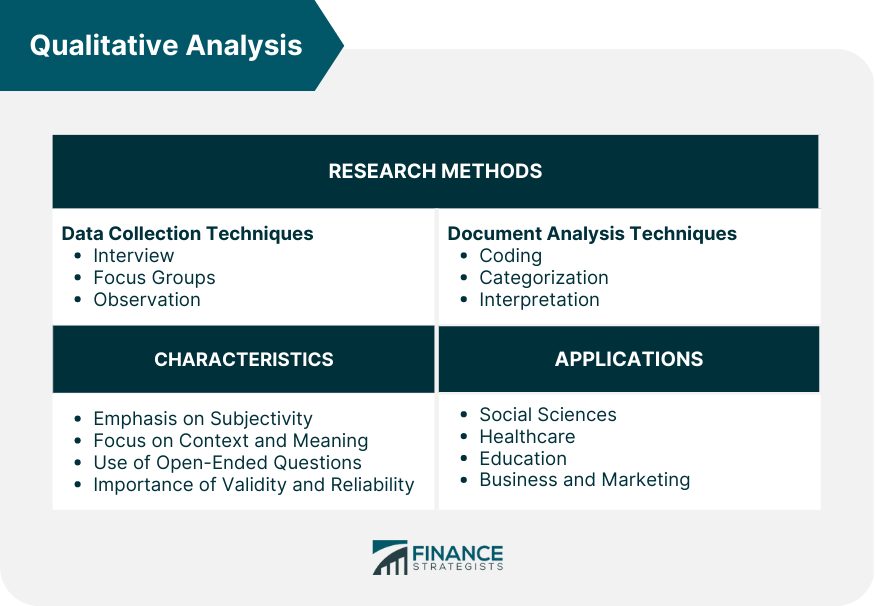

Qualitative analysis is a research methodology that aims to understand and explain the subjective experiences, attitudes, beliefs, and behaviors of individuals or groups. Unlike quantitative research, which focuses on numerical data and statistical analysis, qualitative research methods are used to collect and analyze non-numerical data such as text, images, and observations. Qualitative analysis is an essential tool for researchers and practitioners in various fields such as social sciences, psychology, sociology, anthropology, healthcare, education, and business. ]It is particularly useful when exploring complex phenomena that cannot be easily measured or quantified. The importance of qualitative analysis in research lies in its ability to provide rich and detailed insights into human behavior and social phenomena. It allows researchers to explore issues from the perspective of those who experience them, leading to a deeper understanding of the complexities and nuances of the research topic. Qualitative research methods are used to collect and analyze non-numerical data, such as texts, images, or observations, to gain an in-depth understanding of social phenomena. These methods are particularly useful when exploring complex social phenomena that cannot be easily measured or quantified. The overview of qualitative research methods includes two main components: data collection techniques and data analysis techniques. The following are some of the most commonly used qualitative research methods: In-depth interviews are used to collect data from individuals, with the researcher asking open-ended questions to explore their experiences and opinions. These interviews are conducted one-on-one between the researcher and the participant, and the researcher asks open-ended questions to explore the participant's experiences, opinions, and attitudes. In-depth interviews are particularly useful when exploring sensitive or personal topics, as they provide a safe space for participants to share their experiences. Focus groups involve gathering a small group of people with similar characteristics or experiences to discuss a particular topic. The researcher asks open-ended questions to encourage discussion and gather insights. Such groups are particularly useful when exploring group dynamics and the shared experiences and attitudes of a particular group. This involves observing people in their natural environment and recording their behavior and interactions. This method is particularly useful when studying non-verbal communication and social interactions. This method is particularly useful when studying non-verbal communication and social interactions, as it allows researchers to observe the behavior of participants without disrupting their natural environment. Document analysis is a data collection technique used in qualitative research that involves the examination and interpretation of written or visual materials, such as letters, diaries, photographs, or videos, to gain insights into people's experiences and behaviors. Once the data has been collected, it is analyzed using various qualitative data analysis techniques. These techniques include coding, categorization, and interpretation. It involves breaking down the data into smaller segments and assigning codes or labels to these segments based on their content or meaning. This helps to organize the data and identify patterns and themes. This process of categorization involves grouping codes into larger categories based on similarities or relationships between the codes. This helps to identify broader themes or concepts within the data. This involves identifying patterns and themes in the data and developing explanations or theories based on these patterns and themes. This allows the researcher to draw conclusions and make meaning out of the data Qualitative analysis is characterized by the following: Emphasis on Subjectivity. Recognizes that people's experiences and perspectives are subjective and shaped by their social, cultural, and historical context Focus on Context and Meaning. Aims to understand the social and cultural context in which human behavior occurs and the meaning that individuals attach to their experiences Use of Open-Ended Questions. Uses open-ended questions to allow participants to provide detailed and descriptive responses that can reveal rich insights Importance of Validity and Reliability. Emphasizes the importance of validity and reliability, ensuring that the research findings accurately represent the experiences and perspectives of the participants Qualitative analysis has a wide range of applications in various fields, including: Qualitative analysis is commonly used in social sciences such as psychology, sociology, and anthropology to explore human behavior and social phenomena. For example, it can be used to understand the experiences of marginalized groups, explore the impact of social policies, or examine cultural practices. Often times, it is used in healthcare research to understand patient experiences, attitudes, and behaviors. It can be used to explore the experiences of patients with chronic illnesses, examine the barriers to healthcare access, or understand the attitudes of healthcare providers towards patients. It can be used in education research to explore teaching and learning experiences, student engagement, and classroom dynamics. For example, it can be used to examine the impact of different teaching methods on student learning, explore the experiences of teachers in diverse classrooms, or understand the factors that contribute to student engagement. Similarly, it is used in business and marketing research to understand consumer behavior, brand perception, and market trends. It can be used to explore the factors that influence consumer purchasing decisions, understand the attitudes of consumers towards different brands, or identify emerging market trends. Qualitative data analysis software tools, such as NVivo, ATLAS.ti, and MAXQDA, can assist researchers in organizing, managing, and analyzing their data. These software tools have numerous features that enable researchers to code, categorize, and visualize data, allowing them to identify patterns and relationships. To use these tools effectively, researchers should have a basic understanding of qualitative data analysis and the software's capabilities. Many software providers offer training and support to help researchers get started with the software. NVivo is a popular software tool that allows researchers to manage, code, and analyze qualitative data. It offers features such as automated coding, text search, and visualization tools that make it easier for researchers to explore their data. ATLAS.ti is another popular software tool that offers similar features to NVivo, such as coding and categorization tools, as well as the ability to annotate and tag data. MAXQDA is a software tool that offers powerful text analysis features, such as keyword retrieval, word frequency analysis, and content analysis. It also offers features for analyzing multimedia data, such as audio and video recordings. There are several advantages to using qualitative analysis, which include: Rich Data. Provides detailed and descriptive data that can reveal nuanced insights In-Depth Understanding. Allows researchers to explore issues from the perspective of those who experience them, leading to a deeper understanding of the research topic Flexibility. Allows researchers to adapt to changing research conditions and revise research questions as needed However, the qualitative analysis also has some disadvantages including: Time-Consuming. Requires a significant amount of time to collect and analyze data, as it involves in-depth exploration of complex phenomena Subjectivity. Relies heavily on the researcher's interpretation of the data, which can introduce subjectivity and bias Small Sample Sizes. Often conducted with a small sample size, which can limit the generalizability of the research findings Qualitative analysis is a valuable research methodology that allows researchers to gain a deep understanding of complex human behavior and social phenomena. It is particularly useful when exploring subjective experiences, attitudes, beliefs, and behaviors. It involves a range of research methods, including interviews, focus groups, observation, and document analysis, and uses data analysis techniques such as coding, categorization, and interpretation. While qualitative analysis has several advantages, such as providing rich data and in-depth understanding, it also has some disadvantages, such as subjectivity and small sample sizes. Qualitative data analysis software tools, such as NVivo and ATLAS.ti, can help researchers manage and analyze data effectively. Overall, qualitative analysis is a valuable research methodology with a wide range of applications across various fields. By using qualitative analysis, researchers can gain a deeper understanding of the complexities and nuances of human behavior and social phenomena.What Is Qualitative Analysis?

Qualitative Research Methods

Data Collection Techniques

Interviews

Focus Groups

Observation

Document Analysis Techniques

Coding

Categorization

Interpretation

Characteristics of Qualitative Analysis

Applications of Qualitative Analysis

Social Sciences

Healthcare

Education

Business and Marketing

Software Tools for Qualitative Analysis

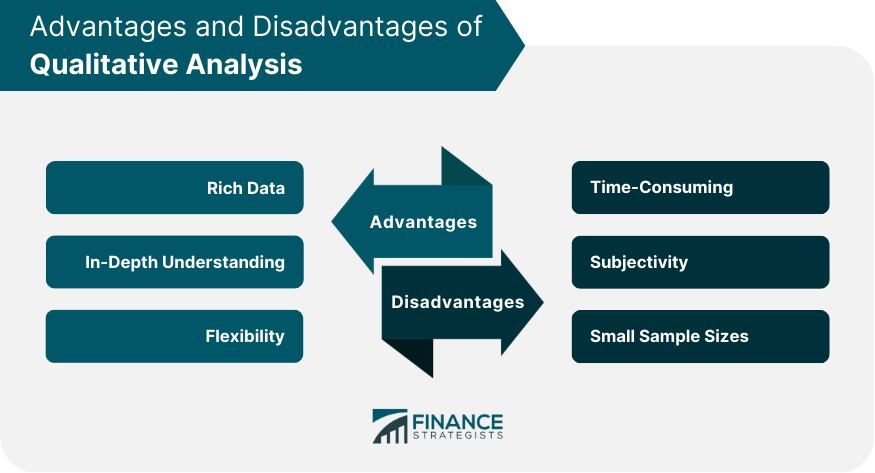

Advantages of Qualitative Analysis

Disadvantages of Qualitative Analysis

Final Thoughts

Qualitative Analysis FAQs

Qualitative analysis is a research methodology used to explore and understand people's beliefs, values, experiences, and behaviors through non-numerical data collection and interpretation.

Common qualitative research methods include interviews, focus groups, observation, and document analysis.

The qualitative analysis provides rich and detailed data that can reveal nuanced insights, allows for an in-depth understanding of research topics, and is flexible in adapting to changing research conditions.

Qualitative analysis can be time-consuming, relies heavily on the researcher's interpretation of the data, and is often conducted with a small sample size, which can limit the generalizability of the research findings.

NVivo, ATLAS.ti, and MAXQDA are software tools commonly used for qualitative data analysis. These tools can help researchers manage and analyze data effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.