Securities, in the world of finance, represent a broad range of tradable financial assets. They offer a means of raising capital for companies, governments, and other entities. Investors purchase securities anticipating future economic benefits such as capital gain, interest, or dividends. Securities are usually classified into three main types: equity securities (like stocks), debt securities (like bonds), and derivative securities (like options or futures). Each type has its own set of rights, obligations, and risk profiles, enabling investors to diversify their portfolios. Securities come into existence through an intricate process known as underwriting, primarily conducted by investment banks. The process starts with a private entity deciding to go public and raise capital, leading to the issuance of securities. The term "universe of securities" refers to all publicly traded securities available for investment. It encompasses various asset classes, sectors, geographical regions, and investment styles. This universe serves as the investment pool for fund managers. The scope and diversity of the universe allow portfolio managers to devise multiple strategies aligning with varying investment objectives and risk appetites. The universe of securities is a comprehensive term that encapsulates every type of tradable financial instrument. This universe can be divided into various components based on parameters such as the type of securities, market location, or market development stage. These classifications are important for investors as they strategize their portfolios based on risk tolerance, investment objectives, and market outlook. All securities traded on public exchanges worldwide form the vast expanse of this universe. These include, but are not limited to: Common and preferred stocks The immense diversity within this universe provides opportunities for asset allocation and portfolio diversification, enabling investors to manage their risk and potential return efficiently. The universe of securities can also be segmented based on the type of securities, namely: Equity securities represent an ownership interest in a company. Common examples include: Common Stocks: These offer voting rights but have a lower claim on assets and earnings. Preferred Stocks: These do not provide voting rights, but they have a higher claim on assets and earnings. Debt securities represent a loan made by an investor to the issuer. Common examples include: Bonds: These are issued by governments, municipalities, and corporations. Treasury Notes and Bills: These are issued by the federal government. Derivative securities derive their value from an underlying asset or group of assets. Common examples include: Options: These give the holder the right, but not the obligation, to buy or sell an asset at a predetermined price. Futures: These obligate the buyer to purchase an asset (or the seller to sell an asset), such as a physical commodity or a financial instrument, at a predetermined future date and price. Another way to categorize the universe of securities is by the market's stage of development: These are countries with highly developed economies and advanced infrastructures. Examples include the US, UK, Japan, Germany, and Australia. Securities in these markets tend to be more stable and less risky. Emerging markets are countries with economies progressing toward becoming advanced. Examples include China, India, Brazil, and Russia. These markets offer high growth potential but have a higher risk due to political and economic instability. Frontier markets are countries with less developed economies. They are even less mature than emerging markets. Examples include Vietnam, Nigeria, and Kenya. These markets can provide high return potential but carry substantial risk due to low liquidity and political instability. Each of these classifications offers unique opportunities and challenges, and a thorough understanding of each can help investors make informed decisions. Securities play a critical role in capital formation. They provide companies with the necessary funding for expansion or debt repayment. In return, investors acquire an ownership interest (stocks) or creditor relationship (bonds). Different securities offer various risk-return trade-offs. Investors can manage and mitigate potential risks by diversifying among a wide range of securities. Securities contribute significantly to price discovery, a mechanism determining the price of an asset in the marketplace through the interactions of buyers and sellers. Qualitative analysis involves assessing non-numerical factors that could affect a company's performance and, by extension, the performance of its securities. This includes: A company's management team's competence, integrity, and strategic vision can significantly influence its success. Investors often scrutinize the management team's track record, experience, and plans for the company's future. Companies with a distinct competitive advantage—such as a unique business model, proprietary technology, or a strong brand—tend to be more resilient in market competition. This resilience can translate into more stable returns for investors. The company's position within its industry also matters. Factors like the company's market share, the industry's growth potential, and the intensity of competition can significantly impact the company's ability to generate profits. Quantitative analysis examines a company's financial data to assess its performance and financial health. This includes: Analyzing a company's financial statements—balance sheet, income statement, and cash flow statement—provides insights into its financial health. For instance, investors can determine a company's profitability, debt levels, and ability to generate cash flow. Financial ratios such as the Price-to-Earnings (P/E) ratio, the Debt-to-Equity (D/E) ratio, and the Return on Equity (ROE) can help investors compare a company's financial performance with other companies in the same industry. Investors use valuation techniques to estimate a security's intrinsic value, which they then compare with its market price to determine whether the security is overvalued or undervalued. The DCF method involves forecasting a company's free cash flows and then discounting them to the present value using an appropriate discount rate. If the intrinsic value calculated using DCF is higher than the current market price, the security could be undervalued, suggesting a potential investment opportunity. The P/E ratio compares a company's current share price with its per-share earnings. A high P/E ratio could indicate that the company's stock is overpriced or might reflect high growth expectations. Comparing a company's P/E ratio with its competitors can provide a relative measure of its market valuation. Various external factors, including economic, political, and technological dynamics, influence the universe of securities. Each of these plays a crucial role in determining the performance and attractiveness of different types of securities. Economic conditions have a direct impact on the performance of securities. The GDP growth rate is essential to a country's economic health. Strong GDP growth typically signifies a robust economy, which can lead to higher corporate profits and, in turn, a rise in the prices of securities. Interest rates, set by central banks, play a crucial role in determining the cost of borrowing and the return on savings and investments. High-interest rates can increase borrowing costs for companies, potentially reducing their profitability and negatively affecting their stock prices. Lower interest rates stimulate economic activity by making borrowing cheaper, potentially leading to higher security prices. Inflation, the rate at which the general level of prices for goods and services is rising, can also affect securities. High inflation can erode purchasing power and create market uncertainty, leading to decreased security prices. Moderate inflation is often a sign of a healthy economy and can support security prices. Political factors can significantly influence the attractiveness and value of securities. Government policies, such as tax laws, monetary policy, and trade regulations, can significantly impact corporate earnings. For instance, decreasing corporate tax rates can increase a company's after-tax profits, potentially boosting its stock price. Political stability is also an important factor. Countries with stable political environments tend to have more predictable business and regulatory environments, which can benefit companies and their securities. Political instability can lead to market uncertainty, potentially negatively impacting security prices. Technological factors can shape the universe of securities by affecting industry dynamics and company performance. Technological disruptions and innovations can create new opportunities for businesses, leading to the emergence of new industries and the decline of others. Companies that can adapt and take advantage of these changes may see an increase in their security prices, while those that cannot experience a decline. Keeping up with technological trends is crucial in the dynamic universe of securities. Developments such as the rise of artificial intelligence, blockchain technology, or renewable energy can create new investment opportunities, potentially leading to new securities in the market. Market risk, also known as systematic risk, is the risk that a security's value will decrease due to changes in market factors such as interest rates, inflation, or political instability. Credit risk is the risk that a borrower will default on their contractual obligations relating to a debt security, resulting in financial loss to the investor. Liquidity risk refers to the risk that an investor might need to be able to buy or sell securities promptly without impacting its price due to insufficient market activity. Operational risk involves loss resulting from inadequate or failed processes, people, and systems, or from external events. This risk is inherent in every investment but can be managed through robust internal controls. The SEC is critical in regulating the United States' securities universe. It oversees securities transactions, activities of financial professionals, and mutual fund trading to prevent fraud and intentional deception. FINRA is a non-governmental organization that regulates member brokerage firms and exchange markets to ensure they operate fairly and honestly. Other global regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK and the European Securities and Markets Authority (ESMA) in the EU, also govern the securities market in their respective regions, contributing to the international framework of securities regulation. Technological innovation is poised to redefine the landscape of securities drastically. Blockchain technology can potentially transform the transaction process in the securities market significantly. It offers a secure and transparent method of recording transactions, eliminating the need for intermediaries and reducing the possibility of fraud. This has implications for improving efficiency, transparency, and trust in the securities market. AI, particularly machine learning, is transforming investment strategy formulation. By analyzing vast amounts of data, AI can help to predict market trends, assess risk, and identify promising investment opportunities, all of which can lead to more informed and potentially profitable investment decisions. Big Data, or the analysis of large, complex datasets, can revolutionize market analysis and prediction. This can give investors more accurate and nuanced insights, enabling better decision-making and potentially leading to higher returns. Emerging forms of securities are expanding the universe of securities, offering both new opportunities and challenges for investors and regulators. Cryptocurrencies, like Bitcoin and Ethereum, represent a new asset class that operates independently of central banks. While highly volatile, they offer a new form of investment that could yield substantial returns. Tokenization, or converting rights to an asset into a digital token on a blockchain, can make investing in certain assets more accessible and efficient. This can lead to new types of securities, such as tokenized real estate, art, or even intellectual property. In addition to cryptocurrencies and tokenized assets, the rise of other digital assets, like non-fungible tokens (NFTs), is changing the securities landscape. NFTs represent a unique digital asset, such as a piece of art or music, which can be bought and sold like other types of securities. The universe of securities is not static and evolves in response to market dynamics and trends. For instance, the growing emphasis on sustainable investing leads to new securities focused on environmental, social, and governance (ESG) criteria. Furthermore, demographic shifts, such as the aging population, may drive demand for certain types of securities, such as those focused on healthcare or retirement. Investors who can anticipate and adapt to these shifts will be better positioned to take advantage of evolving opportunities in the universe of securities. By staying informed and adaptable, investors can navigate the future of the securities landscape and achieve greater returns. The universe of securities represents the vast and diverse world of publicly traded securities, underpinning much of our global economy. It encompasses an array of investment opportunities, each offering different risk-reward profiles, and is significantly influenced by various economic, political, and technological factors. The securities landscape is dynamic and continually evolving, shaped by innovative technologies and shifting market trends. Understanding the intricacies of the universe of securities is not just beneficial—it's essential. It aids in making informed investment decisions, managing risks, and ultimately shaping financial futures. However, navigating this universe can be complex, given its vastness, diversity, and constant evolution. This complexity underscores the value of professional wealth management. A skilled wealth manager can provide the guidance and expertise necessary to navigate the universe of securities effectively, helping you align your investment choices with your financial goals and risk tolerance.What Are Securities?

What Is a Universe of Securities?

Components of the Universe of Securities

All Publicly Traded Securities

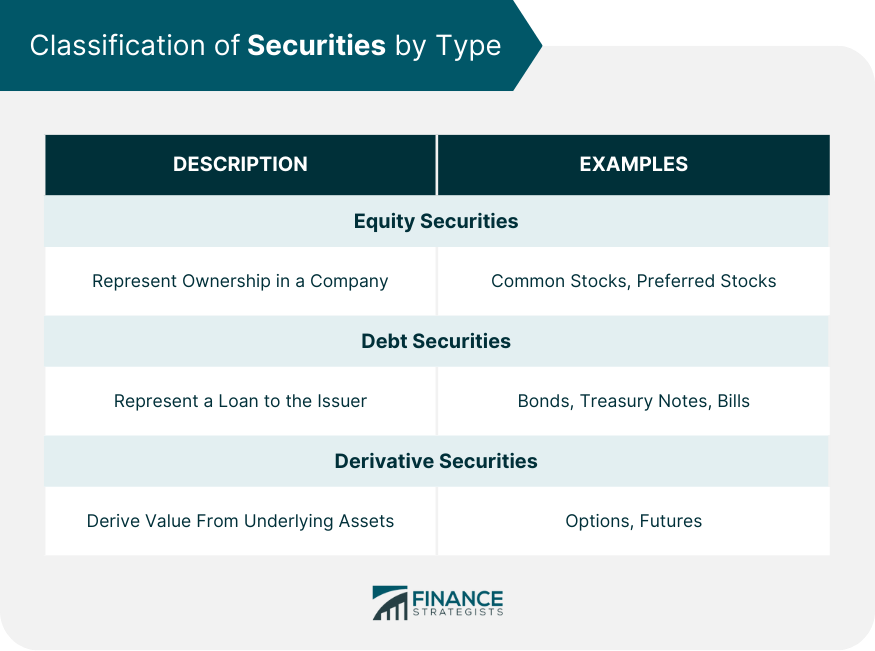

Classification by Type

Equity Securities

Debt Securities

Derivative Securities

Classification by Market

Developed Markets

Emerging Markets

Frontier Markets

Role of Securities in the Financial Markets

Capital Formation

Risk Management

Price Discovery

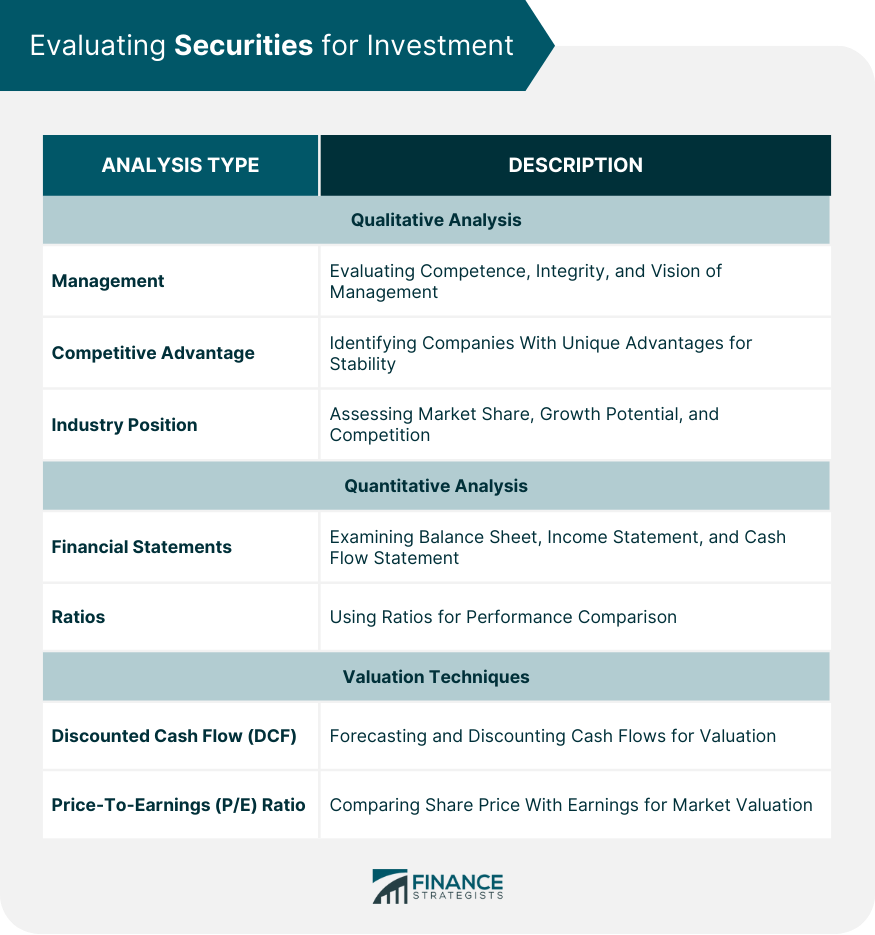

Evaluating Securities for Investment

Qualitative Analysis

Management

Competitive Advantage

Industry Position

Quantitative Analysis

Financial Statements

Ratios

Valuation Techniques

Discounted Cash Flow (DCF)

Price-To-Earnings (P/E) Ratio

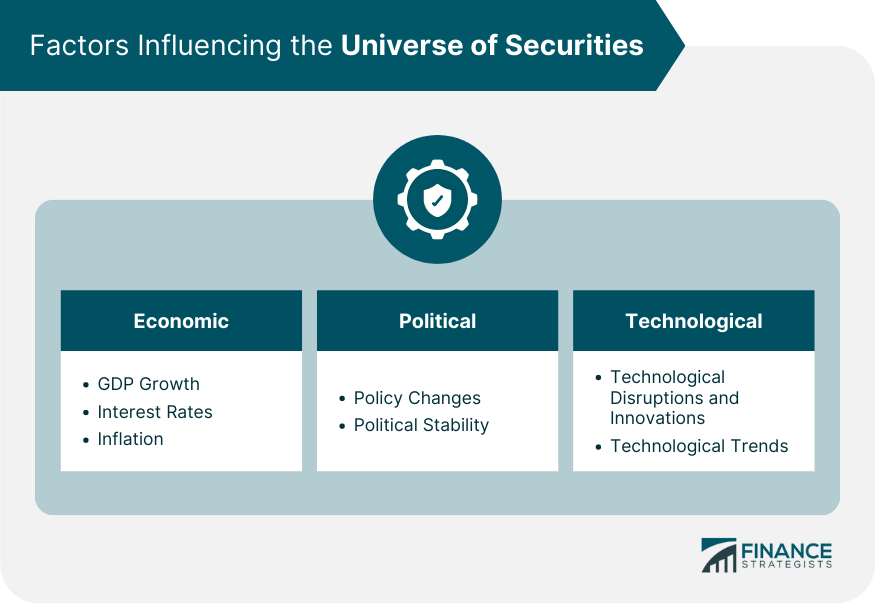

Factors Influencing the Universe of Securities

Economic Factors

GDP Growth

Interest Rates

Inflation

Political Factors

Policy Changes

Political Stability

Technological Factors

Technological Disruptions and Innovations

Technological Trends

Risks Associated With the Universe of Securities

Market Risk

Credit Risk

Liquidity Risk

Operational Risk

Role of Regulatory Bodies in the Universe of Securities

Securities and Exchange Commission (SEC)

Financial Industry Regulatory Authority (FINRA)

Other Global Regulatory Bodies and Their Impact

Future of the Universe of Securities

Technological Advancements and Their Impact

Blockchain Technology

Artificial Intelligence (AI)

Big Data

New Types of Securities

Cryptocurrencies

Tokenization

Digital Assets

Evolving Market Dynamics and Trends

Conclusion

Universe of Securities FAQs

The universe of securities is a comprehensive set of all publicly traded securities available for investment. It includes asset classes such as stocks, bonds, options, and futures across various sectors, geographical regions, and investment styles. The universe also extends to developed, emerging, and frontier markets.

The universe of securities forms the foundation for investment strategies. The vast array of securities allows portfolio managers to diversify their investments based on risk profiles, return expectations, and investment horizons. The universe also provides options for various investment strategies like value, growth, income, and others.

Several factors influence the Universe of Securities. Economic factors such as GDP growth, interest rates, and inflation directly impact security prices. Political factors like policy changes, regulations, and political stability can also affect securities. Additionally, technological disruptions and innovations can significantly shape the universe by impacting the performance of specific industries or companies.

Investing in the universe of Securities comes with several risks. Market risk is the potential for a security's value to decrease due to changes in market factors. Credit risk is the possibility that a borrower will default on their debt obligations. Liquidity risk refers to the potential difficulty in buying or selling securities without impacting their price. Lastly, operational risk involves the potential for loss from inadequate or failed internal processes, people, or systems.

The universe of securities is regulated by various bodies worldwide. The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) play key roles in securities regulation in the United States. Internationally, organizations like the Financial Conduct Authority (FCA) in the UK and the European Securities and Markets Authority (ESMA) in the EU oversee their respective markets. These regulatory bodies help ensure the fairness and transparency of the securities markets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.