Cryptocurrency, often linked with digital change and new-age finance, is basically a digital or online form of money designed using special security features. These digital coins work on a system called blockchain. Over the years, more and more people have started using these cryptocurrencies. From being a topic only a few techies talked about, they have now become a big part of today's finance world, changing the way we think about and use money. What makes these digital coins stand out is how they work. They allow safe, private payments without involving traditional banks. Because they aren’t tied to any central authority, people have more say over their money. They can send or receive funds globally without huge fees or long waits. But to fully grasp why they matter, one needs to explore where they came from and how they've grown. Before Bitcoin made a splash, a few digital money ideas tried to make their mark, but they didn’t quite catch on everywhere. eCash: A system where people buy things online without anyone knowing who they were. It was a neat idea, and kept people's identities hidden, but it needed banks to work. Relying too much on banks made it less appealing to many. b-money: An early version of Bitcoin in some ways. This is a digital money that didn't need any central power to work and would use codes and math to keep things safe. But b-money stayed just an idea and never really came to life. Hashcash: This wasn't a digital coin but more like a tool to stop junk emails. The idea was to make senders do a tiny computer task before sending mail, making it hard for spammers to send many emails at once. Though not a digital currency, Hashcash gave birth to a concept called "proof-of-work," which became crucial for digital coins like Bitcoin. Despite these smart ideas, a big problem remained: the issue of double-spending. In simple terms, this meant making sure people didn’t spend the same digital money twice. This challenge set the stage for Bitcoin, which smartly combined all these features, paving the way for the digital coins you know today. In 2008, an individual or group using the pseudonym Satoshi Nakamoto introduced Bitcoin to the world through a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System". This paper proposed a system where transactions could be verified by network nodes through cryptography, eliminating the need for centralized control. In 2009, Nakamoto released the Bitcoin software, and with it, the first units of the Bitcoin cryptocurrency were minted. As more people began to grasp its significance and the potential it held, Bitcoin's popularity skyrocketed. The decentralized, transparent nature of the blockchain technology behind Bitcoin, combined with its resistance to censorship, made it stand out from its predecessors. Following Bitcoin's success, numerous other cryptocurrencies, often referred to as "altcoins," started sprouting up. Litecoin, Dogecoin, and countless others emerged, each bringing with it variations in block generation time, hashing algorithms, and consensus models. These altcoins aimed to either improve upon the Bitcoin model or introduce entirely new features to cater to various use cases. One of the most notable altcoins is Ethereum. Unlike Bitcoin, which is primarily a digital currency, Ethereum allows developers to create and deploy their applications on its blockchain. These decentralized applications, or DApps, harness the power of blockchain for a myriad of purposes beyond just financial transactions. One of the earliest instances of a price surge was in 2011 when Bitcoin witnessed its first significant price spike and subsequent crash. This established a recurring pattern in the crypto market, characterized by rapid price appreciation followed by sharp downturns. Another memorable cycle was during 2017-2018 when Initial Coin Offerings (ICOs) became a rage, leading to a massive influx of capital into the crypto world, followed by what is known as the "crypto winter," a prolonged bear market. This cyclic nature is attributed to a combination of factors—speculative trading, regulatory news, technological developments, and mainstream adoption. While these deter the risk-averse, many see them as a natural evolution in an emerging market. Over the years, the ecosystem has witnessed some major security breaches. The most infamous of these was the hack of Mt. Gox, a Tokyo-based Bitcoin exchange, leading to the loss of 850,000 Bitcoins. Such incidents raised concerns about the security and maturity of the infrastructure surrounding cryptocurrencies. As the ecosystem matures, there's a pressing demand for robust security measures, better regulations, and more transparent operations from crypto businesses to ensure user trust and confidence. Early on, governments and financial institutions were skeptical, with some outright banning their use. However, as the technology evolved and adoption grew, regulatory stances began to change. Countries started developing frameworks to govern cryptocurrency use, ICOs, and the broader blockchain ecosystem. Legal milestones, such as the U.S. Securities and Exchange Commission's (SEC) rulings on certain ICOs or the legal battles faced by crypto projects, shape the industry's trajectory. By providing clarity on regulatory positions, these milestones influence institutional adoption, innovation, and user confidence. When digital currencies like Bitcoin first showed up, many thought they were just a tech trend. But as time went on, it became clear that they were here to shake things up, especially in the old-school worlds of finance and business. In the past, sending money across countries meant using banks or services like Western Union. It was often slow and came with hefty fees. But with cryptocurrencies, international money transfers became lightning-fast and way cheaper. Thus, cryptocurrencies gave them a new way to save, spend, and send money without needing a bank account. Before digital coins, when people talked about investments, they usually meant things like stocks, bonds, or real estate. But cryptocurrencies added a whole new option to the mix. Just like how some people buy gold hoping its value will go up, many started buying digital coins as an investment. This new kind of investing got so popular that even big financial players, who once laughed off digital coins, began offering crypto-related services. People now see cryptocurrency exchange platforms, wallets, and even crypto retirement plans. Companies could now accept global payments easily without worrying about currency conversion or high transaction fees. Some businesses even raised money by issuing their own digital coins. Additionally, businesses started using blockchain to track products, manage contracts, and even ensure food safety. It became a tool that, while sparked by digital currencies, had the power to change how businesses operate in many other areas. The wave of cryptocurrencies didn't just shake up the financial world; it also brought some big changes to our society and culture. Here’s a closer look at three big ways they’ve made an impact. With just a smartphone and an internet connection, someone can now have a digital wallet to store and transfer money. They don’t need to rely on physical banks or even have a formal bank account. This empowerment has given many a new sense of financial freedom. For instance, in places with unstable local currencies, people have turned to Bitcoin and other cryptocurrencies as a safer way to save their money. Cryptocurrencies introduced a fresh way to raise funds called "crowdfunding with tokens" or ICOs. Instead of giving away a piece of their company or paying back a loan with interest, creators give out their own digital coins. These coins can then be traded, used for services, or held onto in hopes their value rises. This has led to a boom in grassroots projects and startups, as anyone with a solid idea can pitch it directly to the public. Cryptocurrencies have sparked a whole new online community. Forums, social media groups, and websites dedicated to discussing, trading, and understanding digital coins have popped up everywhere. These places are filled with passionate folks, from experts who break down complex topics to newcomers eager to learn. Cryptocurrency has transformed from a niche concept into a pivotal force reshaping finance and beyond. With its foundation on blockchain technology, cryptocurrencies offer secure, private transactions without the need for traditional intermediaries. Bitcoin started all this by showing how cryptocurrencies could work without central control. Other digital coins came after, each with different features. But there have been problems too, like hacks that made people worry about safety. Rules and laws about cryptocurrencies have changed over time, making them more accepted and understood. Now, sending money across countries is fast and cheap. People also use digital coins as investments, like buying gold. Cryptocurrencies have given power to people who didn't have much access to banks. They've also changed how people raise money for projects. All of this has led to new online communities and cultures.What Is Cryptocurrency?

Origins and Evolution

Precursors

Birth of Bitcoin: The First Cryptocurrency

Growth and Proliferation of Altcoins

Developments and Events

Boom and Bust Cycles

Security Incidents and Challenges

Regulatory and Legal Milestones

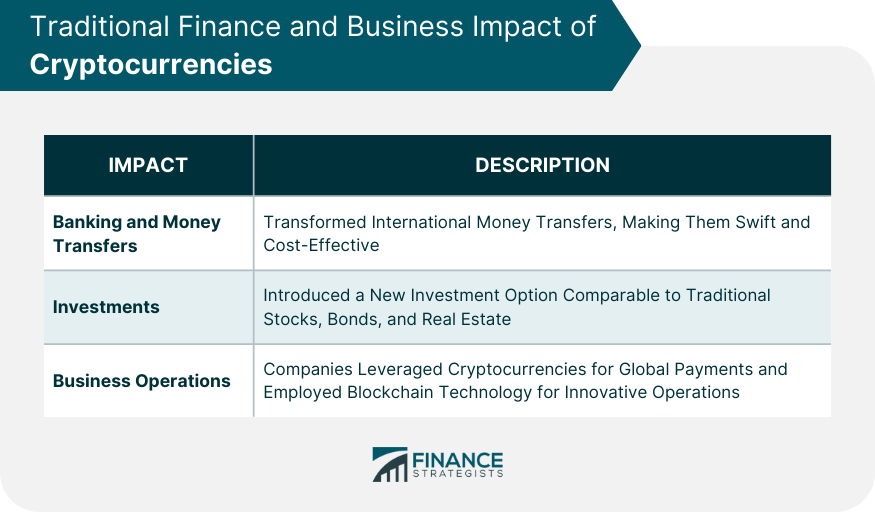

Traditional Finance and Business Impact

Banking and Money Transfers

Investments

Business Operations

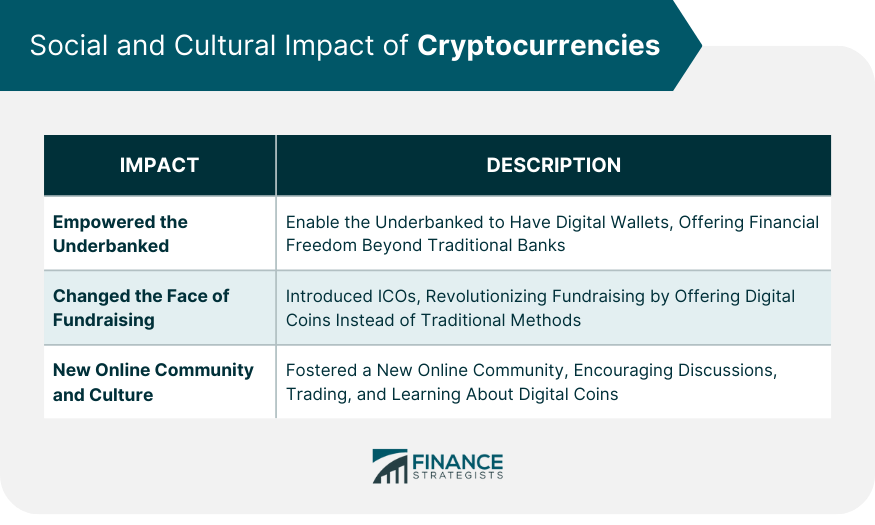

Social and Cultural Impact

Empowered the Underbanked

Changed the Face of Fundraising

New Online Community and Culture

Conclusion

History of Cryptocurrencies FAQs

The history of cryptocurrencies traces back to the concept's early beginnings and the development of Bitcoin, the first cryptocurrency, by an anonymous person or group known as Satoshi Nakamoto in 2008.

The concept of cryptocurrencies evolved from earlier digital money ideas like eCash and b-money, to eventually culminate in the creation of Bitcoin, solving the issue of double-spending and inspiring the creation of other digital coins.

The release of Bitcoin in 2009 marked a significant milestone in cryptocurrency history, introducing a decentralized system of digital money that relies on blockchain technology, enabling secure, private, and direct peer-to-peer transactions without the need for intermediaries.

Altcoins have introduced variations in technology, use cases, and features, with notable examples like Ethereum introducing smart contracts and expanding the potential applications of blockchain technology.

Major milestones in the history of cryptocurrencies include the development of Bitcoin, the growth of the cryptocurrency market, regulatory developments, security incidents, and the rise of blockchain technology beyond financial applications. Challenges have included security breaches, regulatory uncertainties, and market volatility.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.