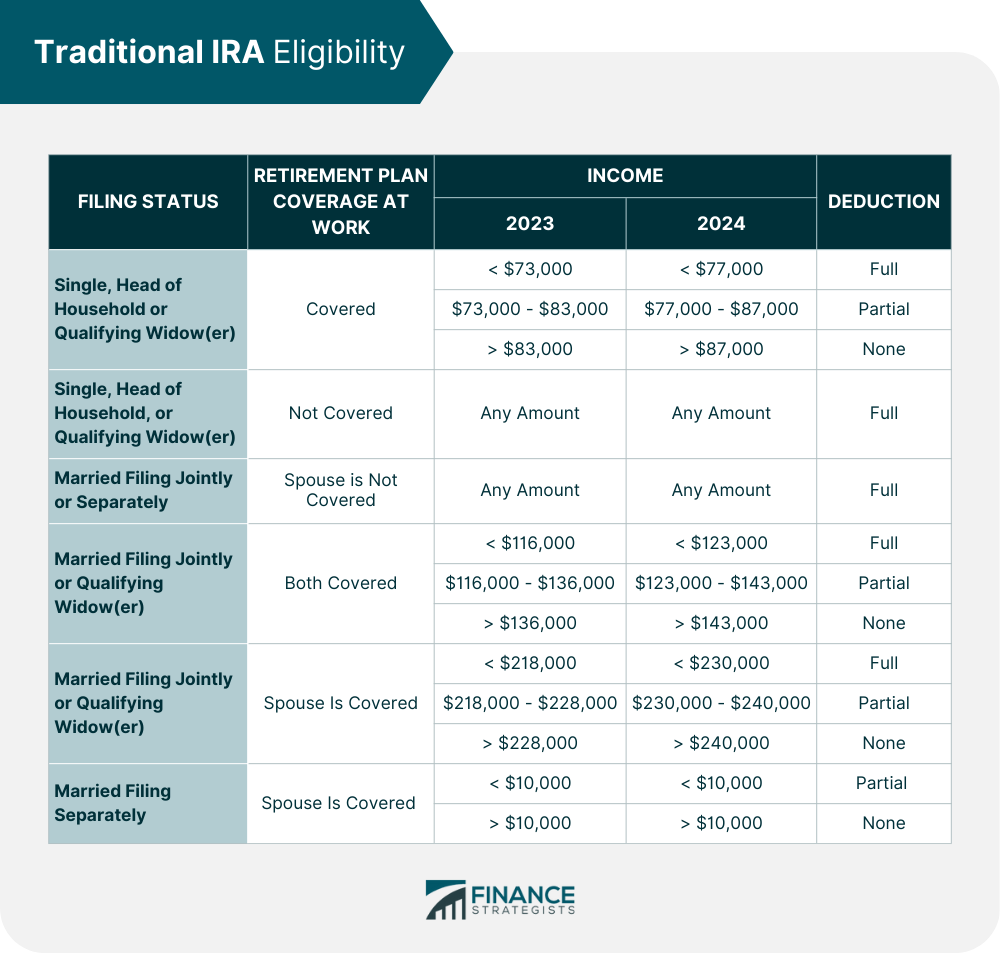

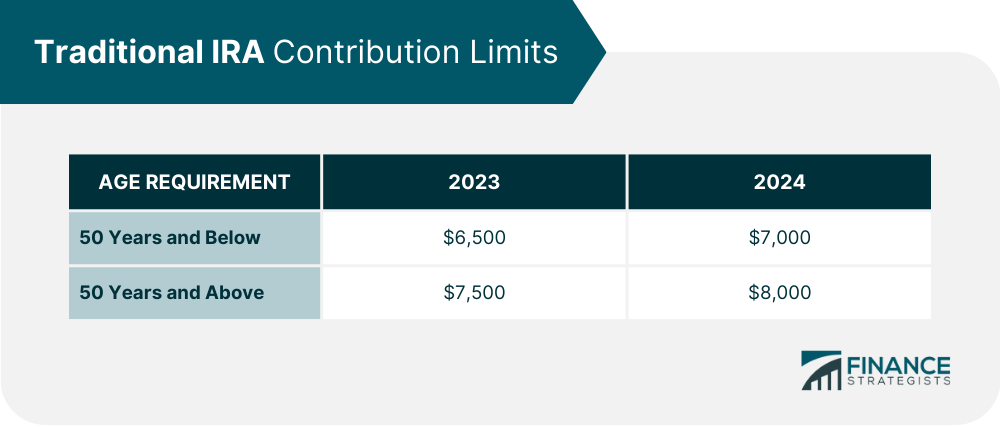

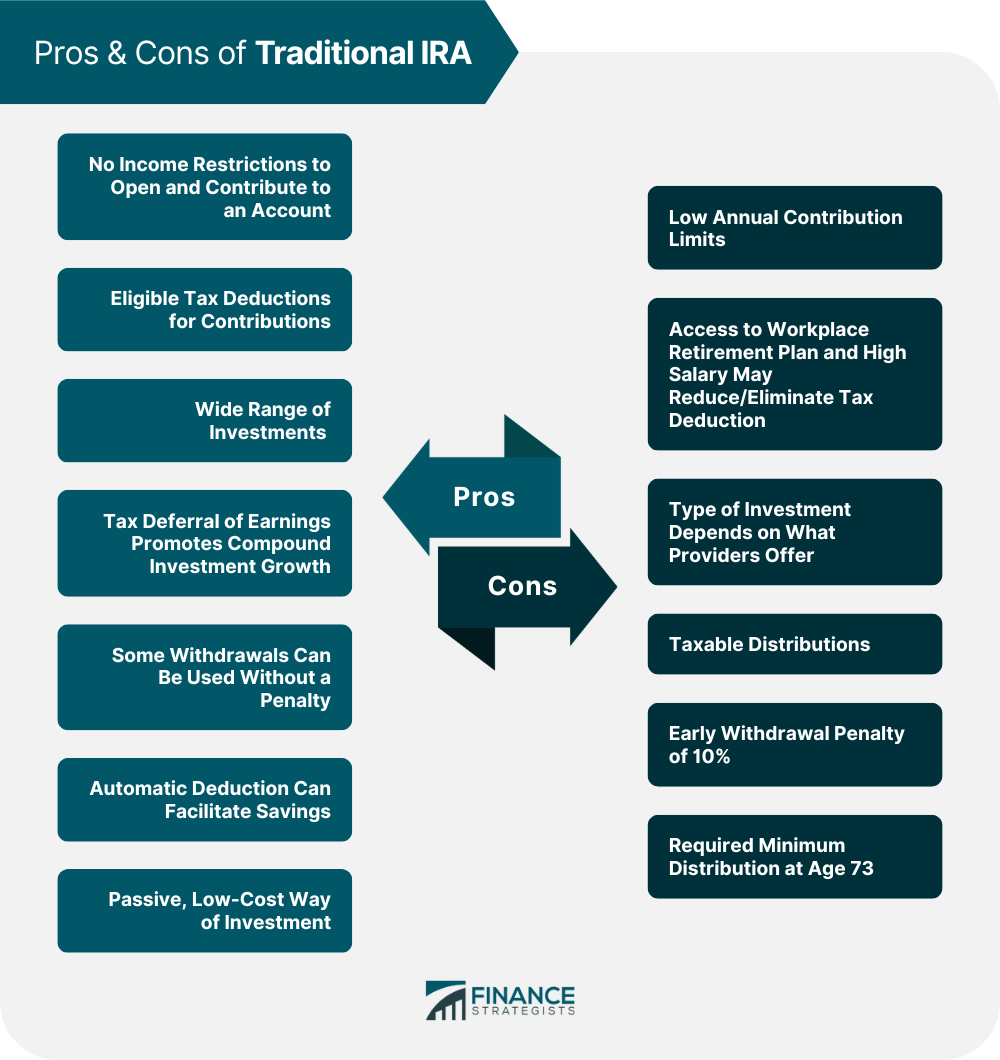

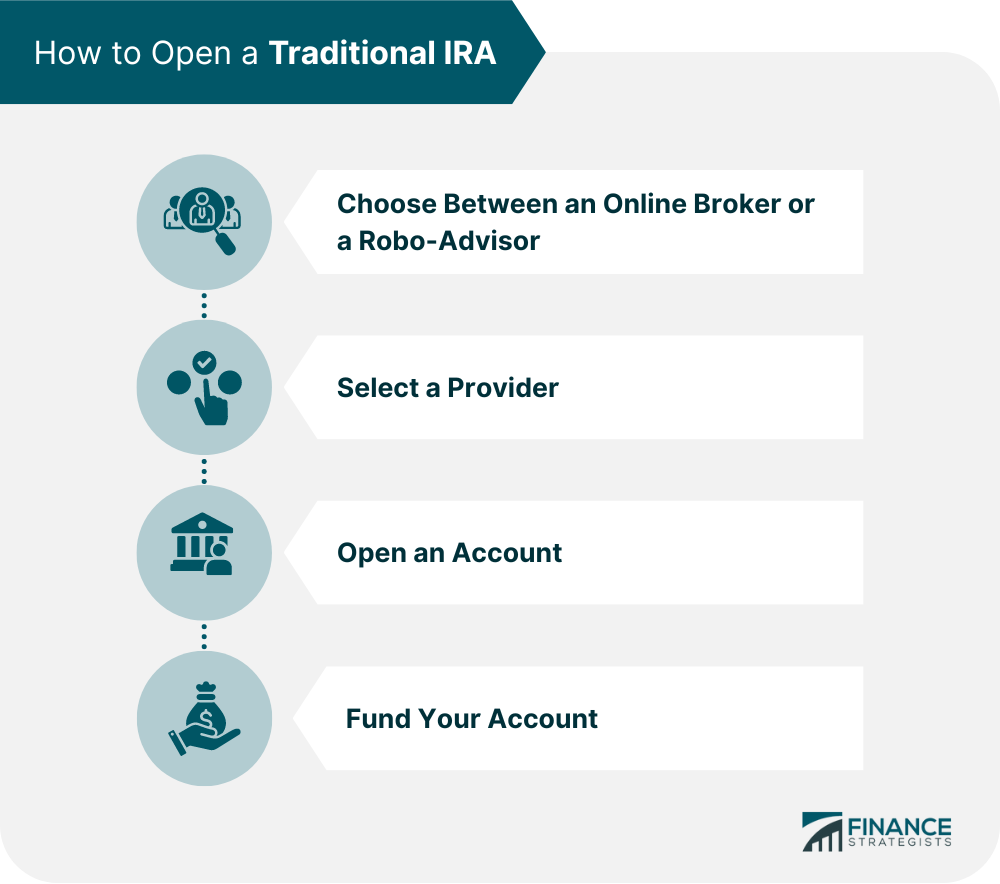

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. I assisted a client in setting up a Traditional IRA, employing tax-deductible contributions to reduce their immediate tax burden and diversifying their investments across stocks, bonds, and mutual funds for balanced growth. We also timed contributions to maximize tax advantages and implemented a rebalancing strategy to maintain the desired asset allocation, optimizing their portfolio for long-term growth. This multi-faceted approach significantly enhanced their retirement outlook. Discover how a Traditional IRA can be part of your strategy today. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation When contributing to a traditional IRA, you will use before-tax dollars, so you may not have to pay taxes on the money until it is withdrawn during retirement. Your contributions can help lower your taxable income for the year, and you will not be required to pay taxes on any earnings you make while the money is invested in the account. The amount you can contribute to your traditional IRA each year depends on factors like your filing status and annual taxable income. Eligibility for tax deductions will depend on your filing status, income, and whether or not you are enrolled in an employer-sponsored retirement plan like a 401(k). If you are a qualified account holder, you only have to pay taxes on your contributions once you begin withdrawing them, at which point distributions are taxed as ordinary income. It is crucial to remember that traditional IRA contributions cannot be withdrawn until retirement age, usually 59 ½, without incurring a 10% penalty. Based on the offerings available at your financial institution, you may choose from various options such as stocks, bonds, mutual funds, or other securities. If you or your spouse, in case you file a joint return earned taxable compensation throughout the year, you may open and contribute to a traditional IRA. Regardless of whether another retirement plan covers both of you, you are still eligible to establish a traditional IRA. Suppose you or your spouse participate in an employer-sponsored retirement plan. Then, you might be unable to deduct all your payments from your taxable income. On the other hand, suppose you do not have access to an employer retirement plan, like a 401(k), and your yearly income falls below specified levels. In that case, you can deduct contributions to a traditional IRA from your taxable income. Below is a guide on the applicable deduction concerning your filing status, income bracket, and retirement plan coverage at work. The maximum amount that you can contribute to a traditional IRA each year is set by the Internal Revenue Service (IRS) and depends on your age. In 2023, you can contribute $6,500 if you are below 50 years old and make a catch-up contribution of $1,000 if you are above 50, making the limit $7,500. For 2024, the contribution limit for those below 50 years old is $7,000 and for those 50 years old and above is $8,000. The contribution restrictions apply to each individual; therefore, you and your spouse may be able to contribute the combined IRA contribution limit. For instance, in 2024, if you are both members aged 50 or older, you may contribute a total of $16,000, with each of you contributing $8,000. Specific rules and regulations regarding traditional IRA withdrawals need to be followed: Traditional IRA withdrawal rules dictate that funds can be withdrawn at any age. However, if withdrawals are made before the age of 59 ½, a 10% early withdrawal penalty may apply. Additionally, taxes will be paid on the distribution as it is treated as ordinary income. Even if you withdraw funds before you turn 59 ½, certain exceptions may apply, and you will not have to pay the penalty. However, note that you will still pay taxes when you withdraw from your account. These exceptions include the following: Death or Disability of the IRA Account Owner Qualified Higher Education Expenses First-Time Home Purchase (With a Limit of $10,000) IRS Levies the Plan Qualified Medical Expenses Qualified Military Reservist Called to Active Duty Returned IRA Contributions Roth Rollovers Section 107 of SECURE 2.0 raises the statutory minimum distribution age to 73 on January 1, 2023. The first withdrawal must be taken by April 1st of the year after you reach this age. The RMD withdrawal amount will change from one year to another based on your account balance, age, and life expectancy. It must be taken by December 31st of each year, and failure to do so will result in a 50% penalty tax on the amount not distributed. Knowing the pros and cons of a traditional IRA is vital when deciding whether or not to open a traditional IRA account. However, you can mitigate the drawbacks with proper planning. Opening an account can be straightforward if you decide that a traditional IRA is the right retirement plan. Choosing between a traditional online broker or a robo-advisor will be your first step when opening an account. Both have advantages and disadvantages, so it is essential to research each option before deciding. A traditional online broker will provide you access to a wide range of investments and may offer more competitive fees than a robo-advisor. However, it does require more financial knowledge as the investor is responsible for making all investment decisions. A robo-advisor will be a good option if you are looking for hands-off investing. Robo-advisors provide automated portfolio management and guidance at lower costs than traditional brokers. Once you have chosen between a broker or a robo-advisor, it is time to select the provider of your choice. Be sure to compare fees and investment options offered by different providers. You can open your account online. You will need to provide personal information such as name, address, Social Security number, and more. Depending on the provider, you may also need to set up a funding method, such as linking your bank account. You can begin making contributions to your IRA as soon as the account is established. Most institutions accept contributions through checks, direct deposit, and payroll deductions. To make the most of your IRA, determine how much you will contribute each month and ensure you know the annual contribution restrictions. A traditional individual retirement account is one of the most common retirement savings accounts. It offers numerous benefits, including tax-deductible contributions and flexible withdrawal rules. You can make annual contributions up to the limit per year. The current year's limits are $7,000 and $8,000 for 50 years and below, and 50 and above, respectively. Contributing to a traditional IRA with pre-tax money may delay taxation until retirement, but this depends if your contributions are qualified based on income, filing status, and enrollment in an employer-sponsored plan. Traditional IRA contributions cannot be withdrawn without a 10% penalty until the retirement age of 59½. However, some exceptions apply, such as education expenses, medical bills, and first-time home purchases. Account holders should note that they are subject to the required minimum distributions at age 73. To help you weigh the benefits and drawbacks of a traditional IRA and get help opening such an account, consider the assistance of a retirement planning professional.What Is a Traditional IRA?

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

How Traditional IRAs Work

Who Is Eligible for a Traditional IRA?

Traditional IRA Contribution Limits

Traditional IRA Withdrawal Rules

IRA Early Withdrawal Rules

Exceptions to the IRA Early Withdrawal Penalty

Required Minimum Distributions (RMDs)

Pros & Cons of Traditional IRA

How to Open a Traditional IRA

Choose Between an Online Broker or a Robo-Advisor

Select a Provider

Open an Account

Fund Your Account

Final Thoughts

Traditional IRA FAQs

Anyone who has earned income is eligible to contribute to a traditional IRA. Eligibility for contribution tax deduction depends on income level, filing status, and participation in employer-sponsored plans.

The advantages of a traditional IRA include tax-deferred growth, tax deductions for qualified contributions, a wide range of investments, a passive investment strategy, and more flexibility in terms of withdrawal rules.

There are no earnings restrictions for traditional IRAs; however, income limitations govern which contributions can be deducted from taxes. Additionally, there are annual contribution limits that must be followed.

The main difference between these two accounts is the tax treatment of contributions. With a traditional IRA, contributions are made pre-tax, but withdrawals are taxed as regular income. With a Roth IRA, contributions are made with after-tax dollars, but withdrawals are not subject to taxes.

Whether a traditional IRA is a good investment will depend on the individual’s financial goals and preferences. Traditional IRAs are an excellent choice for those looking to save for retirement while minimizing their tax burden in the present, as contributions can be made with pre-tax dollars, and qualified distributions are not subject to taxes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.